Answered step by step

Verified Expert Solution

Question

1 Approved Answer

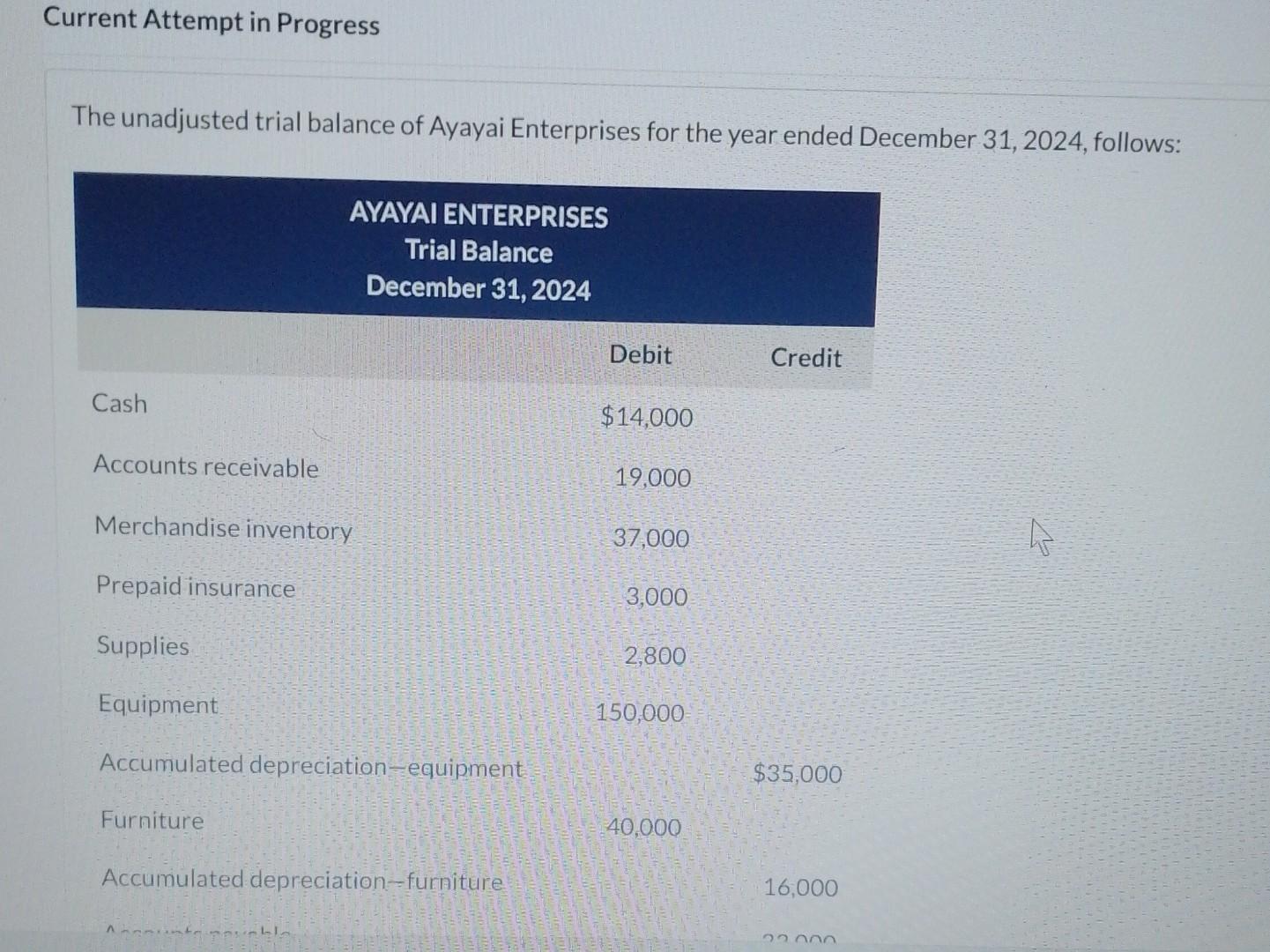

please send answer full Current Attempt in Progress The unadjusted trial balance of Ayayai Enterprises for the year ended December 31,2024 , follows: Furniture 40,000

