Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please respond to question as quickly as possible please respond to question as quickly as possible la hidang Your 2001 have a machother Yound that

please respond to question as quickly as possible

please respond to question as quickly as possible

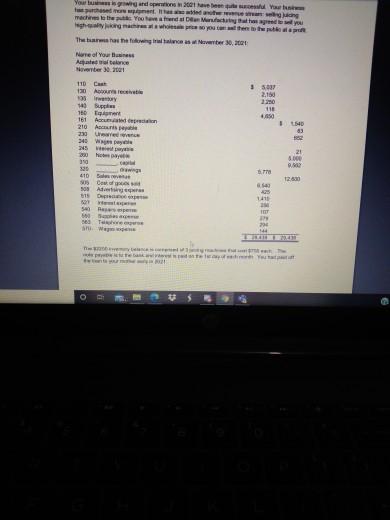

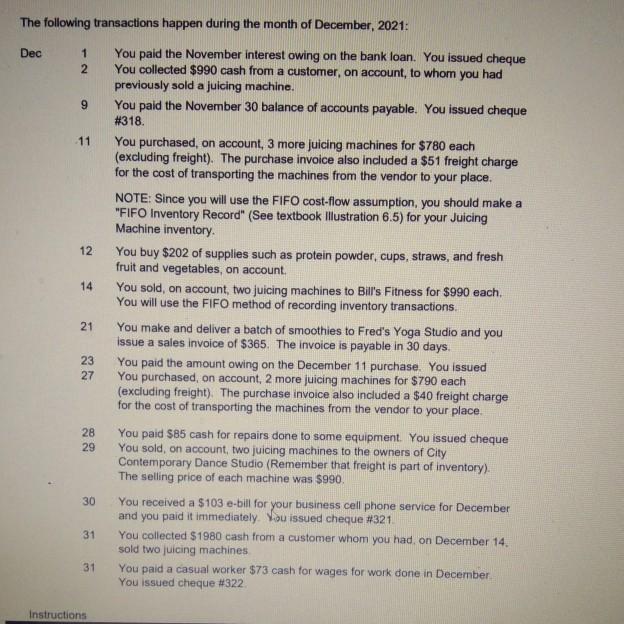

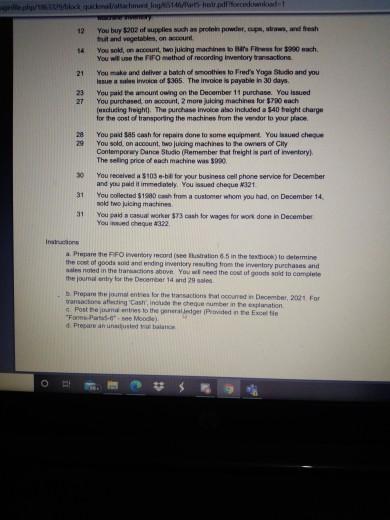

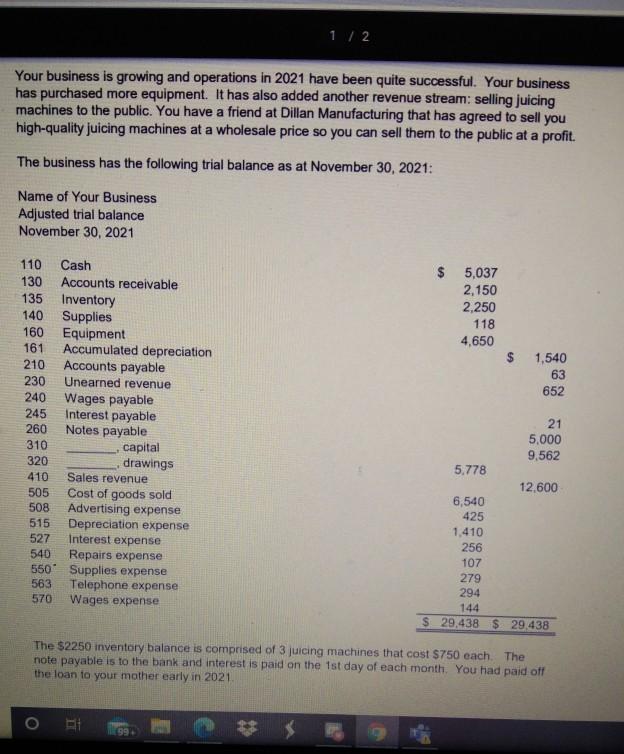

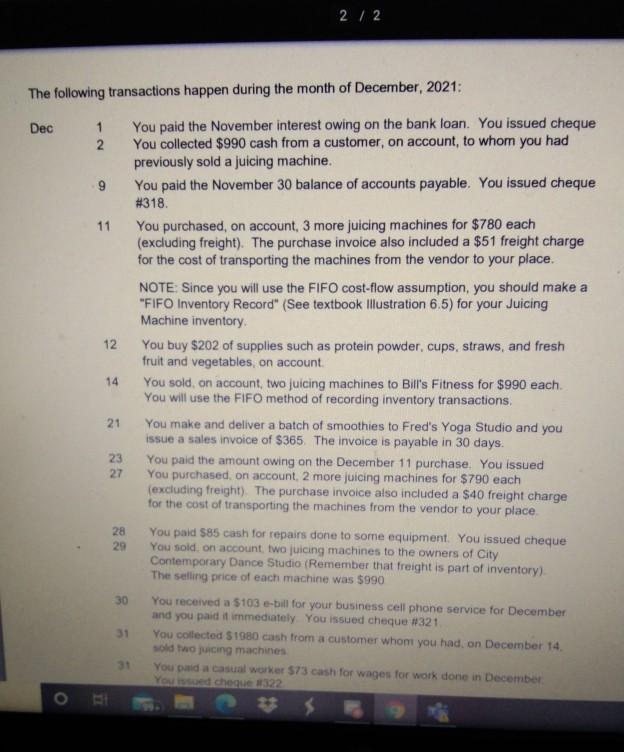

la hidang Your 2001 have a machother Yound that you has a who you can op There are a weber 30, Name of Your Business Achetelorice November 2001 110 130 Aste 193 141 180 161 Aca 210 A 230 Uwe 340 W 3507 2.150 220 110 154 83 SKE DUE 21 8.00 1260 410 3 Cost of 50 Ad 142 SY 09 361 790 144 The following transactions happen during the month of December, 2021: Dec 1 2 9 11 12 14 You paid the November interest owing on the bank loan. You issued cheque You collected $990 cash from a customer, on account, to whom you had previously sold a juicing machine. You paid the November 30 balance of accounts payable. You issued cheque #318. You purchased, on account, 3 more juicing machines for $780 each (excluding freight). The purchase invoice also included a $51 freight charge for the cost of transporting the machines from the vendor to your place. NOTE: Since you will use the FIFO cost-flow assumption, you should make a "FIFO Inventory Record" (See textbook Illustration 6.5) for your Juicing Machine inventory You buy $202 of supplies such as protein powder, cups, straws, and fresh fruit and vegetables, on account. You sold, on account, two juicing machines to Bill's Fitness for $990 each You will use the FIFO method of recording inventory transactions You make and deliver a batch of smoothies to Fred's Yoga Studio and you issue a sales invoice of $365. The invoice is payable in 30 days. You paid the amount owing on the December 11 purchase. You issued You purchased, on account, 2 more juicing machines for $790 each (excluding freight). The purchase invoice also included a $40 freight charge for the cost of transporting the machines from the vendor to your place. You paid $85 cash for repairs done to some equipment. You issued cheque You sold, on account, two juicing machines to the owners of City Contemporary Dance Studio (Remember that freight is part of inventory). The selling price of each machine was $990 You received a $103 e-bill for your business cell phone service for December and you paid it immediately. You issued cheque #321 You collected $1980 cash from a customer whom you had on December 14. sold two juicing machines You paid a casual worker $73 cash for wages for work done in December You issued cheque #322 21 23 27 28 29 30 31 31 Instructions 12 14 21 27 You buy 1202 of supplies such as propere, and true and vegetables on our You sok, count, wojking machines of $980 wach You will use the fro method of recording twentory transactions You make and deliver a batch of smoothies to Fred's Yoga Studio and you Humans of $365. The imalce is payable in 30 days You paid the amount owing on the December 11 purchase. You issued You purchased on cont 2 more juicing machine for 700 each funduting tight. The purchase Invoice who included a $40 freight charge for the cost of transporting the machines from the verder to your place You pad sa cash for repair done to some equipment. You bed cheque You sold on account to Jucing machines to the owners of Cly Contemporary Dance Studio Remember that freight is part of Inventory The selling price of each machine was $900 You received 103 - for your business cell phone service