Answered step by step

Verified Expert Solution

Question

1 Approved Answer

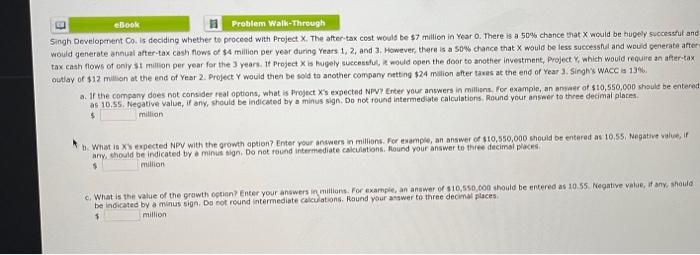

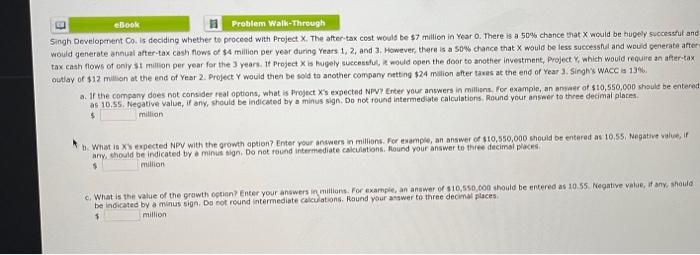

*please round to three decimal places* ingh Developenent Ca. is declding whether to proceed with Project X. The after-tax cost wouls be $7 million in

*please round to three decimal places*

ingh Developenent Ca. is declding whether to proceed with Project X. The after-tax cost wouls be $7 million in Year 0 . There is a 50% chance that X nould be thugety syccessful ant rould generate anhual after-tax cash flows $4 milion per year during Years 1,2 , and 3 . However, there is a sow chance that X would be less successha and would generate afte ax eash flows of oniy st million per year for the 3 years. It Project X is hugely sucenstul, 2 nould epen the doar to ahother investment, Project Y, which would require an affer-tax utlay of $12 million at the end of Year 2. Project Y would then be sold to another company netting $24 malion sfter taxas at the end of Year 3 . 5 inghis Wace is 13%. a. If the company does not consider real options, what is Project X's expected NFV? Enter your answers in miltiens. For example, an anyaer of $10,550,000 shoult be enteres as. 10.55 . Neqative value, if any, should be indicated by a minus sign. Do not round intermediate calculations, Round your answer to three decimal places. $ million b. What is Xs expected NPV with the orowth option? Enter your answers in millions. For example, an answer of 310,550,000 sheuld be entered as 10,55 , Negative value, if aru. donesid be indicated by a minis sign, Do not round intermediate calculations. Round your answer to three decimal places s. milion c. What is the value of the grawth oprian? Enter your answers in milions. For example, an answer of 310,550, coo should be entered as 10.55 . Negative value, if any, should be inkirated by a minus sigh. Do cot round intermediate celculations. Round wour asawer to three decinal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started