Question

Please respond to Newspaper and retail section( Company I, J and O, P) The financial characteristics of companies vary for many reasons. The two most

Please respond to Newspaper and retail section( Company I, J and O, P)

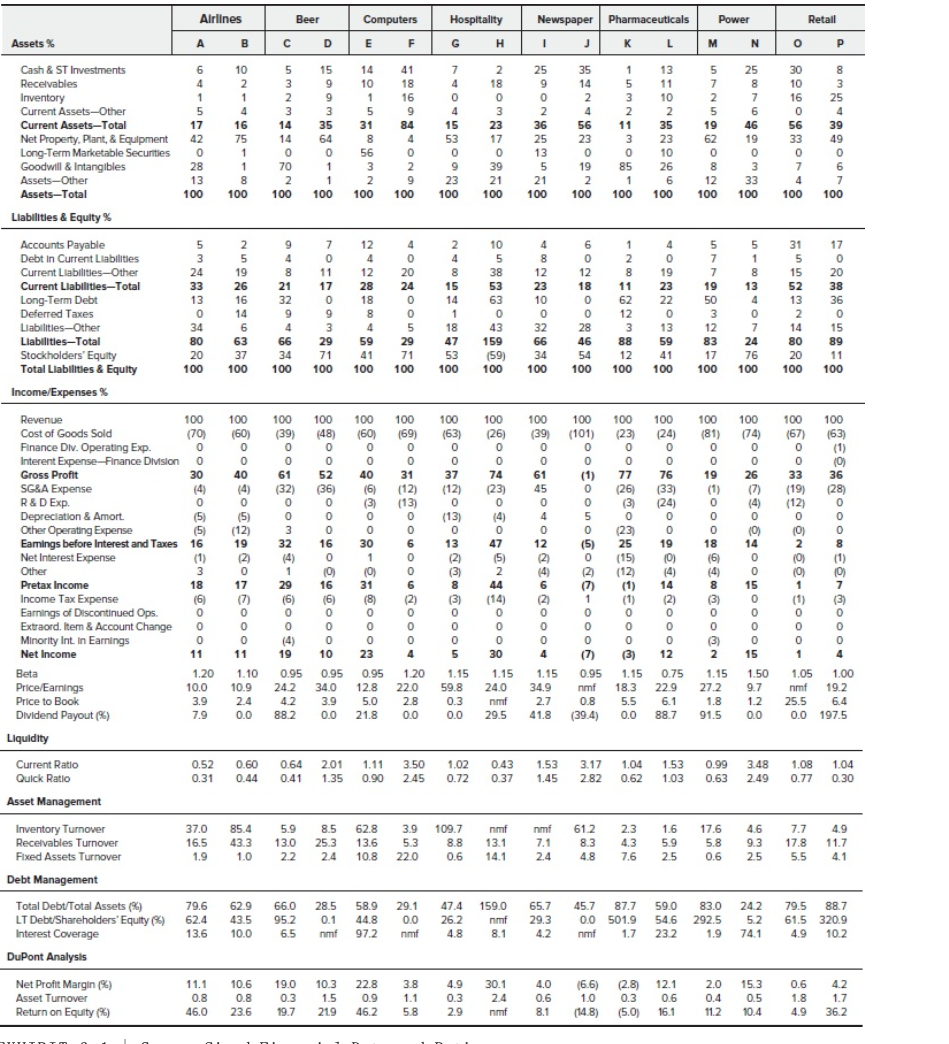

The financial characteristics of companies vary for many reasons. The two most prominent drivers are industry economics and firm strategy.

Each industry has a financial norm around which companies within the industry tend to operate. An airline, for example, would naturally be expected to have a high proportion of fixed assets (airplanes), while a consulting firm would not. A steel manufacturer would be expected to have a lower gross margin than a pharmaceutical manufacturer because commodities such as steel are subject to strong price competition, while highly differentiated products like patented drugs enjoy much more pricing freedom. Because of each industry's unique economic features, average financial statements will vary from one industry to the next.

Similarly, companies within industries have different financial characteristics, in part because of the diverse strategies that can be employed. Executives choose strategies that will position their company favorably in the competitive jockeying within an industry. Strategies typically entail making important choices in how a product is made (e.g., capital intensive versus labor intensive), how it is marketed (e.g., direct sales versus the use of distributors), and how the company is financed (e.g., the use of debt or equity). Strategies among companies in the same industry can differ dramatically. Different strategies can produce striking differences in financial results for firms in the same industry.

The following paragraphs describe pairs of participants in a number of different industries. Their strategies and market niches provide clues as to the financial condition and performance that one would expect of them. The companies' common-sized financial statements and operating data, as of early 2016, are presented in a standardized format in Exhibit 6.1 . It is up to you to match the financial data with the company descriptions. Also, try to explain the differences in financial results across industries.

Newspapers

Companies I and J are newspaper companies. One company owns and operates two newspapers in the southwestern United States. Due to the transition of customer preference from print to digital, the company has begun offering marketing and digital-advertising services and acquiring firms in more profitable industries. The company has introduced cost controls to address cost-structure issues such as personnel expenses. Founded in 1851, the other company is renowned for its highly circulated newspaper offered both in print and online formats. This paper is sold and distributed domestically as well as around the world. Because the company is focused largely on one product, it has strong central controls that have allowed it to remain profitable despite the fierce competition for subscribers and advertising revenues.

Retail

Companies O and P are retailers. One is a leading e-commerce company that sells a broad range of products, including media (books, music, and videos) and electronics, which together account for 92% of revenues. One-third of revenues are international and 20% of sales come from third-party sellers (i.e., sellers who transact through the company's website to sell their own products rather than those owned by the company). A growing portion of operating profit comes from the company's cloud-computing business. With its desire to focus on customer satisfaction, this company has invested considerably in improving its online technologies.

The other company is a leading retailer of apparel and fashion accessories for men, women, and children. The company sells mostly through its upscale brick-and-mortar department stores.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started