please send answer full

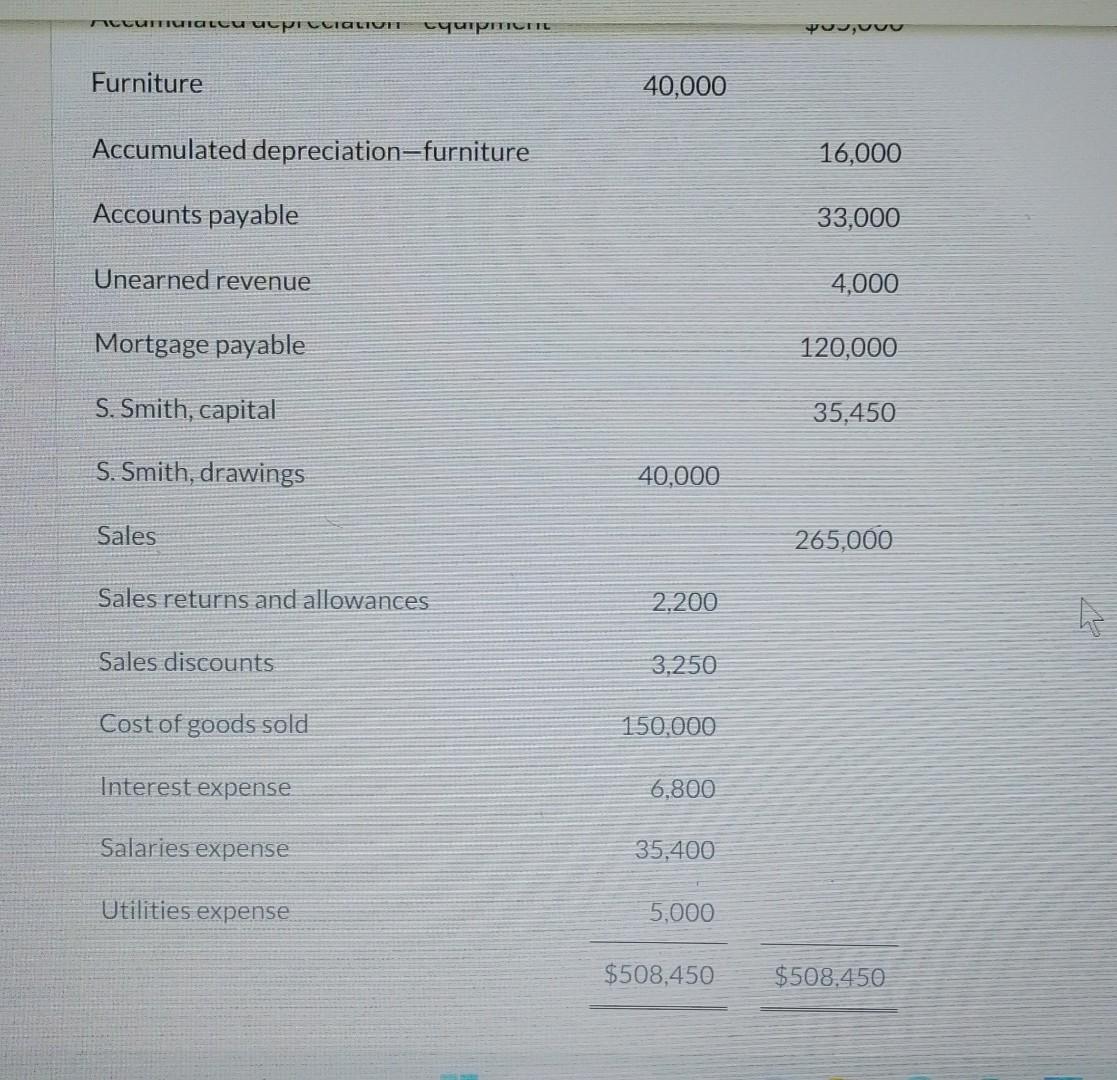

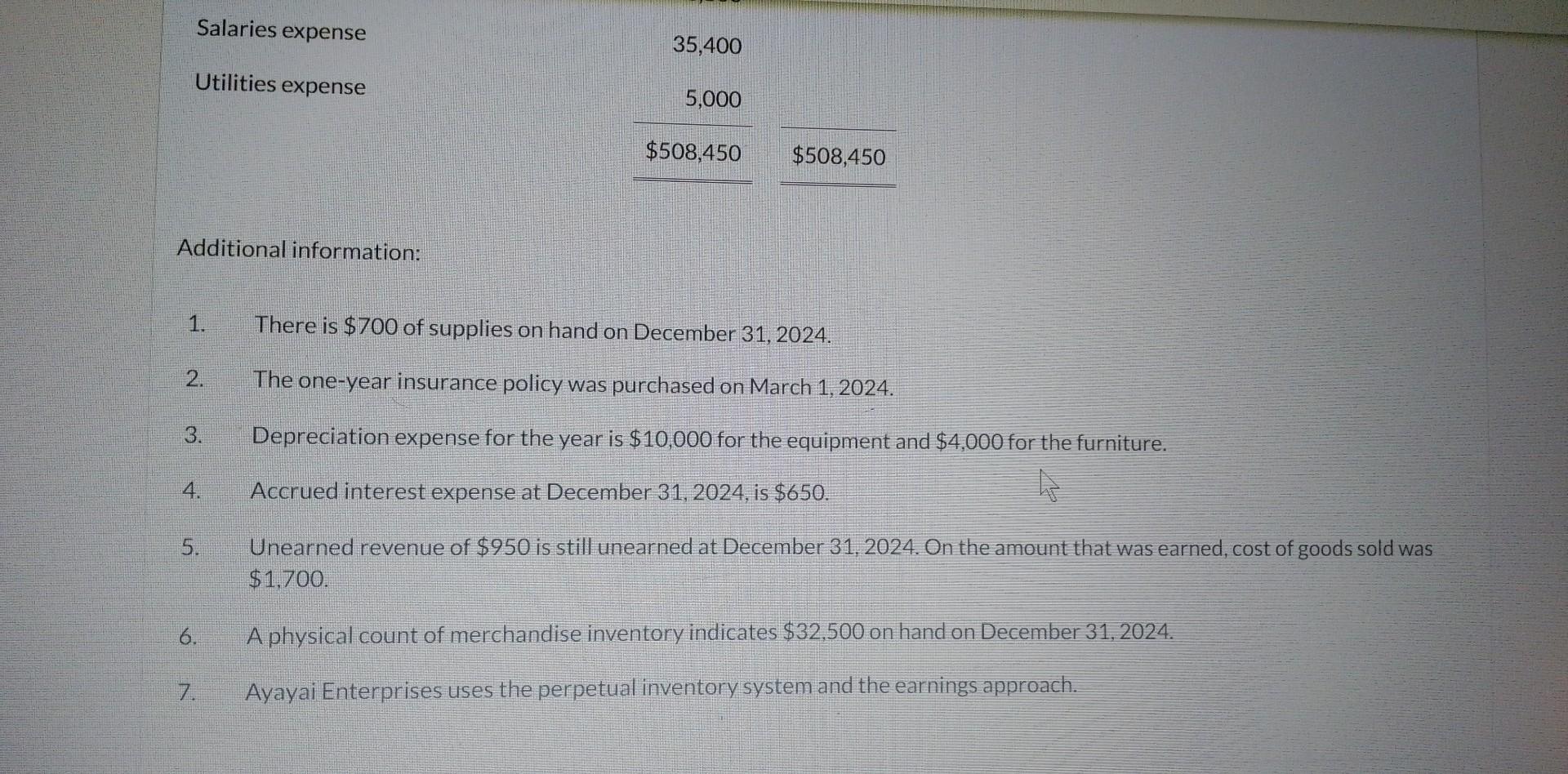

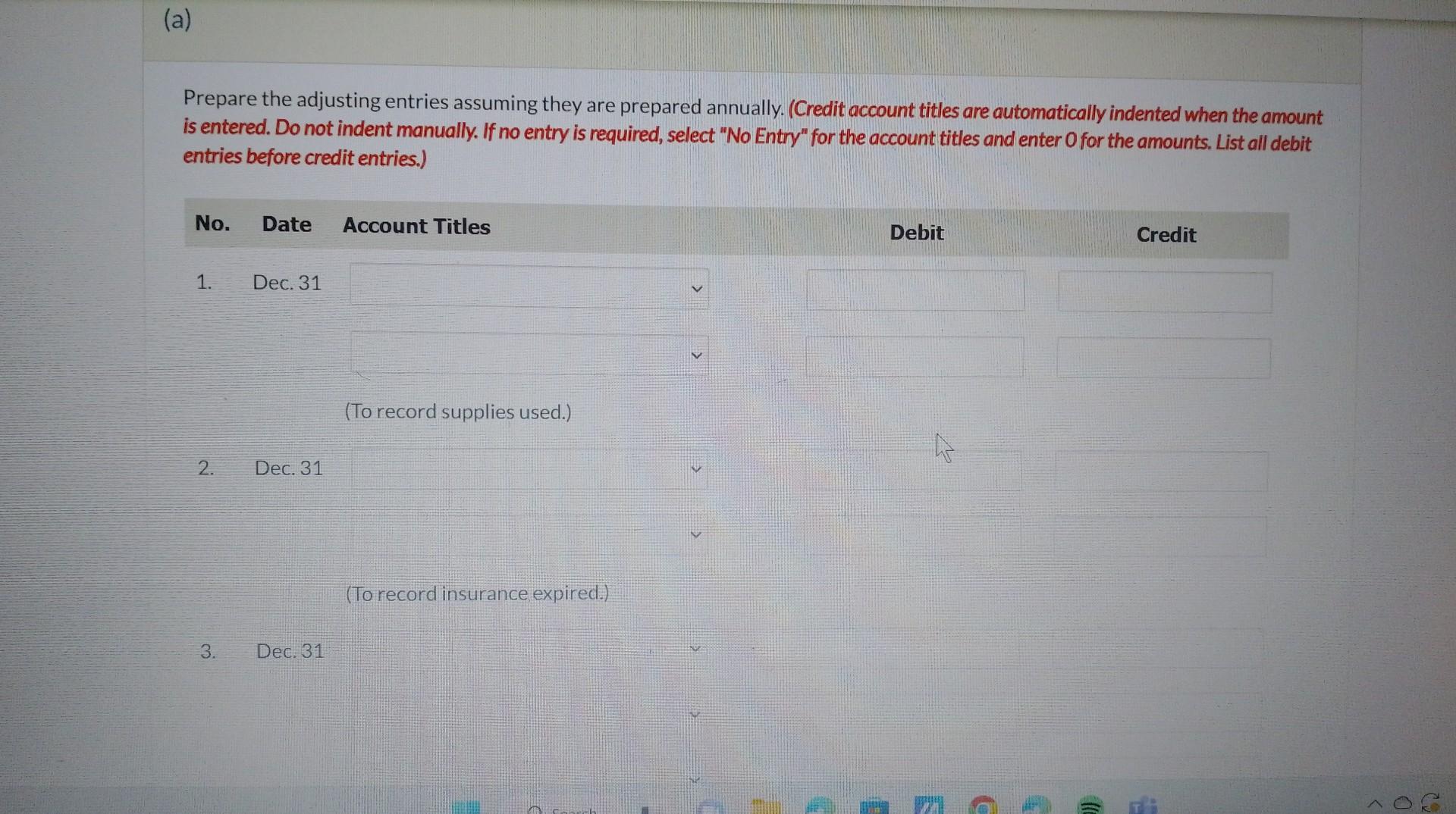

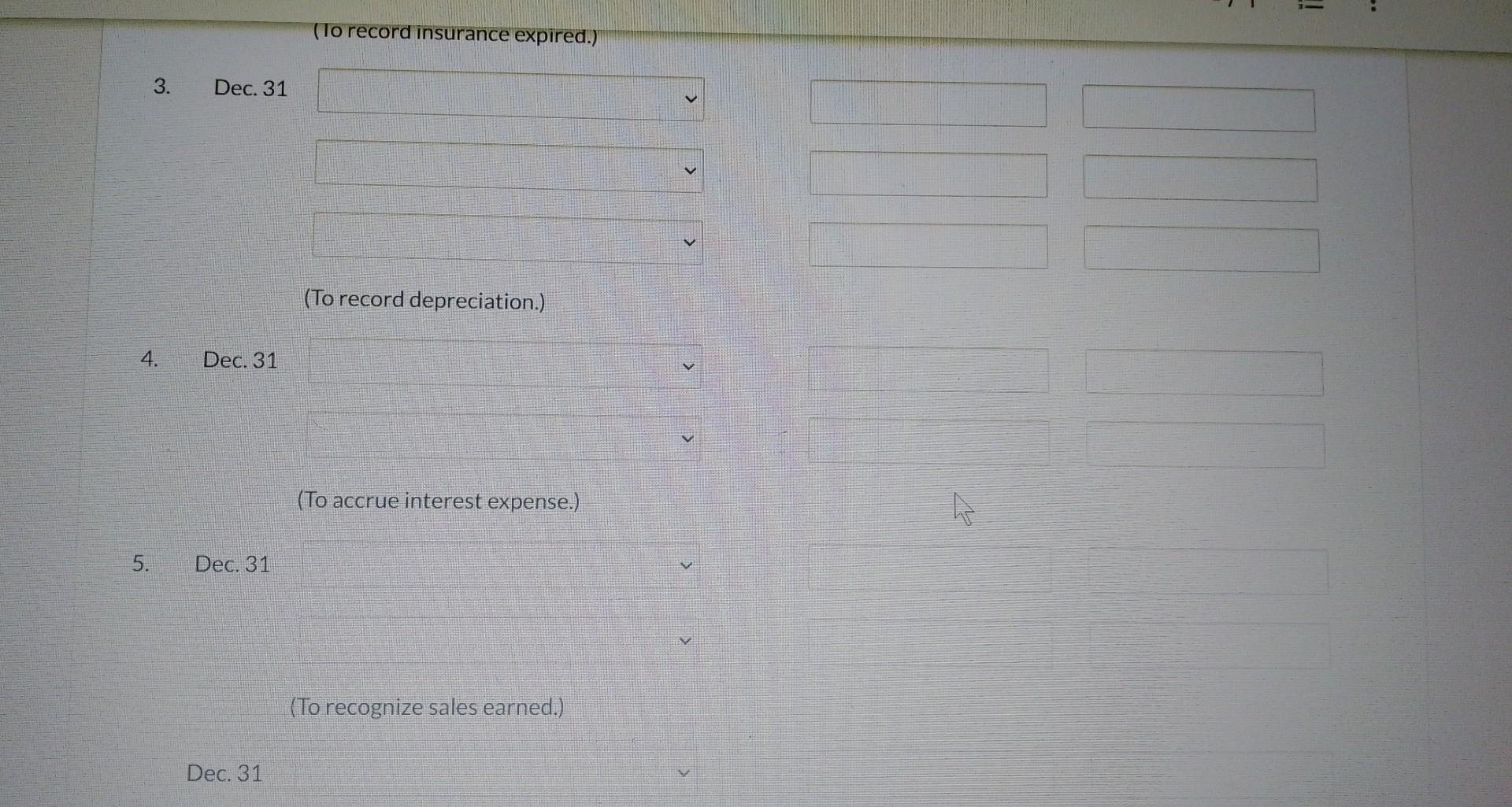

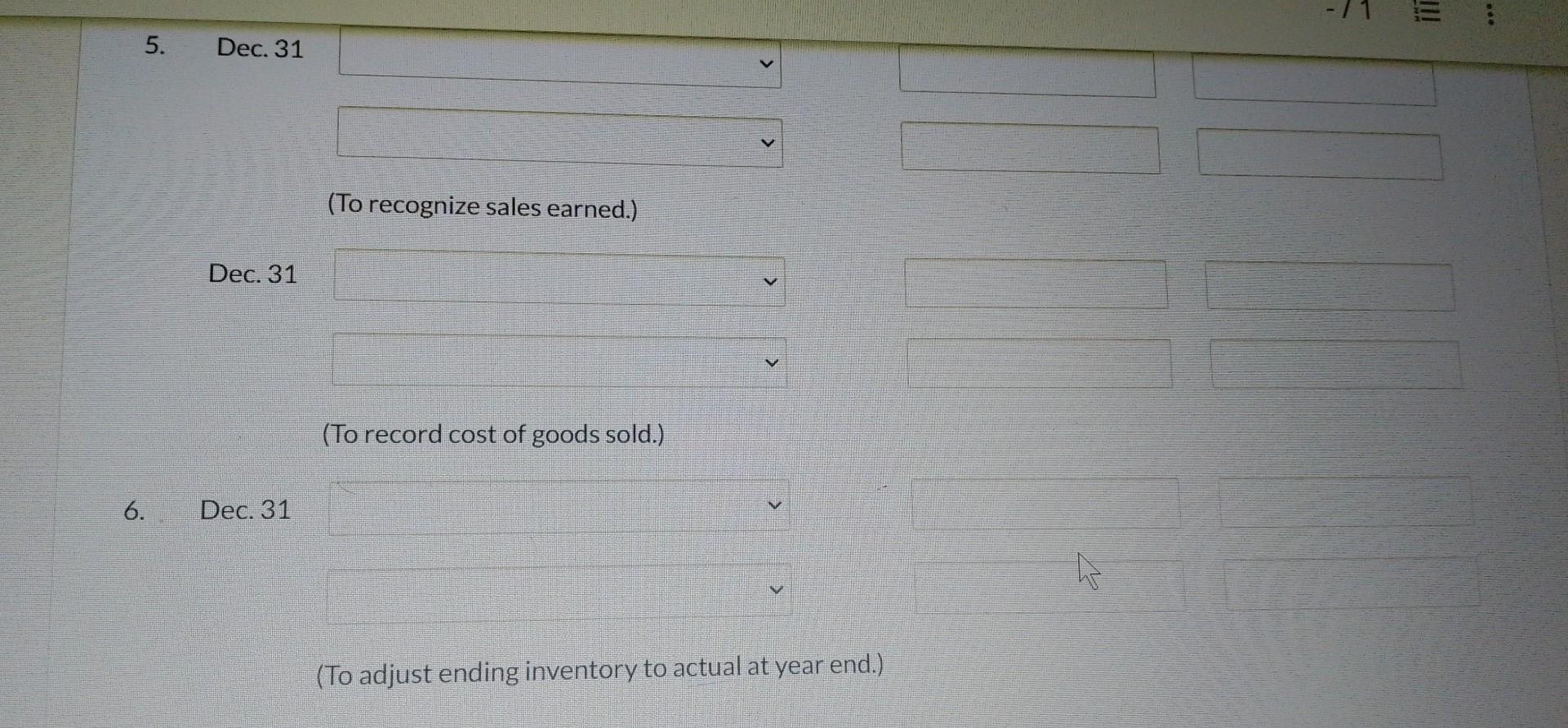

Current Attempt in Progress The unadjusted trial balance of Ayayai Enterprises for the year ended December 31,2024 , follows: Furniture 40,000 Accumulated depreciation-furniture 16,000 Accounts payable 33,000 Unearned revenue Mortgage payable 120,000 S. Smith, capital 35,450 S. Smith, drawings 40,000 Sales 265,000 Sales returns and allowances Sales discounts Cost of goods sold 150,000 Interest expense 6,800 Salaries expense 35,400 Utilities expense Additional information: 1. There is $700 of supplies on hand on December 31,2024. 2. The one-year insurance policy was purchased on March 1, 2024. 3. Depreciation expense for the year is $10,000 for the equipment and $4,000 for the furniture. 4. Accrued interest expense at December 31,2024 , is $650. 5. Unearned revenue of $950 is still unearned at December 31, 2024. On the amount that was earned, cost of goods sold was $1,700 6. A physical count of merchandise inventory indicates $32,500 on hand on December 31,2024. 7. Ayayai Enterprises uses the perpetual inventory system and the earnings approach. Prepare the adjusting entries assuming they are prepared annually. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) ( lo record insurance expired.) 3. Dec. 31 (To record depreciation.) 4. Dec. 31 (To accrue interest expense.) 5. Dec. 31 (To recognize sales earned.) Dec. 31 5. Dec. 31 (To recognize sales earned.) Dec. 31 (To record cost of goods sold.) 6. Dec. 31 (To adjust ending inventory to actual at year end.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started