- Please, Review Example 14-9 in the text (pictured below)

- Calculate the optimal capital structure assuming a 21% tax rate

- How does it compare to the optimal capital structure with a 40% tax rate? Explain why it's different

- Share your Excel file

Thank you!

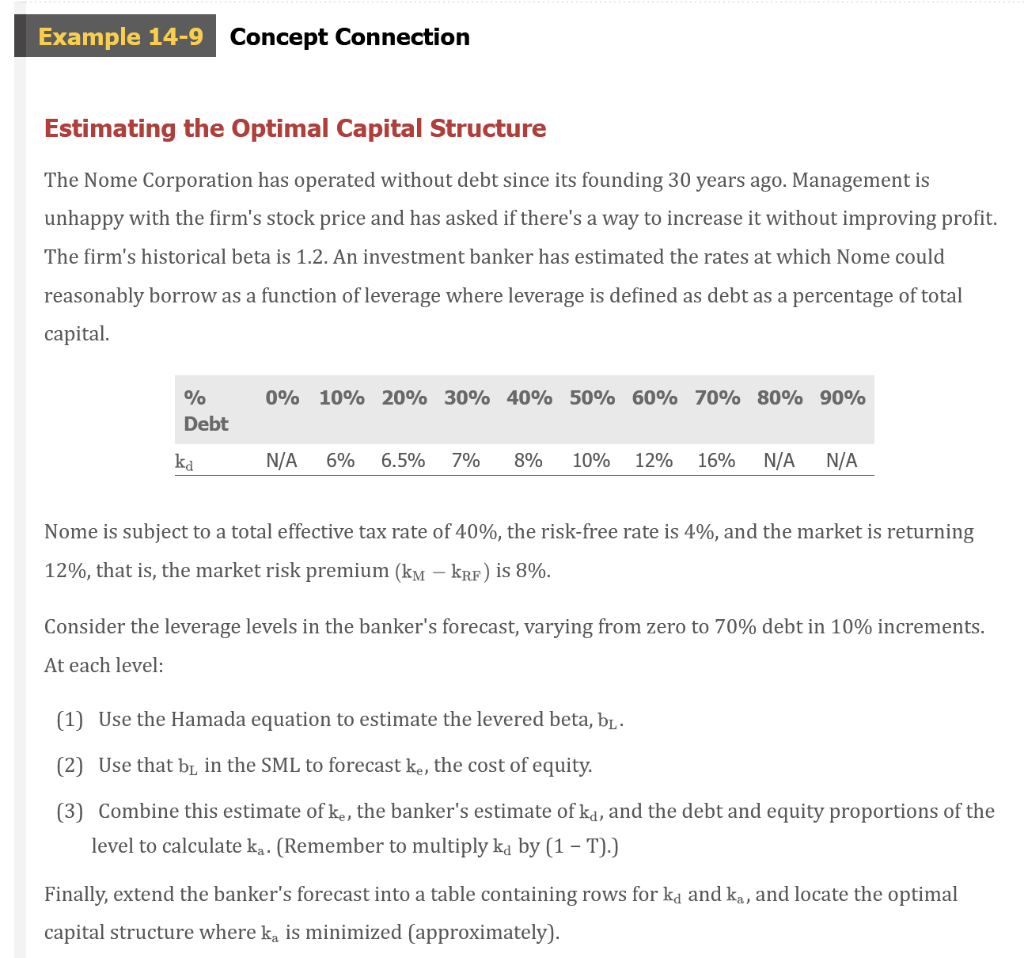

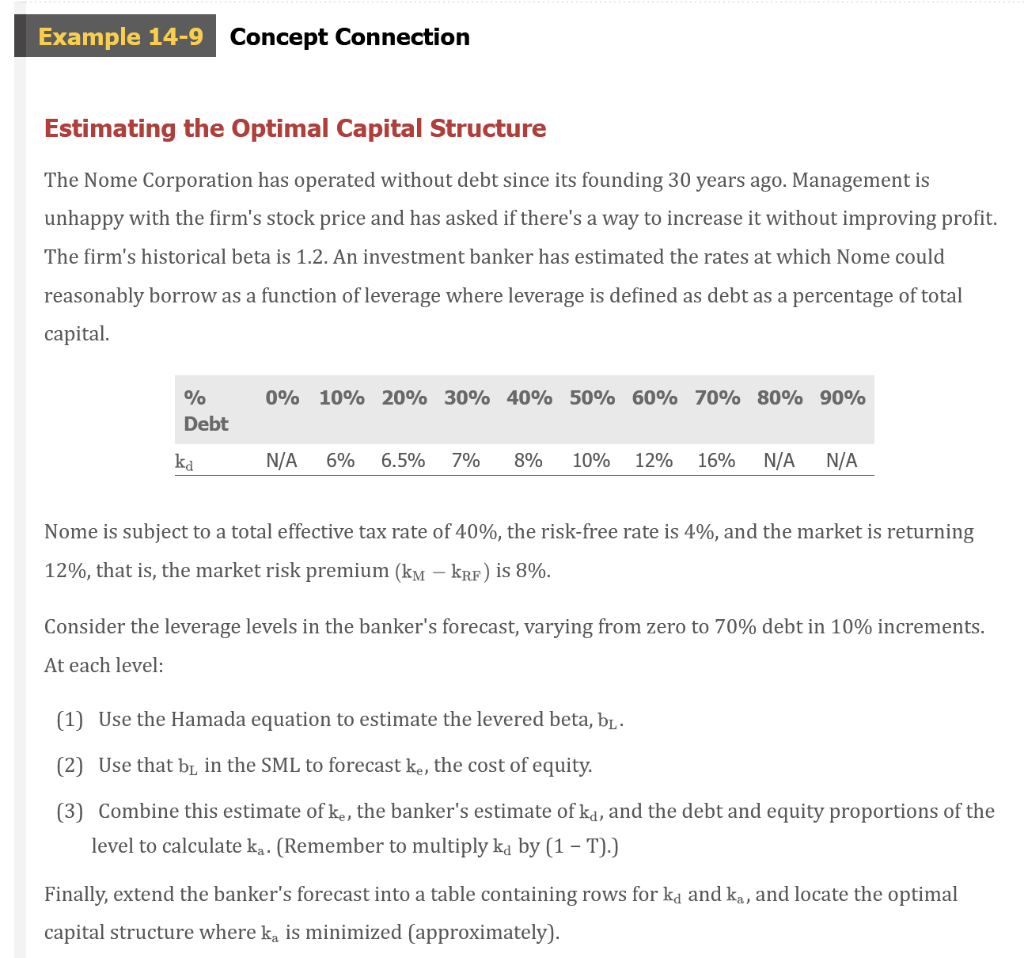

Example 14-9 Concept Connection Estimating the optimal Capital Structure The Nome Corporation has operated without debt since its founding 30 years ago. Management is unhappy with the firm's stock price and has asked if there's a way to increase it without improving profit. The firm's historical beta is 1.2. An investment banker has estimated the rates at which Nome could reasonably borrow as a function of leverage where leverage is defined as debt as a percentage of total capital. % 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Debt ka N/A 6% 6.5% 7% 8% 10% 12% 16% N/A N/A Nome is subject to a total effective tax rate of 40%, the risk-free rate is 4%, and the market is returning 12%, that is, the market risk premium (km - krF) is 8%. Consider the leverage levels in the banker's forecast, varying from zero to 70% debt in 10% increments. At each level: (1) Use the Hamada equation to estimate the levered beta, bl- (2) Use that b in the SML to forecast ke, the cost of equity. (3) Combine this estimate of ke, the banker's estimate of kd, and the debt and equity proportions of the level to calculate ka. (Remember to multiply