Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please see image and help me answer Alex and Bess have been in partnership for many years. The partners, who share profits and losses on

Please see image and help me answer

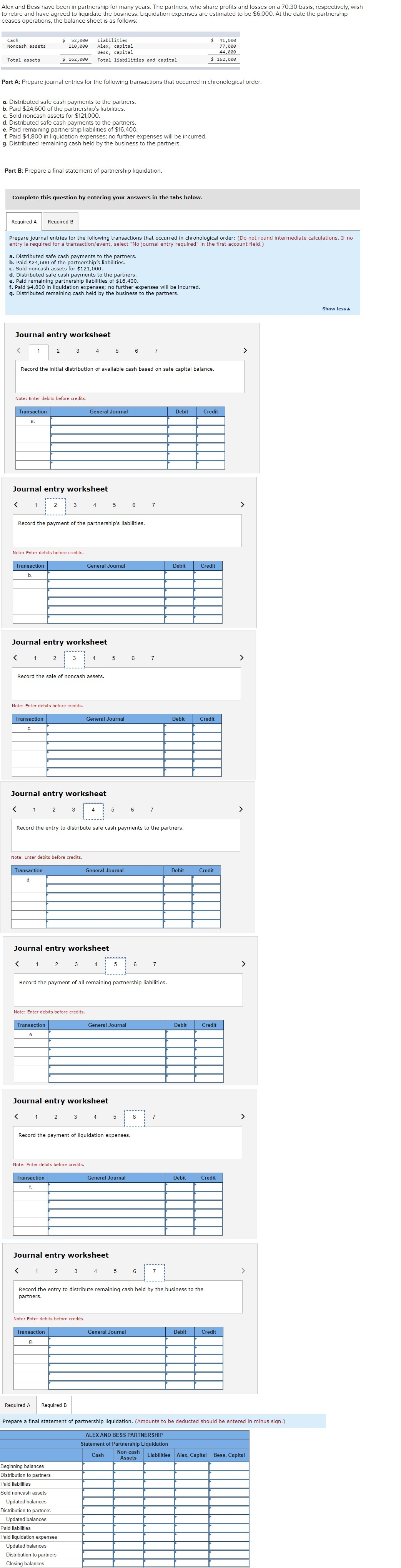

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,000 At the date the partnership ceases operations, the balance sheet is as follows: 41, aaa 77 , aaa 44 , aaa 162, Cash Noncash assets Total assets 52,e lla,e $ 162,eo Liabilities Alex, capital Bess, capital Total liabilities and capital Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $24,600 of the partnership's liabilities. c. Sold noncash assets for $121,000. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $16,400 f. Paid $4,800 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final statement of partnership liquidation. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries for the following transactions that occurred in chronological order: (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Distributed safe cash payments to the partners. a. b. Paid $24,600 of the partnership's liabilities. Sold noncash assets for $121,000. c. d. Distributed safe cash payments to the partners. Paid remaining partnership liabilities of $16,400. e. f. Paid $4,800 in liquidation expenses; no further expenses will be incurred. Distributed remaining cash held by the business to the partners. g. Show less A Journal entry worksheet 2 3 4 5 6 7 Record the initial distribution of available cash based on safe capital balance. Note: Enter debits before credits. ransactiil eneral Journ Journal entry worksheet 2 3 4 5 6 Record the payment of the partnership's liabilities. Note: Enter debits before credits. Journal entry worksheet 2 3 4 5 Record the sale of noncash assets. Note: Enter debits before credits. n saction General Journal Journal entry worksheet 2 3 4 5 6 6 7 7 7 bebif Debit Record the entry to distribute safe cash payments to the partners. Note: Enter debits before credits. Journal entry worksheet 2 3 4 5 6 7 Record the payment of all remaining partnership liabilities. Note: Enter debits before credits. Journal entry worksheet 2 3 4 5 Record the payment of liquidation expenses. Note: Enter debits before credits. n sactin eneralJOurn Journal entry worksheet 2 3 4 5 6 6 7 7 Record the entry to distribute remaining cash held by the business to the partners. Note: Enter debits before credits. Required A Required B Prepare a final statement of partnership liquidation. (Amounts to be deducted should be entered in minus sign.) ALEX AND BESS PARTNERSHIP Statement of Partnership Liquidation Cash Beginning balances Distribution to partners Paid liabilities Sold noncash assets Updated balances Distribution to partners Updated balances Paid liabilities Paid liquidation expenses Updated balances Distribution to partners Closing balances Non-cash Liabilities Assets Alex, Capital Bess, Capita

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started