Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please see below. I need help with this asap and only one attempt is given. Thanks in advance.All pictures are part of the same problem.

Please see below. I need help with this asap and only one attempt is given. Thanks in advance.All pictures are part of the same problem.

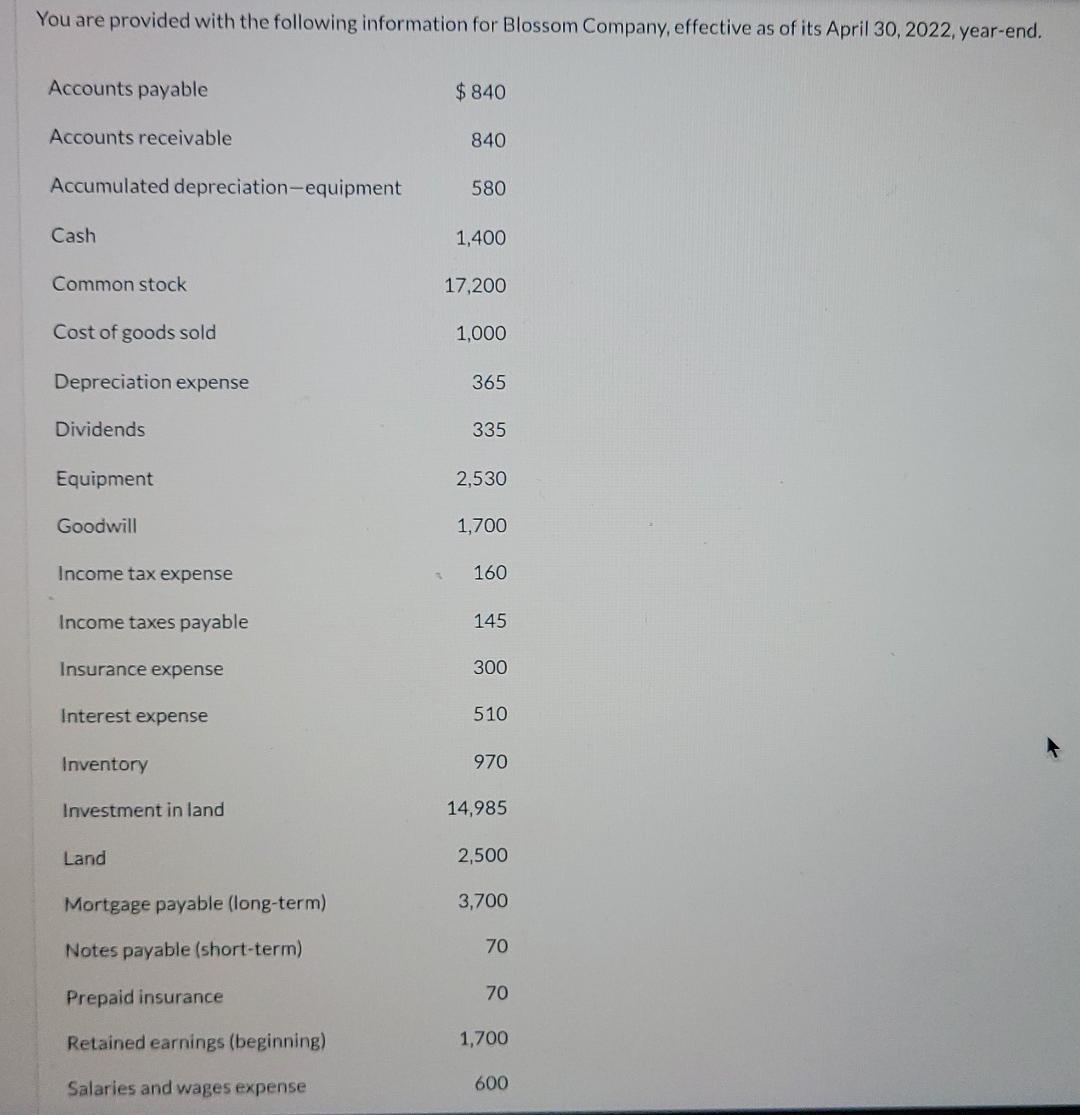

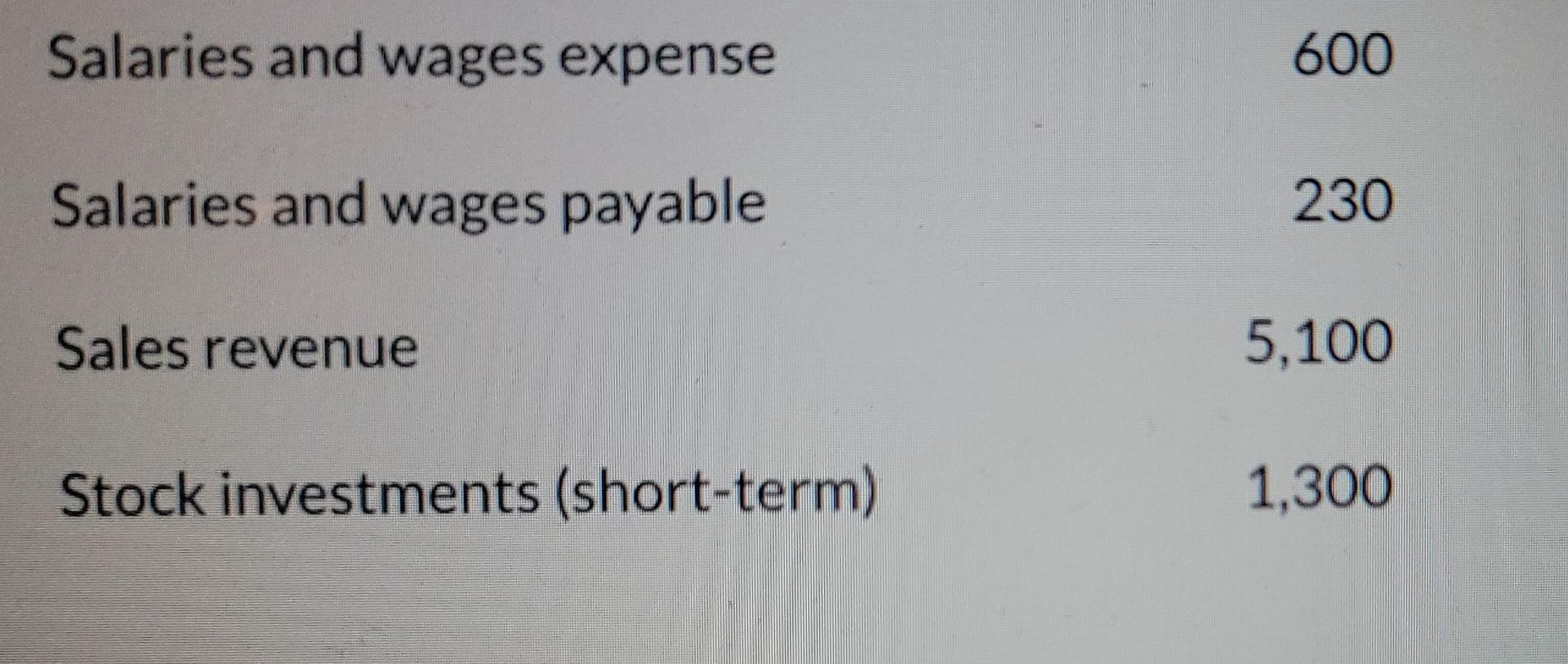

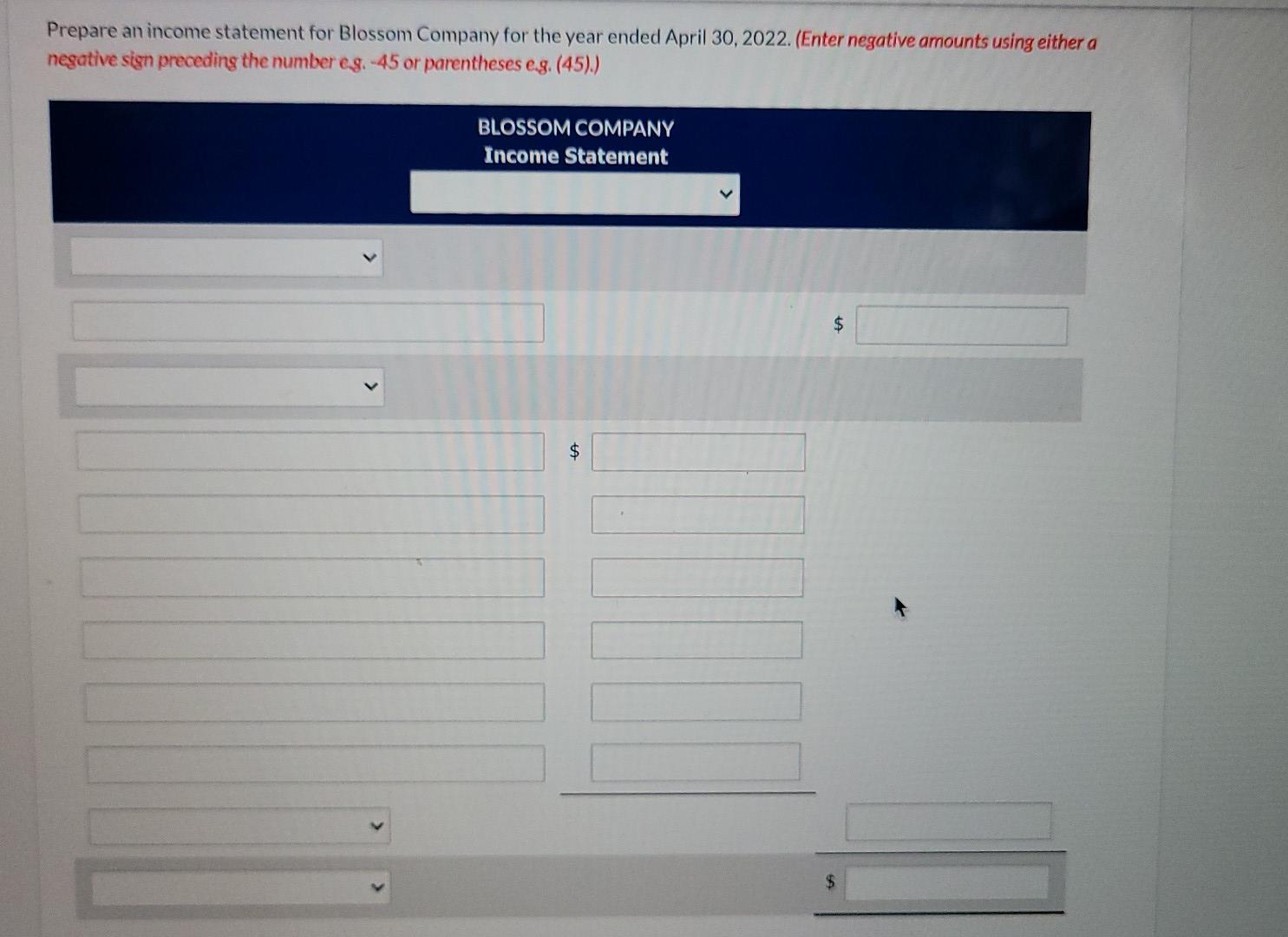

You are provided with the following information for Blossom Company, effective as of its April 30, 2022, year-end. Accounts payable $ 840 Accounts receivable 840 Accumulated depreciation-equipment 580 Cash 1,400 Common stock 17,200 Cost of goods sold 1,000 Depreciation expense 365 Dividends 335 Equipment 2,530 Goodwill 1,700 Income tax expense 160 Income taxes payable 145 Insurance expense 300 Interest expense 510 Inventory 970 Investment in land 14,985 Land 2,500 Mortgage payable (long-term) 3,700 Notes payable (short-term) 70 Prepaid insurance 70 Retained earnings (beginning) 1,700 Salaries and wages expense 600 Salaries and wages expense 600 Salaries and wages payable 230 Sales revenue 5,100 Stock investments (short-term) 1,300 Prepare an income statement for Blossom Company for the year ended April 30, 2022. (Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (45).) BLOSSOM COMPANY Income Statement $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started