for December and you paid it immediately You issued cheque #321 You collected $19.00 h from a customer whom you had on December 14 Botolong machines You paid atauawe 73 osh for wages for work done in December You cheque 4322 29 30 31 31 ins Prepare the PFO invertory card estration 65 in the toca) to determine the cost of goods and ending investing from the inventory purchases and med in the transactions shove You wled the cost of goods sold to complete the jou only for the December 14 and 29 Prepare the mainties for the actional courber 2001 For ramacione tecnichege number in a plation For more green Egelin Format Mode Prepare and be 1 / 2 Your business is growing and operations in 2021 have been quite successful. Your business has purchased more equipment. It has also added another revenue stream: selling juicing machines to the public. You have a friend at Dillan Manufacturing that has agreed to sell you high-quality juicing machines at a wholesale price so you can sell them to the public at a profit. The business has the following trial balance as at November 30, 2021: Name of Your Business Adjusted trial balance November 30, 2021 $ 5,037 2,150 2,250 118 4,650 $ 1,540 63 652 110 Cash 130 Accounts receivable 135 Inventory 140 Supplies 160 Equipment 161 Accumulated depreciation 210 Accounts payable 230 Unearned revenue 240 Wages payable 245 Interest payable 260 Notes payable 310 capital 320 drawings 410 Sales revenue 505 Cost of goods sold 508 Advertising expense 515 Depreciation expense 527 Interest expense 540 Repairs expense 550Supplies expense 563 Telephone expense 570 Wages expense 21 5,000 9,562 5.778 12.600 6,540 425 1,410 256 107 279 294 144 $ 29,438 $ 29,438 The $2250 inventory balance is comprised of 3 juicing machines that cost $750 each. The note payable is to the bank and interest is paid on the 1st day of each month. You had paid off the loan to your mother early in 2021 99 2 / 2 The following transactions happen during the month of December, 2021: Dec 1 You paid the November interest owing on the bank loan. You issued cheque 2 You collected $990 cash from a customer, on account, to whom you had previously sold a juicing machine. 9 You paid the November 30 balance of accounts payable. You issued cheque #318 11 You purchased, on account, 3 more juicing machines for $780 each (excluding freight). The purchase invoice also included a $51 freight charge for the cost of transporting the machines from the vendor to your place. NOTE: Since you will use the FIFO cost-flow assumption, you should make a "FIFO Inventory Record" (See textbook Illustration 6.5) for your Juicing Machine inventory 12 You buy $202 of supplies such as protein powder, cups, straws, and fresh fruit and vegetables, on account You sold on account, two juicing machines to Bill's Fitness for $990 each You will use the FIFO method of recording inventory transactions, 21 You make and deliver a batch of smoothies to Fred's Yoga Studio and you issue a sales invoice of $365. The invoice is payable in 30 days. 23 You paid the amount owing on the December 11 purchase. You issued 27 You purchased on account 2 more juicing machines for $790 each (excluding freight). The purchase invoice also included a $40 freight charge for the cost of transporting the machines from the vendor to your place. 