Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please see below {3 parts} Required information [The following information applies to the questions displayed below) Phoenix Company's 2019 master budget included the following fixed

please see below {3 parts}

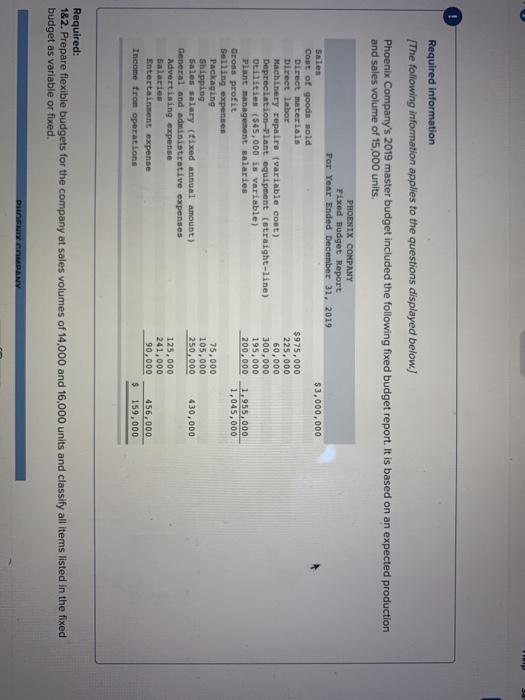

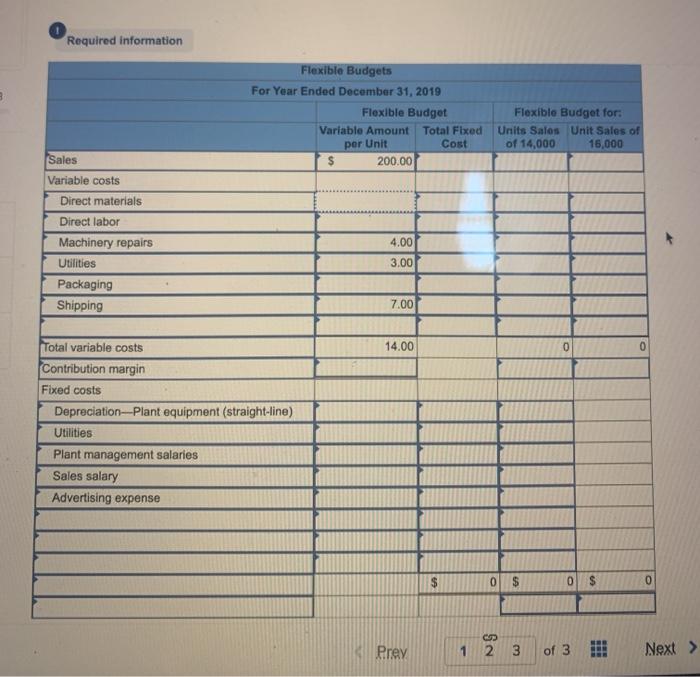

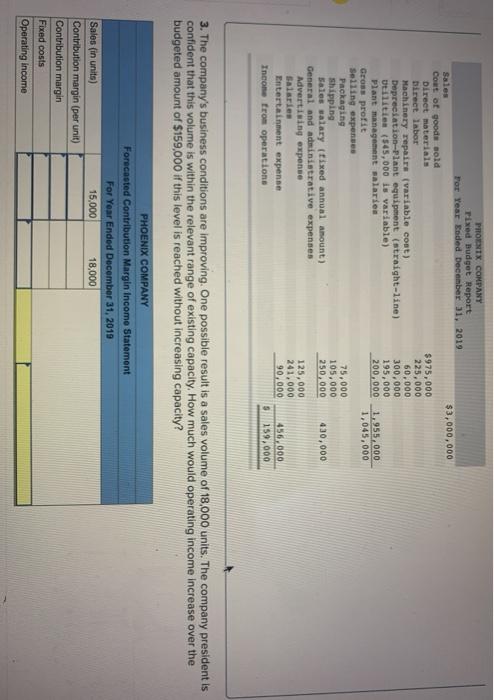

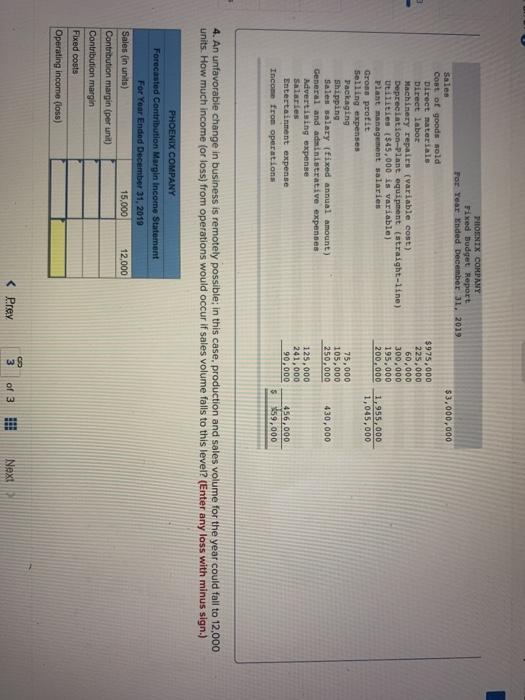

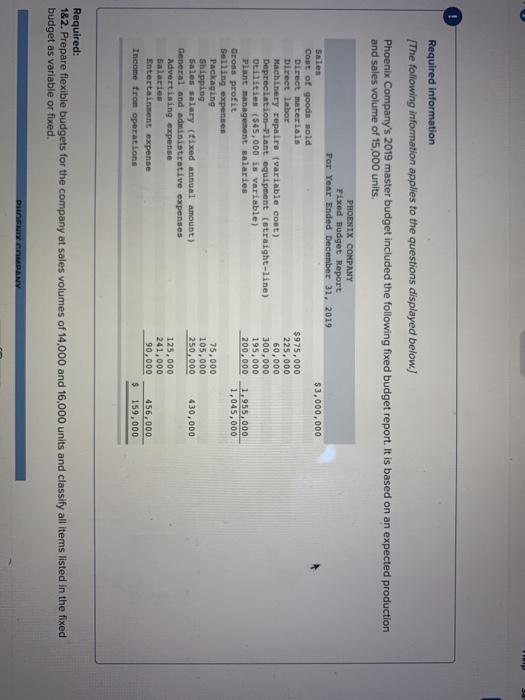

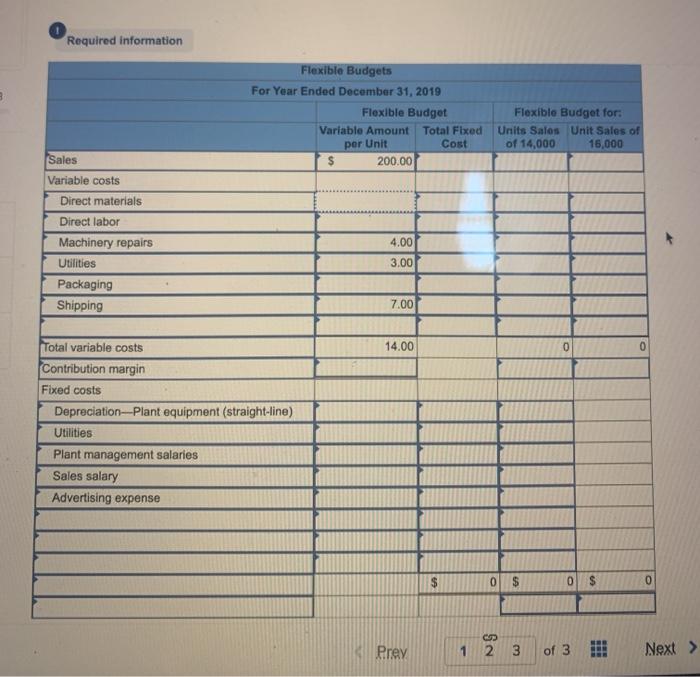

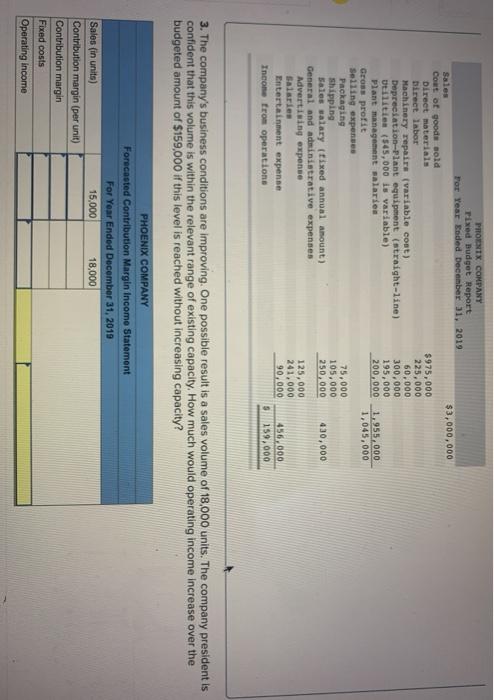

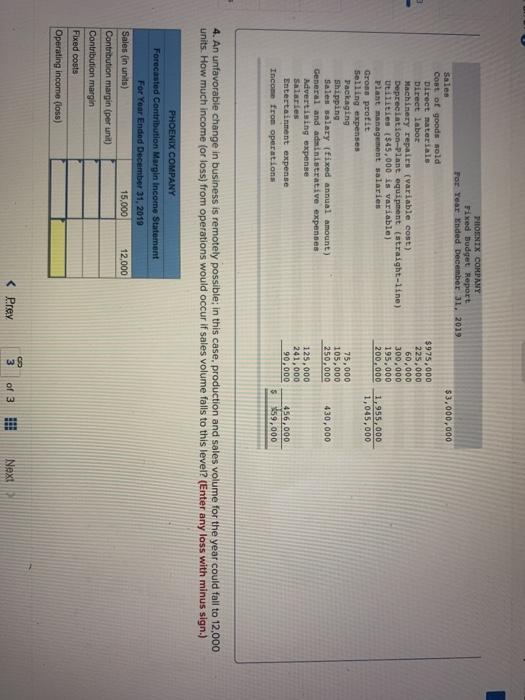

Required information [The following information applies to the questions displayed below) Phoenix Company's 2019 master budget included the following fixed budget report. It is based on an expected production and sales volume of 15,000 units. $3,000,000 PHOENIX COMPANY Fixed Budget Report For Year Ended December 31, 2019 Sales Cost of goods sold Direct materials $975,000 Direct labor 225.000 Machinery repaire (variable cont) 60,000 Depreciation Flant equipment (straight-line) 300,000 Utilities ($45,000 is variable) 195,000 plant management salaries 200,000 Gross profit Selling expenses Packaging 75,000 Shipping 105,000 Sales salary fixed annual amount) 250,000 General and administrative expenses Advertising expense 125,000 Salaries 241,000 Entertainment expense 90,000 Income from operations 1,955,000 1.045,000 430,000 456,000 159,000 $ Required: 