Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please see images Johnson Products is considering purchasing a new milling machine that costs $50,000. The machine's Installation and shipping costs will total $2,000. If

please see images

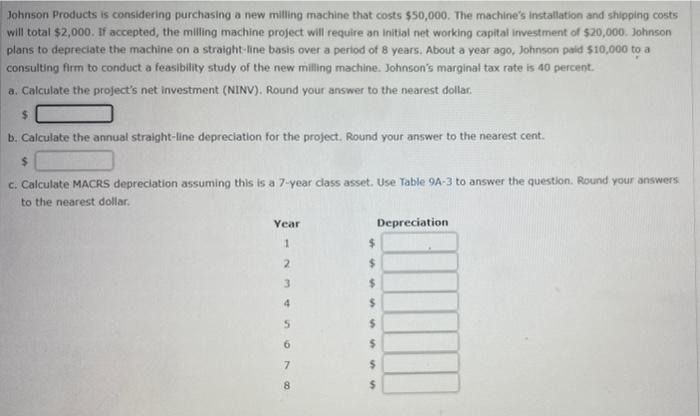

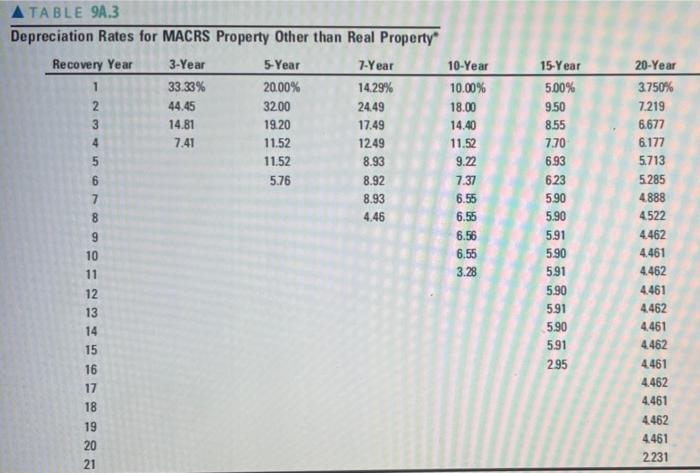

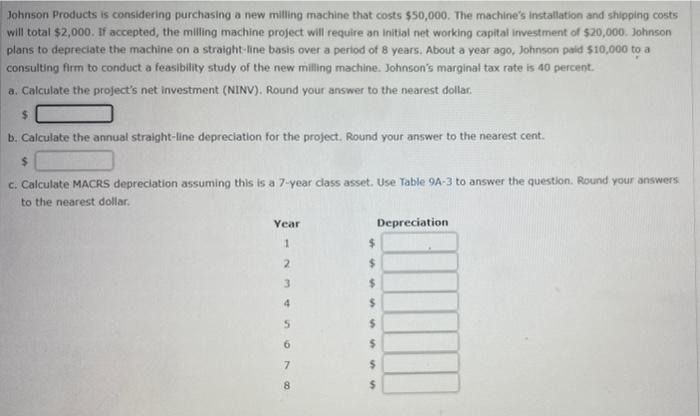

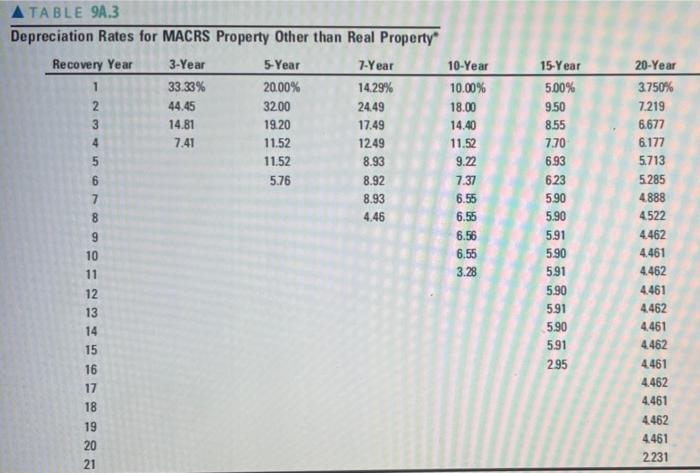

Johnson Products is considering purchasing a new milling machine that costs $50,000. The machine's Installation and shipping costs will total $2,000. If accepted, the milling machine project will require an initial net working capital investment of $20,000. Johnson plans to depreciate the machine on a straight-line basis over a period of 8 years. About a year ago, Johnson paid $10,000 to a consulting firm to conduct a feasibility study of the new milling machine. Johnson's marginal tax rate is 40 percent. a. Calculate the project's net investment (NINV). Round your answer to the nearest dollar. $ b. Calculate the annual straight-line depreciation for the project. Round your answer to the nearest cent. $ c. Calculate MACRS depreciation assuming this is a 7-year class asset. Use Table 9A-3 to answer the question. Round your answers to the nearest dollar. Year 1 2 3 4 5 6 7 8 Depreciation $ $ $ $ $ $ $ $ ATABLE 9A.3 Depreciation Rates for MACRS Property Other than Real Property Recovery Year 1 23456TSINSHSS16982 7 10 11 17 20 3-Year 33.33% 44.45 14.81 7.41 5-Year 20.00% 32.00 19.20 11.52 11.52 5.76 7-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10-Year 10.00% 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 15-Year 5.00% 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 20-Year 3.750% 7,219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4462 4461 4.462 4.461 4.462 4.461 2.231

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started