Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please respond with the appropriate responses based on the options given this is for the United States of America. this is a CPA practice question

please respond with the appropriate responses based on the options given

this is for the United States of America. this is a CPA practice question please help

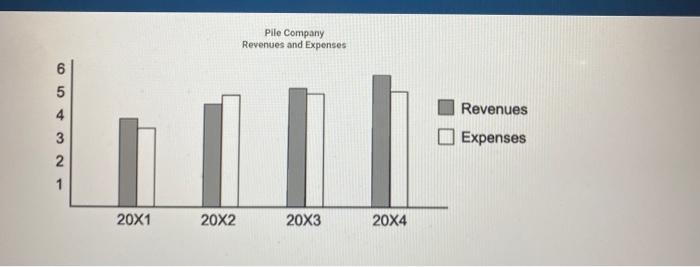

sorry, here is the additional info

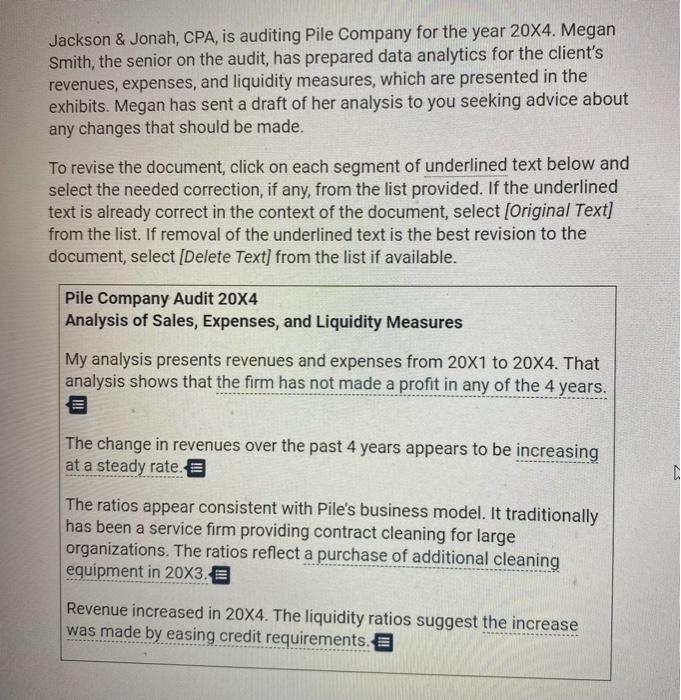

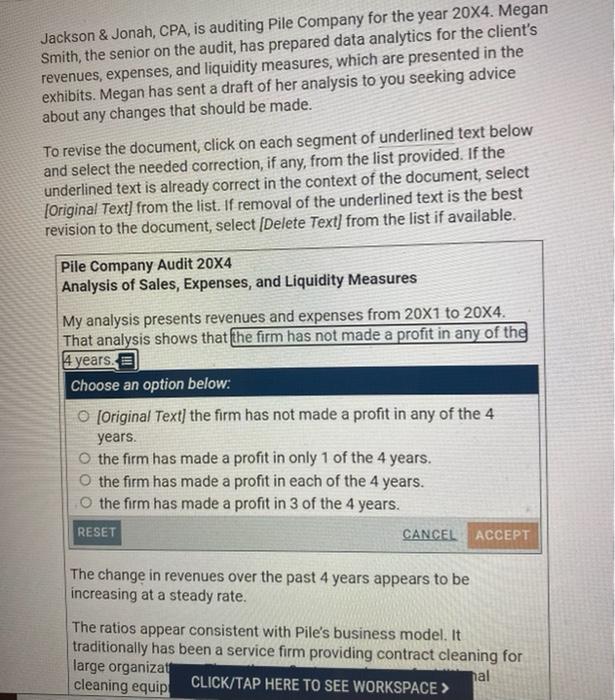

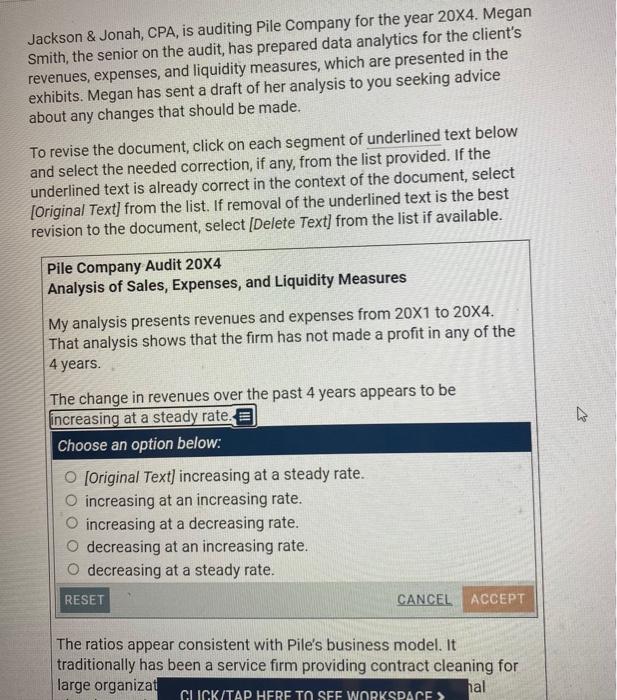

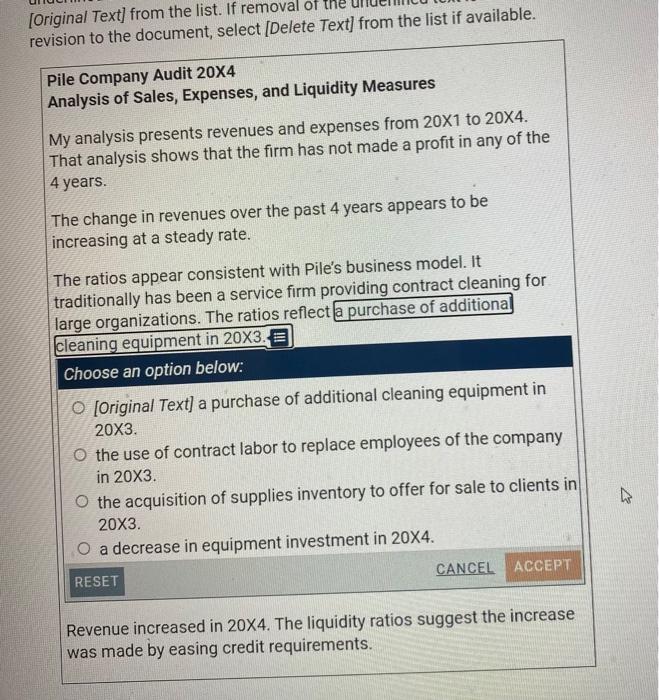

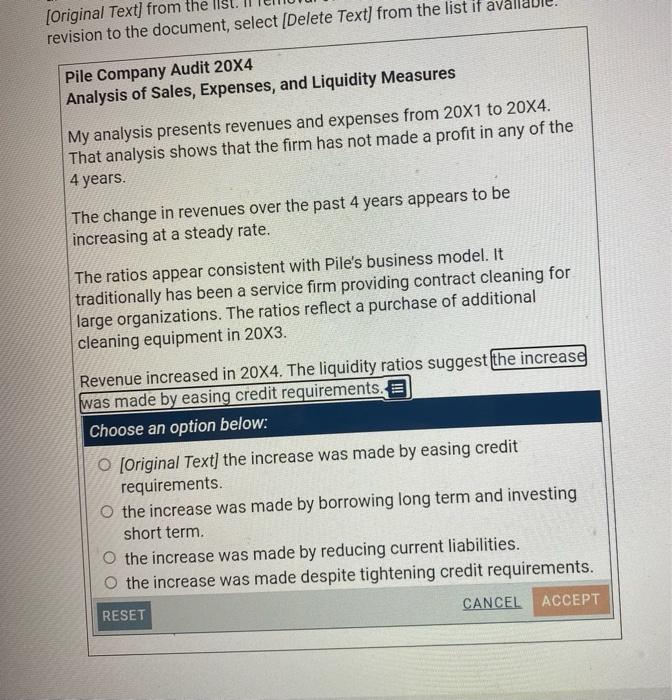

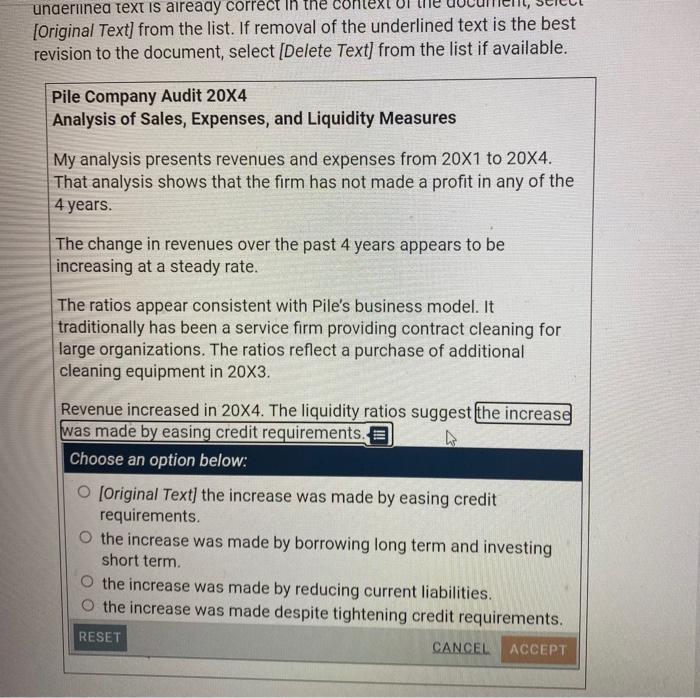

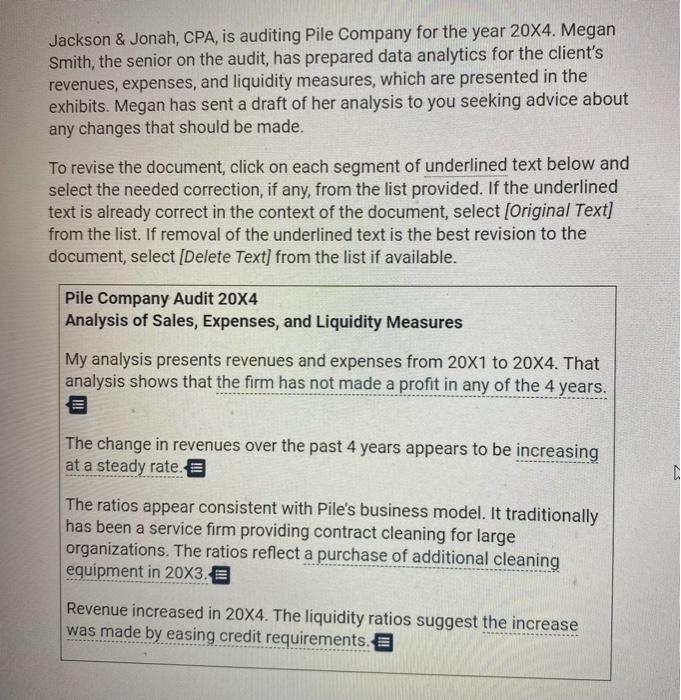

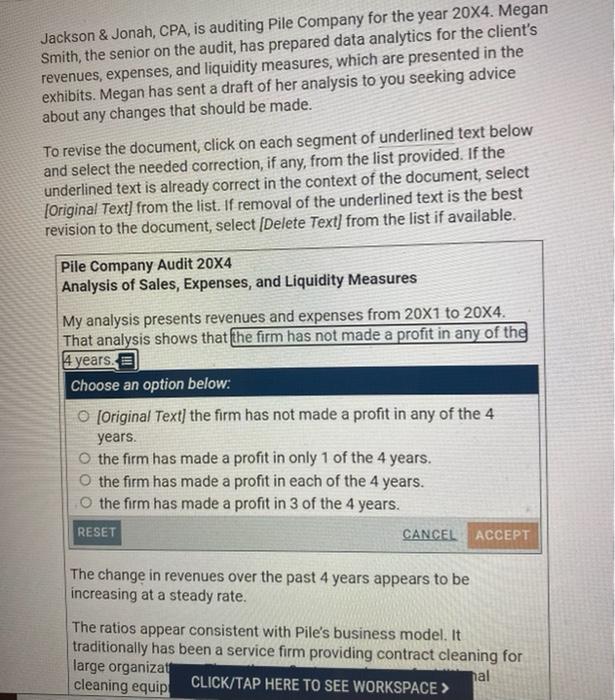

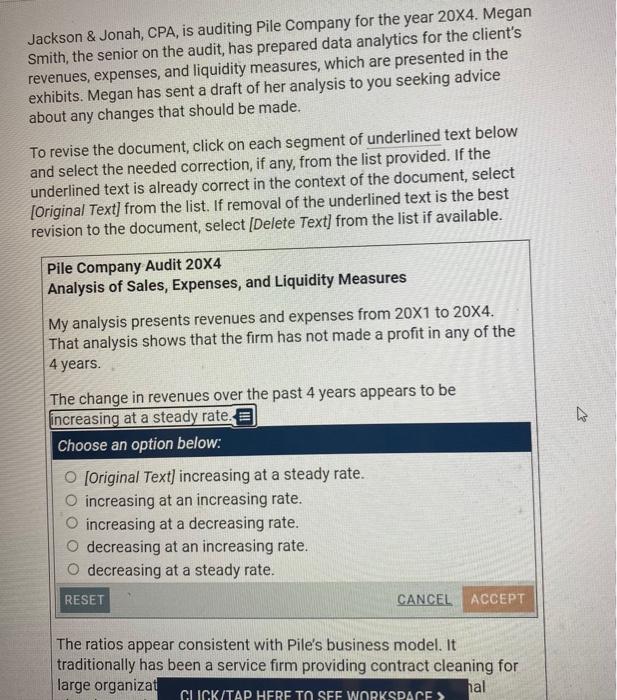

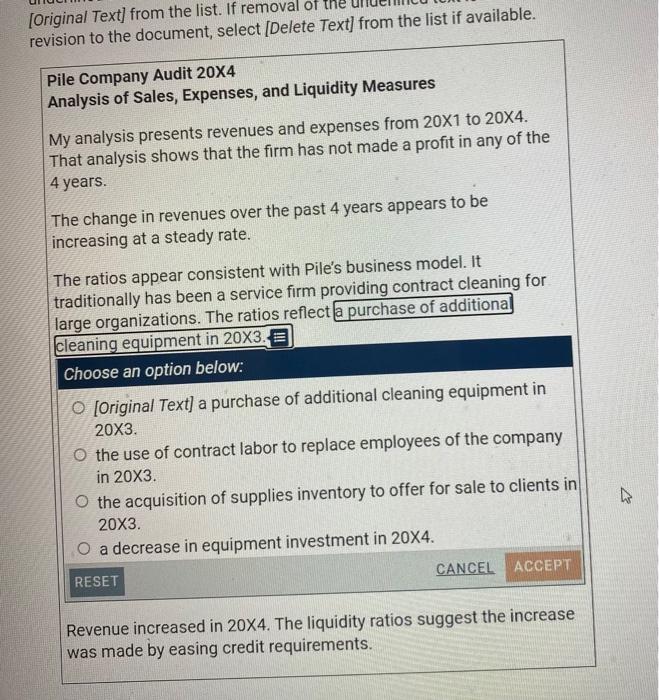

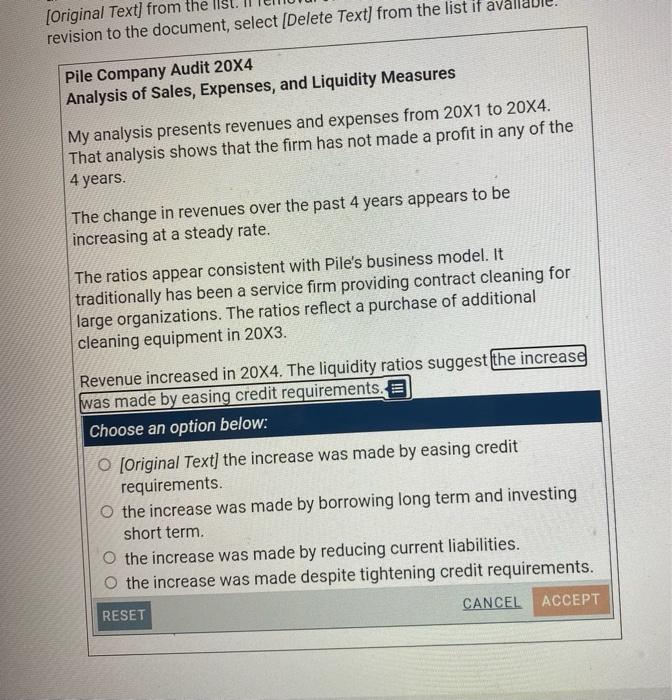

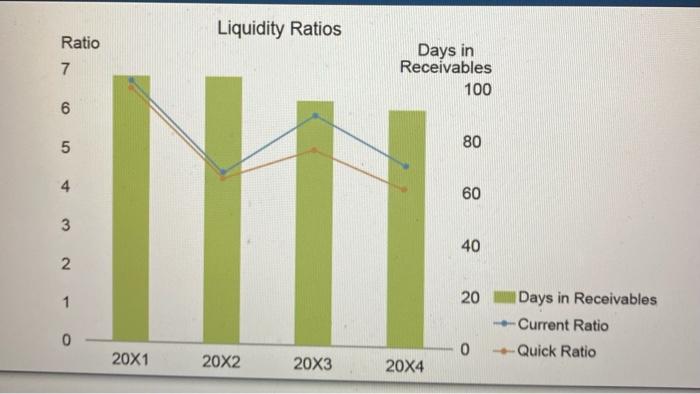

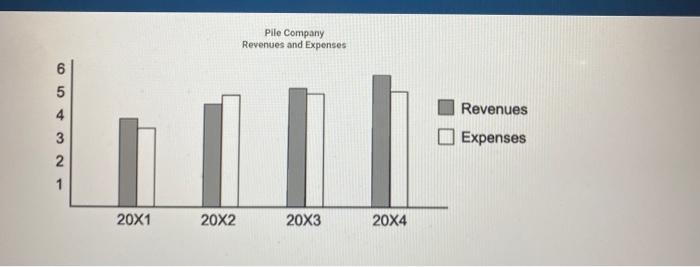

Jackson & Jonah, CPA, is auditing Pile Company for the year 20X4. Megan Smith, the senior on the audit, has prepared data analytics for the client's revenues, expenses, and liquidity measures, which are presented in the exhibits. Megan has sent a draft of her analysis to you seeking advice about any changes that should be made. To revise the document, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select (Original