Question

Please selecet from the below accounts: Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend

Please selecet from the below accounts:

Accumulated Other Comprehensive Income

Allowance for Investment Impairment

Bond Investment at Amortized Cost

Cash

Commission Expense

Dividends Receivable

Dividend Revenue

FV-NI Investments

FV-OC|Investments

Gain on Disposal of Investments - FV-NI

Gain on Disposal of Investments - FV-OCI

Gain on Sale of Investments

GST Receivable

Interest Expense

Interest Income

Interest Payable

Interest Receivable

Investment in Associate

Investment Income or Loss

Loss on Discontinued Operations

Loss on Disposal of Investments FV-NI

Loss on Disposal of Investments FV-OCI

Loss on Impairment

Loss on Sale of Investments

No Entry

Note Investment at Amortized Cost

Other Investments

Recovery of Loss from Impairment

Retained Earnings

Unrealized Gain or Loss

Unrealized Gain or Loss - OCI

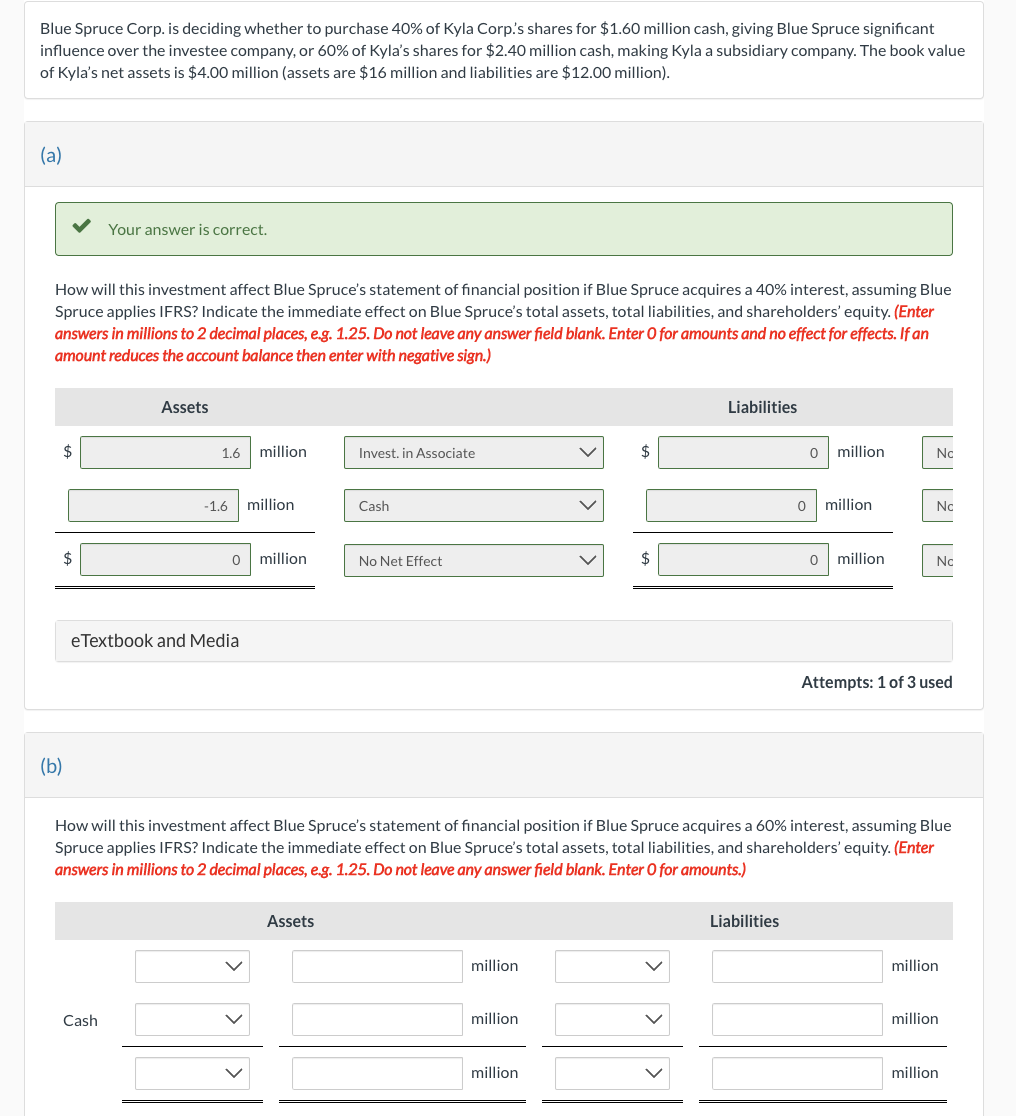

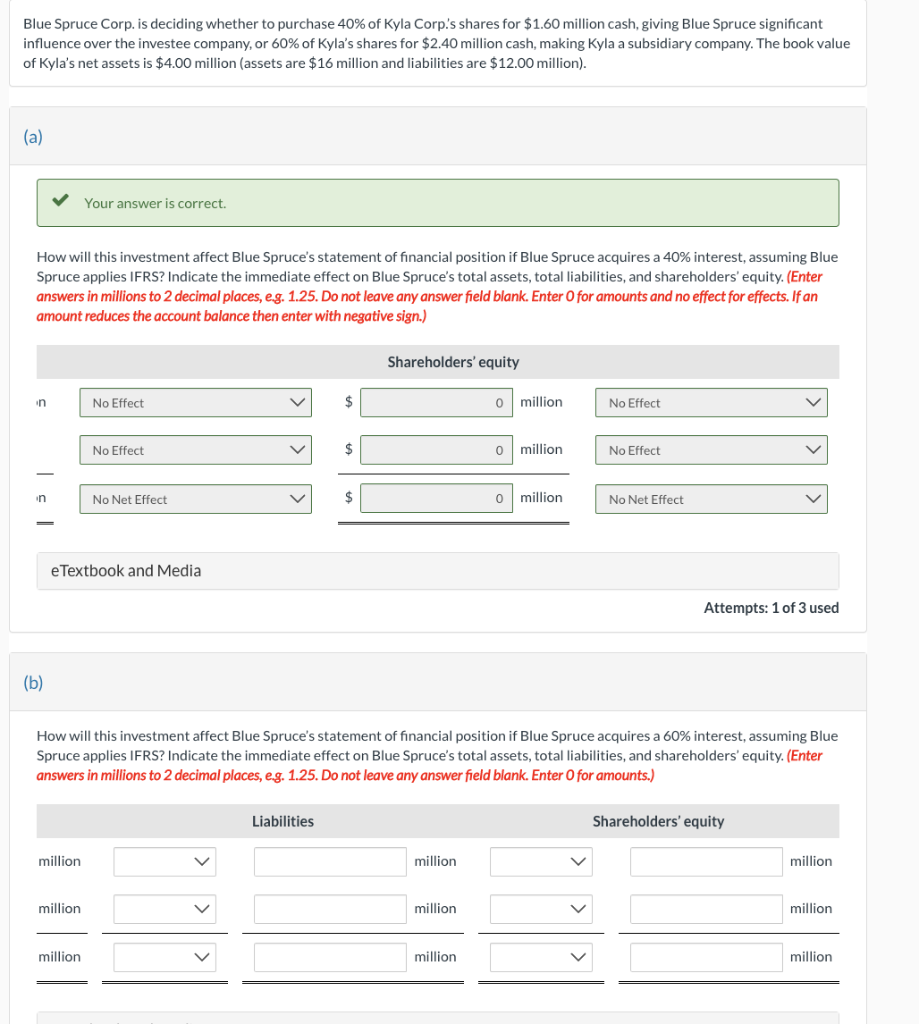

Blue Spruce Corp. is deciding whether to purchase 40% of Kyla Corp.'s shares for $1.60 million cash, giving Blue Spruce significant influence over the investee company, or 60% of Kyla's shares for $2.40 million cash, making Kyla a subsidiary company. The book value of Kyla's net assets is $4.00 million (assets are $16 million and liabilities are $12.00 million). (a) Your answer is correct. How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 40% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, e.g. 1.25. Do not leave any answer field blank. Enter 0 for amounts and no effect for effects. If an amount reduces the account balance then enter with negative sign.) eTextbook and Media Attempts: 1 of 3 used (b) How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 60% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, e.g. 1.25. Do not leave any answer field blank. Enter 0 for amounts.) Blue Spruce Corp. is deciding whether to purchase 40% of Kyla Corp.'s shares for $1.60 million cash, giving Blue Spruce significant influence over the investee company, or 60% of Kyla's shares for $2.40 million cash, making Kyla a subsidiary company. The book value of Kyla's net assets is $4.00 million (assets are $16 million and liabilities are $12.00 million). (a) Your answer is correct. How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 40% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, eg. 