Please see images

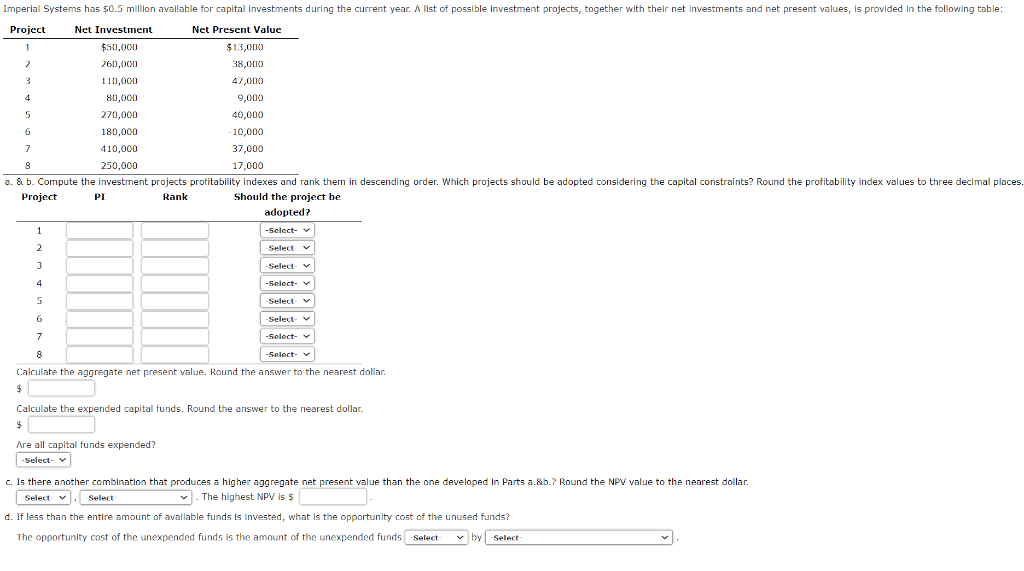

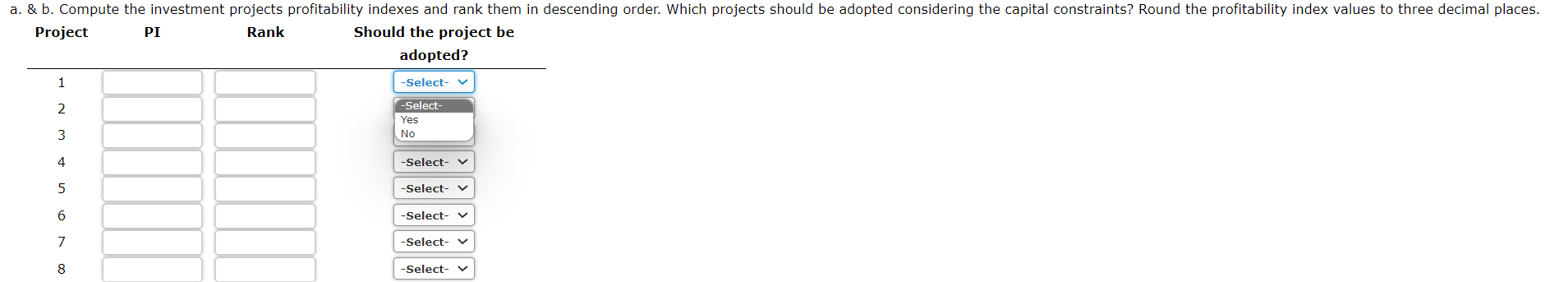

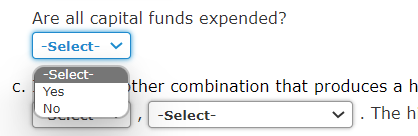

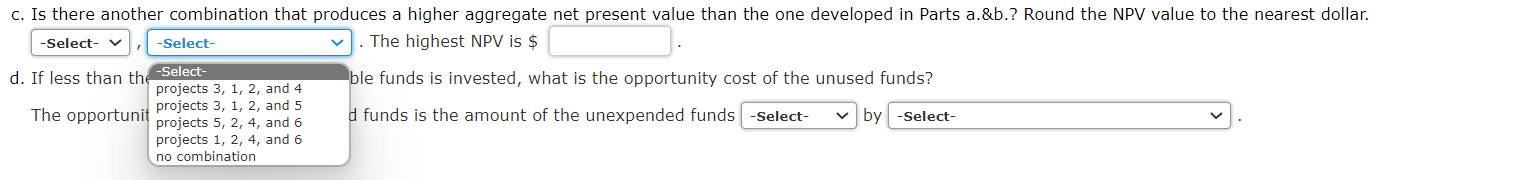

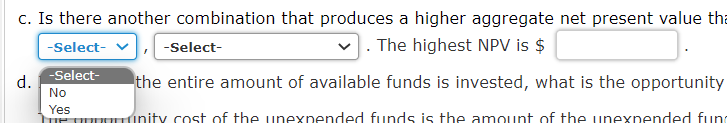

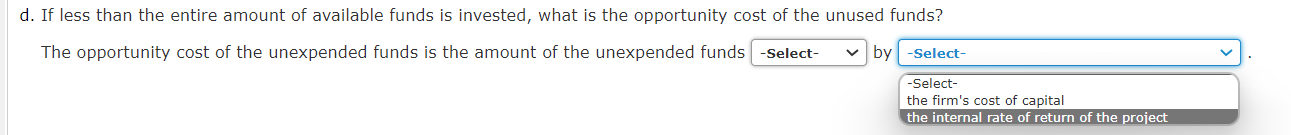

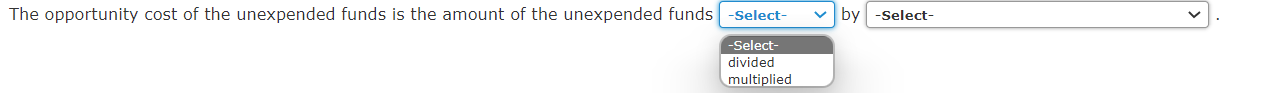

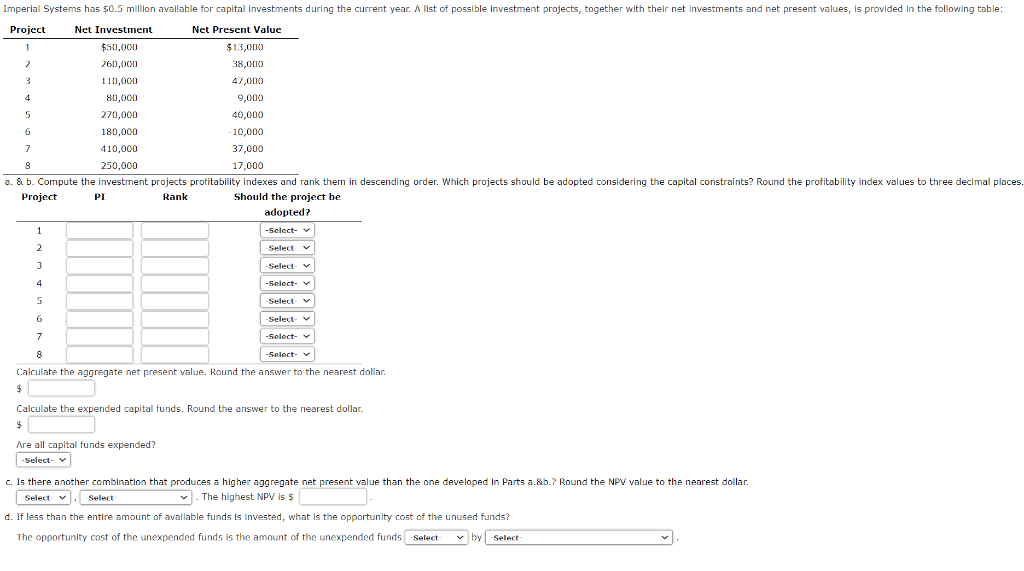

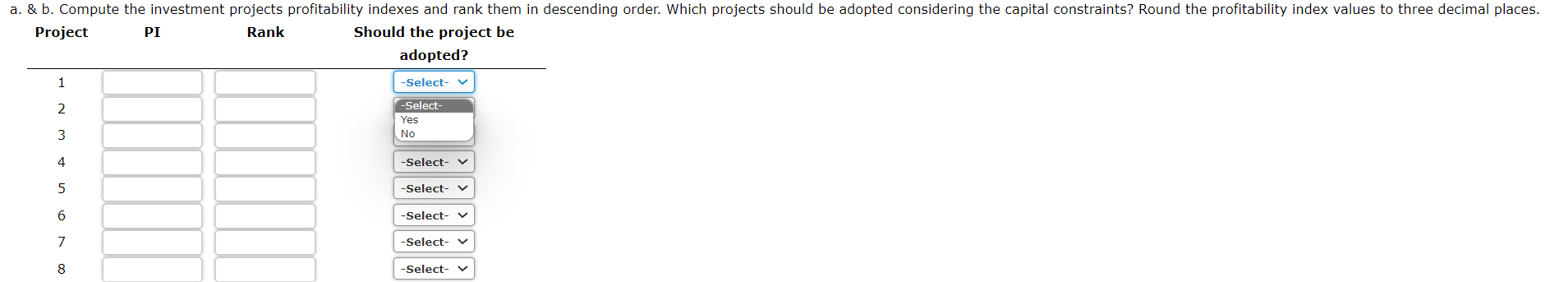

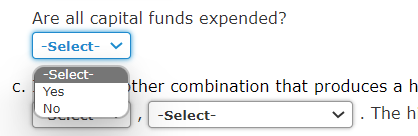

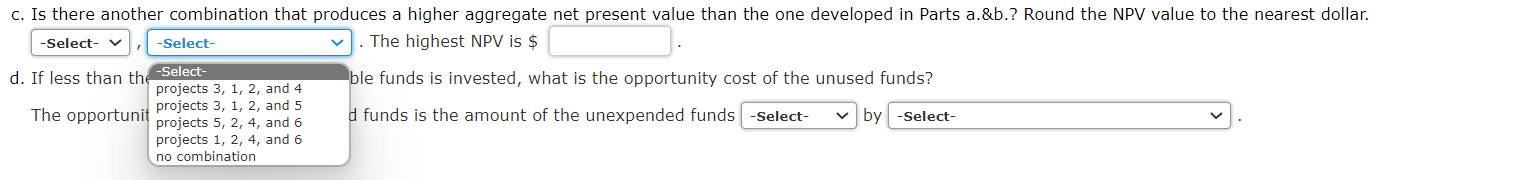

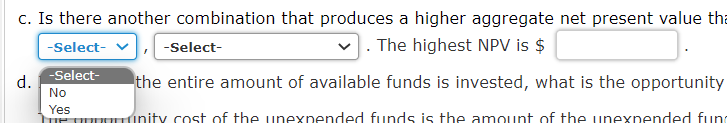

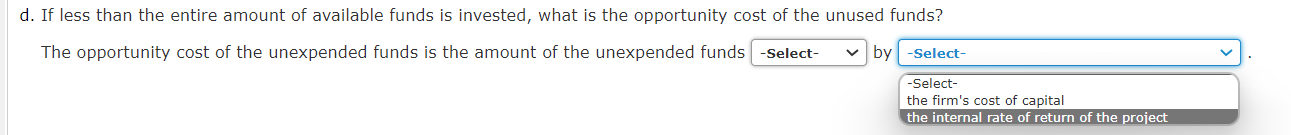

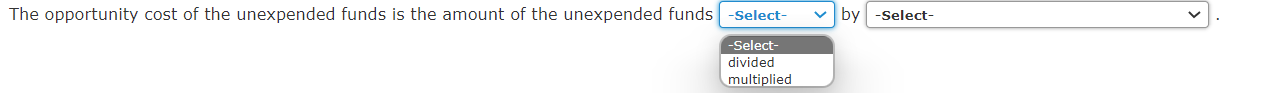

Imperial Systems has $0.5 million available for capital investments during the current year. A list of possible investment projects, together with their net investments and net present values, is provided in the following table: Net Investment Project Net Present Value 1 $50,000 260,000 110,000 80,000 2 3 $13,000 38,000 47,000 9,000 40,000 4 5 270,000 6 180,000 7 410,000 8 250,000 a. & b. Compute the investment projects profitability indexes and rank them in descending order. Which projects should be adopted considering the capital constraints? Round the profitability index values to three decimal places. Project PI Rank