Please see attached screenshots for the questions. Please actually click on them to get the most accurate view of the questions as sometimes the format could be a bit messed up when displayed without clicking on the actual screenshots. Thank you so much for your help!

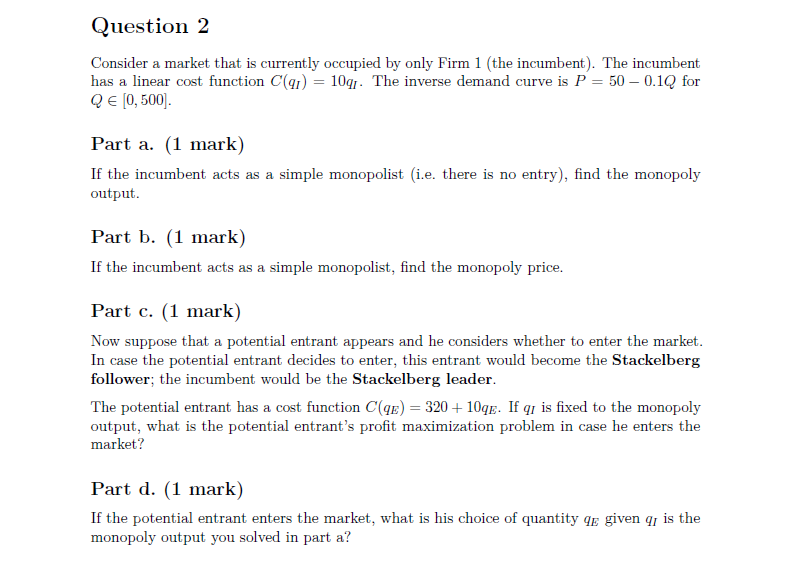

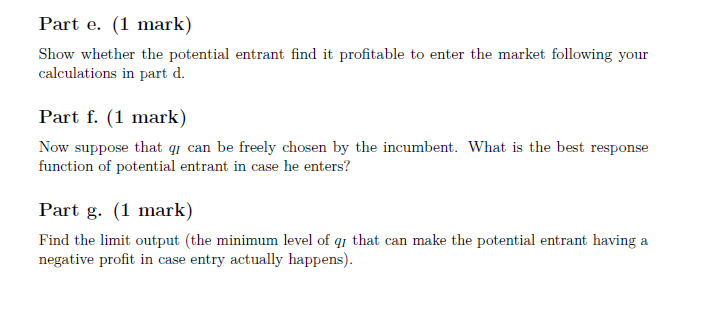

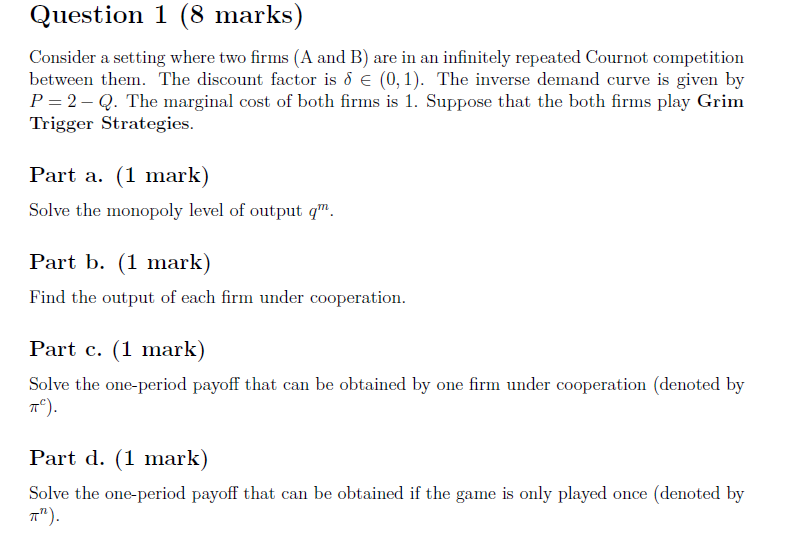

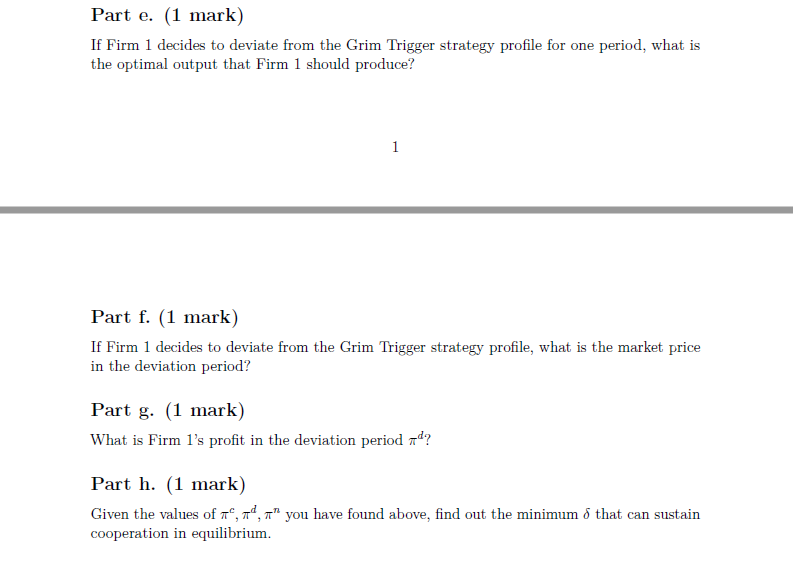

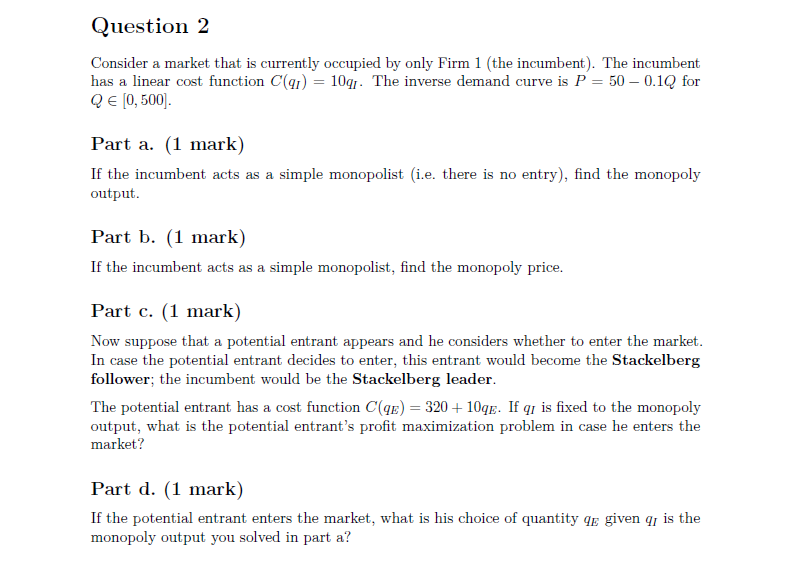

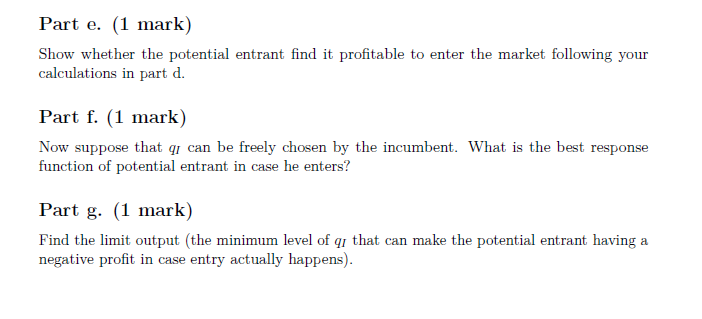

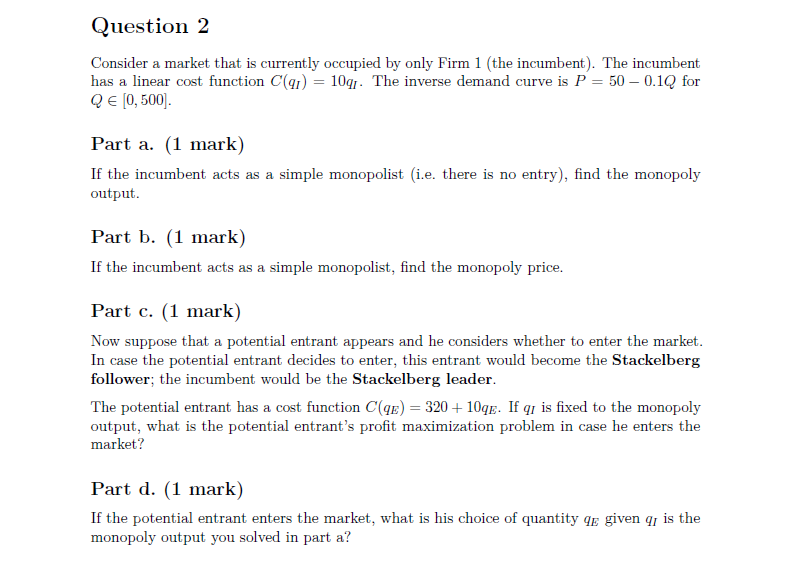

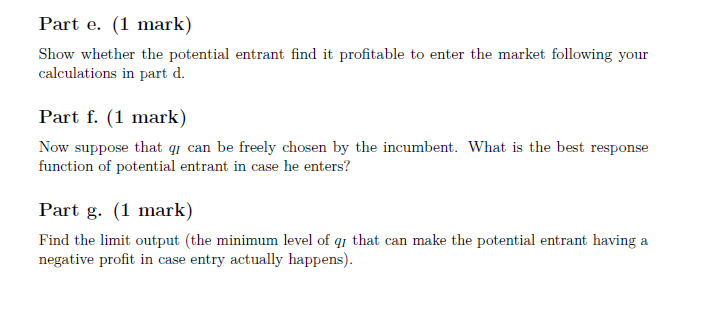

Question 1 (8 marks) Consider a setting Where two rms (A and B) are in an innitely repeated lCournot competition between them. The discount factor is J E (U, 1). The inverse demand curve is given by P = 2 Q. The marginal cost of both rms is 1. Suppose that the both rms play Grim Trigger Strategies. Part a. (1 mark) Solve the monopol}r level of output q\". Part I). (1 mark) Find the output of each rm under cooperation. Part c. (1 mark) Solve the oneperiod payoff that can be obtained by one rm under cooperation {denoted by TIC). Part (1. (1 mark) Solve the oneperiod payoff that can be obtained if the game is only played once (denoted by it"). Part e. (1 mark) If Firm 1 decides to deviate from the Grim Trigger strategy profile for one period, what is the optimal output that Firm 1 should produce? Part f. (1 mark) If Firm 1 decides to deviate from the Grim Trigger strategy profile, what is the market price in the deviation period? Part g. (1 mark) What is Firm I's profit in the deviation period ad? Part h. (1 mark) Given the values of 7", "", " you have found above, find out the minimum o that can sustain cooperation in equilibrium.Question 2 Consider a market that is currently occupied by only Firm 1 (the incumbent). The incumbent has a linear cost function C(q/) = 10q. The inverse demand curve is P = 50 - 0.1Q for Q E [0, 500]. Part a. (1 mark) If the incumbent acts as a simple monopolist (i.e. there is no entry), find the monopoly output. Part b. (1 mark) If the incumbent acts as a simple monopolist, find the monopoly price. Part c. (1 mark) Now suppose that a potential entrant appears and he considers whether to enter the market. In case the potential entrant decides to enter, this entrant would become the Stackelberg follower; the incumbent would be the Stackelberg leader. The potential entrant has a cost function C(qz) = 320 + 10qg. If qr is fixed to the monopoly output, what is the potential entrant's profit maximization problem in case he enters the market? Part d. (1 mark) If the potential entrant enters the market, what is his choice of quantity q given q is the monopoly output you solved in part a?Part e. {1 mark} Show whether the potential entrant nd it protable to enter the market following your calculations in part cl. Part f. (1 mark) Now suppose that q: can he freely chosen by the incumbent. 'What is the but response function of potential entrant in case he enters?r Part g. (1 mark) Find the limit output [the minimum level of qr: that can make the potential Intrant having a negative prot in case entry actually happens}