1.25. Do not leave any answer field blank. Enter 0 for amounts and no effect for effects. If an amount reduces the account balance then enter with negative sign.) eTextbook and Media Attempts: 1 of 3 used (b) How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 60% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, eg. 1.25. Do not leave any answer field blank. Enter 0 for amounts.) Blue Spruce Corp. is deciding whether to purchase 40% of Kyla Corp.'s shares for $1.60 million cash, giving Blue Spruce significant influence over the investee company, or 60% of Kyla's shares for $2.40 million cash, making Kyla a subsidiary company. The book value of Kyla's net assets is $4.00 million (assets are $16 million and liabilities are $12.00 million). (a) Your answer is correct. How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 40% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, e.g. 1.25. Do not leave any answer field blank. Enter 0 for amounts and no effect for effects. If an amount reduces the account balance then enter with negative sign.) eTextbook and Media Attempts: 1 of 3 used (b) How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 60% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, e.g. 1.25. Do not leave any answer field blank. Enter 0 for amounts.) Blue Spruce Corp. is deciding whether to purchase 40% of Kyla Corp.'s shares for $1.60 million cash, giving Blue Spruce significant influence over the investee company, or 60% of Kyla's shares for $2.40 million cash, making Kyla a subsidiary company. The book value of Kyla's net assets is $4.00 million (assets are $16 million and liabilities are $12.00 million). (a) Your answer is correct. How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 40% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, eg. 1.25. Do not leave any answer field blank. Enter 0 for amounts and no effect for effects. If an amount reduces the account balance then enter with negative sign.) eTextbook and Media Attempts: 1 of 3 used (b) How will this investment affect Blue Spruce's statement of financial position if Blue Spruce acquires a 60% interest, assuming Blue Spruce applies IFRS? Indicate the immediate effect on Blue Spruce's total assets, total liabilities, and shareholders' equity. (Enter answers in millions to 2 decimal places, eg. 1.25. Do not leave any answer field blank. Enter 0 for amounts.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started