Answered step by step

Verified Expert Solution

Question

1 Approved Answer

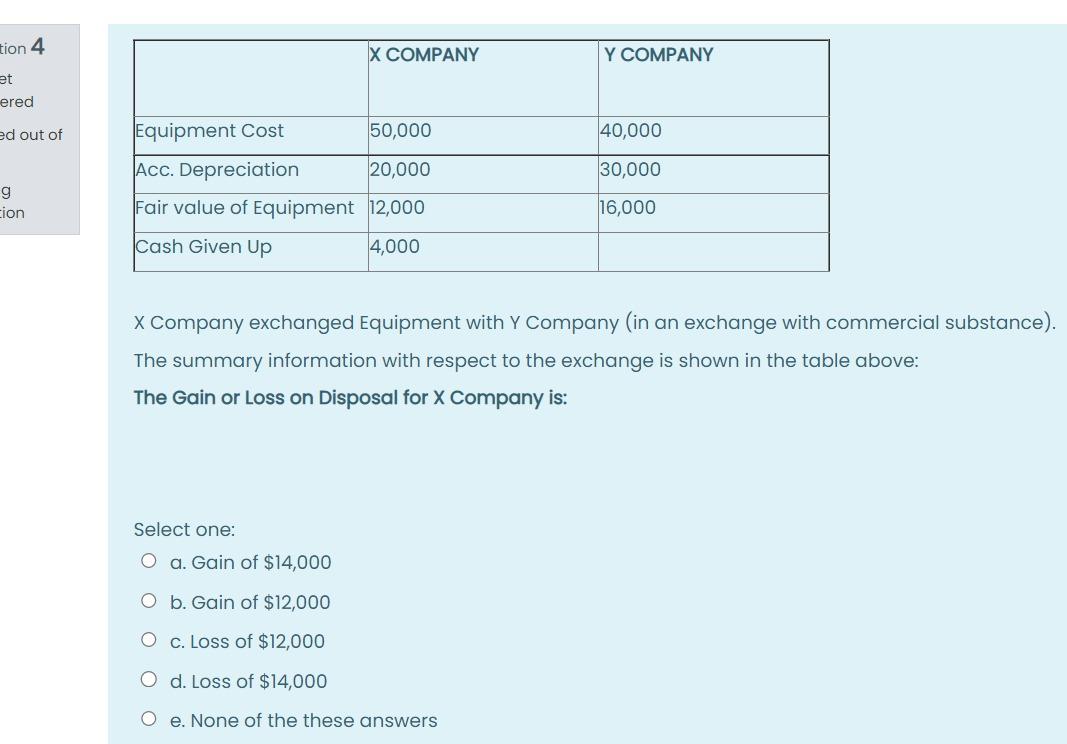

PLEASE SEND ME ALL QUESTIONS ONLY FINAL ANSWER. THANK YOU X Company exchanged Equipment with Y Company (in an exchange with commercial substance). The summary

PLEASE SEND ME ALL QUESTIONS ONLY FINAL ANSWER. THANK YOU

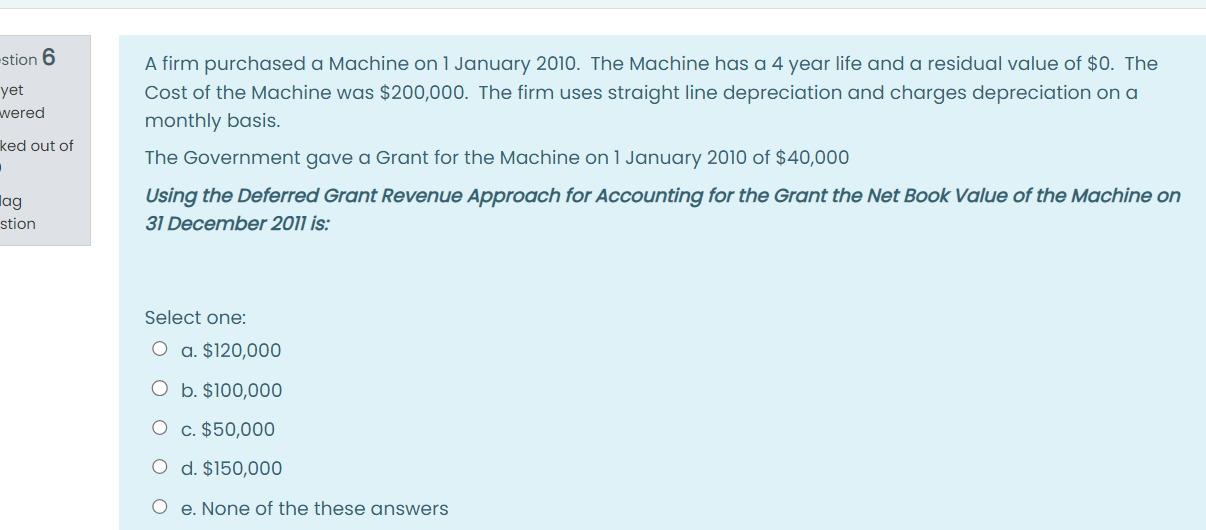

X Company exchanged Equipment with Y Company (in an exchange with commercial substance). The summary information with respect to the exchange is shown in the table above: The Gain or Loss on Disposal for X Company is: Select one: a. Gain of $14,000 b. Gain of $12,000 c. Loss of $12,000 d. Loss of $14,000 e. None of the these answers A firm purchased a Machine on 1 January 2010 . The Machine has a 4 year life and a residual value of $0. The Cost of the Machine was $200,000. The firm uses straight line depreciation and charges depreciation on a monthly basis. The Government gave a Grant for the Machine on 1 January 2010 of $40,000 Using the Deferred Grant Revenue Approach for Accounting for the Grant the Net Book Value of the Machine on 31 December 2011 is: Select one: a. $120,000 b. $100,000 c. $50,000 d. $150,000 e. None of the these answersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started