Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please review the charts below. Create a column for the Industry Averages for all Ratios (use median). Please review questions at the bottom of the

Please review the charts below. Create a column for the Industry Averages for all Ratios (use median). Please review questions at the bottom of the post. Thank you!

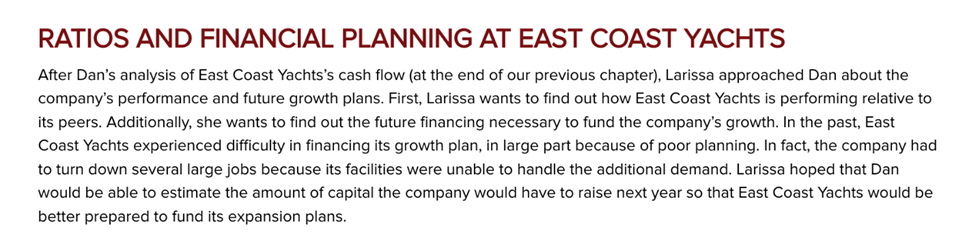

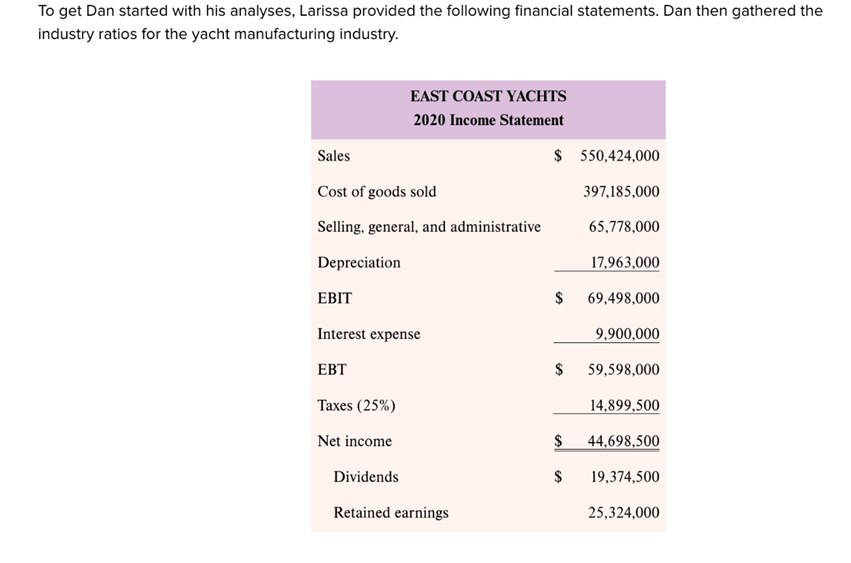

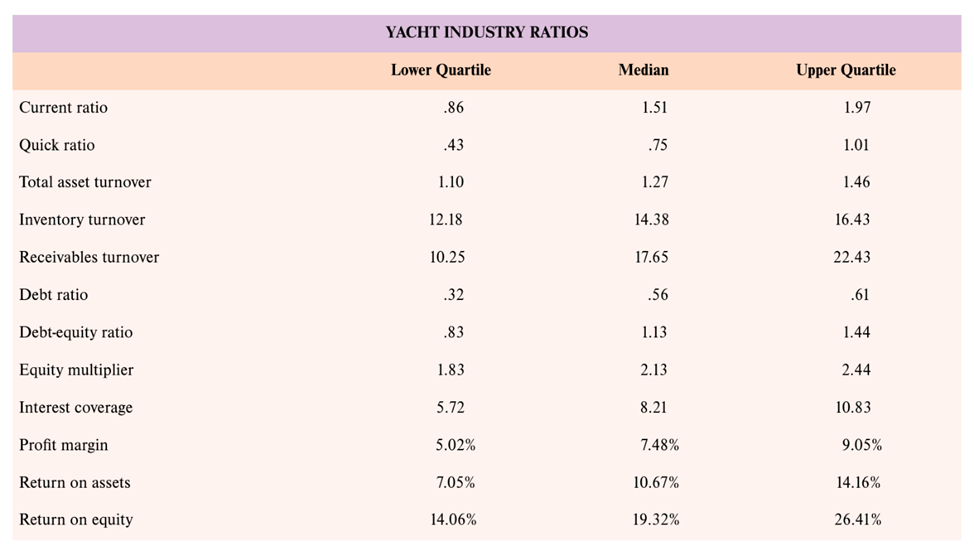

RATIOS AND FINANCIAL PLANNING AT EAST COAST YACHTS After Dan's analysis of East Coast Yachts's cash flow (at the end of our previous chapter), Larissa approached Dan about the company's performance and future growth plans. First, Larissa wants to find out how East Coast Yachts is performing relative to its peers. Additionally, she wants to find out the future financing necessary to fund the company's growth. In the past, East Coast Yachts experienced difficulty in financing its growth plan, in large part because of poor planning. In fact, the company had to turn down several large jobs because its facilities were unable to handle the additional demand. Larissa hoped that Dan would be able to estimate the amount of capital the company would have to raise next year so that East Coast Yachts would be better prepared to fund its expansion plans. To get Dan started with his analyses, Larissa provided the following financial statements. Dan then gathered the industry ratios for the yacht manufacturing industry. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ YACHT INDUSTRY RATIOS } \\ \hline & Lower Quartile & Median & Upper Quartile \\ \hline Current ratio & .86 & 1.51 & 1.97 \\ \hline Quick ratio & .43 & .75 & 1.01 \\ \hline Total asset turnover & 1.10 & 1.27 & 1.46 \\ \hline Inventory turnover & 12.18 & 14.38 & 16.43 \\ \hline Receivables turnover & 10.25 & 17.65 & 22.43 \\ \hline Debt ratio & .32 & .56 & .61 \\ \hline Debt-equity ratio & .83 & 1.13 & 1.44 \\ \hline Equity multiplier & 1.83 & 2.13 & 2.44 \\ \hline Interest coverage & 5.72 & 8.21 & 10.83 \\ \hline Profit margin & 5.02% & 7.48% & 9.05% \\ \hline Return on assets & 7.05% & 10.67% & 14.16% \\ \hline Return on equity & 14.06% & 19.32% & 26.41% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} EAST COAST YACHTS \\ 2020 Balance Sheet \end{tabular}} \\ \hline Current assets & & Current liabilities & \\ \hline Cash and equivalents & $10,107,000 & Accounts payable & $40,161,400 \\ \hline Accounts receivable & 16,813,300 & Accrued expenses & 5,723,700 \\ \hline Inventory & 18,135,700 & Total current liabilities & $45,855,100 \\ \hline Other & 1,054,900 & & \\ \hline Total current assets & $46,110,900 & & \\ \hline Fixed assets & & Long-term debt & $152,374,000 \\ \hline Property, plant, and equipment & $412,032,000 & Total long-term liabilities & $152,374,000 \\ \hline Less accumulated depreciation & (102,452,000) & & \\ \hline Net property, plant, and equipment & $309,580,000 & & \\ \hline Intangible assets and others & 6,772,000 & Stockholders' equity & \\ \hline \multirow[t]{6}{*}{ Total fixed assets } & $316,352,000 & Preferred stock & $1,773,000 \\ \hline & & Common stock & 31,802,000 \\ \hline & & Capital surplus & 27,348,000 \\ \hline & & Accumulated retained earnings & 146,052,800 \\ \hline & & Less treasury stock & (42,772,000) \\ \hline & & Total equity & $164,203,800 \\ \hline Total assets & $362,462,900 & Total liabilities and shareholders' equity & $362,462,900 \\ \hline \end{tabular} 1. East Coast Yachts uses a small percentage of preferred stock as a source of financing. In calculating the ratios for the company, should preferred stock be included as part of the company's total equity? 2. Calculate all of the ratios listed in the industry table for East Coast Yachts. 3. Compare the performance of East Coast Yachts to the industry as a whole. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How would you interpret this ratio? How does East Coast Yachts compare to the industry average for this ratio

RATIOS AND FINANCIAL PLANNING AT EAST COAST YACHTS After Dan's analysis of East Coast Yachts's cash flow (at the end of our previous chapter), Larissa approached Dan about the company's performance and future growth plans. First, Larissa wants to find out how East Coast Yachts is performing relative to its peers. Additionally, she wants to find out the future financing necessary to fund the company's growth. In the past, East Coast Yachts experienced difficulty in financing its growth plan, in large part because of poor planning. In fact, the company had to turn down several large jobs because its facilities were unable to handle the additional demand. Larissa hoped that Dan would be able to estimate the amount of capital the company would have to raise next year so that East Coast Yachts would be better prepared to fund its expansion plans. To get Dan started with his analyses, Larissa provided the following financial statements. Dan then gathered the industry ratios for the yacht manufacturing industry. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ YACHT INDUSTRY RATIOS } \\ \hline & Lower Quartile & Median & Upper Quartile \\ \hline Current ratio & .86 & 1.51 & 1.97 \\ \hline Quick ratio & .43 & .75 & 1.01 \\ \hline Total asset turnover & 1.10 & 1.27 & 1.46 \\ \hline Inventory turnover & 12.18 & 14.38 & 16.43 \\ \hline Receivables turnover & 10.25 & 17.65 & 22.43 \\ \hline Debt ratio & .32 & .56 & .61 \\ \hline Debt-equity ratio & .83 & 1.13 & 1.44 \\ \hline Equity multiplier & 1.83 & 2.13 & 2.44 \\ \hline Interest coverage & 5.72 & 8.21 & 10.83 \\ \hline Profit margin & 5.02% & 7.48% & 9.05% \\ \hline Return on assets & 7.05% & 10.67% & 14.16% \\ \hline Return on equity & 14.06% & 19.32% & 26.41% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{l} EAST COAST YACHTS \\ 2020 Balance Sheet \end{tabular}} \\ \hline Current assets & & Current liabilities & \\ \hline Cash and equivalents & $10,107,000 & Accounts payable & $40,161,400 \\ \hline Accounts receivable & 16,813,300 & Accrued expenses & 5,723,700 \\ \hline Inventory & 18,135,700 & Total current liabilities & $45,855,100 \\ \hline Other & 1,054,900 & & \\ \hline Total current assets & $46,110,900 & & \\ \hline Fixed assets & & Long-term debt & $152,374,000 \\ \hline Property, plant, and equipment & $412,032,000 & Total long-term liabilities & $152,374,000 \\ \hline Less accumulated depreciation & (102,452,000) & & \\ \hline Net property, plant, and equipment & $309,580,000 & & \\ \hline Intangible assets and others & 6,772,000 & Stockholders' equity & \\ \hline \multirow[t]{6}{*}{ Total fixed assets } & $316,352,000 & Preferred stock & $1,773,000 \\ \hline & & Common stock & 31,802,000 \\ \hline & & Capital surplus & 27,348,000 \\ \hline & & Accumulated retained earnings & 146,052,800 \\ \hline & & Less treasury stock & (42,772,000) \\ \hline & & Total equity & $164,203,800 \\ \hline Total assets & $362,462,900 & Total liabilities and shareholders' equity & $362,462,900 \\ \hline \end{tabular} 1. East Coast Yachts uses a small percentage of preferred stock as a source of financing. In calculating the ratios for the company, should preferred stock be included as part of the company's total equity? 2. Calculate all of the ratios listed in the industry table for East Coast Yachts. 3. Compare the performance of East Coast Yachts to the industry as a whole. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How would you interpret this ratio? How does East Coast Yachts compare to the industry average for this ratio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started