please review & help with anything I may have left blank. Thank you

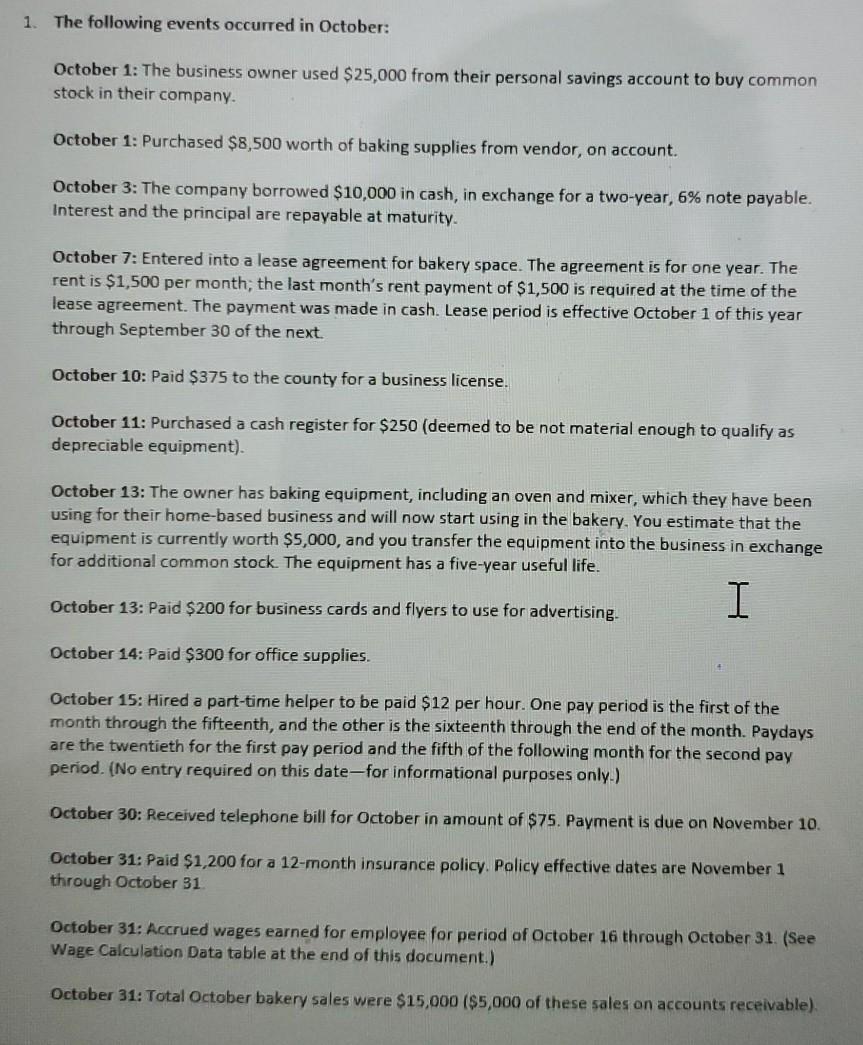

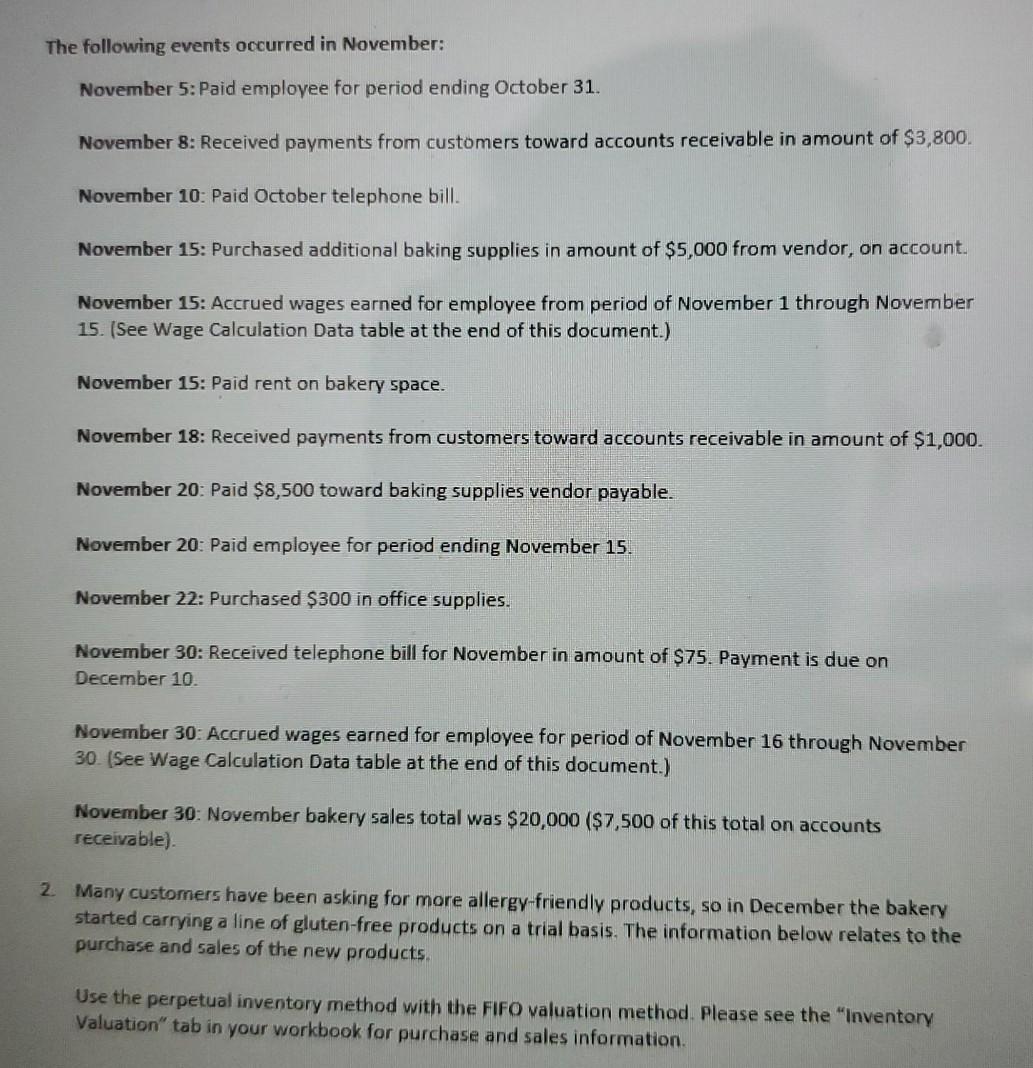

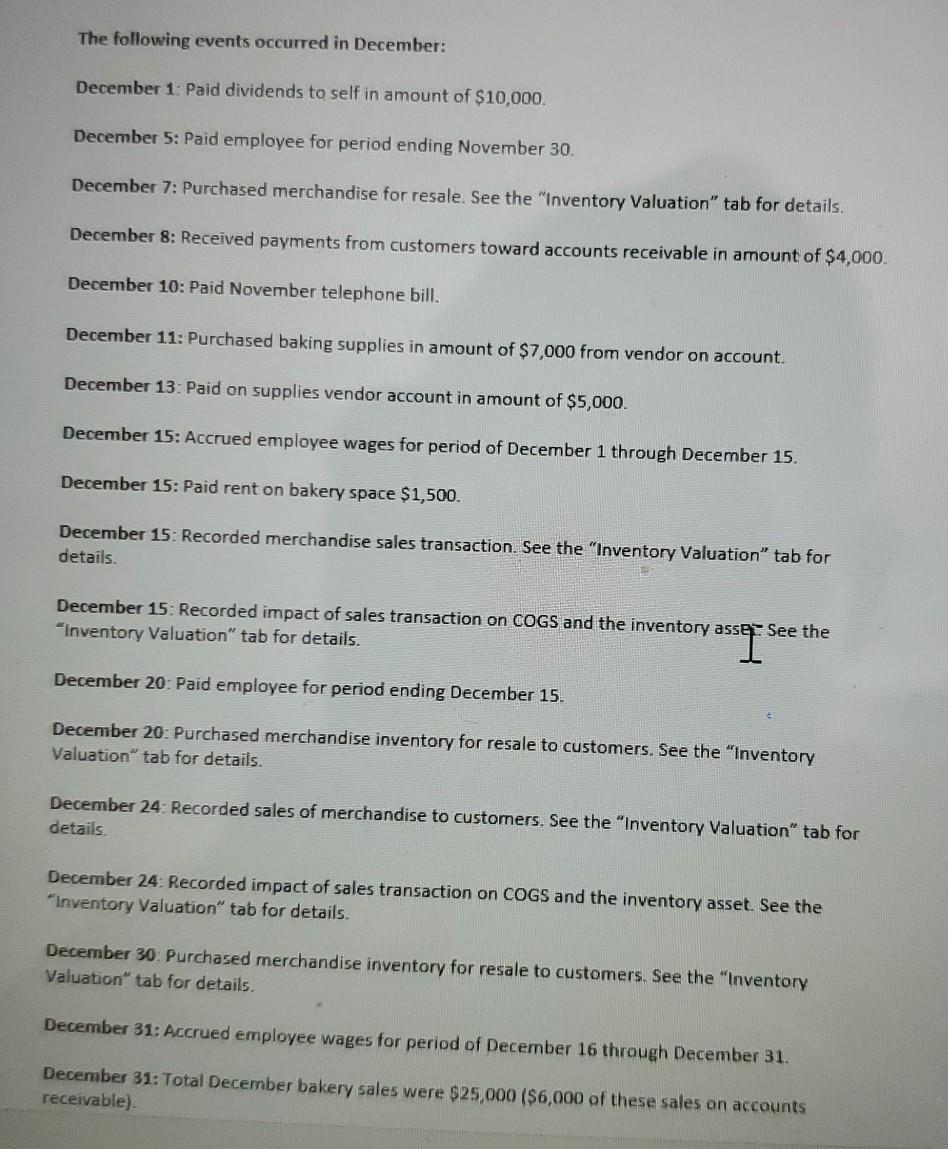

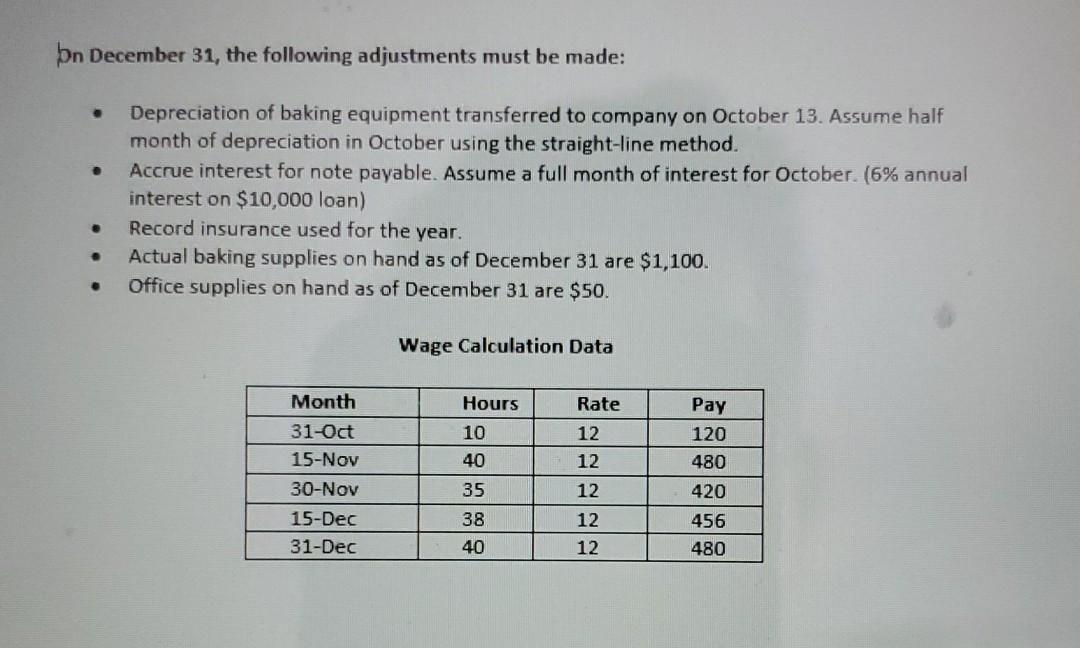

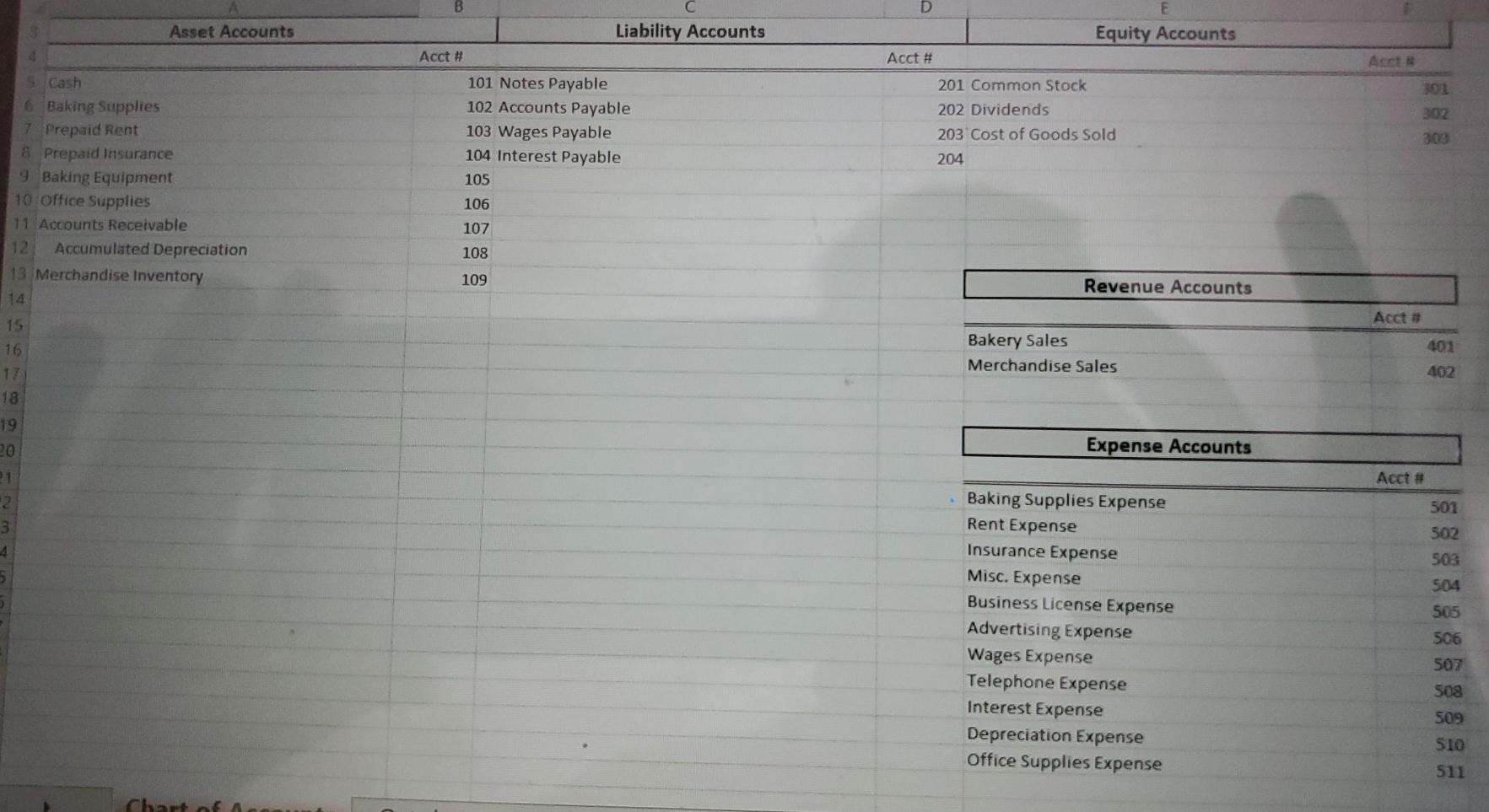

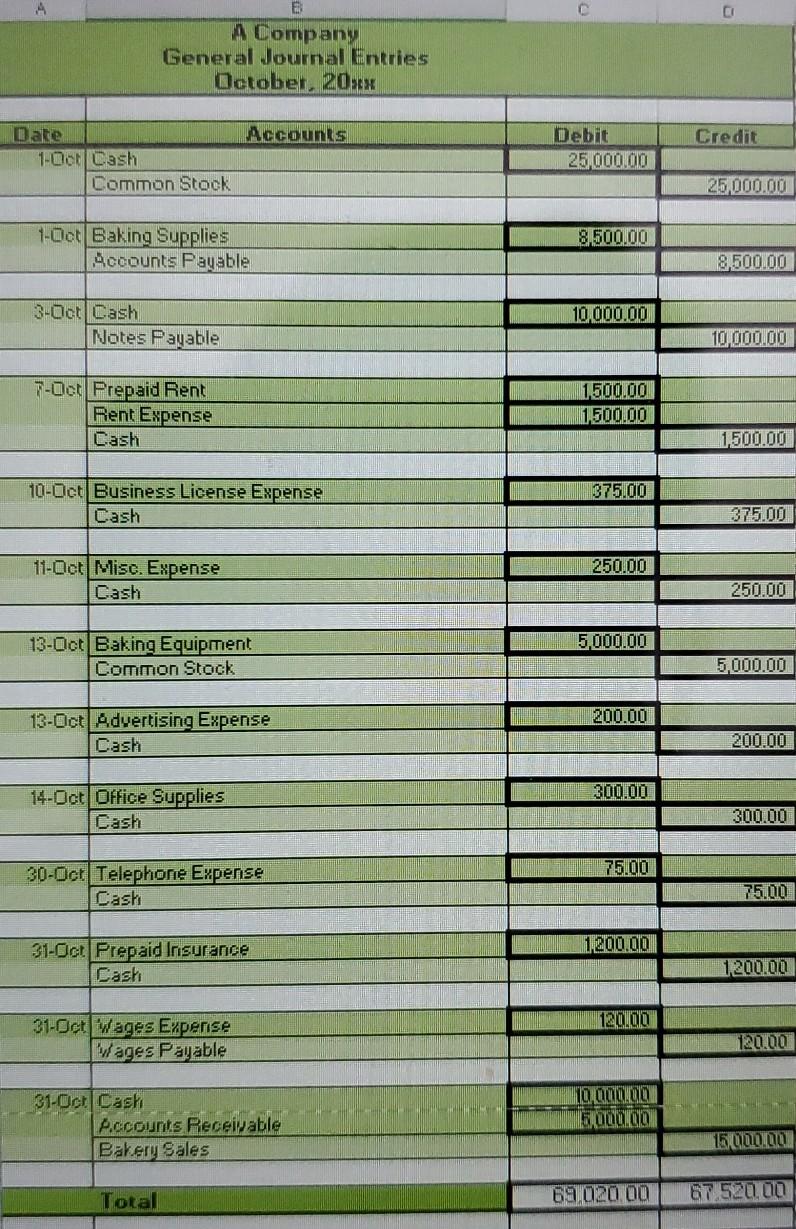

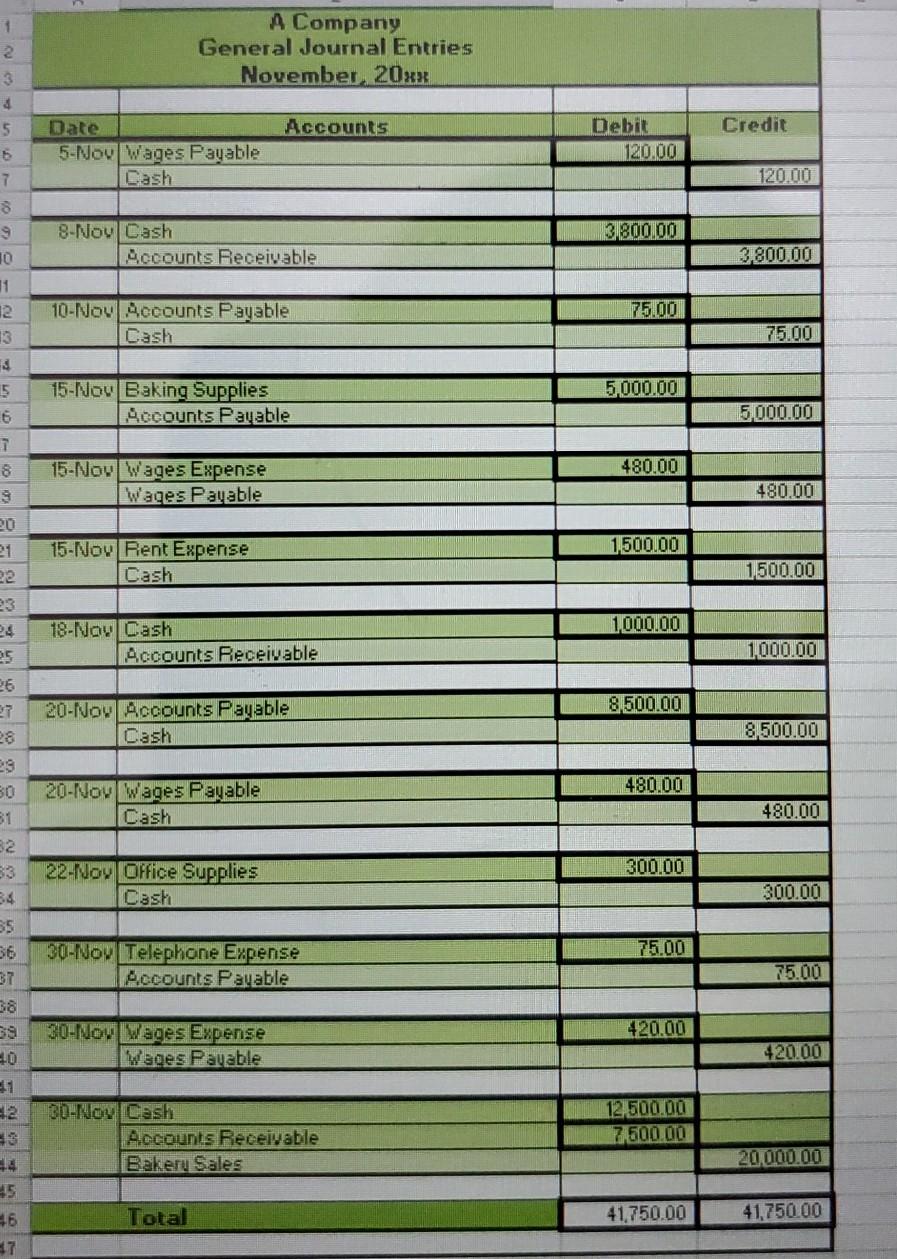

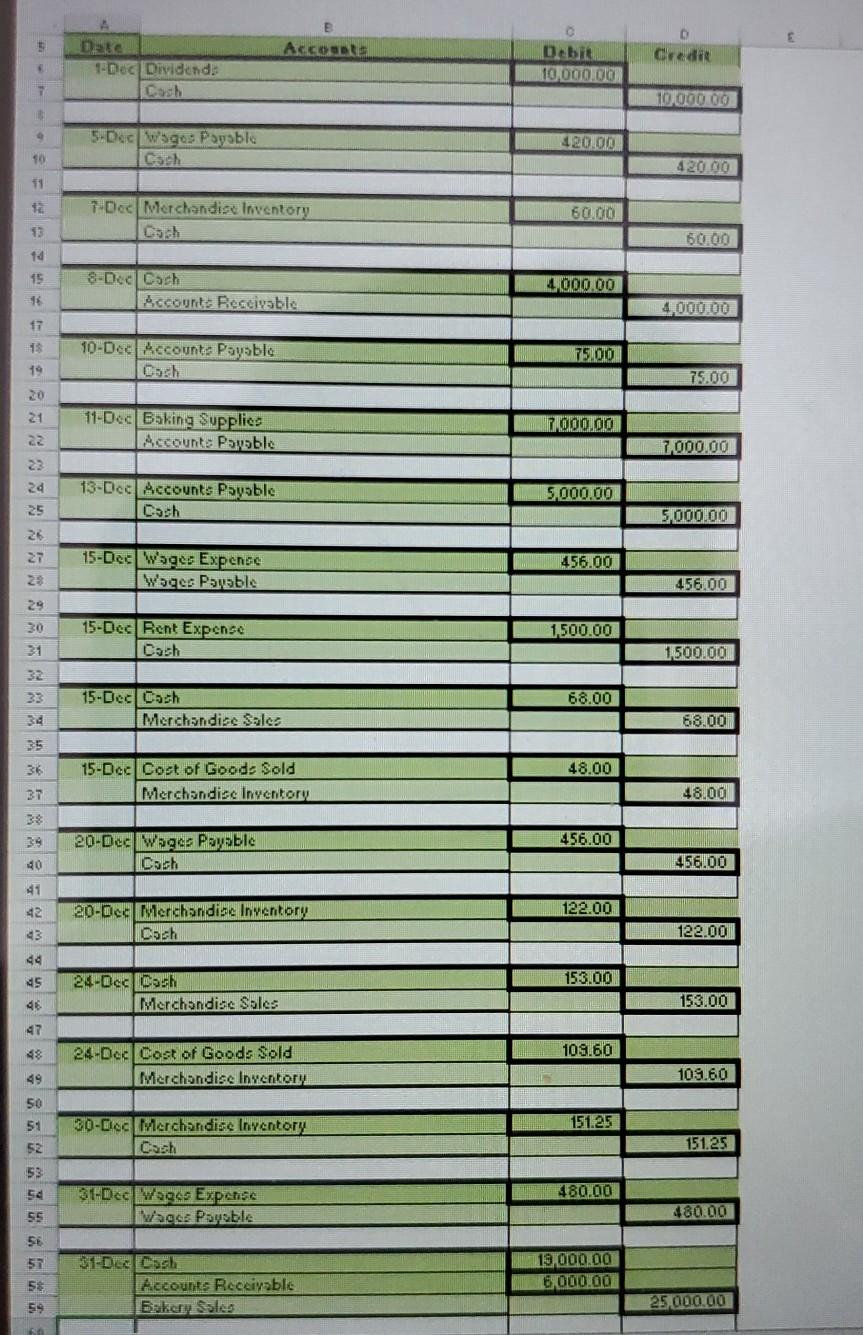

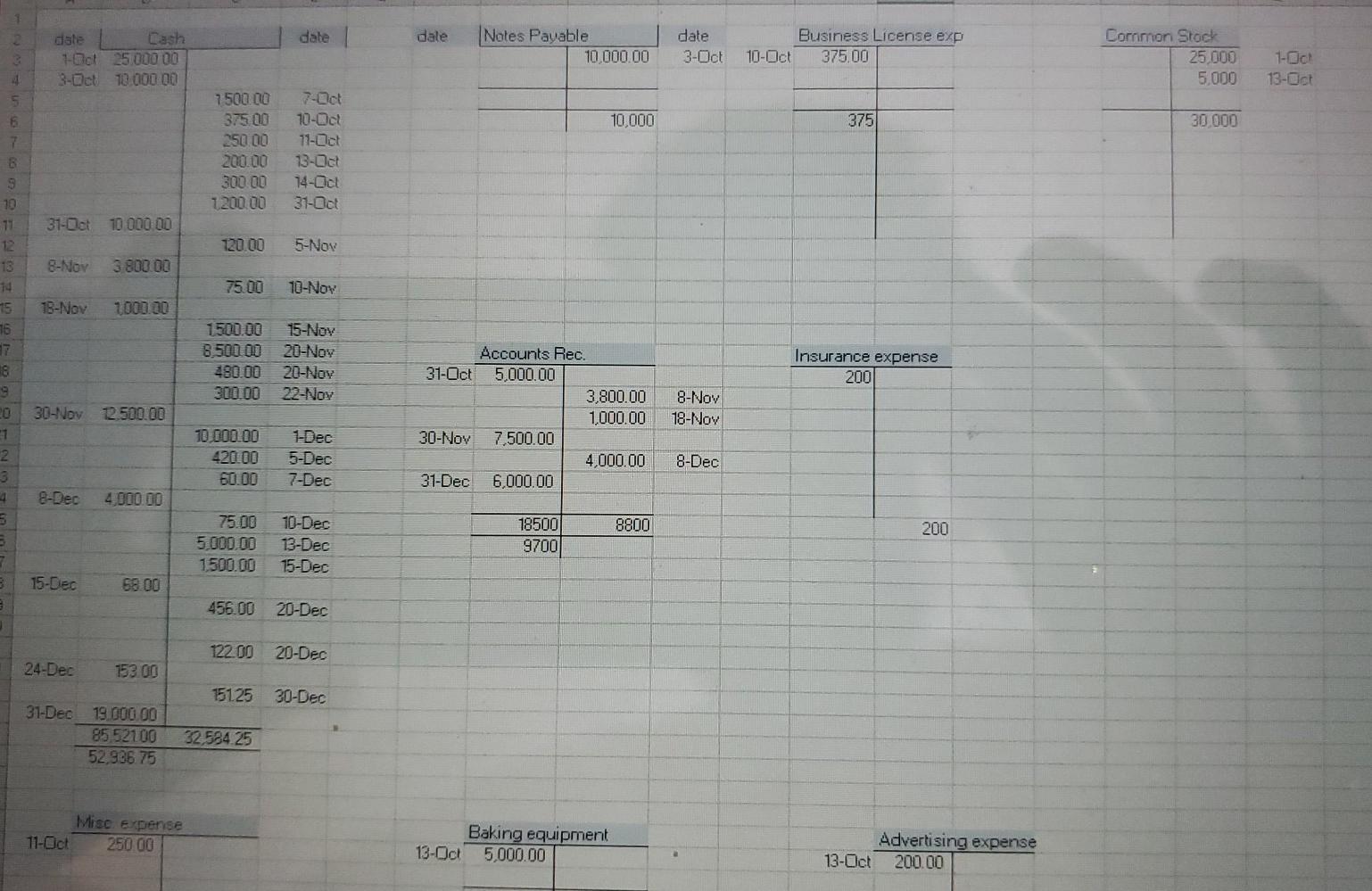

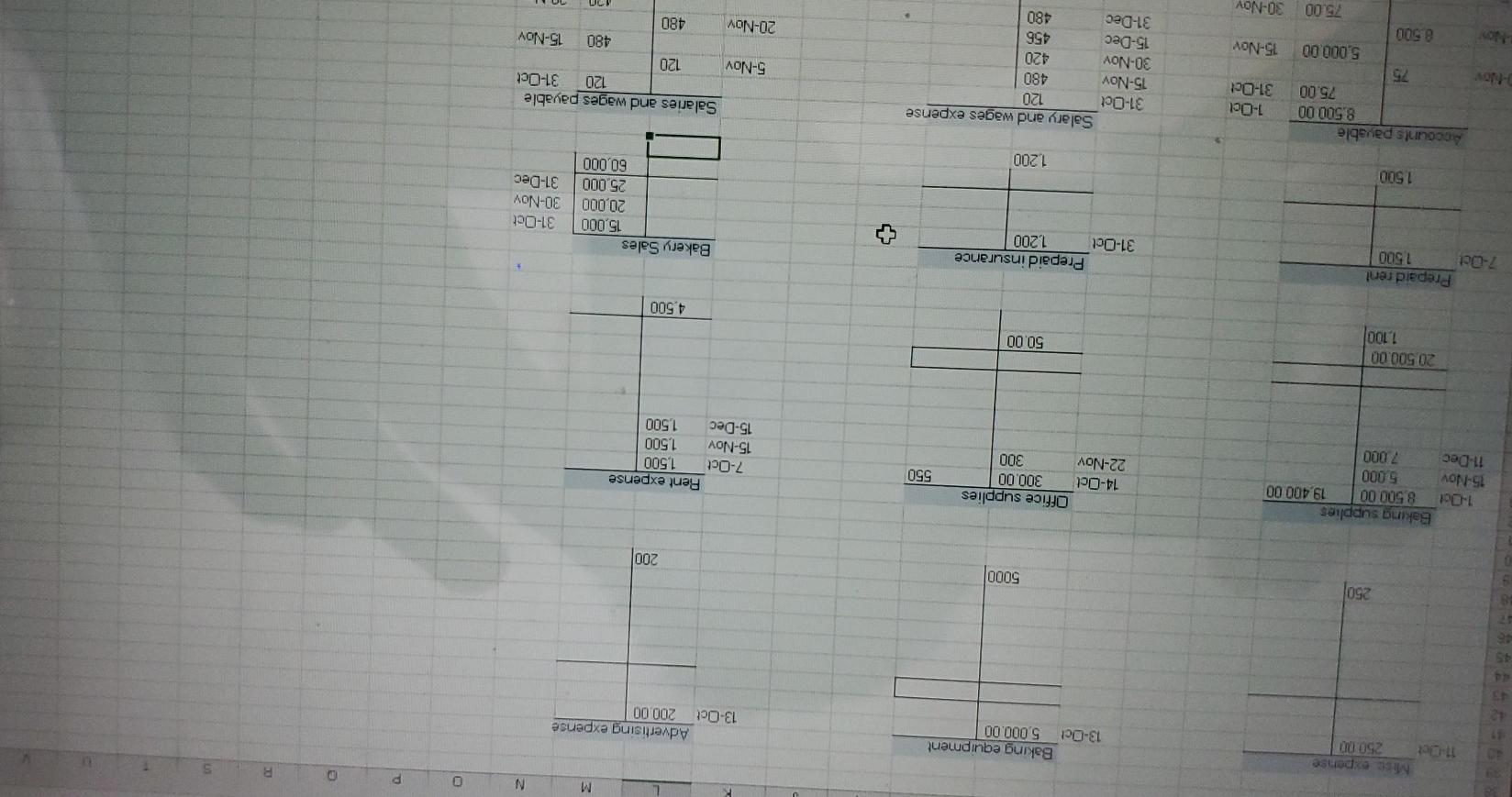

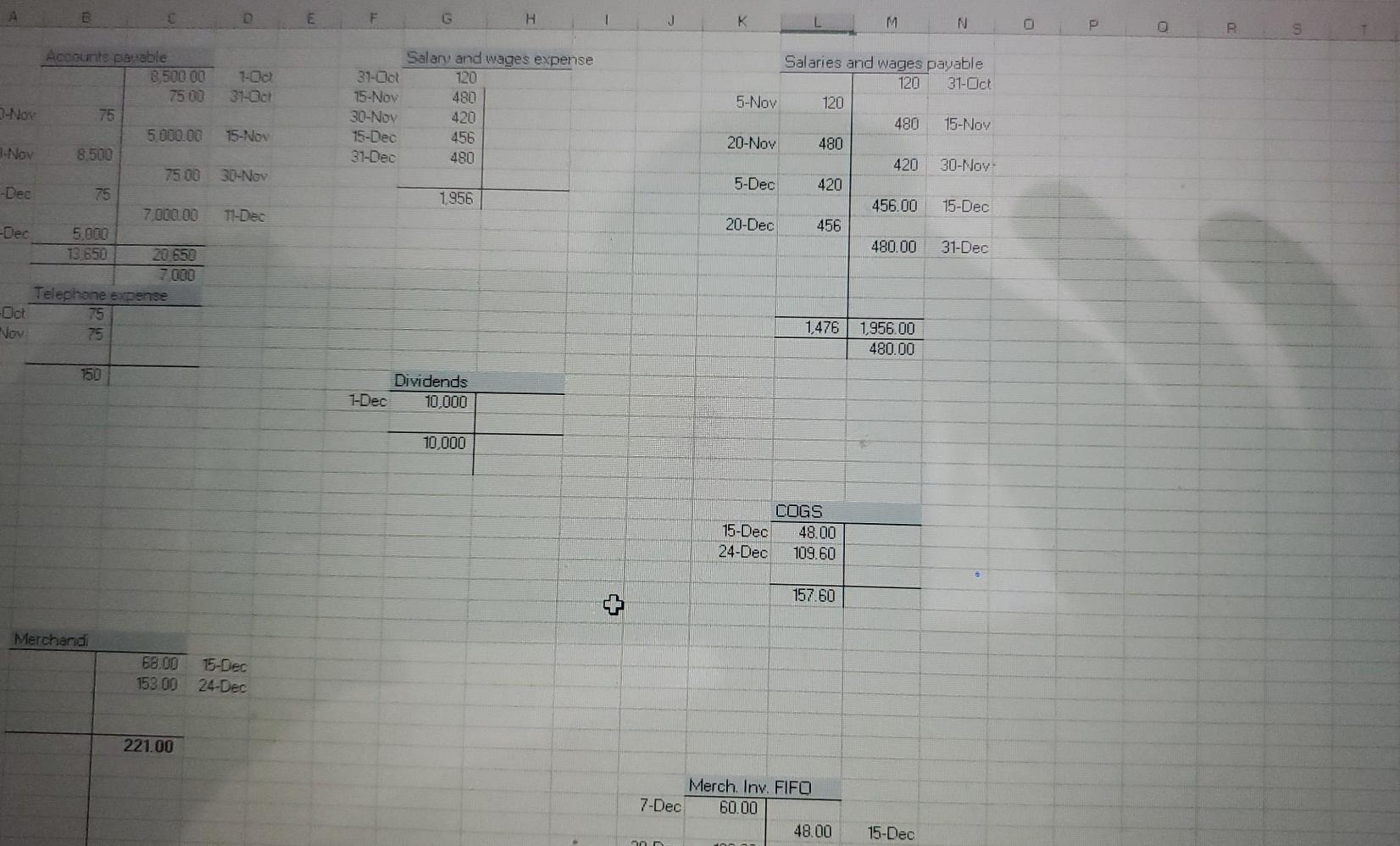

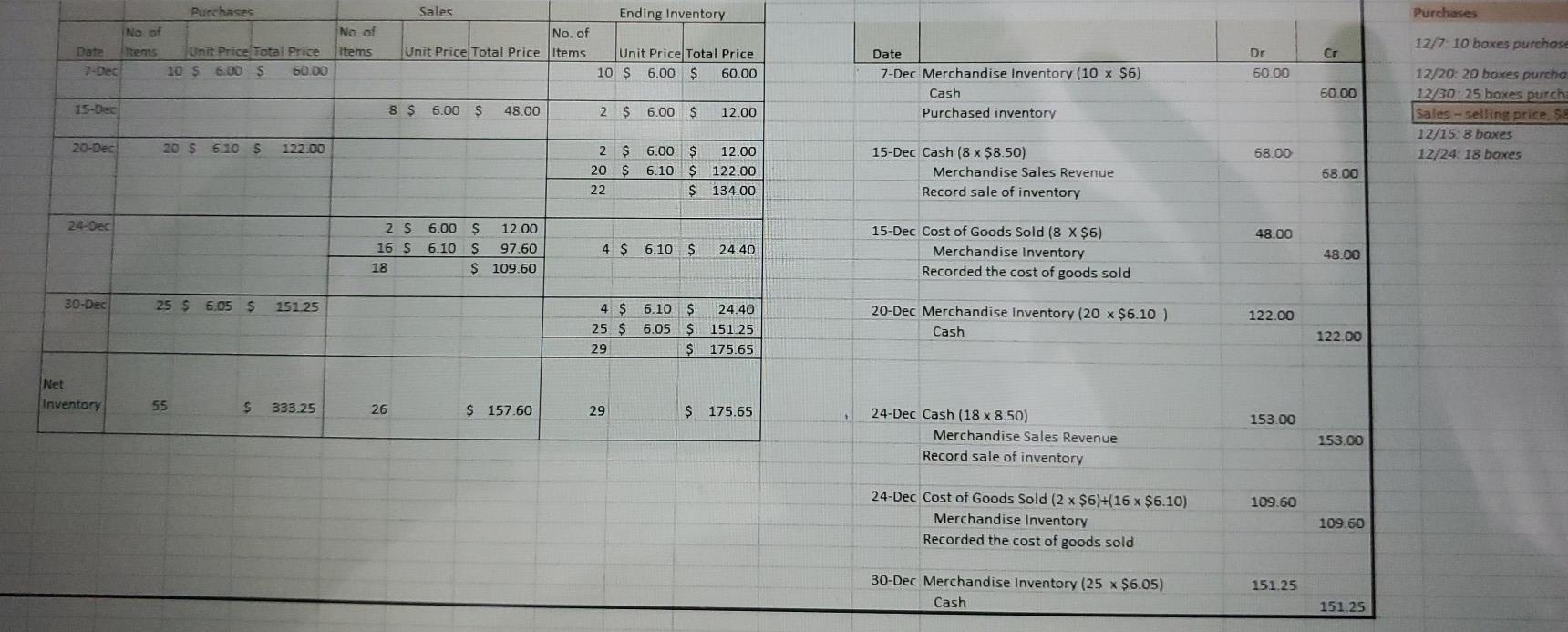

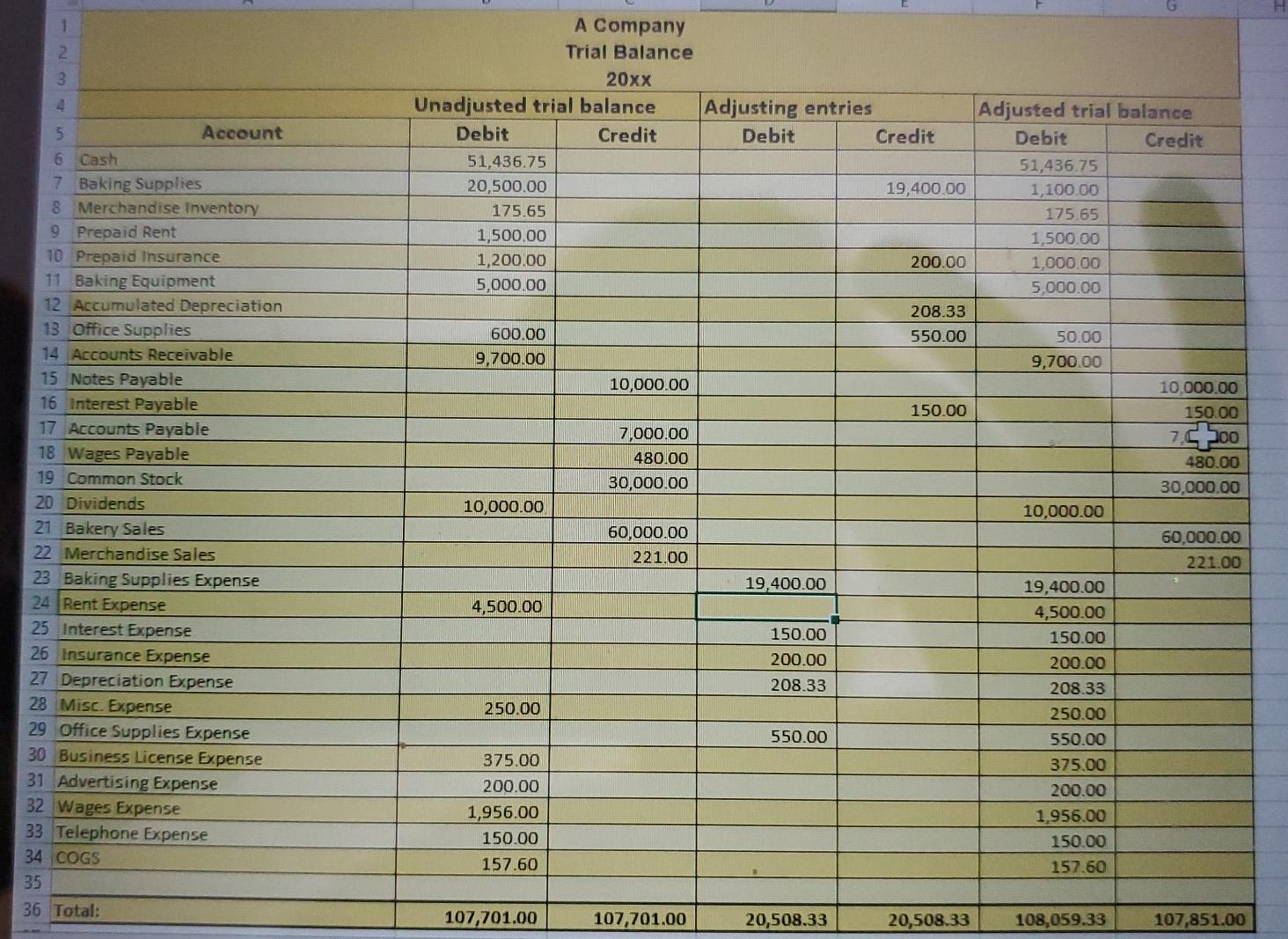

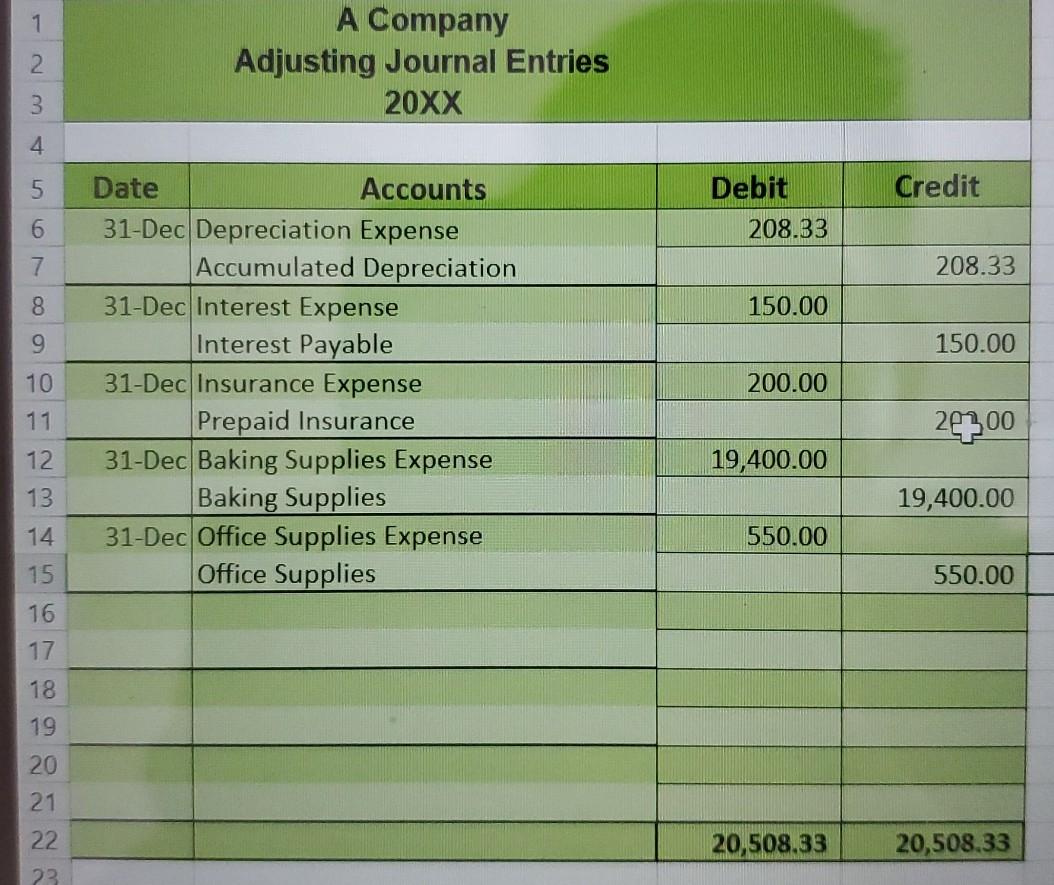

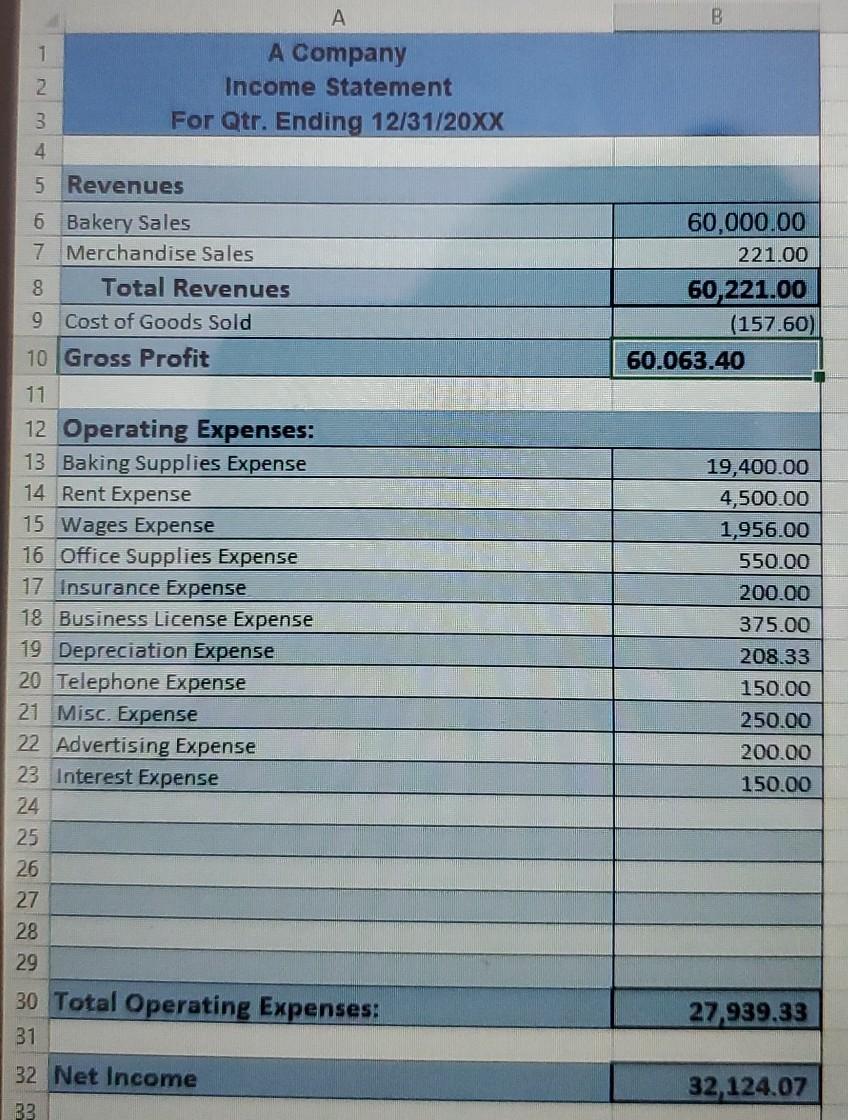

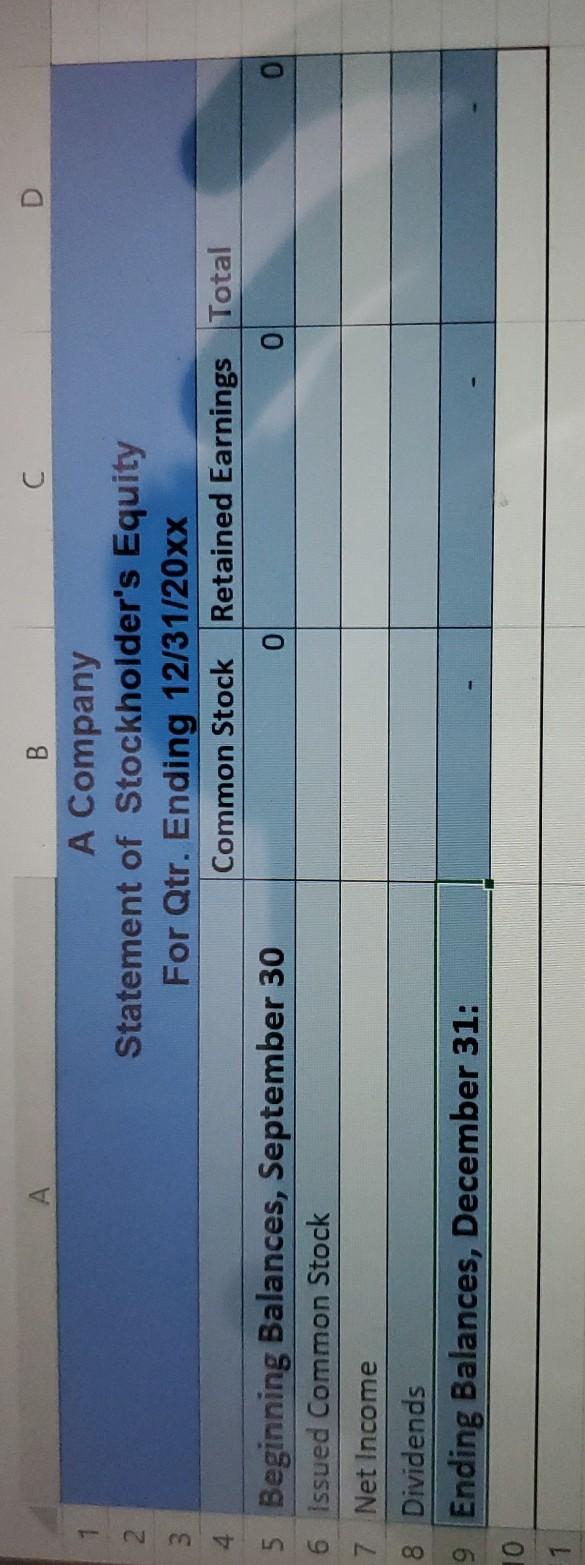

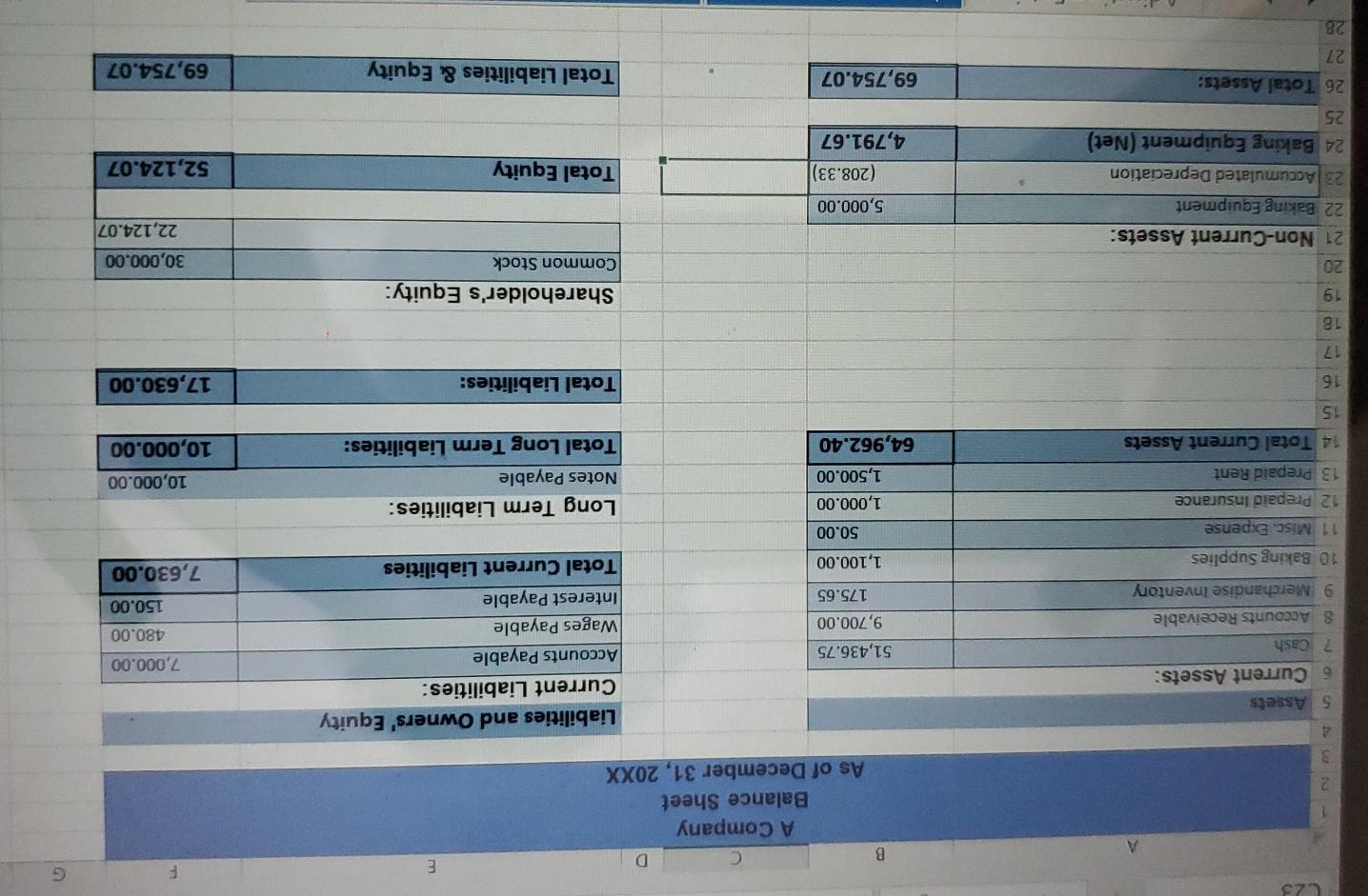

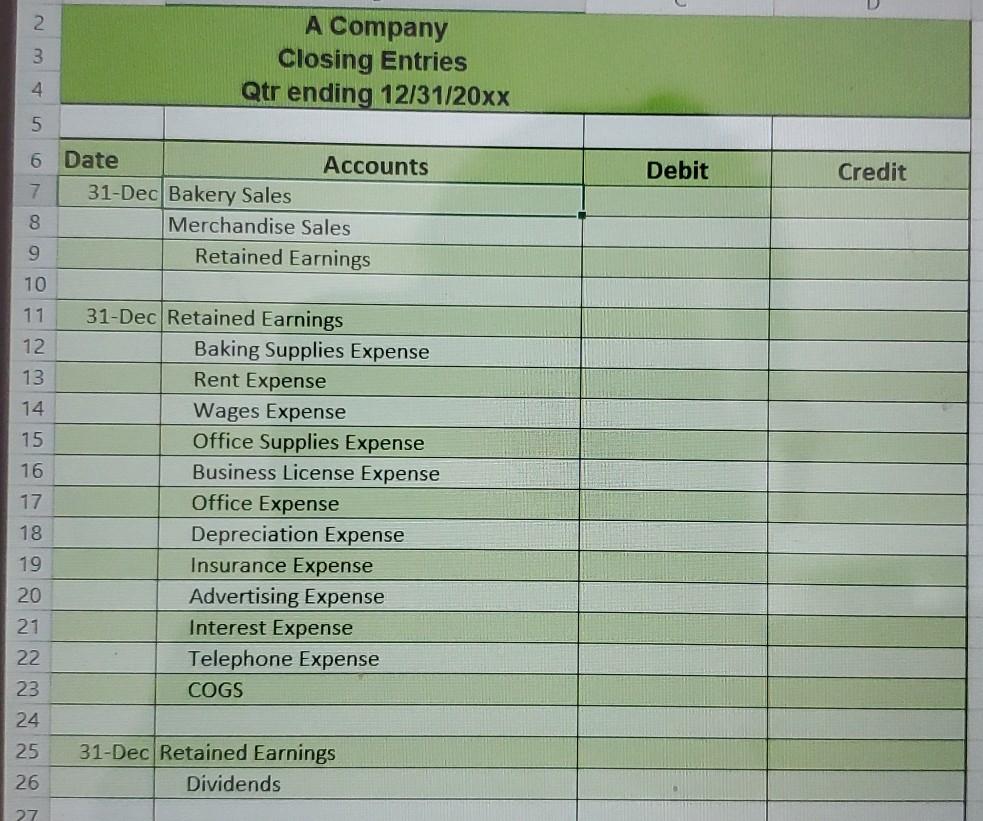

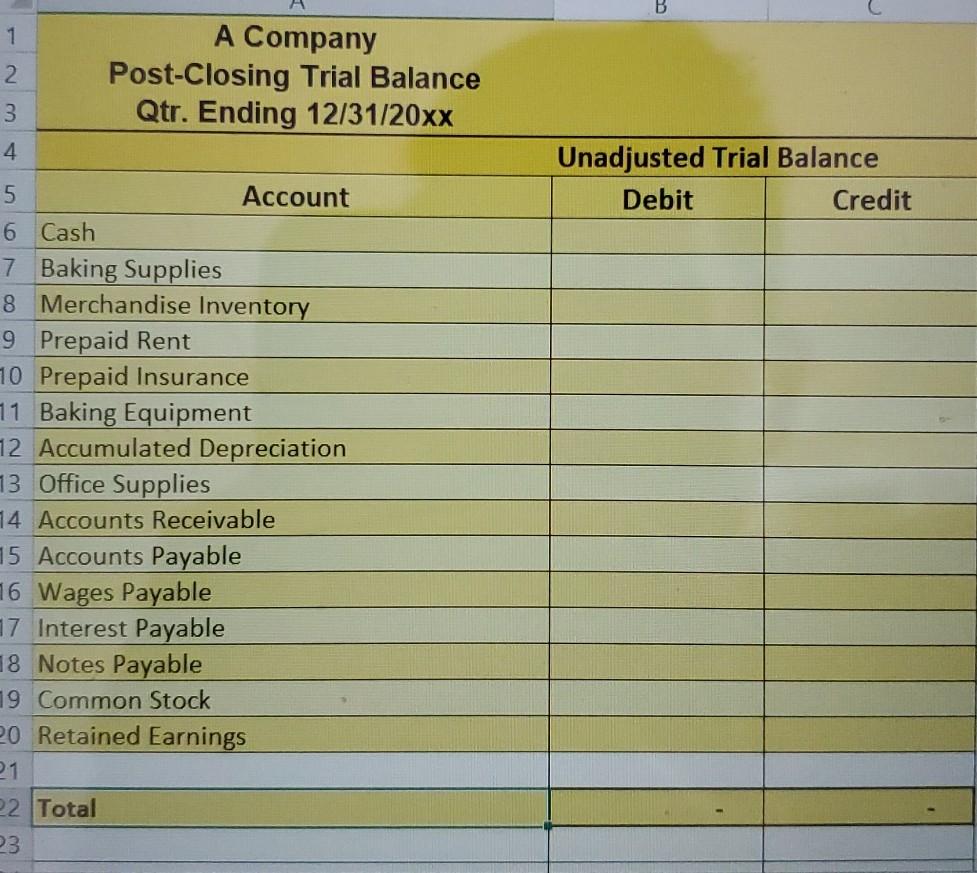

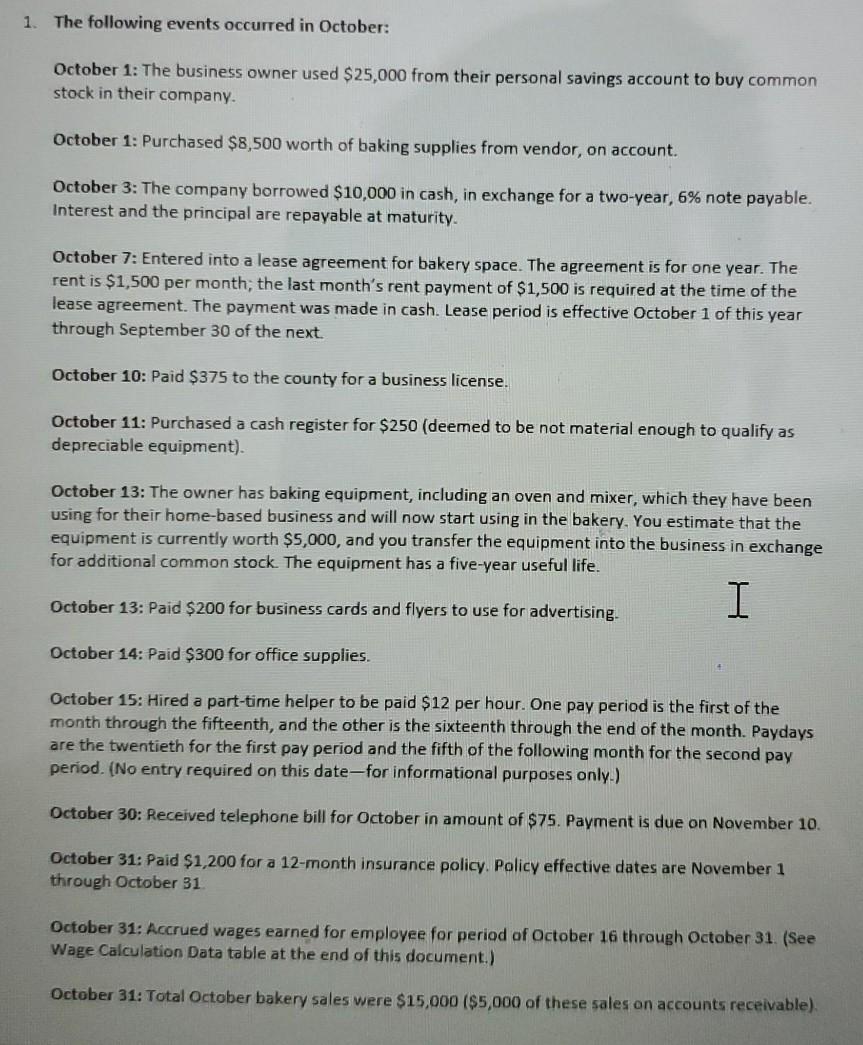

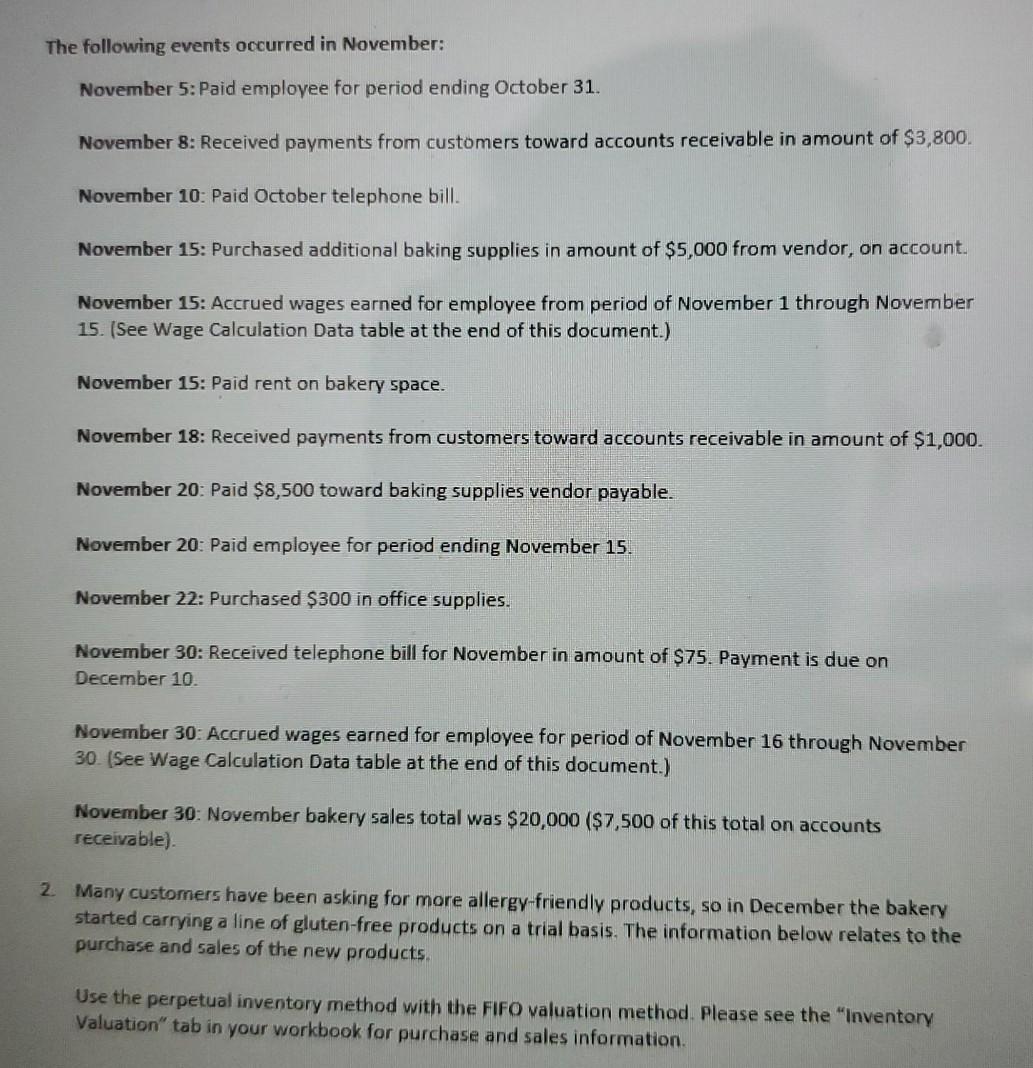

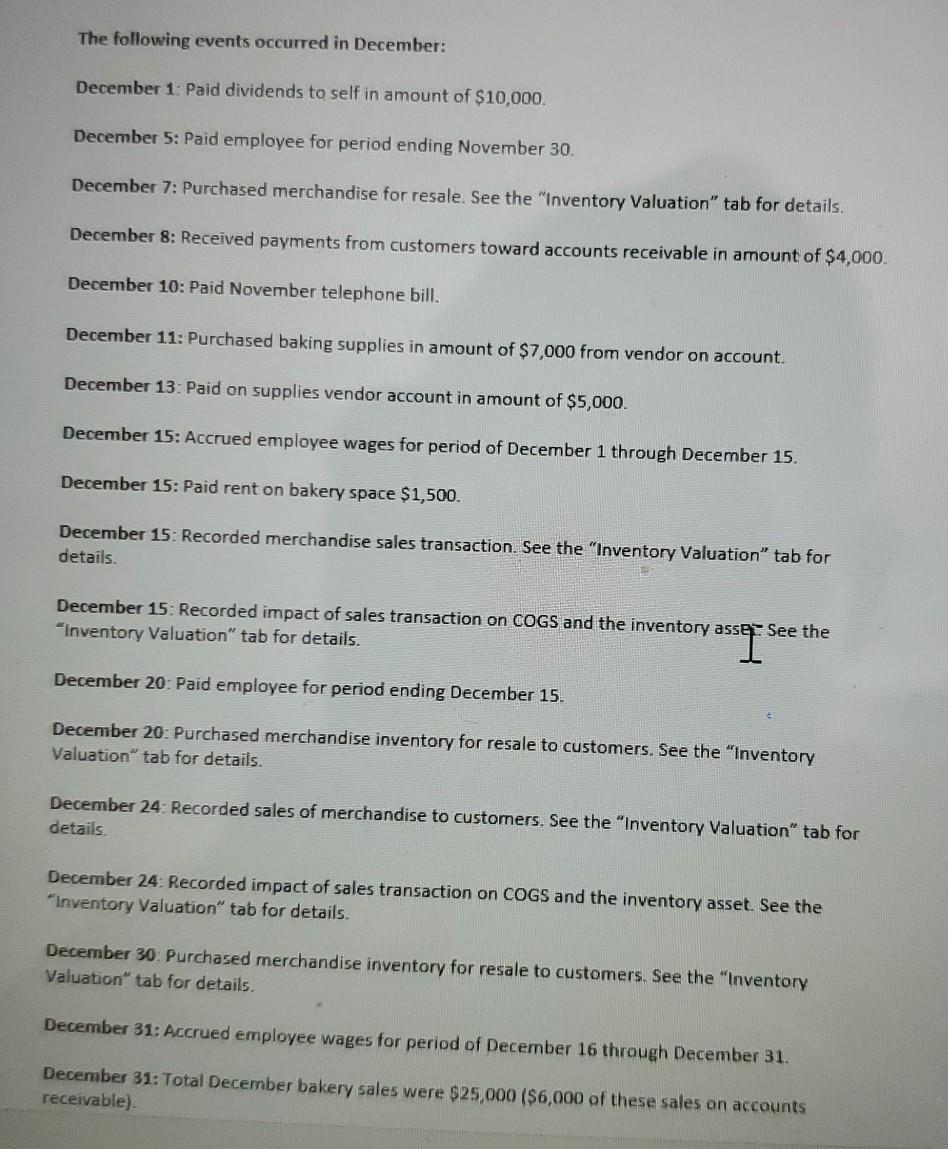

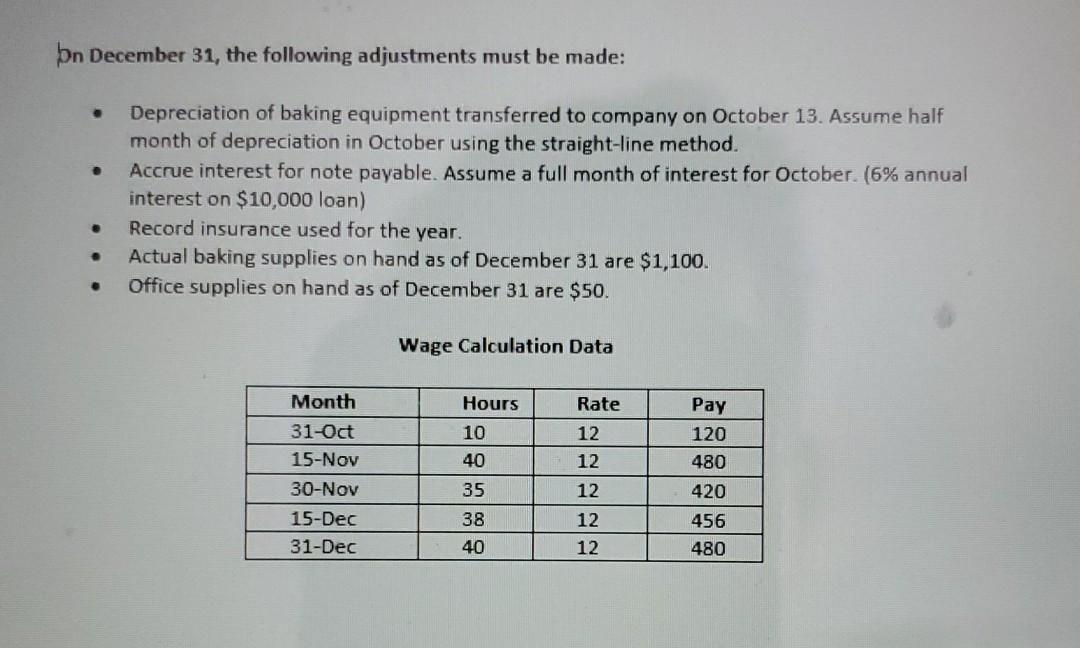

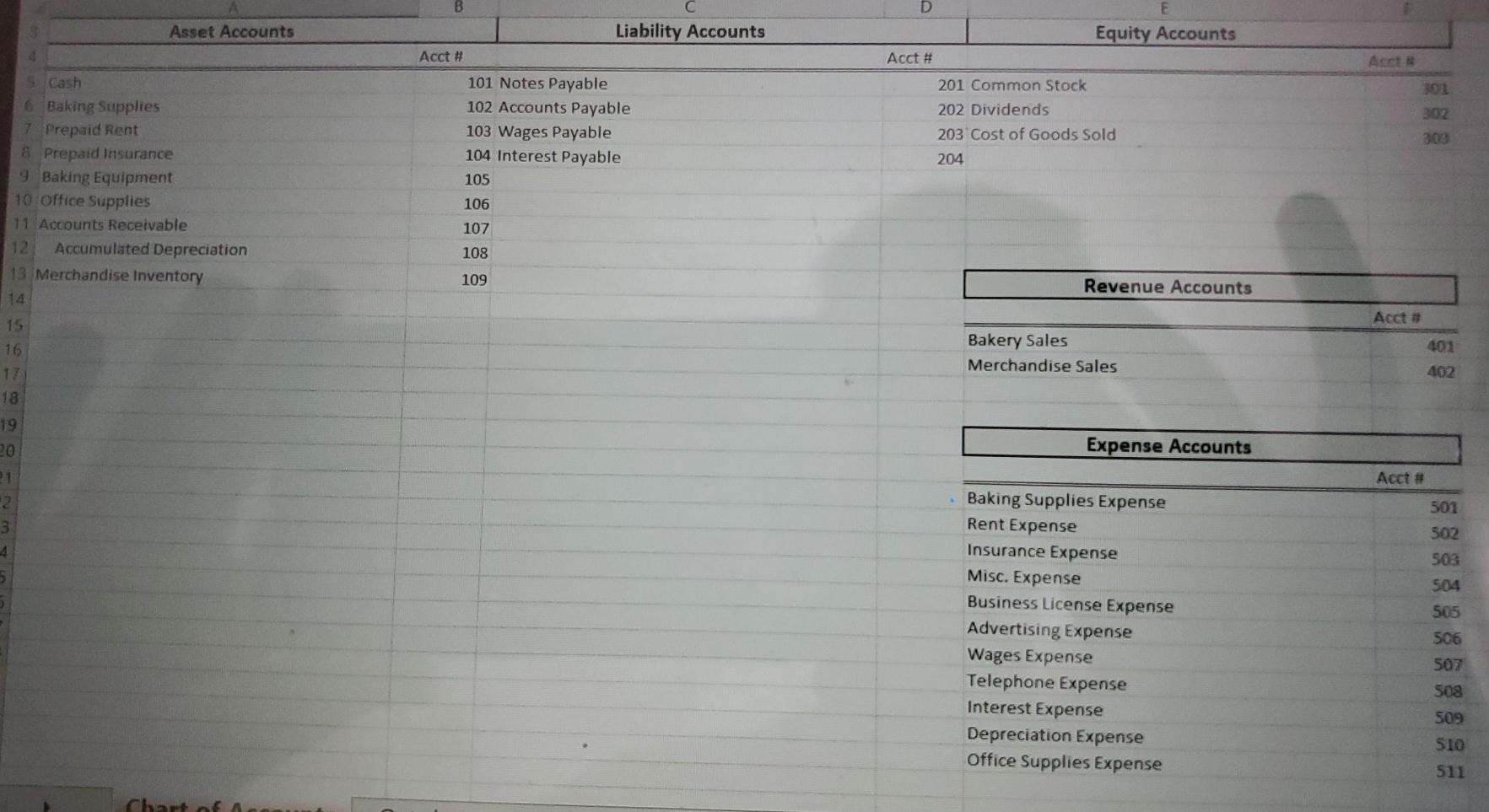

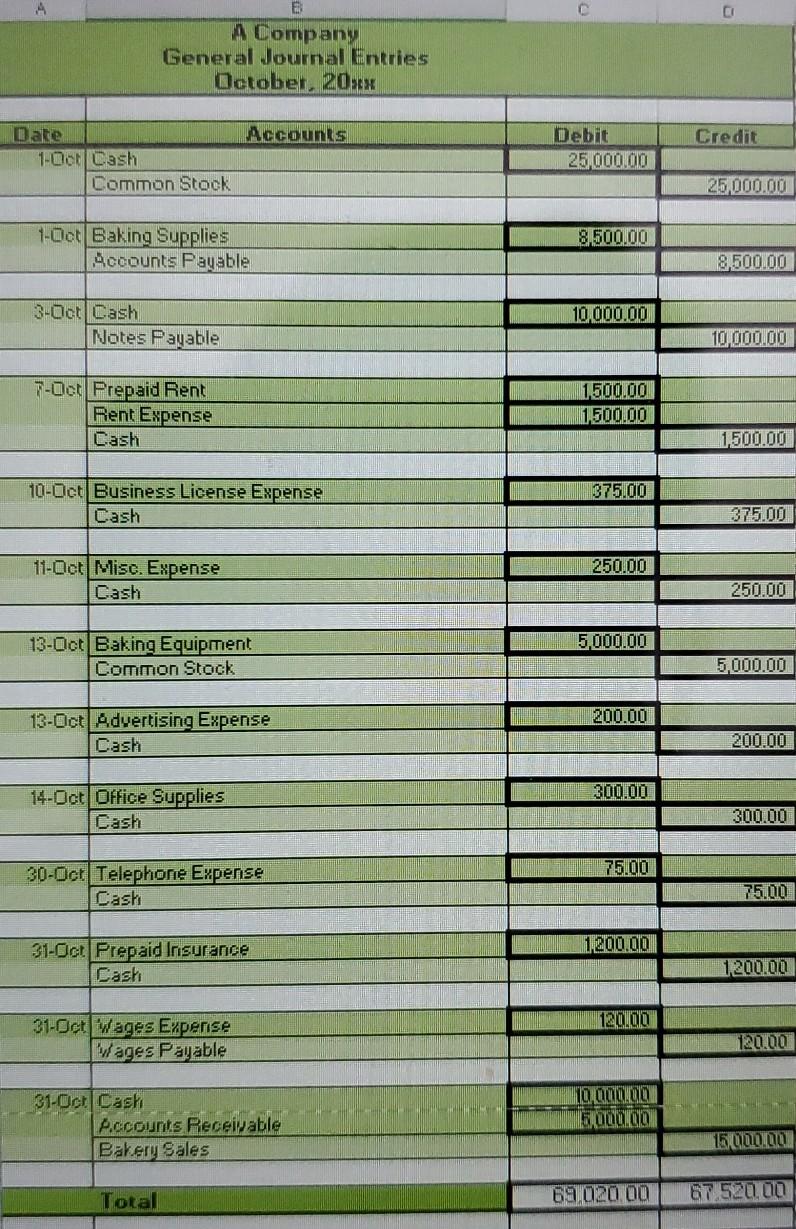

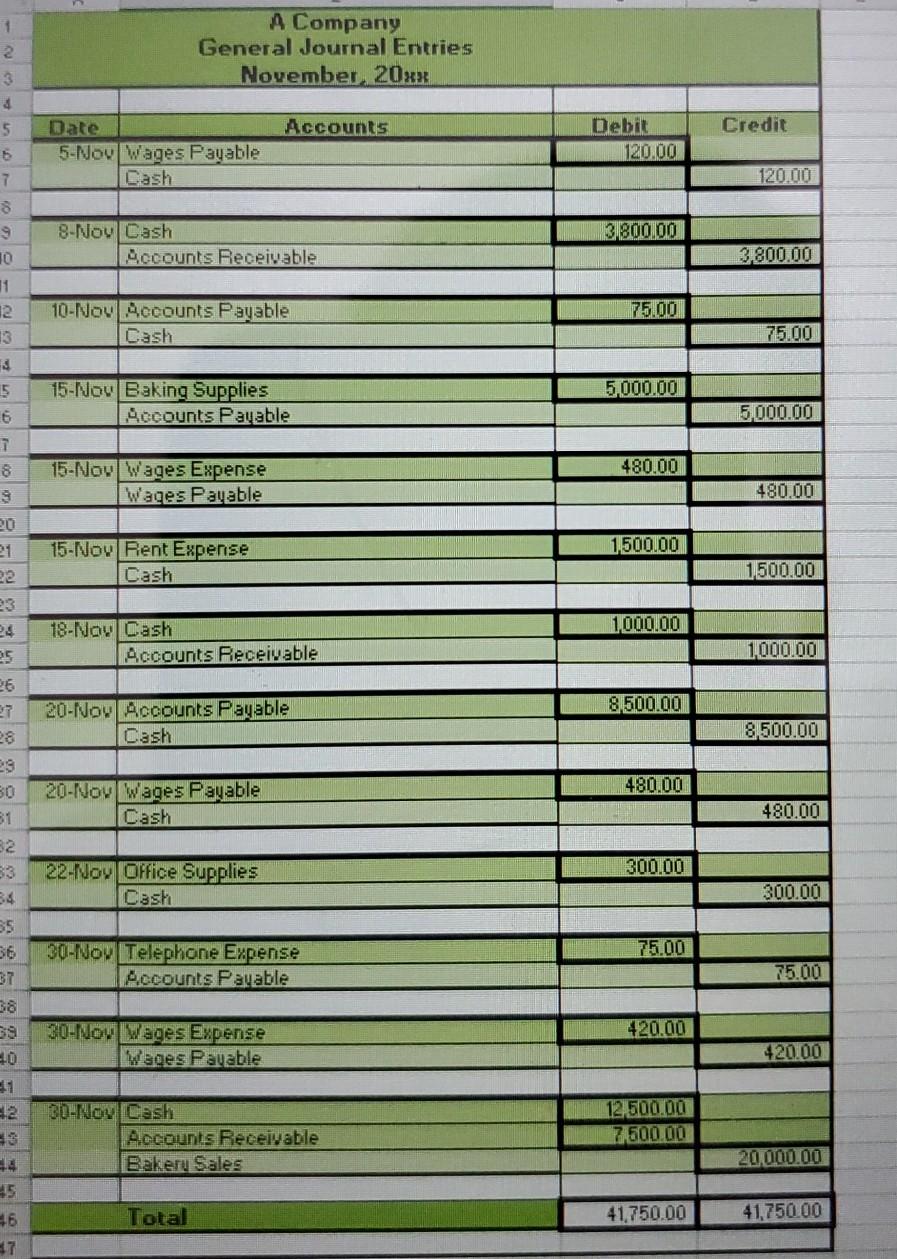

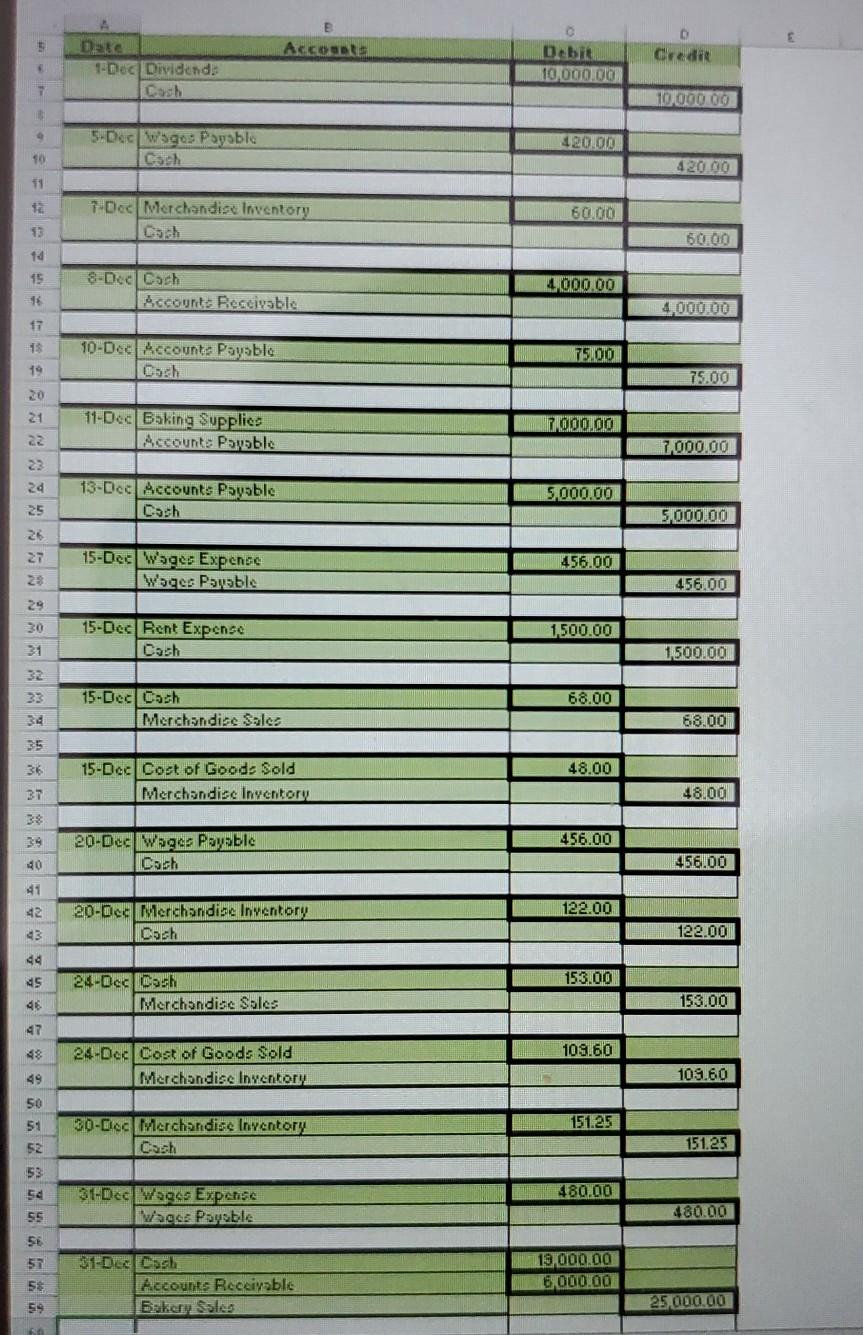

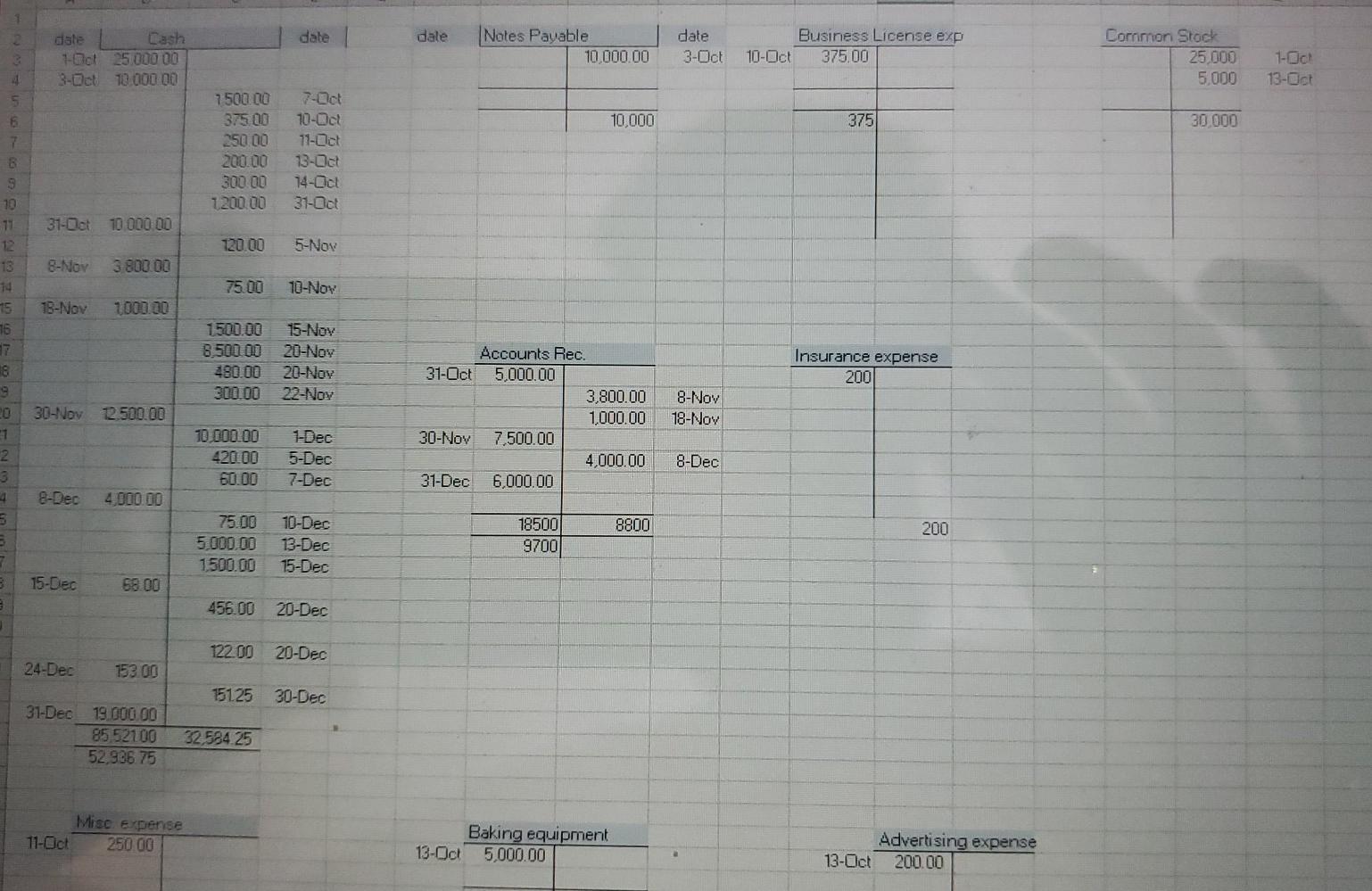

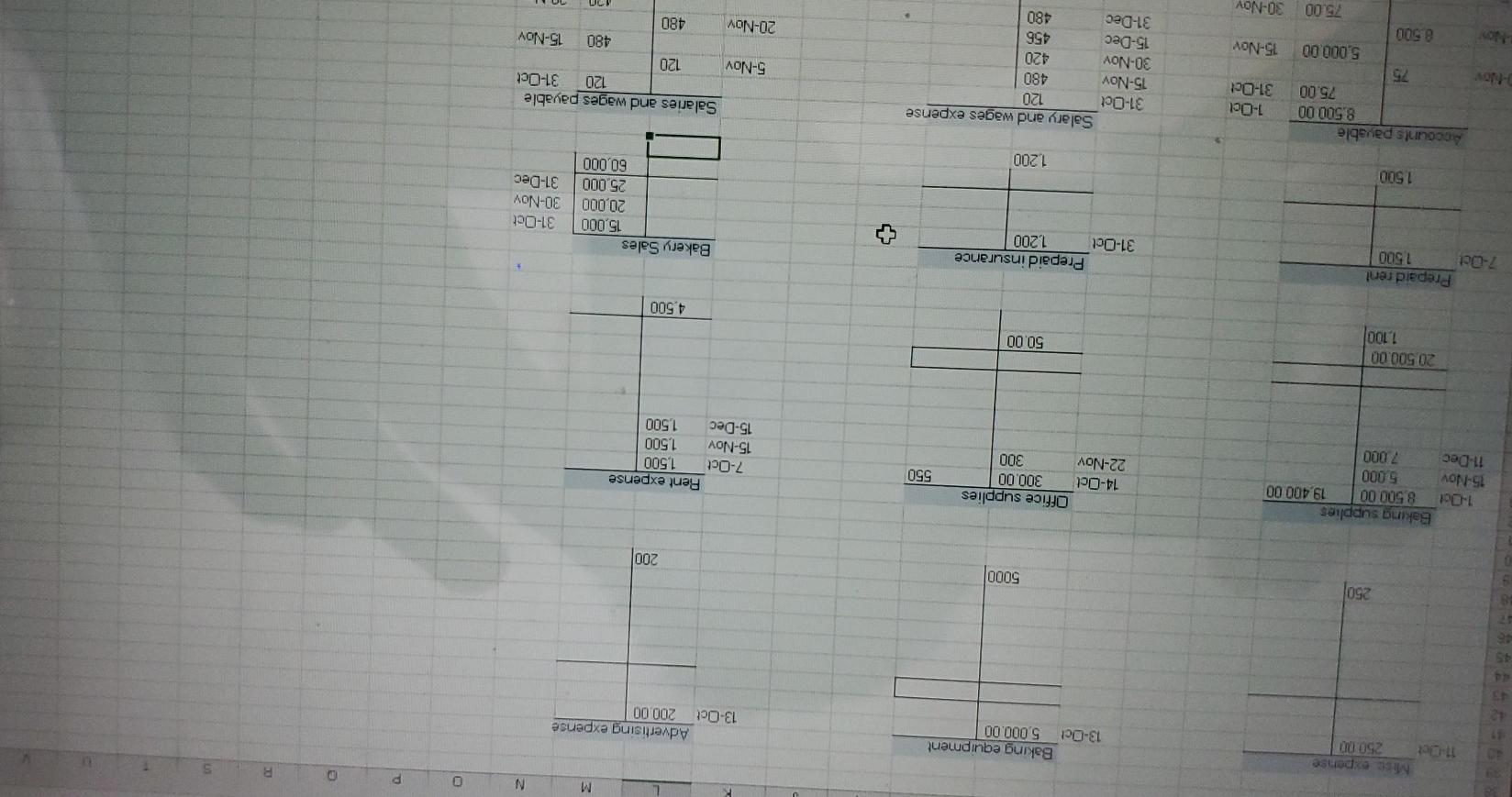

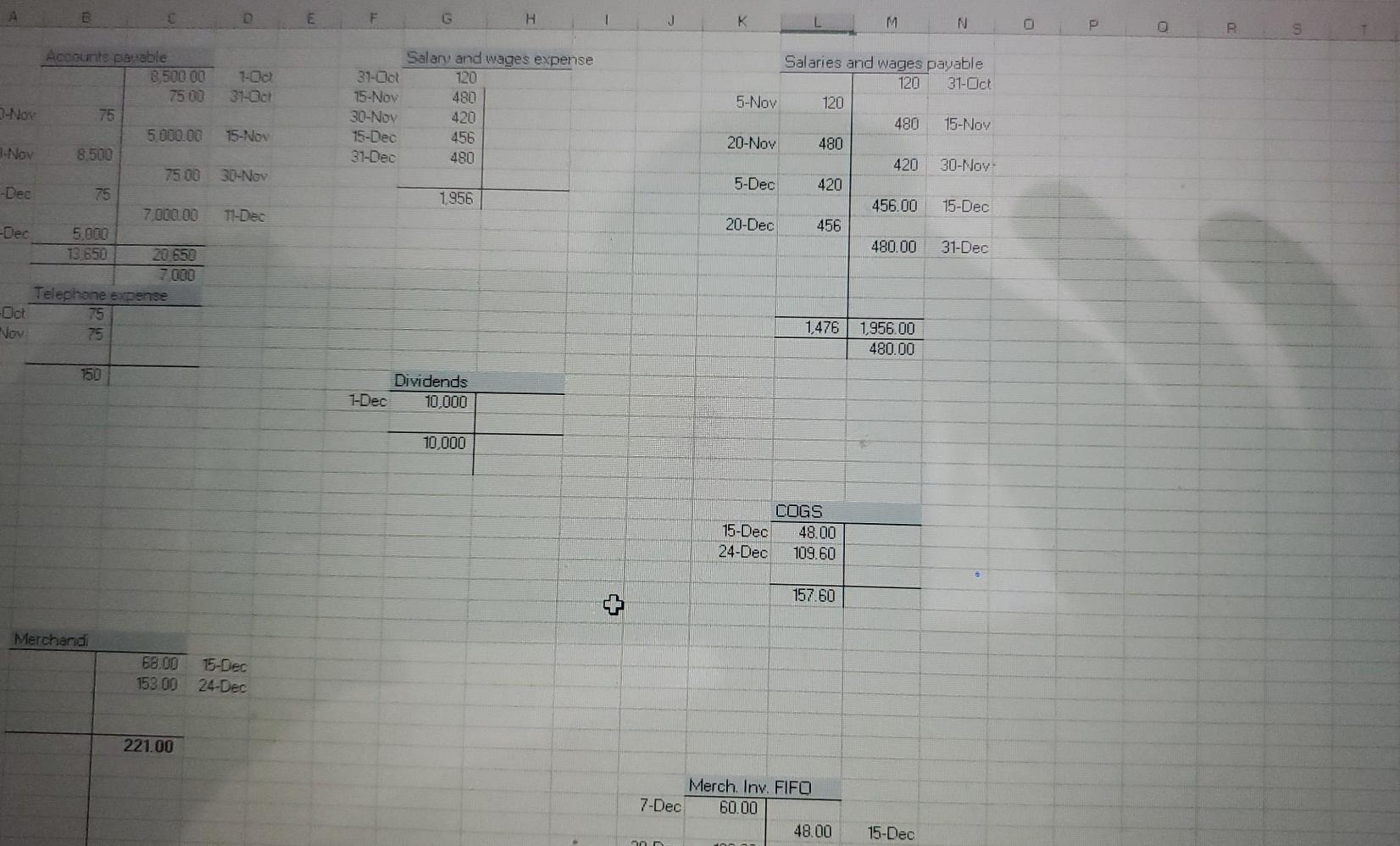

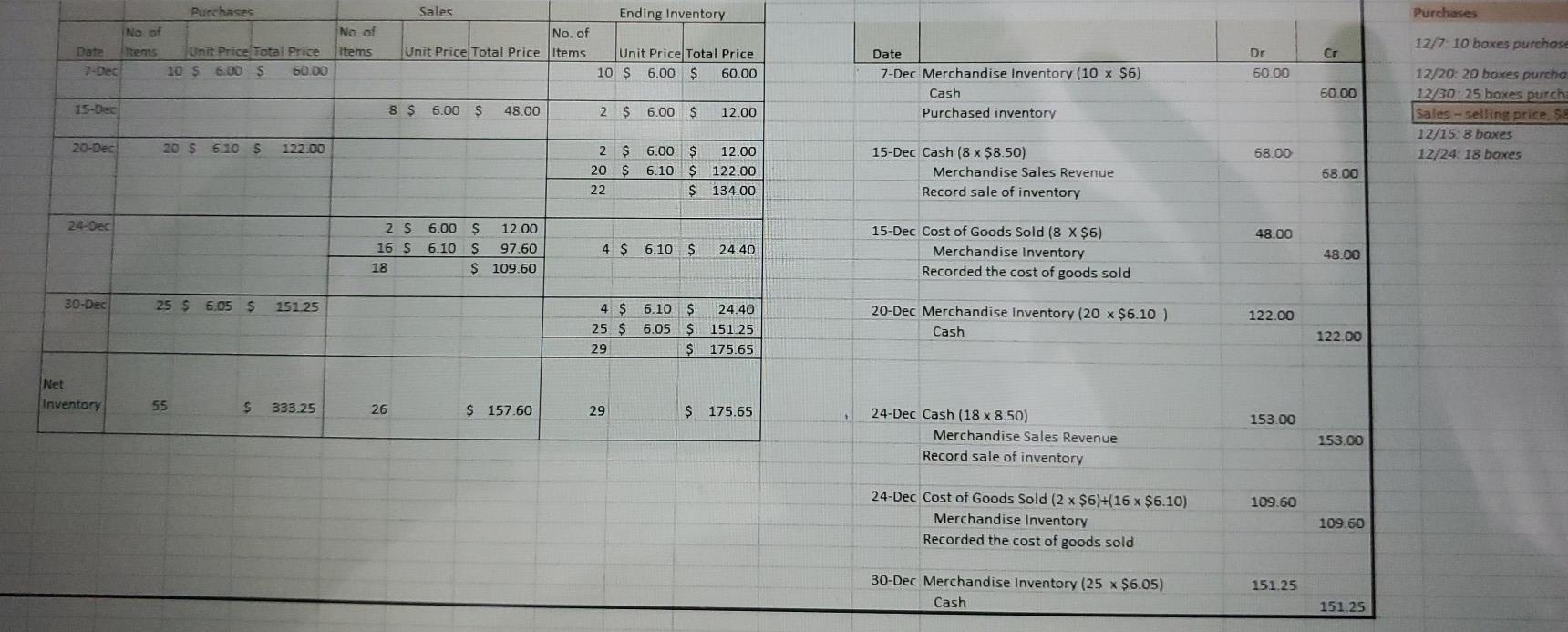

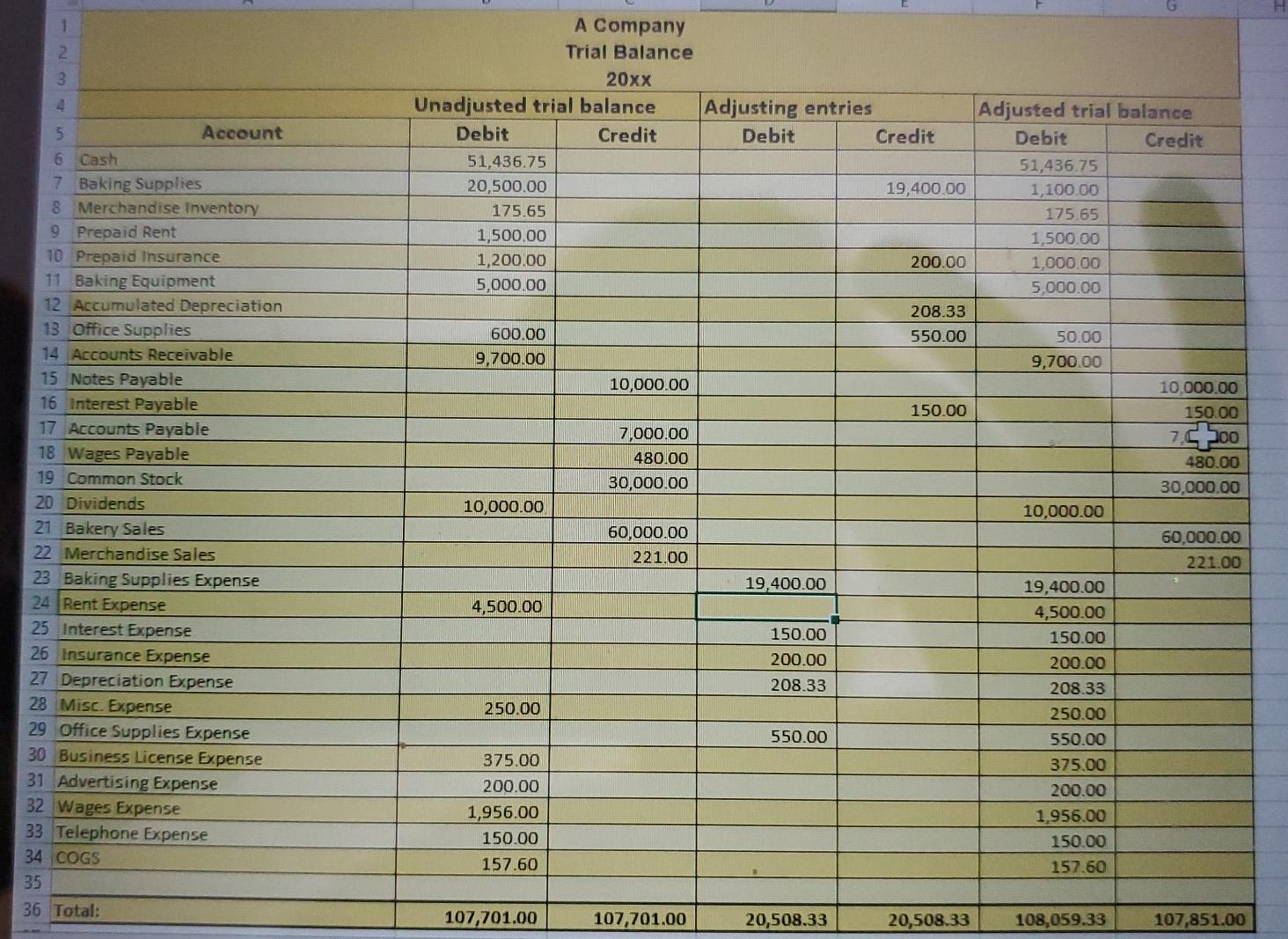

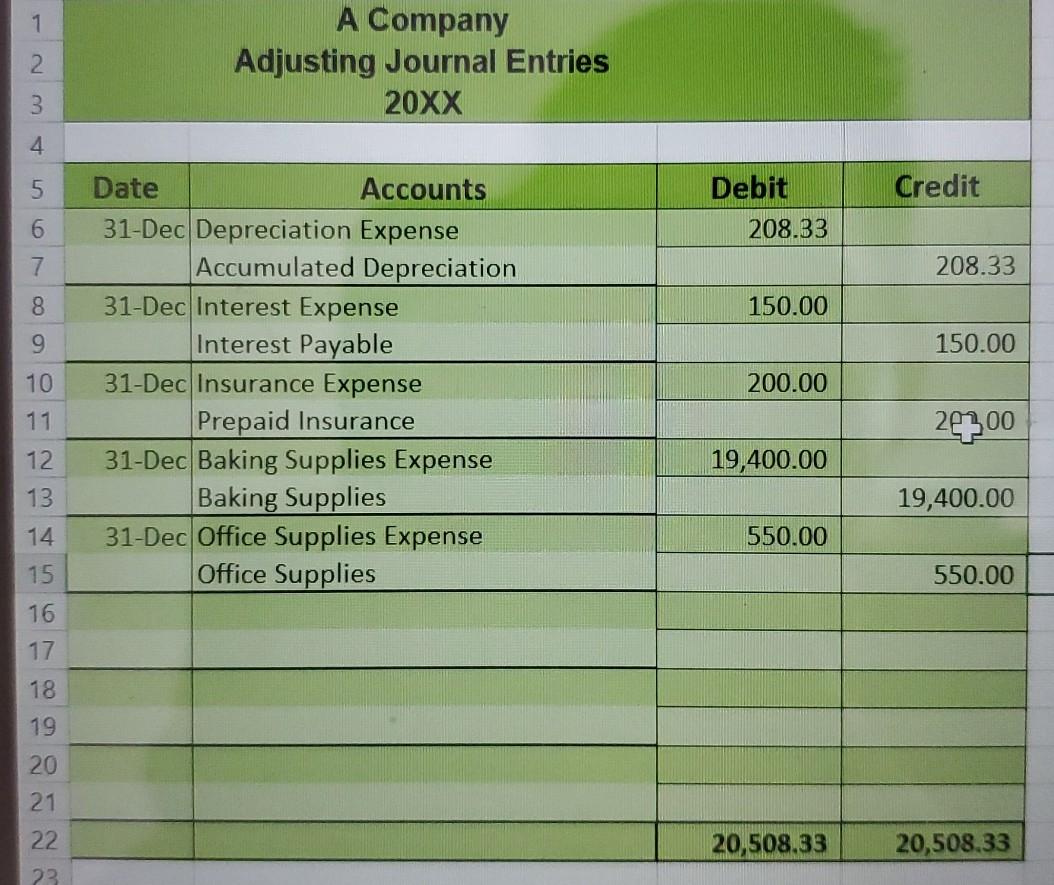

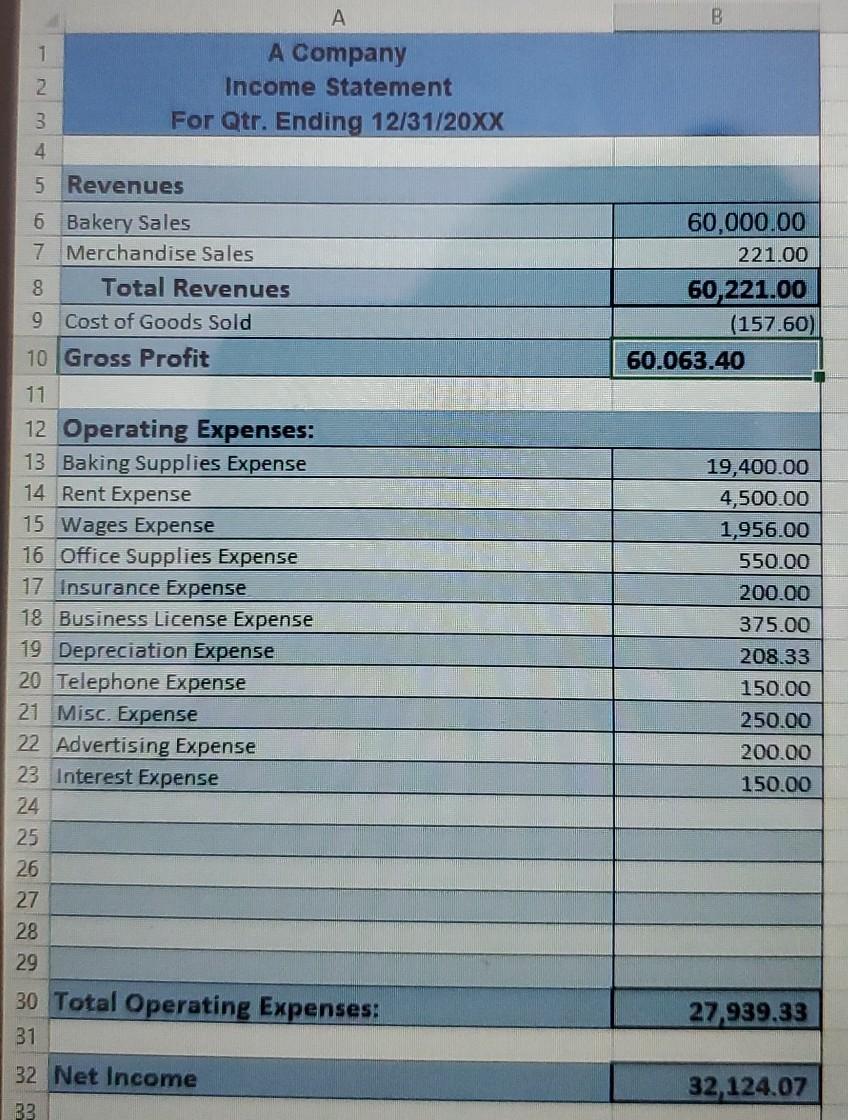

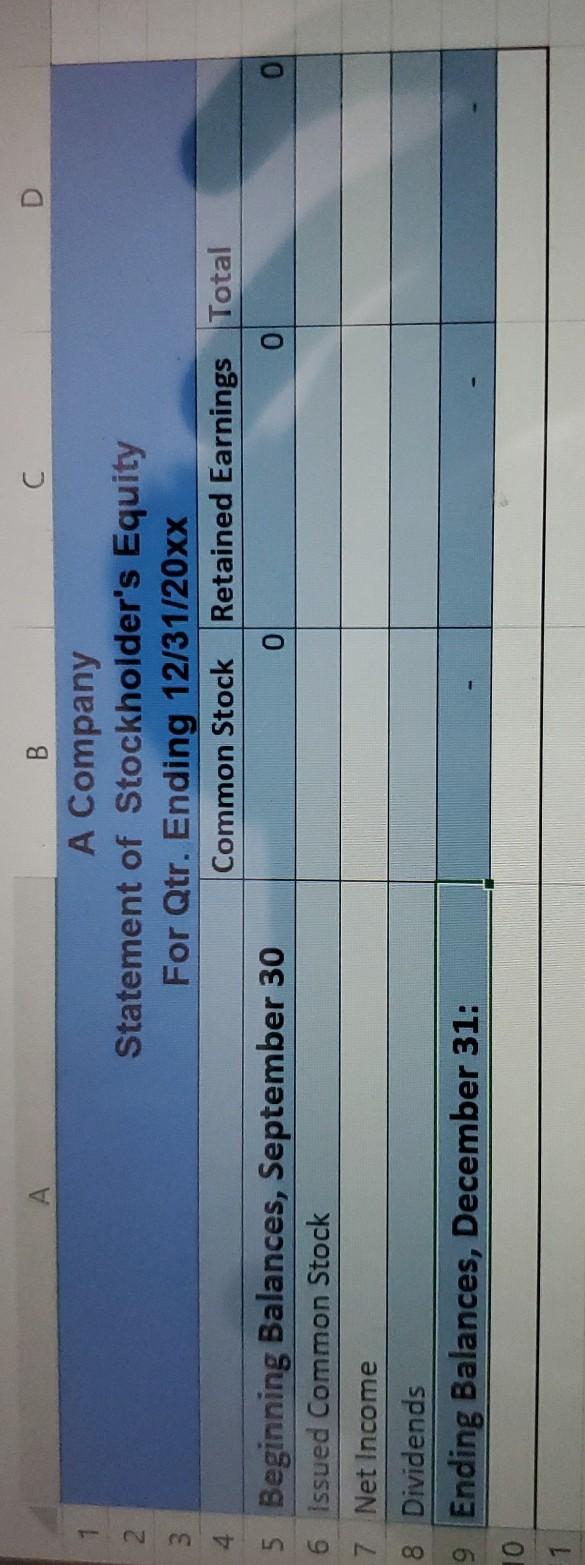

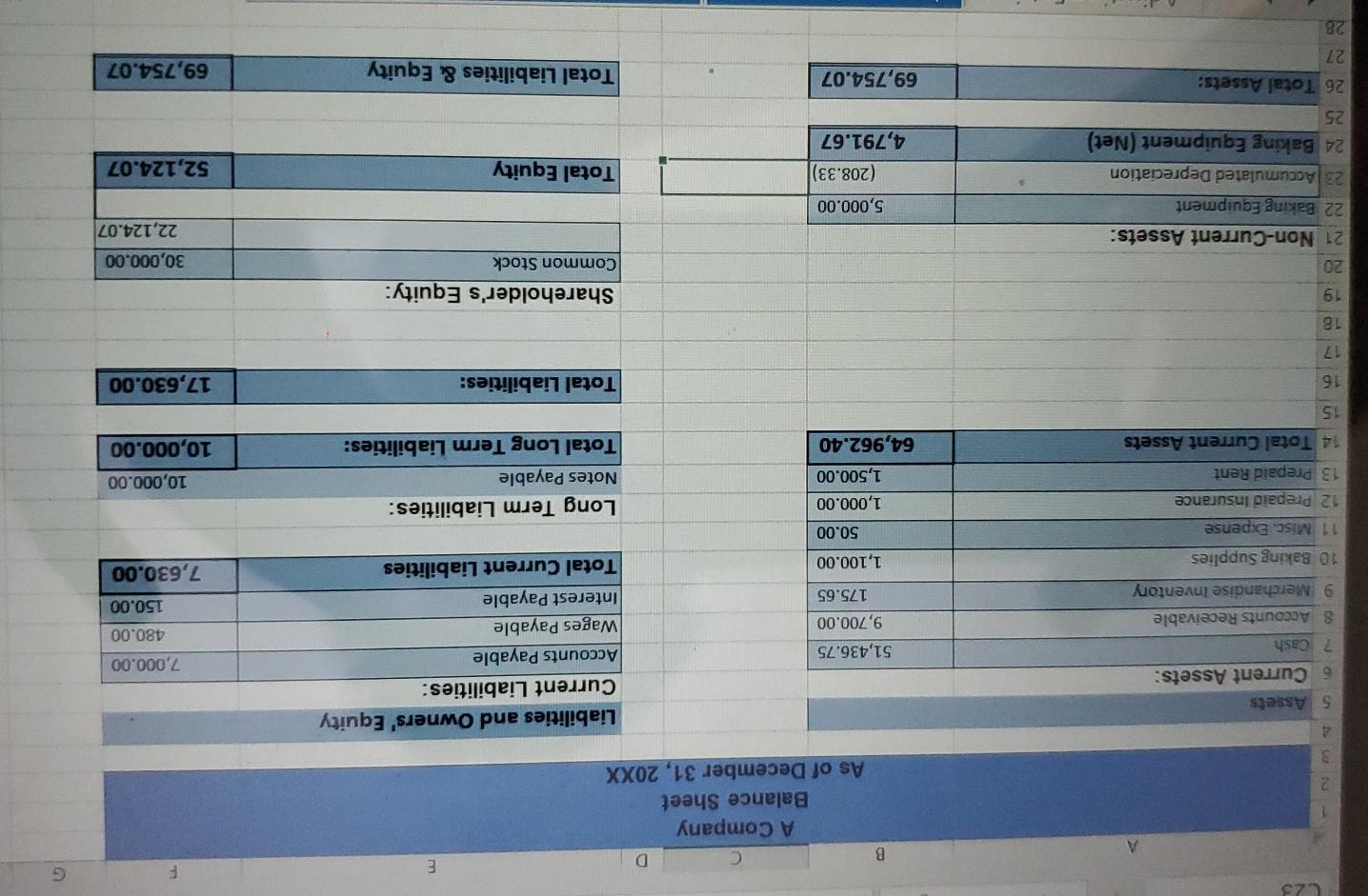

1. The following events occurred in October: October 1: The business owner used $25,000 from their personal savings account to buy common stock in their company. October 1: Purchased $8,500 worth of baking supplies from vendor, on account. October 3: The company borrowed $10,000 in cash, in exchange for a two-year, 6% note payable. Interest and the principal are repayable at maturity. October 7: Entered into a lease agreement for bakery space. The agreement is for one year. The rent is $1,500 per month; the last month's rent payment of $1,500 is required at the time of the lease agreement. The payment was made in cash. Lease period is effective October 1 of this year through September 30 of the next. October 10: Paid $375 to the county for