Answered step by step

Verified Expert Solution

Question

1 Approved Answer

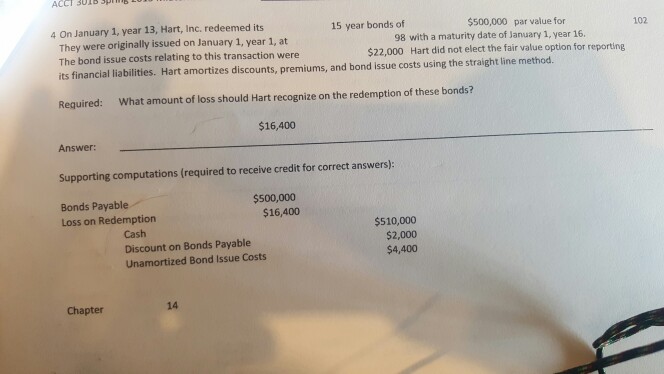

Please show all calculations $500,000 par value for 15 year bonds of 4 On January 1, year 13, Hart, Inc. redeemed its 98 with a

Please show all calculations

$500,000 par value for 15 year bonds of 4 On January 1, year 13, Hart, Inc. redeemed its 98 with a maturity date of January 1, year 16. They were originally issued on January year 1, at $22,000 Hart did not elect the fair value option for reporting The bond issue costs relating to this transaction were the straight line method. its financial liabilities. Hart amortizes discounts, premiums, and bond issue costs using Required: What amount of loss should Hart recognize on the redemption of these bonds? $16,400 Supporting computations (required to receive credit for correct answers): $500,000 Bonds Payable $16,400 Loss on Redemption $510,000 Cash $2,000 Discount on Bonds Payable $4,400 Un amortized Bond lssue Costs ChapterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started