Please see information below. Any help would be great. Thank you!

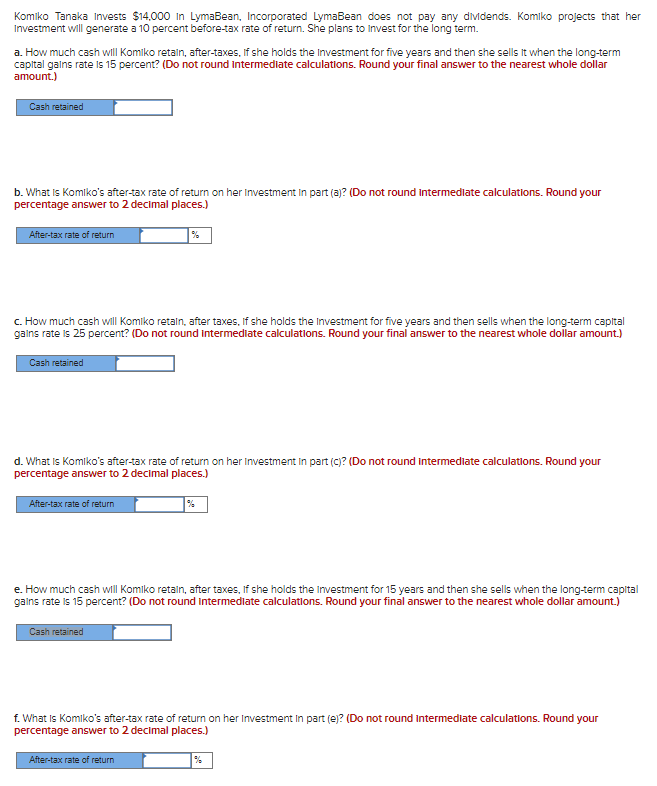

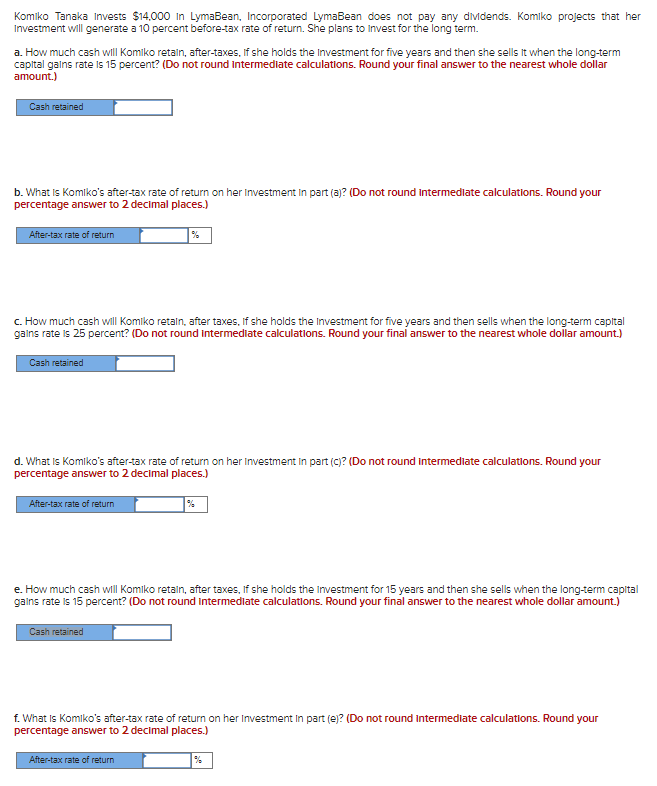

Komiko Tanaka Invests $14.000 in LymaBean, Incorporated LymaBean does not pay any dividends. Komiko projects that her Investment will generate a 10 percent before-tax rate of return. She plans to invest for the long term. a. How much cash will Komiko retain, after-taxes, if she holds the investment for five years and then she sells it when the long-term capital gains rate is 15 percent? (Do not round Intermediate calculations. Round your final answer to the nearest whole dollar amount.) Cash retained b. What is Komiko's after-tax rate of return on her Investment in part (a)? (Do not round Intermediate calculations. Round your percentage answer to 2 decimal places.) After-tax rate of return c. How much cash will Komiko retain after taxes, if she holds the Investment for five years and then sells when the long-term capital gains rate is 25 percent? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Cash retained d. What is Komiko's after-tax rate of return on her Investment in part (c)? (Do not round intermediate calculations. Round your percentage answer to 2 decimal places.) After-tax rate of return % e. How much cash will Komiko retain, after taxes. If she holds the investment for 15 years and then she sells when the long-term capital gains rate is 15 percent? (Do not round Intermediate calculations. Round your final answer to the nearest whole dollar amount.) Cash retained f. What Is Komiko's after-tax rate of return on her Investment in part (e)? (Do not round Intermediate calculations. Round your percentage answer to 2 decimal places.) After-tax rate of return % Komiko Tanaka Invests $14.000 in LymaBean, Incorporated LymaBean does not pay any dividends. Komiko projects that her Investment will generate a 10 percent before-tax rate of return. She plans to invest for the long term. a. How much cash will Komiko retain, after-taxes, if she holds the investment for five years and then she sells it when the long-term capital gains rate is 15 percent? (Do not round Intermediate calculations. Round your final answer to the nearest whole dollar amount.) Cash retained b. What is Komiko's after-tax rate of return on her Investment in part (a)? (Do not round Intermediate calculations. Round your percentage answer to 2 decimal places.) After-tax rate of return c. How much cash will Komiko retain after taxes, if she holds the Investment for five years and then sells when the long-term capital gains rate is 25 percent? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount.) Cash retained d. What is Komiko's after-tax rate of return on her Investment in part (c)? (Do not round intermediate calculations. Round your percentage answer to 2 decimal places.) After-tax rate of return % e. How much cash will Komiko retain, after taxes. If she holds the investment for 15 years and then she sells when the long-term capital gains rate is 15 percent? (Do not round Intermediate calculations. Round your final answer to the nearest whole dollar amount.) Cash retained f. What Is Komiko's after-tax rate of return on her Investment in part (e)? (Do not round Intermediate calculations. Round your percentage answer to 2 decimal places.) After-tax rate of return %