a business license. October 11: Purchased a cash register for $250 (deemed to be not material enough to qualify as depreciable equipment). October 13: The owner has baking equipment, including an oven and mixer, which they have been using for their home-based business and will now start using in the bakery. You estimate that the equipment is currently worth $5,000, and you transfer the equipment into the business in exchange for additional common stock. The equipment has a five-year useful life. October 13: Paid $200 for business cards and flyers to use for advertising I October 14: Paid $300 for office supplies. October 15: Hired a part-time helper to be paid $12 per hour. One pay period is the first of the month through the fifteenth, and the other is the sixteenth through the end of the month. Paydays are the twentieth for the first pay period and the fifth of the following month for the second pay period. (No entry required on this date--for informational purposes only.) October 30: Received telephone bill for October in amount of $75. Payment is due on November 10. October 31: Paid $1,200 for a 12-month insurance policy. Policy effective dates are November 1 through October 31 October 31: Accrued wages earned for employee for period of October 16 through October 31. (See Wage Calculation Data table at the end of this document.) October 31: Total October bakery sales were $15,000 ($5,000 of these sales on accounts receivable) The following events occurred in November: November 5: Paid employee for period ending October 31. November 8: Received payments from customers toward accounts receivable in amount of $3,800. November 10: Paid October telephone bill. November 15: Purchased additional baking supplies in amount of $5,000 from vendor, on account. November 15: Accrued wages earned for employee from period of November 1 through November 15. (See Wage Calculation Data table at the end of this document.) November 15: Paid rent on bakery space. November 18: Received payments from customers toward accounts receivable in amount of $1,000. November 20: Paid $8,500 toward baking supplies vendor payable. November 20: Paid employee for period ending November 15. November 22: Purchased $300 in office supplies. November 30: Received telephone bill for November in amount of $75. Payment is due on