Text] from the list. If removal of the underlined text is the best revision to the document, select [Delete Text] from the list if available. Pile Company Audit 20X4 Analysis of Sales, Expenses, and Liquidity Measures My analysis presents revenues and expenses from 20x1 to 20X4. That analysis shows that the firm has not made a profit in any of the 4 years. The change in revenues over the past 4 years appears to be increasing at a steady rate. The ratios appear consistent with Pile's business model. It traditionally has been a service firm providing contract cleaning for large organizations. The ratios reflect a purchase of additional cleaning equipment in 20X3. E Revenue increased in 20X4. The liquidity ratios suggest the increase was made by easing credit requirements Jackson & Jonah, CPA, is auditing Pile Company for the year 20X4. Megan Smith, the senior on the audit, has prepared data analytics for the client's revenues, expenses, and liquidity measures, which are presented in the exhibits. Megan has sent a draft of her analysis to you seeking advice about any changes that should be made. To revise the document, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original Text) from the list. If removal of the underlined text is the best revision to the document, select [Delete Text) from the list if available. Pile Company Audit 20X4 Analysis of Sales, Expenses, and Liquidity Measures My analysis presents revenues and expenses from 20x1 to 20X4. That analysis shows that the firm has not made a profit in any of the 4 years. 5 Choose an option below: (Original Text] the firm has not made a profit in any of the 4 years. the firm has made a profit in only 1 of the 4 years. the firm has made a profit in each of the 4 years. the firm has made a profit in 3 of the 4 years. . RESET CANCEL ACCEPT The change in revenues over the past 4 years appears to be increasing at a steady rate. The ratios appear consistent with Pile's business model. It traditionally has been a service firm providing contract cleaning for large organizat nal cleaning equip CLICK/TAP HERE TO SEE WORKSPACE > Jackson & Jonah, CPA, is auditing Pile Company for the year 20X4. Megan Smith, the senior on the audit, has prepared data analytics for the client's revenues, expenses, and liquidity measures, which are presented in the exhibits. Megan has sent a draft of her analysis to you seeking advice about any changes that should be made. To revise the document, click on each segment of underlined text below and select the needed correction, if any, from the list provided. If the underlined text is already correct in the context of the document, select [Original Text] from the list. If removal of the underlined text is the best revision to the document, select [Delete Text] from the list if available. Pile Company