Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLease see the errors that were made on the answer I have recieved (25 Marks) (5 marks) 1.1 1.2 (7 marks) Answer ALL the questions

PLease see the errors that were made on the answer I have recieved

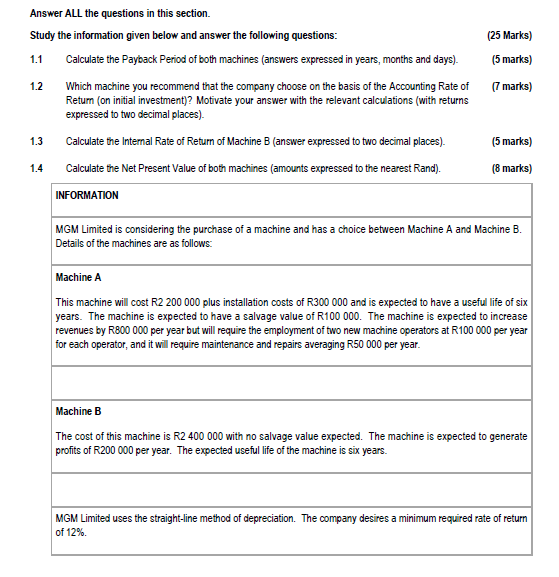

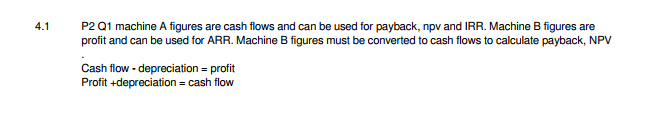

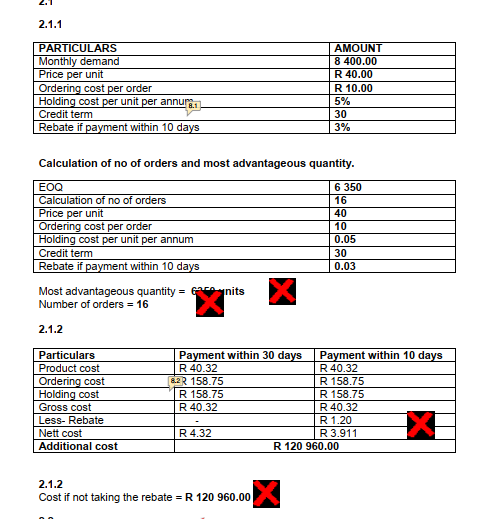

(25 Marks) (5 marks) 1.1 1.2 (7 marks) Answer ALL the questions in this section. Study the information given below and answer the following questions: Calculate the Payback period of both machines (answers expressed in years, months and days). Which machine you recommend that the company choose on the basis of the Accounting Rate of Return (on initial investment)? Motivate your answer with the relevant calculations (with returns expressed to two decimal places). Calculate the Internal Rate of Return of Machine B (answer expressed to two decimal places). 1.4 Calculate the Net Present Value of both machines (amounts expressed to the nearest Rand). INFORMATION 1.3 (5 marks) (8 marks) MGM Limited is considering the purchase of a machine and has a choice between Machine A and Machine B. Details of the machines are as follows: Machine A This machine will cost R2 200 000 plus installation costs of R300 000 and is expected to have a useful life of six years. The machine is expected to have a salvage value of R100 000. The machine is expected to increase revenues by R800 000 per year but will require the employment of two new machine operators at R100 000 per year for each operator, and it will require maintenance and repairs averaging R50 000 per year. Machine B The cost of this machine is R2 400 000 with no salvage value expected. The machine is expected to generate profits of R200 000 per year. The expected useful life of the machine is six years. MGM Limited uses the straight-line method of depreciation. The company desires a minimum required rate of return of 12% 4.1 P2 Q1 machine A figures are cash flows and can be used for payback, npv and IRR. Machine B figures are profit and can be used for ARR. Machine B figures must be converted to cash flows to calculate payback, NPV Cash flow - depreciation = profit Profit +depreciation = cash flow 2.1.1 PARTICULARS Monthly demand Price per unit Ordering cost per order Holding cost per unit per annura. Credit term Rebate if payment within 10 days AMOUNT 8 400.00 R 40.00 R 10.00 5% 30 3% Calculation of no of orders and most advantageous quantity. 6 350 16 EOQ Calculation of no of orders Price per unit Ordering cost per order Holding cost per unit per annum Credit term Rebate if payment within 10 days Most advantageous quantity = GAC nits Number of orders = 16 40 10 0.05 30 0.03 2.1.2 Particulars Product cost Ordering cost Holding cost Gross cost Less-Rebate Nett cost Additional cost Payment within 30 days Payment within 10 days R 40.32 R 40.32 82R 158.75 R 158.75 R 158.75 R 158.75 R 40.32 R 40.32 R 1.20 R 4.32 R 3.911 R 120 960.00 XL 2.1.2 Cost if not taking the rebate = R 120 960.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started