Answered step by step

Verified Expert Solution

Question

1 Approved Answer

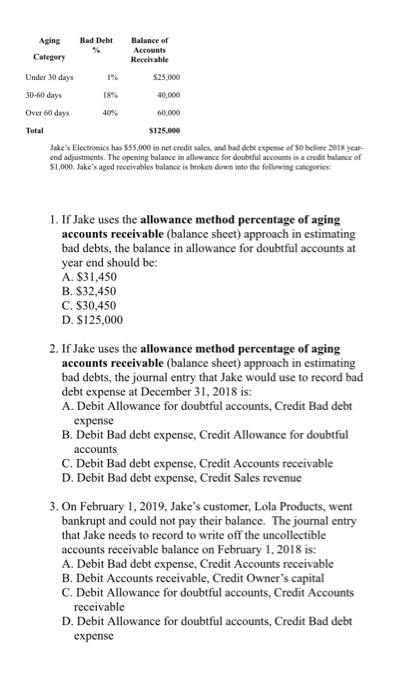

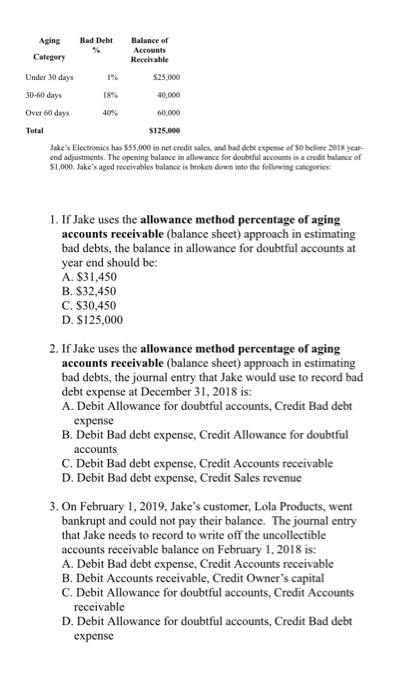

Please reply fast my mid term is going on Aging Bad Debt Balance of Accounts Category Receivable Under 30 days S25.000 30-60 days 18% 40.000

Please reply fast my mid term is going on

Aging Bad Debt Balance of Accounts Category Receivable Under 30 days S25.000 30-60 days 18% 40.000 Over 60 days 40% 60.000 Total $125.000 Jake's Electronics has 555,000 in net credit sales, and bad debt expense of Socfo2018 year end adjustments. The opening balance in allowance for doubtful account is a credit balance of $1,000 Jake's aged receivables balance is broken down into the following categories 1. If Jake uses the allowance method percentage of aging accounts receivable (balance sheet) approach in estimating bad debts, the balance in allowance for doubtful accounts at year end should be: A. $31.450 B. $32,450 C. $30,450 D. $125,000 2. If Jake uses the allowance method percentage of aging accounts receivable (balance sheet) approach in estimating bad debts, the journal entry that Jake would use to record bad debt expense at December 31, 2018 is: A. Debit Allowance for doubtful accounts, Credit Bad debt expense B. Debit Bad debt expense, Credit Allowance for doubtful accounts C. Debit Bad debt expense, Credit Accounts receivable D. Debit Bad debt expense, Credit Sales revenue 3. On February 1, 2019, Jake's customer, Lola Products, went bankrupt and could not pay their balance. The journal entry that Jake needs to record to write off the uncollectible accounts receivable balance on February 1, 2018 is: A. Debit Bad debt expense. Credit Accounts receivable B. Debit Accounts receivable, Credit Owner's capital C. Debit Allowance for doubtful accounts, Credit Accounts receivable D. Debit Allowance for doubtful accounts, Credit Bad debt expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started