December 10. November 30: Accrued wages earned for employee for period of November 16 through November 30. (See Wage Calculation Data table at the end of this document.) November 30: November bakery sales total was $20,000 ($7,500 of this total on accounts receivable) 2. Many customers have been asking for more allergy-friendly products, so in December the bakery started carrying a line of gluten-free products on a trial basis. The information below relates to the purchase and sales of the new products. Use the perpetual inventory method with the FIFO valuation method. Please see the "Inventory Valuation" tab in your workbook for purchase and sales information. The following events occurred in December: December 1: Paid dividends to self in amount of $10,000. December 5: Paid employee for period ending November 30. December 7: Purchased merchandise for resale. See the "Inventory Valuation" tab for details, December 8: Received payments from customers toward accounts receivable in amount of $4,000. December 10: Paid November telephone bill. December 11: Purchased baking supplies in amount of $7,000 from vendor on account. December 13: Paid on supplies vendor account in amount of $5,000. December 15: Accrued employee wages for period of December 1 through December 15. December 15: Paid rent on bakery space $1,500. December 15: Recorded merchandise sales transaction. See the "Inventory Valuation" tab for details December 15: Recorded impact of sales transaction on COGS and the inventory asse: See the "Inventory Valuation" tab for details. December 20: Paid employee for period ending December 15. December 20: Purchased merchandise inventory for resale to customers. See the "Inventory Valuation" tab for details. December 24. Recorded sales of merchandise to customers. See the "Inventory Valuation tab for details December 24: Recorded impact of sales transaction on COGS and the inventory asset. See the "Inventory Valuation" tab for details. December 30. Purchased merchandise inventory for resale to customers. See the "Inventory Valuation" tab for details. December 31: Accrued employee wages for period of December 16 through December 31. December 31: Total December bakery sales were $25,000 ($6,000 of these sales on accounts receivable) bn December 31, the following adjustments must be made: . . Depreciation of baking equipment transferred to company on October 13. Assume half month of depreciation in October using the straight-line method. Accrue interest for note payable. Assume a full month of interest for October (6% annual interest on $10,000 loan) Record insurance used for the year. Actual baking supplies on hand as of December 31 are $1,100. Office supplies on hand as of December 31 are $50. Wage Calculation Data Rate Hours 10 40 Month 31-Oct 15-Nov 30-Nov 15-Dec 31-Dec Pay 120 480 420 12 12 12 12 12 35 38 456 40 480 D Asset Accounts Liability Accounts E Equity Accounts Acct # Acct # Acct 101 Notes Payable 102 Accounts Payable 103 Wages Payable 104 Interest Payable 105 106 201 Common Stock 202 Dividends 203 Cost of Goods Sold 204 Cash 6. Baking Supplies 7 Prepaid Rent 8 Prepaid Insurance 9 Baking Equipment 10 Office Supplies 11 Accounts Receivable 12 Accumulated Depreciation 13 Merchandise Inventory 14 302 303 107 108 109 Revenue Accounts Acct # 15 16 Bakery Sales Merchandise Sales 401 402 18 19 20 Expense Accounts Acct # 21 2 3 501 Baking Supplies Expense Rent Expense Insurance Expense Misc. Expense Business License Expense Advertising Expense Wages Expense Telephone Expense Interest Expense Depreciation Expense Office Supplies Expense 502 503 504 505 506 507 508 509 $10 511 Chart of A Company General Journal Entries October, 20xx Accounts Credit Date 1-06 Wash Common Stock Debit 25000100 25,000.00 1-Oct Baking Supplies Accounts Payable 8500.00 8500.00 10,000.00 3-Oct Cash Notes Payable 10,000.00 7-Oct Prepaid Rent Rent Expense Cash 1500100 1500100 1,500.00 10-Oct Business License Expense Cash 375.00 375.00 250.00 11-Oct| Misc. Expense Cash 250.00 5,000.00 13-Oct Baking Equipment Common Stock 5,000.00 200.00 13-Oct Advertising Expense Cash 300.00 14-Oct Office Supplies Cash 300 00 30-0 75.00 Telephone Expense Cash 75.00 1200.00 31-Oct Prepaid Insurance Cash 1200.00 120.00 31-Oct Wages Expense Wages Payable 120.00 31-Oct Cash P.ccounts Receivable Bakery Sales 1000000 BUCCINO 15000.00 Total 69 020 00 67.520.00 1 2 3 4 5 A Company General Journal Entries November, 20xx Accounts Credit Date 5-Nov Wages Payable Cash Debit 120.00 6 120.00 7 8 3.800.00 8-Nou Cash Accounts Receivable, 10 3,800.00 11 12 13 75.00 10-Nov Accounts Payable Cash 75.00 3 5000.00 5 6 15-Nov Baking Supplies