Question: please show all calculations and formulas i need help with problems 10 and 11 QUESTION 10 AND 11 PLEASE 8. Now suppose that Temp Force's

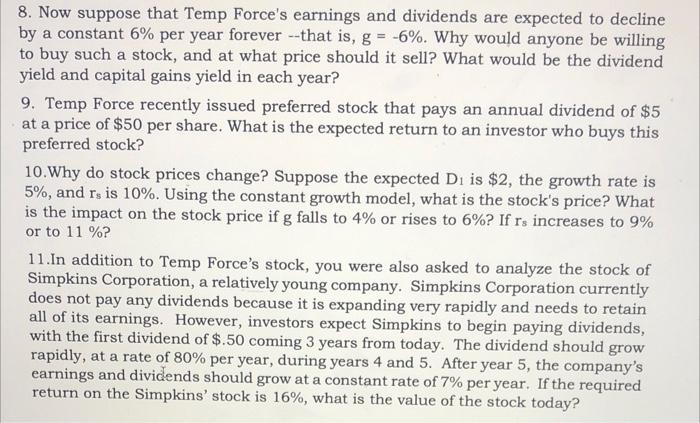

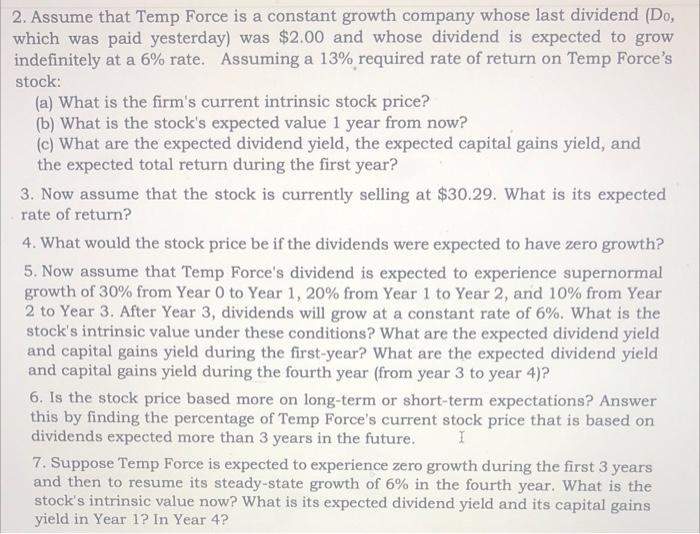

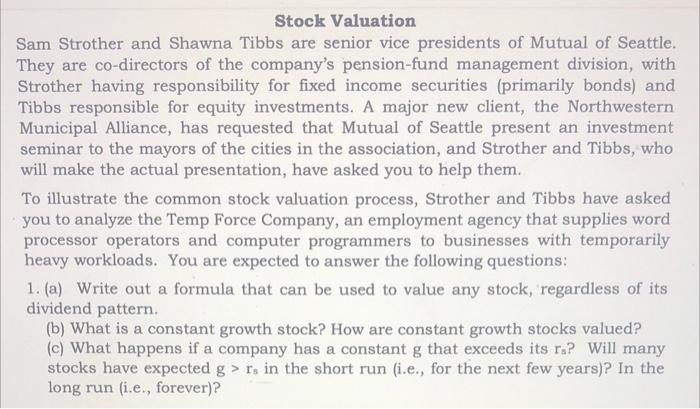

8. Now suppose that Temp Force's earnings and dividends are expected to decline by a constant 6% per year forever --that is, g = -6%. Why would anyone be willing to buy such a stock, and at what price should it sell? What would be the dividend yield and capital gains yield in each year? 9. Temp Force recently issued preferred stock that pays an annual dividend of $5 at a price of $50 per share. What is the expected return to an investor who buys this preferred stock? 10. Why do stock prices change? Suppose the expected D. is $2, the growth rate is 5%, and rs is 10%. Using the constant growth model, what is the stock's price? What is the impact on the stock price if g falls to 4% or rises to 6%? If rs increases to 9% or to 11 %? 11. In addition to Temp Force's stock, you were also asked to analyze the stock of Simpkins Corporation, a relatively young company. Simpkins Corporation currently does not pay any dividends because it is expanding very rapidly and needs to retain all of its earnings. However, investors expect Simpkins to begin paying dividends, with the first dividend of $.50 coming 3 years from today. The dividend should grow rapidly, at a rate of 80% per year, during years 4 and 5. After year 5, the company's earnings and dividends should grow at a constant rate of 7% per year. If the required return on the Simpkins' stock is 16%, what is the value of the stock today? 2. Assume that Temp Force is a constant growth company whose last dividend (Do, which was paid yesterday) was $2.00 and whose dividend is expected to grow indefinitely at a 6% rate. Assuming a 13% required rate of return on Temp Force's stock: (a) What is the firm's current intrinsic stock price? (b) What is the stock's expected value 1 year from now? (c) What are the expected dividend yield, the expected capital gains yield, and the expected total return during the first year? 3. Now assume that the stock is currently selling at $30.29. What is its expected rate of return? 4. What would the stock price be if the dividends were expected to have zero growth? 5. Now assume that Temp Force's dividend is expected to experience supernormal growth of 30% from Year 0 to Year 1, 20% from Year 1 to Year 2, and 10% from Year 2 to Year 3. After Year 3, dividends will grow at a constant rate of 6%. What is the stock's intrinsic value under these conditions? What are the expected dividend yield and capital gains yield during the first-year? What are the expected dividend yield and capital gains yield during the fourth year (from year 3 to year 4)? 6. Is the stock price based more on long-term or short-term expectations? Answer this by finding the percentage of Temp Force's current stock price that is based on dividends expected more than 3 years in the future. I 7. Suppose Temp Force is expected to experience zero growth during the first 3 years and then to resume its steady-state growth of 6% in the fourth year. What is the stock's intrinsic value now? What is its expected dividend yield and its capital gains yield in Year 1? In Year 4? Stock Valuation Sam Strother and Shawna Tibbs are senior vice presidents of Mutual of Seattle. They are co-directors of the company's pension-fund management division, with Strother having responsibility for fixed income securities (primarily bonds) and Tibbs responsible for equity investments. A major new client, the Northwestern Municipal Alliance, has requested that Mutual of Seattle present an investment seminar to the mayors of the cities in the association, and Strother and Tibbs, who will make the actual presentation, have asked you to help them. To illustrate the common stock valuation process, Strother and Tibbs have asked you to analyze the Temp Force Company, an employment agency that supplies word processor operators and computer programmers to businesses with temporarily heavy workloads. You are expected to answer the following questions: 1. (a) Write out a formula that can be used to value any stock, regardless of its dividend pattern (b) What is a constant growth stock? How are constant growth stocks valued? (c) What happens if a company has a constant g that exceeds its r.? Will many stocks have expected g > rs in the short run (i.e., for the next few years)? In the long run (i.e., forever)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts