Question

Learning Objectives Assessed This assessment corresponds to the Course Learning Outcomes (CLO): CLO 1 -Identify and justify various approaches to measuring an organization's performance, including

Learning Objectives Assessed This assessment corresponds to the Course Learning Outcomes (CLO): CLO 1 -Identify and justify various approaches to measuring an organization's performance, including financial performance, social performance, and environmental performance.

CLO 2 - Interpret and analyze a range of approaches to providing accountability, including measuring an organization's financial performance, social performance, and environmental performance.

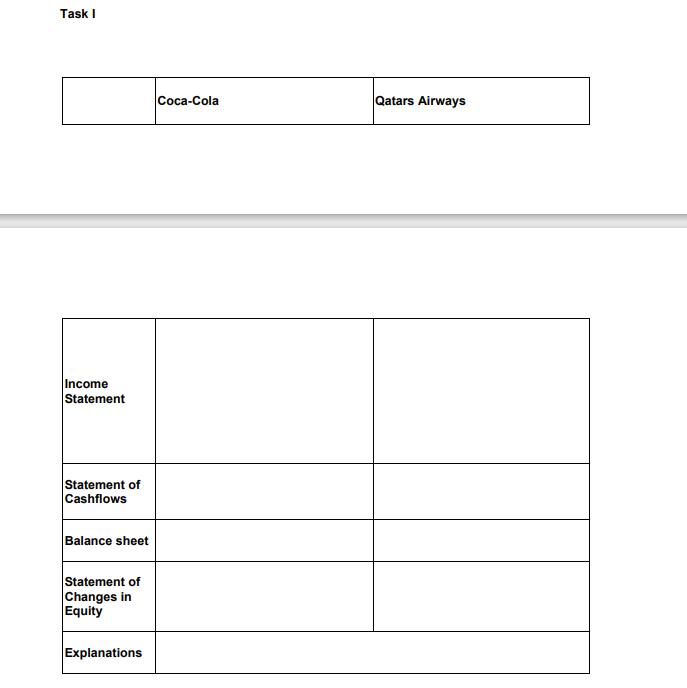

CLO 3 - Analyse case studies to identify instances that justify accounting as both a technical and social practice in a changing and interconnected world. Ready for Life and Work Organisations use their annual reports as a channel to communicate financial information and a wide range of details about their operations, including the regulations they comply with in compiling their financial reports. This is yet another opportunity for you to explore the information provided in the annual reports by examining the financial reports and the notes to the financial statements. In so doing, you will be connected once again to the world of accounting practice and will enhance your understanding of financial reports. Assessment Details You are required to select two companies from two different industries (manufacturing and merchandising) in Australia and complete the following two tasks using their most recent annual reports: Task I: Understanding financial statements’ items Compare and contrast the detailed information provided in the financial reports (i.e the Income statement, the Balance Sheet, Statement of Cash flows and Statement of changes in Equity) of the two selected companies. Summarise the differences in their formats, contents, structure, and presentation. Provide at least two explanations for all the differences you have identified using the format.

Task II: Understanding financial statements in detail You are required to answer the following questions using one of the companies selected for

Task I (Total: 10 marks - includes 1 mark for citing and referencing):

Question 1 (1 mark) Describe the principal activities of the company.

Question 2 (1.5 marks) Identify the method of depreciation the company uses to depreciate its property, plant, and equipment. Which note (number) deals with this?

Question 3 (2 marks) Describe the purpose of the external auditor's report. Explain why the auditors must declare their independence.

Question 4 (1.5 marks) How are trade and other receivables measured? Identify the note (number) that deals with this.

Question 5 (1.5 marks) Identify how the amounts in the financial report for this company are rounded and briefly explain why rounding occurs

Question 6 (1.5 marks) Identify the regulations with which the financial statements should comply as outlined in the Director’s declaration. Give at least 2.

Explain the rationale for regulating public companies

Task I Income Statement Statement of Cashflows Balance sheet Statement of Changes in Equity Explanations Coca-Cola Qatars Airways

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Comparison of Financial Reports Income Statement CocaCola The income statement of CocaCola will likely include revenue from the sale of its beverage products operating expenses and net income It may h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started