ka by (1 - T).) Finally, extend the banker's forecast into a table containing rows for ka and ka, and locate the optimal capital structure where ka is minimized (approximately). Example 14-9 Concept Connection Estimating the optimal Capital Structure The Nome Corporation has operated without debt since its founding 30 years ago. Management is unhappy with the firm's stock price and has asked if there's a way to increase it without improving profit. The firm's historical beta is 1.2. An investment banker has estimated the rates at which Nome could reasonably borrow as a function of leverage where leverage is defined as debt as a percentage of total capital. % 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Debt ka N/A 6% 6.5% 7% 8% 10% 12% 16% N/A N/A Nome is subject to a total effective tax rate of 40%, the risk-free rate is 4%, and the market is returning 12%, that is, the market risk premium (km - krF) is 8%. Consider the leverage levels in the banker's forecast, varying from zero to 70% debt in 10% increments. At each level: (1) Use the Hamada equation to estimate the levered beta, bl- (2) Use that b in the SML to forecast ke, the cost of equity. (3) Combine this estimate of ke, the banker's estimate of kd, and the debt and equity proportions of the level to calculate ka. (Remember to multiply ka by (1 - T).) Finally, extend the banker's forecast into a table containing rows for ka and ka, and locate the optimal capital structure where ka is minimized (approximately)