Please show all excel equations being used

Please show all excel equations being used

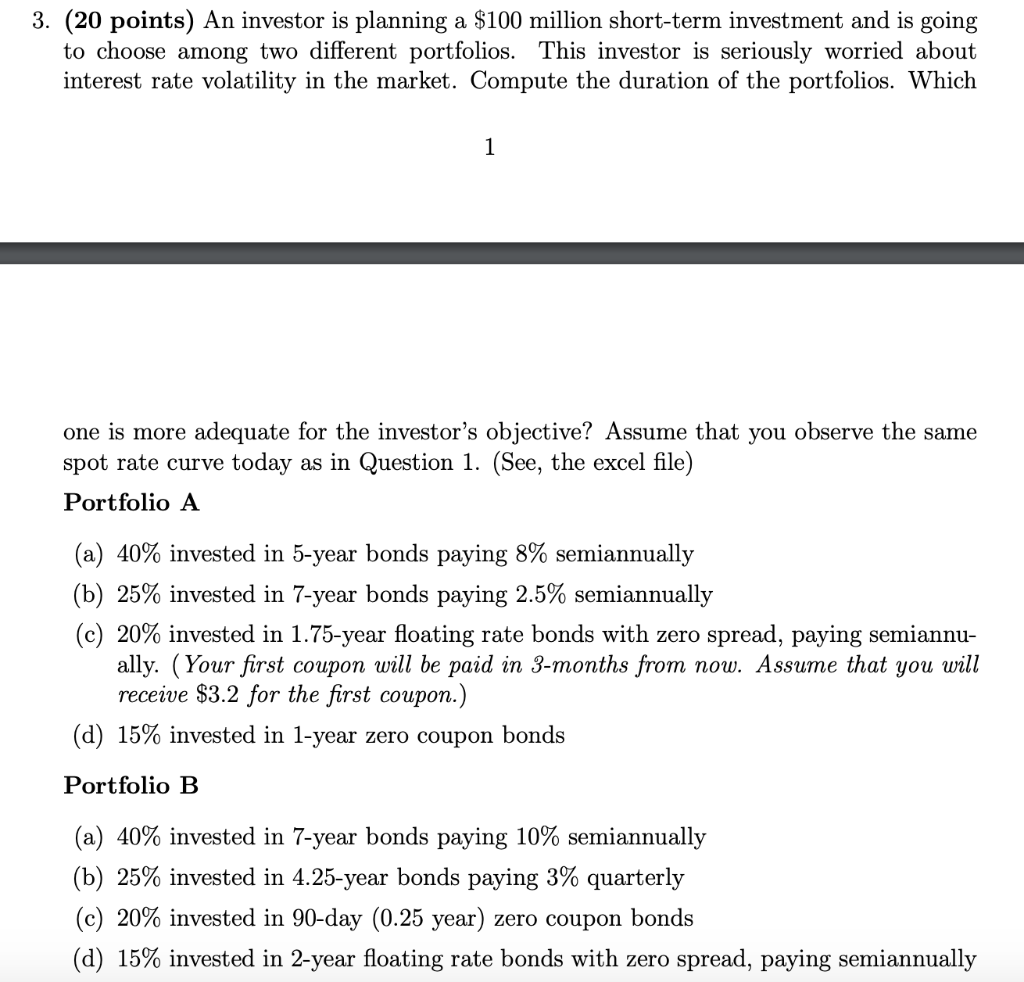

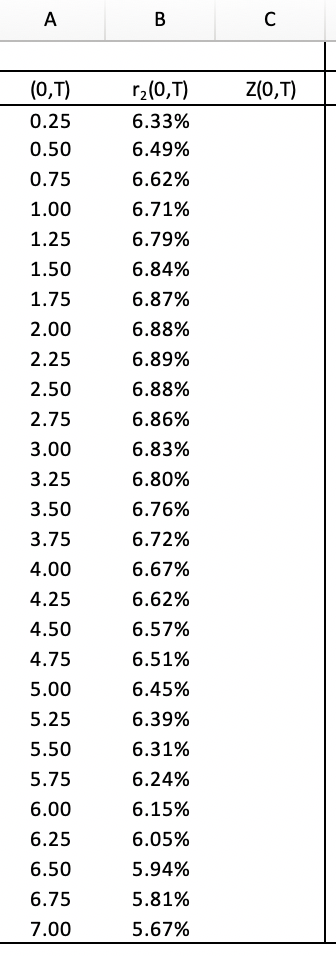

A B Z(0,T) (0,T) 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 r,(0,T) 6.33% 6.49% 6.62% 6.71% 6.79% 6.84% 6.87% 6.88% 6.89% 6.88% 6.86% 6.83% 6.80% 6.76% 6.72% 6.67% 6.62% 6.57% 6.51% 6.45% 6.39% 6.31% 6.24% 6.15% 6.05% 5.94% 5.81% 5.67% 3. (20 points) An investor is planning a $100 million short-term investment and is going to choose among two different portfolios. This investor is seriously worried about interest rate volatility in the market. Compute the duration of the portfolios. Which 1 one is more adequate for the investor's objective? Assume that you observe the same spot curve today as in Question 1. (See, the excel file) Portfolio A (a) 40% invested in 5-year bonds paying 8% semiannually (b) 25% invested in 7-year bonds paying 2.5% semiannually (c) 20% invested in 1.75-year floating rate bonds with zero spread, paying semiannu- ally. (Your first coupon will be paid in 3-months from now. Assume that you will receive $3.2 for the first coupon.) (d) 15% invested in 1-year zero coupon bonds Portfolio B (a) 40% invested in 7-year bonds paying 10% semiannually (b) 25% invested in 4.25-year bonds paying 3% quarterly (c) 20% invested in 90-day (0.25 year) zero coupon bonds (d) 15% invested in 2-year floating rate bonds with zero spread, paying semiannually A B Z(0,T) (0,T) 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 3.75 4.00 4.25 4.50 4.75 5.00 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 r,(0,T) 6.33% 6.49% 6.62% 6.71% 6.79% 6.84% 6.87% 6.88% 6.89% 6.88% 6.86% 6.83% 6.80% 6.76% 6.72% 6.67% 6.62% 6.57% 6.51% 6.45% 6.39% 6.31% 6.24% 6.15% 6.05% 5.94% 5.81% 5.67% 3. (20 points) An investor is planning a $100 million short-term investment and is going to choose among two different portfolios. This investor is seriously worried about interest rate volatility in the market. Compute the duration of the portfolios. Which 1 one is more adequate for the investor's objective? Assume that you observe the same spot curve today as in Question 1. (See, the excel file) Portfolio A (a) 40% invested in 5-year bonds paying 8% semiannually (b) 25% invested in 7-year bonds paying 2.5% semiannually (c) 20% invested in 1.75-year floating rate bonds with zero spread, paying semiannu- ally. (Your first coupon will be paid in 3-months from now. Assume that you will receive $3.2 for the first coupon.) (d) 15% invested in 1-year zero coupon bonds Portfolio B (a) 40% invested in 7-year bonds paying 10% semiannually (b) 25% invested in 4.25-year bonds paying 3% quarterly (c) 20% invested in 90-day (0.25 year) zero coupon bonds (d) 15% invested in 2-year floating rate bonds with zero spread, paying semiannually

Please show all excel equations being used

Please show all excel equations being used