Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please send the answers as soon as possible. thanks Impak Crystal Company (ICC) is a manufacturer and supplier of medals, plaques and trophies. Located in

please send the answers as soon as possible. thanks

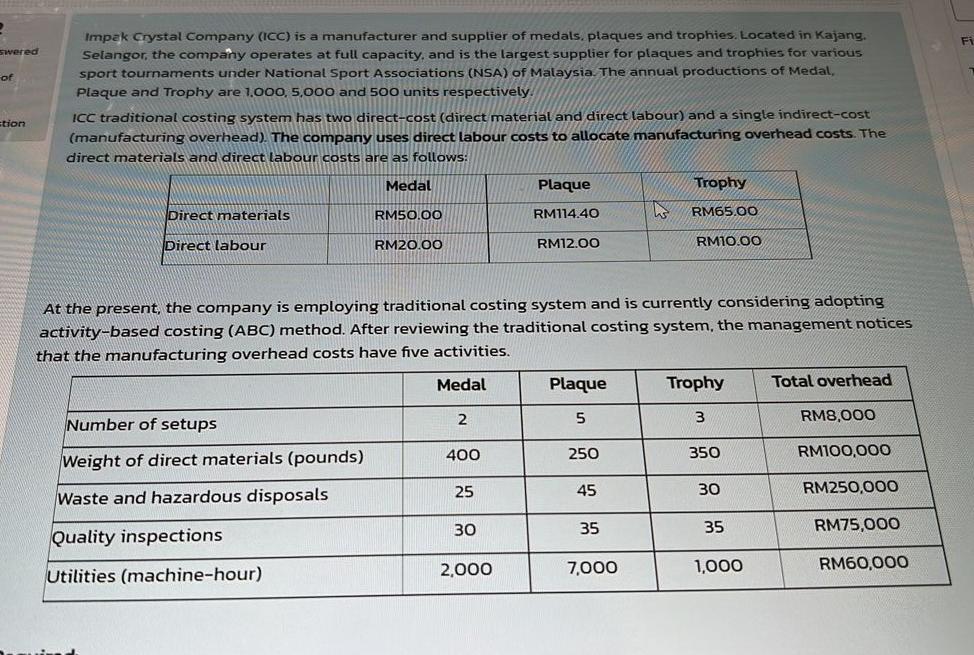

Impak Crystal Company (ICC) is a manufacturer and supplier of medals, plaques and trophies. Located in Kajang. Selangor, the company operates at full capacity, and is the largest supplier for plaques and trophies for various sport tournaments under National Sport Associations (NSA) of Mataysia. The annual productions of Medal, Plaque and Trophy are 1,000,5,000 and 500 units respectively. ICC traditional costing system has two direct-cost (direct material and direct labour) and a single indirect-cost (manufacturing overhead). The company uses direct labour costs to allocate manufacturing overhead costs. The direct materials and direct labour costs are as follows: At the present, the company is employing traditional costing system and is currently considering adopting activity-based costing (ABC) method. After reviewing the traditional costing system, the management notices hat the manufacturing overhead costs have five activities. Required: a. Using traditional costing system, i. Calculate the allocation rate for manufacturing overhead costs. (1 marks) ii. Calculate product cost per unit for each product. (6 marks) b. Using activity-based costing system. i. Calculate the allocation rate for each activity. ( 2 \% marks) ii. Allocate the manufacturing overhead costs to each product. (7%/2 marks) iii. Calculate product cost per unit for each product. (3) marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started