182. Prepare flexible budgets for the company at sales volumes of 14,000 and 16,000 units and classify all items listed in the fixed budget as variable or fixed. DUINEMY COURANY Required information Flexible Budgets For Year Ended December 31, 2019 Flexible Budget Variable Amount Total Fixed per Unit Cost $ 200.00 Flexible Budget for: Units Salos Unit Sales of of 14,000 16,000 Sales Variable costs Direct materials Direct labor Machinery repairs Utilities Packaging Shipping 4.00 3.00 7.00 14.00 0 Total variable costs Contribution margin Fixed costs Depreciation-Plant equipment (straight-line) Utilities Plant management salaries Sales salary Advertising expense $ 0 $ 0 Prey 1 2 3 of 3 Next > $3,000,000 PRONEX COMPANY Fixed Budget Report For Year Ended December 31, 2019 Sales Coat of goods sold Direct materials Direct Tabar Machinery repairs (variable cont) Depreciation-plant equipment (straight-line) Utilities (545,000 is variable) Plant management salaries Gross profit Selling expenses Packaging Shipping Sales salary fixed annual amount) General and administrative expenses Advertising expense Salaries Entertainment expense Income from operations $975,000 225,000 60,000 300,000 195,000 200,000 1,955,000 1,045,000 75,000 105,000 250,000 430,000 125,000 241,000 90,000 456, 000 159.000 5 3. The company's business conditions are improving. One possible result is a sales volume of 18,000 units. The company president is confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the budgeted amount of $159,000 if this level is reached without increasing capacity? PHOENIX COMPANY Forecasted Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (in units) 15,000 18,000 Contribution margin (per unit) Contribution margin Fixed costs Operating income $3.000.000 PHOENIX COMPANY Fixed Budget Report For Year Ended December 31, 2019 Sales Cost of goods sold Direct materiale $975.000 Direct labor 225.000 Machinery repairs (variable cost) 60,000 Depreciation-Plant equipment (straight-line) 300.000 Utilities ($45.000 is variable) 195,000 Plant management salaries 200,000 Gross profit Selling expenses Packaging 75,000 Shipping 105,000 Sales salary fixed annual amount) 250,000 General and administrative expenses Advertising expense 125,000 Salaries 241,000 Entertainment expense 90,000 Income from operations 1,955,000 1,045,000 430,000 456,000 59,000 4. An unfavorable change in business is remotely possible in this case, production and sales volume for the year could fall to 12,000 units. How much income for loss) from operations would occur if sales volume folls to this level? (Enter any loss with minus sign.) PHOENIX COMPANY Forecasted Contribution Margin Income Statement For Yoar Ended December 31, 2019 Sales in units) 15,000 12,000 Contribution margin (per unit) Contribution margin Fixed costs Operating income floss)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started