28 You paid $85 cash for repairs done to some equipment. You issued cheque 29 You sold on account, two juicing machines to the owners of City Contemporary Dance Studio (Remember that freight is part of inventory) The selling price of each machine was $990 You received a $103 e-bill for your business cell phone service for December and you paid it immediately You issued cheque #321 31 You collected $1980 cash from a customer whom you had, on December 14, sold two pucing machines 14 30 You paid a casual worker 573 cash for wages for work done in December Yound cheque 11122 O la hidang Your 2001 have a machother Yound that you has a who you can op There are a weber 30, Name of Your Business Achetelorice November 2001 110 130 Aste 193 141 180 161 Aca 210 A 230 Uwe 340 W 3507 2.150 220 110 154 83 SKE DUE 21 8.00 1260 410 3 Cost of 50 Ad 142 SY 09 361 790 144 The following transactions happen during the month of December, 2021: Dec 1 2 9 11 12 14 You paid the November interest owing on the bank loan. You issued cheque You collected $990 cash from a customer, on account, to whom you had previously sold a juicing machine. You paid the November 30 balance of accounts payable. You issued cheque #318. You purchased, on account, 3 more juicing machines for $780 each (excluding freight). The purchase invoice also included a $51 freight charge for the cost of transporting the machines from the vendor to your place. NOTE: Since you will use the FIFO cost-flow assumption, you should make a "FIFO Inventory Record" (See textbook Illustration 6.5) for your Juicing Machine inventory You buy $202 of supplies such as protein powder, cups, straws, and fresh fruit and vegetables, on account. You sold, on account, two juicing machines to Bill's Fitness for $990 each You will use the FIFO method of recording inventory transactions You make and deliver a batch of smoothies to Fred's Yoga Studio and you issue a sales invoice of $365. The invoice is payable in 30 days. You paid the amount owing on the December 11 purchase. You issued You purchased, on account, 2 more juicing machines for $790 each (excluding freight). The purchase invoice also included a $40 freight charge for the cost of transporting the machines from the vendor to your place. You paid $85 cash for repairs done to some equipment. You issued cheque You sold, on account, two juicing machines to the owners of City Contemporary Dance Studio (Remember that freight is part of inventory). The selling price of each machine was $990 You received a $103 e-bill for your business cell phone service for December and you paid it immediately. You issued cheque #321 You collected $1980 cash from a customer whom you had on December 14. sold two juicing machines You paid a casual worker $73 cash for wages for work done in December You issued cheque #322 21 23 27 28 29 30 31 31 Instructions 12 14 21 27 You buy 1202 of supplies such as propere, and true and vegetables on our You sok, count, wojking machines of $980 wach You will use the fro method of recording twentory transactions You make and deliver a batch of smoothies to Fred's Yoga Studio and you Humans of $365. The imalce is payable in 30 days You paid the amount owing on the December 11 purchase. You issued You purchased on cont 2 more juicing machine for 700 each funduting tight. The purchase Invoice who included a $40 freight charge for the cost of transporting the machines from the verder to your place You pad sa cash for repair done to some equipment. You bed cheque You sold on account to Jucing machines to the owners of Cly Contemporary Dance Studio Remember that freight is part of Inventory The selling price of each machine was $900 You received 103 - for your business cell phone service for December and you paid it immediately You issued cheque #321 You collected $19.00 h from a customer whom you had on December 14 Botolong machines You paid atauawe 73 osh for wages for work done in December You cheque 4322 29 30 31 31 ins Prepare the PFO invertory card estration 65 in