Answered step by step

Verified Expert Solution

Question

1 Approved Answer

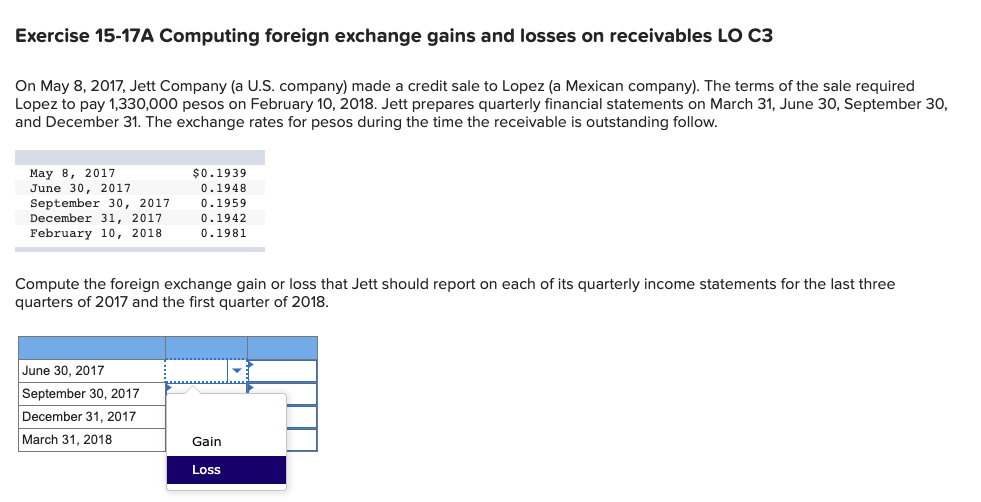

Please send back with same tables. Exercise 15-17A Computing foreign exchange gains and losses on receivables LO C3 On May 8, 2017, Jett Company (a

Please send back with same tables.

Exercise 15-17A Computing foreign exchange gains and losses on receivables LO C3 On May 8, 2017, Jett Company (a U.S. company) made a credit sale to Lopez (a Mexican company). The terms of the sale required Lopez to pay 1,330,000 pesos on February 10, 2018. Jett prepares quarterly financial statements on March 31, June 30, September 30, and December 31. The exchange rates for pesos during the time the receivable is outstanding follow. $0.1939 0.1948 May 8, 2017 June 30, 2017 September 30, 2017 December 31, 2017 February 10, 2018 0.1942 0.1981 Compute the foreign exchange gain or loss that Jett should report on each of its quarterly income statements for the last three quarters of 2017 and the first quarter of 2018. June 30, 2017 September 30, 2017 December 31, 2017 March 31, 2018 Gain Loss Exercise 15-17A Computing foreign exchange gains and losses on receivables LO C3 On May 8, 2017, Jett Company (a U.S. company) made a credit sale to Lopez (a Mexican company). The terms of the sale required Lopez to pay 1,330,000 pesos on February 10, 2018. Jett prepares quarterly financial statements on March 31, June 30, September 30, and December 31. The exchange rates for pesos during the time the receivable is outstanding follow. $0.1939 0.1948 May 8, 2017 June 30, 2017 September 30, 2017 December 31, 2017 February 10, 2018 0.1942 0.1981 Compute the foreign exchange gain or loss that Jett should report on each of its quarterly income statements for the last three quarters of 2017 and the first quarter of 2018. June 30, 2017 September 30, 2017 December 31, 2017 March 31, 2018 Gain LossStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started