Audit 20X4 Analysis of Sales, Expenses, and Liquidity Measures My analysis presents revenues and expenses from 20x1 to 20X4. That analysis shows that the firm has not made a profit in any of the 4 years. The change in revenues over the past 4 years appears to be increasing at a steady rate. Choose an option below: [Original Text) increasing at a steady rate. O increasing at an increasing rate. O increasing at a decreasing rate. decreasing at an increasing rate. O decreasing at a steady rate. RESET CANCEL ACCEPT The ratios appear consistent with Pile's business model. It traditionally has been a service firm providing contract cleaning for large organizat hal CLICK/TAP HERE TO SEE WORKSPACES [Original Text) from the list. If removal of the revision to the document, select [Delete Text] from the list if available. Pile Company Audit 20X4 Analysis of Sales, Expenses, and Liquidity Measures My analysis presents revenues and expenses from 20x1 to 20X4. That analysis shows that the firm has not made a profit in any of the 4 years. The change in revenues over the past 4 years appears to be increasing at a steady rate. The ratios appear consistent with Pile's business model. It traditionally has been a service firm providing contract cleaning for large organizations. The ratios reflect a purchase of additional cleaning equipment in 20X3. E Choose an option below: O [Original Text] a purchase of additional cleaning equipment in 20X3. O the use of contract labor to replace employees of the company in 20X3. O the acquisition of supplies inventory to offer for sale to clients in 20X3. O a decrease in equipment investment in 20X4. ho CANCEL ACCEPT RESET Revenue increased in 20X4. The liquidity ratios suggest the increase was made by easing credit requirements. (Original Text] from the revision to the document, select [Delete Text) from the list it a Pile Company Audit 20X4 Analysis of Sales, Expenses, and Liquidity Measures My analysis presents revenues and expenses from 20x1 to 20X4. That analysis shows that the firm has not made a profit in any of the 4 years. The change in revenues over the past 4 years appears to be increasing at a steady rate. The ratios appear consistent with Pile's business model. It traditionally has been a service firm providing contract cleaning for large organizations. The ratios reflect a purchase of additional cleaning equipment in 20x3. Revenue increased in 20X4. The liquidity ratios suggest the increase was made by easing credit requirements. E Choose an option below: O (Original Text] the increase was made by easing credit requirements. o the increase was made by borrowing long term and investing short term. the increase was made by reducing current liabilities. o the increase was made despite tightening credit requirements. RESET CANCEL ACCEPT underlinea text is aiready correct [Original Text] from the list. If removal of the underlined text is the best revision to the document, select [Delete Text] from the list if available. Pile Company Audit 20X4 Analysis of Sales, Expenses, and Liquidity Measures My analysis presents revenues and expenses from 20x1 to 20X4. That analysis shows that the firm has not made a profit in any of the 4 years. The change in revenues over the past 4 years appears to be increasing at a steady rate. The ratios appear consistent with Pile's business model. It traditionally has been a service firm providing contract cleaning for large organizations. The ratios reflect a purchase of additional cleaning equipment in 20X3. Revenue increased in 20X4. The liquidity ratios suggest the increase was made by easing credit requirements. Choose an option below: (Original Text] the increase was made by easing credit requirements o the increase was made by borrowing long term and investing short term. the increase was made by reducing current liabilities. the increase was made despite tightening credit requirements. RESET CANCEL ACCEPT Liquidity Ratios Ratio 7 Days in Receivables 100 6 5 80 4 60 3 40 2 1 20 Days in Receivables --Current Ratio Quick Ratio 0 0 20X1 20X2 20X3 20X4 Pile Company Revenues and Expenses 4 3 2 Revenues Expenses 1 20X1 20X2 20X3 20X4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started