Accounts Payable 15,000.00 T 8 480.00 15-Nov Wages Expense Wages Payable 480.00 1,500.00 15-Nov Rent Expense Cash 1,500.00 1,000.00 21 22 23 24 25 6 27 28 18-Noy Cash Accounts Receivable 1000100 8500.00 20-Nov Accounts Payable Cash 8,500.00 480.00 20-Nov Wages Payable Cash 480.00 31 2 33 300.00 22-NOV Office Supplies Cash 300.00 35 75.00 30-NOV Telephone Expense Accounts Payable 75.00 38 420.00 30-NOV Wages Expense Weges Payable 10 420.00 12 30-NOV Cash Accounts Receivable Bakeru Sales 12 500.00 7,500.00 20,000.00 45 56 Total 41,750.00 41,750.00 7 Ascona Date 1-Dec Dividend Coch Debit 10,000.00 Crede 7 1000000 3 Dec W590 Payable Cach 420,00 90 420.00 11 ta 7-Dec Merchandise Inventory 60.00 13 60.00 14 15 8-04 |tsch Account Receivable 4000.00 1 4,000.00 17 13 10-D& Accounts Payable 75.00 19 75.00 21 22 11-Dec Baking Supplies Accounts Payable 17000100) 2000.00 23 24 13-Dec Accounts Payable Cash 15,000.00 25 5000.00 26 27 28 15-Dec Wages Expence Wages Payable 456.00 456.00 29 15-Dec Rent Expense Cash 1,500.00 1,500.00 68.00 15-Dec Cash Merchandise Sales 68.00 35 36 48.00 15-Dec Cost of Goods Sold Merchandise Inventory 37 48.00 456.00 20-Dee Wage: Payable Cach 40 456.00 42 122.00 20-Dee Merchandise Inventory Coch 43 122.00 45 153.00 - 20-Dec bash Merchandise Sales 46 153.00 47 38 109.60 24-Dec cost of Goods Sold Merchandise Inventory 49 109.60 50 51 151.25 G0-0 Merchandise Inventory Cash 52 151.25 53 54 480.00 31-Dec Waec Expense Wrecs Parable 55 480.00 56 57 31 DR Cah Accounts Receivable Bokep Sales 19,000.00 6,000.00 58 59 25 000.00 2 date dale date Cash 1-Oct 25 000 00 3-Oct 10.000.00 Notes Payable 10.000.00 date 3-Oct Business License exp 375.00 10-Oct Common Stock 25 000 5.000 1-00 13-Oct 10.000 375 30.000 7500.00 375.00 250.00 200.00 300.00 7200.00 7-Oct 10-Oct 11-ct 13-Oct 14-ct 31-Oct 31-Oct 10.000.00 4 5 6 7 8 s 10 11 12 13 14 15 16 7 18 9 120.00 5-Nov 8-NOY 3 800.00 75.00 10-Nov 18-Nov 1000.00 1500.00 8,500.00 480.00 300.00 15-Nov 20-Nov 20-Nov 22-Nov Insurance expense 200 8-Nov 30-Nov 12.500.00 Accounts Rec. 31-Oct 5,000.00 3,800.00 1,000.00 30-Nov 7,500.00 4,000.00 31-Dec 6,000.00 18-Nov 1 2 3 4 10.000.00 420.00 60.00 1-Dec 5-Dec 7-Dec 8-Dec 8-Dec 4,000.00 8800 200 5 7 75.00 5.000.00 1.500.00 10-Dec 13-Dec 15-Dec 18500 9700 15-Dec 68.00 456.00 20-Dec 122.00 20-Dec 24-Dec 153.00 15125 30-Dec 31-Dec 19.000.00 85 52100 52.966.75 32.584.25 Mise expense 11-Oct 250 00 Baking equipment 13-Oct 5,000.00 Advertising expense 13-Oct 200.00 M N @ P Mice expense 250.00 Baking equipment 13-Oc! 5,000.00 13-Oct Advertising expense 200.00 250 5000 200 Baking supplies Toot 8,500.00 19.400 00 15-Nov 5.000 11-Dec 7.000 Office supplies 14-Oct 300.00 22-Nov 300 550 Rent expense 7-Oct 1.500 15-Nov 15-Dec 1,500 1,500 20 500.00 1.100 50.00 4,500 Prepaid rent 7-Oct 1500 Prepaid insurance 31-Oct 1.200 + Bakery Sales 15,000 20,000 25.000 60,000 31-Oct 30-Nov 31-Dec 1500 1200 1-Oct 31-Oct Accounts payable 8.500 00 75.00 tov 75 5.000.00 Nos 8.500 75,00 Salary and wages expense 31-Oct 120 15-Nov 480 30-Nov 420 15-Dec 31-Dec 480 Salaries and wages payable 120 31-Oct 120 480 15-Nov 20-Nov 480 5-Nov 15-Nov 456 30-Noy B D E F G H J K M N R 7-oc! 3100 31-00 15-Nov 30-Noy 15-Dec 31-Dec Salary and wages expense 120 480 420 456 480 15-Nov Salaries and wages payable 120 31-Oct 5-Nov 120 480 15-Nov 20-Nov 480 420 30-Nov 5-Dec 420 456.00 15-Dec 20-Dec 456 480.00 31-Dec Accounts payable 8.500 00 7500 7-Nov 75 5000.00 3-Nov 8.500 75 00 Dec 75 7.000.00 -Dec 5.000 19 650 20 650 7 000 Telephone expense Oct 75 Now 75 30-Nov 1956 11-Dec 1,476 1,956.00 480.00 Dividends 1-Dec 10,000 10,000 COGS 15-Dec 48.00 24-Dec 109.60 157.60 Merchand 68.00 153 00 15-Dec 24-Dec 221.00 Merch. Inv. FIFO 7-Dec 60.00 48.00 15-Dec Ending Inventory Purcheses Purchases No. of No. of Date Items Unit Price Total Price items 7-Dec 20 $ 6.00 $ 50.00 Sales No. of Unit Price Total Price Items 12/7 10 boxes purchase Cr Unit Price Total Price 10 $ 6.00 $ 60.00 Dr 60.00 Date 7-Dec Merchandise Inventory (10 x $6) Cash Purchased inventory 60.00 15-Dec 8 $ 6.00 $ 48.00 2 $ 6.00 $ 12.00 12/20:20 boxes purcha 1230-25 boxes purcha Sales - selling price. Se 12/15. 8 boxes 12/24: 18 boxes 20-Dec 20 S 6.10 5 122.00 68.00 2 S 20 S 22 6.00 $ 12.00 6.10 $ 122.00 $ 134.00 15-Dec Cash (8 x $8.50) Merchandise Sales Revenue Record sale of inventory 68.00 24-Dec 48.00 2 $ 6.00 $ 12.00 16 $ 6.10 $ 97.60 18 $ 109.60 4 $ 6.10 $ 24.40 15-Dec Cost of Goods Sold (8 X $6) Merchandise Inventory Recorded the cost of goods sold 48.00 30-Dec 25 $ 6.05 $ 15125 4 $ 25 $ 29 122.00 6.10 $ 6.05 $ $ 24.40 151.25 175.65 20-Dec Merchandise Inventory (20 x $6.10 ) Cash 122.00 Net