Answered step by step

Verified Expert Solution

Question

1 Approved Answer

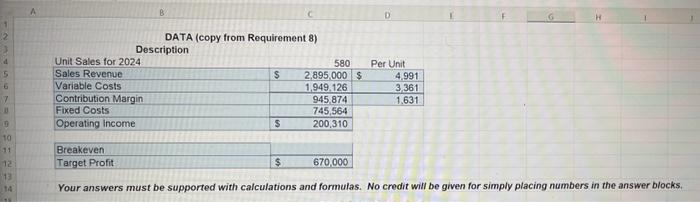

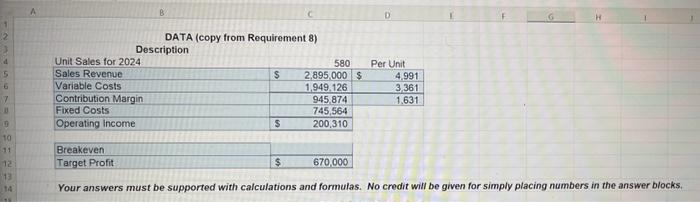

please show all cell references DATA (copy from Requirement 8) Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units.

please show all cell references

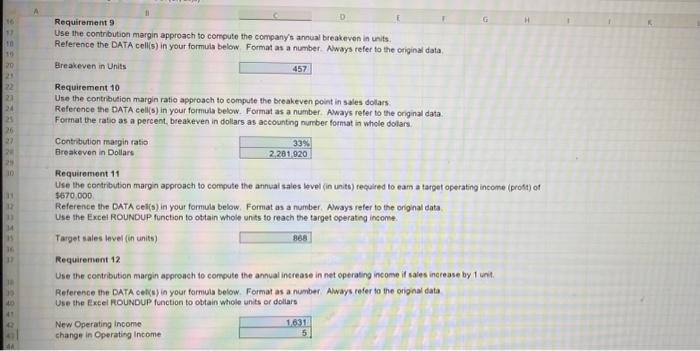

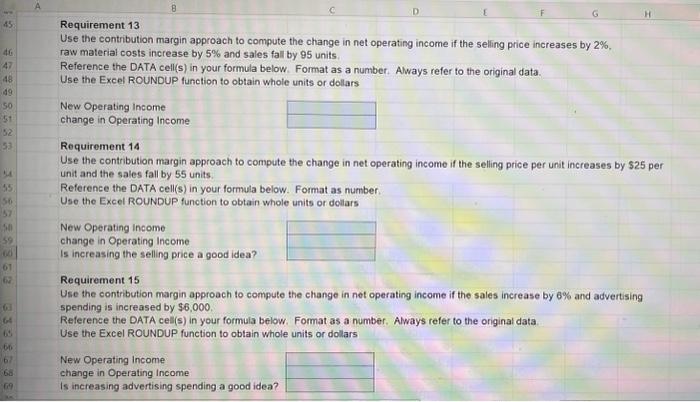

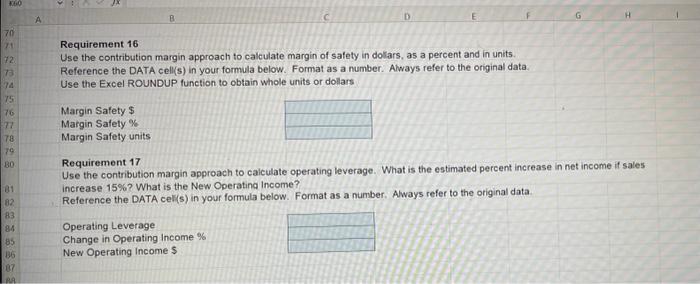

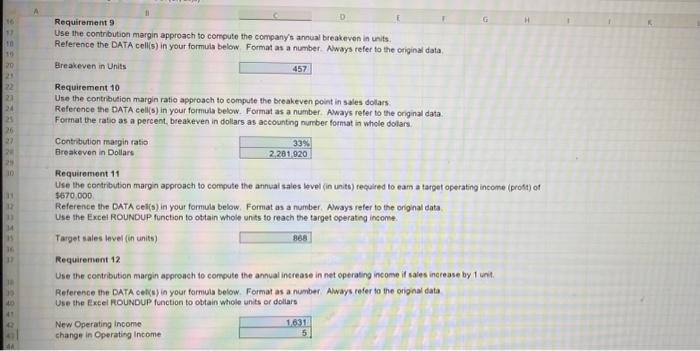

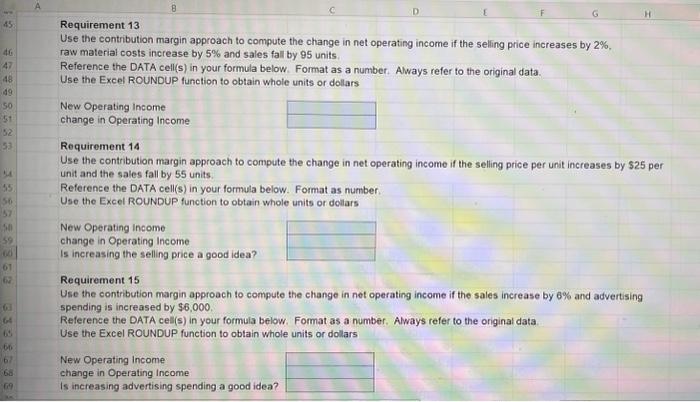

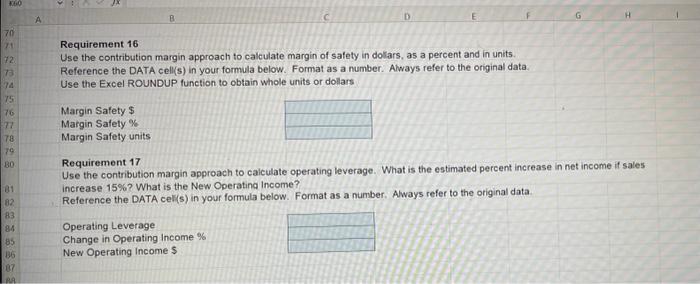

DATA (copy from Requirement 8) Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units. Reference the DATA cell(s) in your formula below. Format as a number. Aways refer to the criginal data. Ereakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the breakeven point in sales dolars: Reference the DATA cell(s) in your formula below. Format as a number. Aways reter to the original data Format the ratio as a percent, breakeven in dollars as accounting nurber format in while dolars: Requirement 11 Use the contribution margin approach to compute the annual sales ievel (in unite) recuired to eam a target operating income (prost) of $670,000. Reference the DATA cell(s) in your formuls below. Format as a number. Aways refer to the oniginal data Use the Excel ROUNDUP function to ottain whole unis to reach the target ogerating income. Requirement 12 Use the contribution margin approach to compute the annual intrease in net eperating income if sales inccease by 1 unt. Reference the DATA ceks) in your formula below. Format as a number. Aways cefer to the orignal data Use the Excel fROUNDUP function to ottain whole units or dollars Requirement 13 Use the contribution margin approach to compute the change in net operating income if the selling price increases by 2%, raw material costs increase by 5% and sales fall by 95 units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 14 Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $25 per unit and the sales fall by 55 units. Reference the DATA cell(s) in your formula below. Format as number. Use the Excel ROUNDUP function to obtain whole units or dellars Requirement 15 Use the contribution margin approach to compute the change in net operating income if the sales increase by 6% and advertising spending is increased by $6,000. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 16 Use the contribution margin approach to calculate margin of safety in dolars, as a percent and in units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 17 Use the contribution margin approach to calculate operating leverage. What is the estimated percent increase in net income if sales increase 15% ? What is the New Operatina income? Reference the DATA celk(s) in your formula below. Format as a number. Aways refer to the original data DATA (copy from Requirement 8) Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units. Reference the DATA cell(s) in your formula below. Format as a number. Aways refer to the criginal data. Ereakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the breakeven point in sales dolars: Reference the DATA cell(s) in your formula below. Format as a number. Aways reter to the original data Format the ratio as a percent, breakeven in dollars as accounting nurber format in while dolars: Requirement 11 Use the contribution margin approach to compute the annual sales ievel (in unite) recuired to eam a target operating income (prost) of $670,000. Reference the DATA cell(s) in your formuls below. Format as a number. Aways refer to the oniginal data Use the Excel ROUNDUP function to ottain whole unis to reach the target ogerating income. Requirement 12 Use the contribution margin approach to compute the annual intrease in net eperating income if sales inccease by 1 unt. Reference the DATA ceks) in your formula below. Format as a number. Aways cefer to the orignal data Use the Excel fROUNDUP function to ottain whole units or dollars Requirement 13 Use the contribution margin approach to compute the change in net operating income if the selling price increases by 2%, raw material costs increase by 5% and sales fall by 95 units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 14 Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $25 per unit and the sales fall by 55 units. Reference the DATA cell(s) in your formula below. Format as number. Use the Excel ROUNDUP function to obtain whole units or dellars Requirement 15 Use the contribution margin approach to compute the change in net operating income if the sales increase by 6% and advertising spending is increased by $6,000. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 16 Use the contribution margin approach to calculate margin of safety in dolars, as a percent and in units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 17 Use the contribution margin approach to calculate operating leverage. What is the estimated percent increase in net income if sales increase 15% ? What is the New Operatina income? Reference the DATA celk(s) in your formula below. Format as a number. Aways refer to the original data

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started