Should the project be adopted? -Select- $ -10,000 37,000 17,000 1 2 3 4 5 -Select- v 6 -Select- 7 -Select- 8 -Select- Calculate the aggregate net present value. Round the answer to the nearest dollar. Select v -Select- -Select- Calculate the expended capital funds. Round the answer to the nearest dollar. $ Are all capital funds expended? -Select- c. Is there another combination that produces a higher aggregate net present value than the one developed In Parts a.&b.? Round the NPV value to the nearest dollar. . The highest NPV is $ -Select- Select d. If less than the entire amount of available funds Is Invested, what is the opportunity cost of the unused funds? The opportunity cost of the unexpended funds is the amount of the unexpended funds -Select- by -Select- a. & b. Compute the investment projects profitability indexes and rank them in descending order. Which projects should be adopted considering the capital constraints? Round the profitability index values to three decimal places. PI Rank Project Should the project be adopted? 1 2 3 4 5 6 7 8 -Select- -Select- Yes No -Select- v -Select- V -Select- -Select- -Select- C. Are all capital funds expended? -Select- -Select- Yes No ther combination that produces a h . The hi -Select- c. Is there another combination that produces a higher aggregate net present value than the one developed in Parts a.&b.? Round the NPV value to the nearest dollar. -Select- The highest NPV is $ d. If less than the ble funds is invested, what is the opportunity cost of the unused funds? The opportunit d funds is the amount of the unexpended funds -Select- -Select- -Select- projects 3, 1, 2, and 4 projects 3, 1, 2, and 5 projects 5, 2, 4, and 6 projects 1, 2, 4, and 6 no combination by -Select- c. Is there another combination that produces a higher aggregate net present value th -Select- -Select- . The highest NPV is $ -Select- No the entire amount of available funds is invested, what is the opportunity Yes munity cost of the unexpended funds is the amount of the unexpended fund d. d. If less than the entire amount of available funds is invested, what is the opportunity cost of the unused funds? by -Select- The opportunity cost of the unexpended funds is the amount of the unexpended funds -Select- -Select- the firm's cost of capital the internal rate of return of the project The opportunity cost of the unexpended funds is the amount of the unexpended funds -Select- -Select- divided multiplied by -Select