Inventory 55 S 333.25 26 $ 157.60 29 $ 175.65 153.00 24-Dec Cash (18 x 8.50) Merchandise Sales Revenue Record sale of inventory 153.00 109.60 24-Dec Cost of Goods Sold (2 x $6)+(16 x $6.10) Merchandise Inventory Recorded the cost of goods sold 109.60 30-Dec Merchandise Inventory (25 x $6.05) Cash 151.25 151.25 1 2 3 4 5 Account 6 Cash 7 Baking Supplies 8 Merchandise Inventory 9 Prepaid Rent 10 Prepaid Insurance 11 Baking Equipment 12 Accumulated Depreciation 13 Office Supplies 14 Accounts Receivable 15 Notes Payable 16 Interest Payable 17 Accounts Payable 18 Wages Payable 19 Common Stock 20 Dividends 21 Bakery Sales 22 Merchandise Sales 23 Baking Supplies Expense 24 Rent Expense 25 Interest Expense 26 Insurance Expense 27 Depreciation Expense 28 Misc. Expense 29 Office Supplies Expense 30 Business License Expense 31 Advertising Expense 32 Wages Expense 33 Telephone Expense 34 COGS 35 36 Total: A Company Trial Balance 20xx Unadjusted trial balance Adjusting entries Adjusted trial balance Debit Credit Debit Credit Debit Credit 51,436.75 51,436.75 20,500.00 19,400.00 1,100.00 175.65 175.65 1,500.00 1,500.00 1,200.00 200.00 1,000.00 5,000.00 5,000.00 208.33 600.00 550.00 50.00 9,700.00 9,700.00 10,000.00 10,000.00 150.00 150.00 7,000.00 7200 480.00 480.00 30,000.00 30,000.00 10,000.00 10,000.00 60,000.00 60,000.00 221.00 221.00 19,400.00 19,400.00 4,500.00 4,500.00 150.00 150.00 200.00 200.00 208.33 208.33 250.00 250.00 550.00 550.00 375.00 375.00 200.00 200.00 1,956.00 1,956.00 150.00 150.00 157.60 157.60 107,701.00 107,701.00 20,508.33 20,508.33 108,059.33 107,851.00 1 2 A Company Adjusting Journal Entries 20XX 3 4. Debit Credit 6 208.33 7 208.33 8 150.00 9 150.00 10 Date Accounts 31-Dec Depreciation Expense Accumulated Depreciation 31-Dec Interest Expense Interest Payable 31-Dec Insurance Expense Prepaid Insurance 31-Dec Baking Supplies Expense Baking Supplies 31-Dec Office Supplies Expense Office Supplies 200.00 11 22100 12 19,400.00 13 19,400.00 14 550.00 15 550.00 16 17 18 19 20 21 22 20,508.33 20,508.33 23 B 60,000.00 221.00 60,221.00 (157.60) 60.063.40 A Company 2. Income Statement For Qtr. Ending 12/31/20XX 4 5 Revenues 6 Bakery Sales 7 Merchandise Sales 8 Total Revenues 9 Cost of Goods Sold 10 Gross Profit 11 12 Operating Expenses: 13 Baking Supplies Expense 14 Rent Expense 15 Wages Expense 