please share not only answer but also solitions

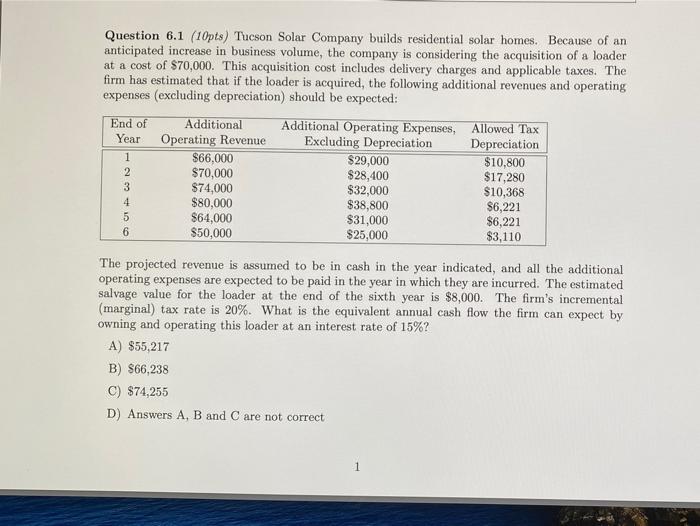

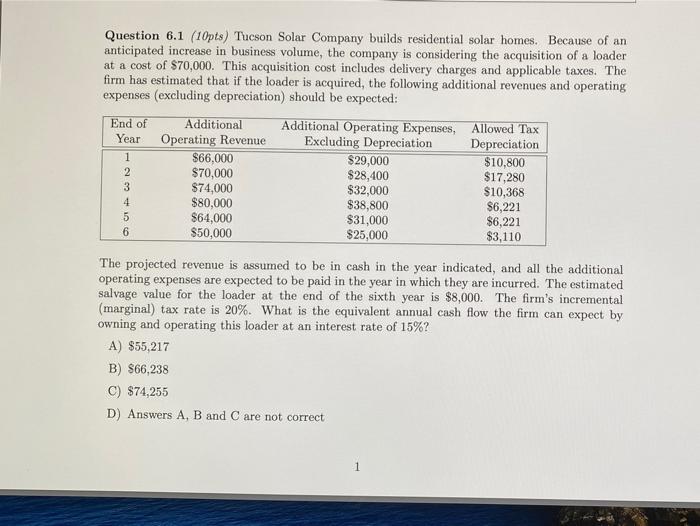

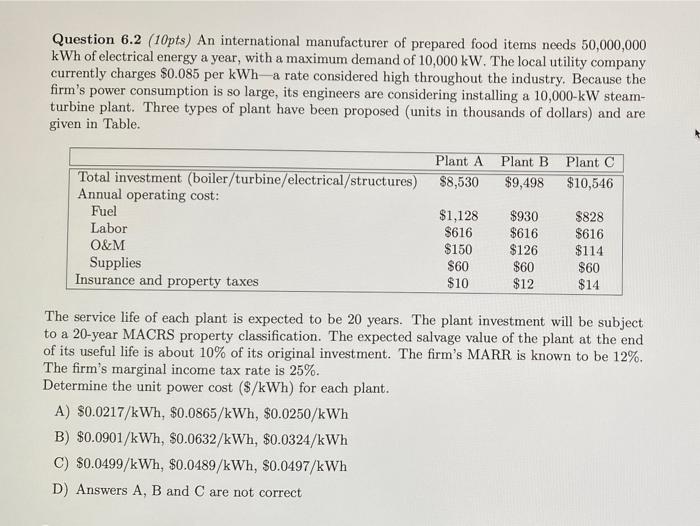

Question 6.1 (10pts) Tucson Solar Company builds residential solar homes. Because of an anticipated increase in business volume, the company is considering the acquisition of a loader at a cost of $70,000. This acquisition cost includes delivery charges and applicable taxes. The firm has estimated that if the loader is acquired, the following additional revenues and operating expenses (excluding depreciation) should be expected: End of Additional Additional Operating Expenses, Allowed Tax Year Operating Revenue Excluding Depreciation Depreciation $66,000 $29,000 $10,800 2 $70,000 $28,400 $17,280 $74,000 $32,000 $10,368 $80,000 $38,800 $6,221 $64,000 $31,000 $6,221 $50,000 $25,000 $3,110 1 3 4 5 6 The projected revenue is assumed to be in cash in the year indicated, and all the additional operating expenses are expected to be paid in the year in which they are incurred. The estimated salvage value for the loader at the end of the sixth year is $8,000. The firm's incremental (marginal) tax rate is 20%. What is the equivalent annual cash flow the firm can expect by owning and operating this loader at an interest rate of 15%? A) $55,217 B) $66,238 C) $74,255 D) Answers A, B and C are not correct 1 Question 6.2 (10pts) An international manufacturer of prepared food items needs 50,000,000 kWh of electrical energy a year, with a maximum demand of 10,000 kW. The local utility company currently charges $0.085 per kWh a rate considered high throughout the industry. Because the firm's power consumption is so large, its engineers are considering installing a 10,000-kW steam- turbine plant. Three types of plant have been proposed (units in thousands of dollars) and are given in Table. Plant A Plant B Plant C Total investment (boiler/turbine/electrical/structures) $8,530 $9,498 $10,546 Annual operating cost: Fuel $1,128 $930 $828 Labor $616 $616 $616 O&M $150 $126 $114 Supplies $60 $60 $60 Insurance and property taxes $10 $12 $14 The service life of each plant is expected to be 20 years. The plant investment will be subject to a 20-year MACRS property classification. The expected salvage value of the plant at the end of its useful life is about 10% of its original investment. The firm's MARR is known to be 12%. The firm's marginal income tax rate is 25%. Determine the unit power cost ($/kWh) for each plant. A) $0.0217/kWh, $0.0865/kWh, $0.0250/kWh B) $0.0901/kWh, $0.0632/kWh, $0.0324/kWh C) $0.0499/kWh, $0.0489/kWh, $0.0497/kWh D) Answers A, B and C are not correct