the toca) to determine the cost of goods and ending investing from the inventory purchases and med in the transactions shove You wled the cost of goods sold to complete the jou only for the December 14 and 29 Prepare the mainties for the actional courber 2001 For ramacione tecnichege number in a plation For more green Egelin Format Mode Prepare and be 1 / 2 Your business is growing and operations in 2021 have been quite successful. Your business has purchased more equipment. It has also added another revenue stream: selling juicing machines to the public. You have a friend at Dillan Manufacturing that has agreed to sell you high-quality juicing machines at a wholesale price so you can sell them to the public at a profit. The business has the following trial balance as at November 30, 2021: Name of Your Business Adjusted trial balance November 30, 2021 $ 5,037 2,150 2,250 118 4,650 $ 1,540 63 652 110 Cash 130 Accounts receivable 135 Inventory 140 Supplies 160 Equipment 161 Accumulated depreciation 210 Accounts payable 230 Unearned revenue 240 Wages payable 245 Interest payable 260 Notes payable 310 capital 320 drawings 410 Sales revenue 505 Cost of goods sold 508 Advertising expense 515 Depreciation expense 527 Interest expense 540 Repairs expense 550Supplies expense 563 Telephone expense 570 Wages expense 21 5,000 9,562 5.778 12.600 6,540 425 1,410 256 107 279 294 144 $ 29,438 $ 29,438 The $2250 inventory balance is comprised of 3 juicing machines that cost $750 each. The note payable is to the bank and interest is paid on the 1st day of each month. You had paid off the loan to your mother early in 2021 99 2 / 2 The following transactions happen during the month of December, 2021: Dec 1 You paid the November interest owing on the bank loan. You issued cheque 2 You collected $990 cash from a customer, on account, to whom you had previously sold a juicing machine. 9 You paid the November 30 balance of accounts payable. You issued cheque #318 11 You purchased, on account, 3 more juicing machines for $780 each (excluding freight). The purchase invoice also included a $51 freight charge for the cost of transporting the machines from the vendor to your place. NOTE: Since you will use the FIFO cost-flow assumption, you should make a "FIFO Inventory Record" (See textbook Illustration 6.5) for your Juicing Machine inventory 12 You buy $202 of supplies such as protein powder, cups, straws, and fresh fruit and vegetables, on account You sold on account, two juicing machines to Bill's Fitness for $990 each You will use the FIFO method of recording inventory transactions, 21 You make and deliver a batch of smoothies to Fred's Yoga Studio and you issue a sales invoice of $365. The invoice is payable in 30 days. 23 You paid the amount owing on the December 11 purchase. You issued 27 You purchased on account 2 more juicing machines for $790 each (excluding freight). The purchase invoice also included a $40 freight charge for the cost of transporting the machines from the vendor to your place. 28 You paid $85 cash for repairs done to some equipment. You issued cheque 29 You sold on account, two juicing machines to the owners of City Contemporary Dance Studio (Remember that freight is part of inventory) The selling price of each machine was $990 You received a $103 e-bill for your business cell phone service for December and you paid it immediately You issued cheque #321 31 You collected $1980 cash from a customer whom you had, on December 14, sold two pucing machines 14 30 You paid a casual worker 573 cash for wages for work done in December Yound cheque 11122 OStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started