16 Office Supplies Expense 17 Insurance Expense 18 Business License Expense 19 Depreciation Expense 20 Telephone Expense 21 Misc. Expense 22 Advertising Expense 23 Interest Expense 24 25 26 27 28 29 19,400.00 4,500.00 1,956.00 550.00 200.00 375.00 208.33 150.00 250.00 200.00 150.00 27,939.33 30 Total Operating Expenses: 31 32 Net Income 32,124.07 33 B C A Company 2 Statement of Stockholder's Equity For Qtr. Ending 12/31/20xx Common Stock Retained Earnings Total 5 Beginning Balances, September 30 6 issued Common Stock 7 Net Income 8 Dividends 9 Ending Balances, December 31: 10 1 L23 G F E D B A Company Balance Sheet As of December 31, 20XX 2 3 4 7,000.00 480.00 Liabilities and Owners' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Total Current Liabilities 5 Assets 6 Current Assets: 7 Cash 8 Accounts Receivable 9 Merchandise Inventory 10 Baking Supplies 11 Misc. Expense 12 Prepaid insurance 13 Prepaid Rent 51,436.75 9,700.00 175.65 150.00 7,630.00 1,100.00 50.00 1,000.00 1,500.00 64,962.40 Long Term Liabilities: Notes Payable Total Long Term Liabilities: 10,000.00 14 Total Current Assets 10,000.00 15 16 Total Liabilities: 17,630.00 17 18 19 Shareholder's Equity: Common Stock 30,000.00 22,124.07 5,000.00 (208.33) 4,791.67 Total Equity 20 21 Non-Current Assets: 22 Baking Equipment 23 Accumulated Depreciation 24 Baking Equipment (Net) 25 26 Total Assets: 27 28 52,124.07 69,754.07 Total Liabilities & Equity 69,754.07 A Company Closing Entries Qtr ending 12/31/20xx 4 5 Debit Credit No co wn Date Accounts 31-Dec Bakery Sales Merchandise Sales Retained Earnings 9 12 13 14 15 16 17 18 19 31-Dec Retained Earnings Baking Supplies Expense Rent Expense Wages Expense Office Supplies Expense Business License Expense Office Expense Depreciation Expense Insurance Expense Advertising Expense Interest Expense Telephone Expense COGS 20 21 22 23 24 25 31-Dec Retained Earnings Dividends 26 27 B 1 2. A Company Post-Closing Trial Balance Qtr. Ending 12/31/20xx 3 4 Unadjusted Trial Balance Debit Credit 5 Account 6 Cash 7 Baking Supplies 8 Merchandise Inventory 9 Prepaid Rent 10 Prepaid Insurance 11 Baking Equipment 12 Accumulated Depreciation 13 Office Supplies 14 Accounts Receivable 15 Accounts Payable 16 Wages Payable 17 Interest Payable 18 Notes Payable 19 Common Stock 20 Retained Earnings 21 22 Total 23