Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please see image Fred and Frieda have always wanted to enter the blueberry business. They locate a 50-acre piece of hillside in Maine that is

please see image

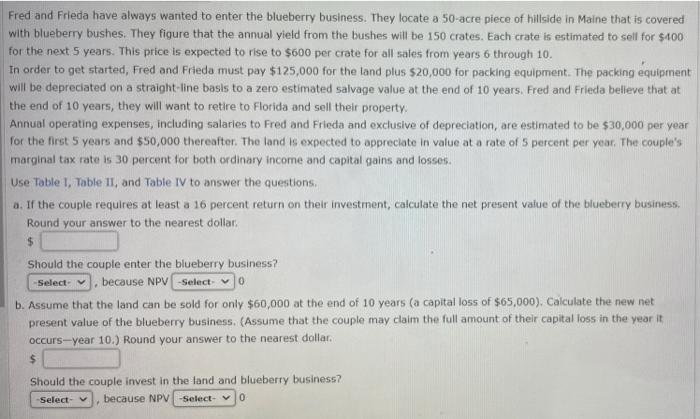

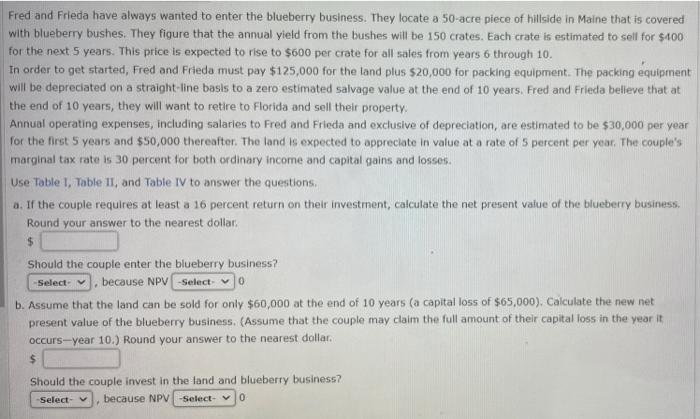

Fred and Frieda have always wanted to enter the blueberry business. They locate a 50-acre piece of hillside in Maine that is covered with blueberry bushes. They figure that the annual yield from the bushes will be 150 crates. Each crate is estimated to sell for $400 for the next 5 years. This price is expected to rise to $600 per crate for all sales from years 6 through 10. In order to get started, Fred and Frieda must pay $125,000 for the land plus $20,000 for packing equipment. The packing equipment will be depreciated on a straight-line basis to a zero estimated salvage value at the end of 10 years. Fred and Frieda believe that at the end of 10 years, they will want to retire to Florida and sell their property. Annual operating expenses, including salaries to Fred and Frieda and exclusive of depreciation, are estimated to be $30,000 per year for the first 5 years and $50,000 thereafter. The land is expected to appreciate in value at a rate of 5 percent per year. The couple's marginal tax rate is 30 percent for both ordinary income and capital gains and losses. Use Table 1, Table II, and Table IV to answer the questions. a. If the couple requires at least a 16 percent return on their investment, calculate the net present value of the blueberry business. Round your answer to the nearest dollar. $ Should the couple enter the blueberry business? -Select- because NPV -Select-0 b. Assume that the land can be sold for only $60,000 at the end of 10 years (a capital loss of $65,000). Calculate the new net present value of the blueberry business. (Assume that the couple may claim the full amount of their capital loss in the year it occurs-year 10.) Round your answer to the nearest dollar. $ Should the couple invest in the land and blueberry business? -Select- v because NPV -Select-0- b. Round your answer to the nearest dollar. $ Should the couple enter the blueberry business? -Select- V because NPV -Select- v 0 -Select- Yes No t the land can be sold for only $60,0 e of the blueberry business. (Assum r 10.) Round your answer to the nea couple invest in the land and blueber -Select- , because NPV -Select-0 Round your answer to the nearest dollar. $ Should the couple enter the blueberry business? -Select- because NPV -Select- V 0 b. Assume that the land can be present value of the blueber occurs-year 10.) Round yo > $ Should the couple invest in -Select- -Select- because NPV = ly $60,000 at the end of 10 years (a capital loss of (Assume that the couple may claim the full amoun the nearest dollar. blueberry business? -Select- because NPV -Select- b. Assume that the land can be sold for only $60,000 at the end of 10 years (a capital loss of $65,0 present value of the blueberry business. (Assume that the couple may claim the full amount of t occurs-year 10.) Round your answer to the nearest dollar. Should the couple invest in the land and blueberry business? because NPV -Select- 0 -Select- v -Select- Yes No b. Assume that the land can be sold for only $60,000 at the end of 10 ye present value of the blueberry business. (Assume that the couple may occurs-year 10.) Round your answer to the nearest dollar. $ Should the couple invest in the land and blueberry business? -Select- because NPV -Select- 0 Icon Key -Select- V ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started