Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all excel formulas / functions needed to complete the problem. Stock A and Stock B prices and dividends, along with the Market Index,

Please show all excel formulas / functions needed to complete the problem.

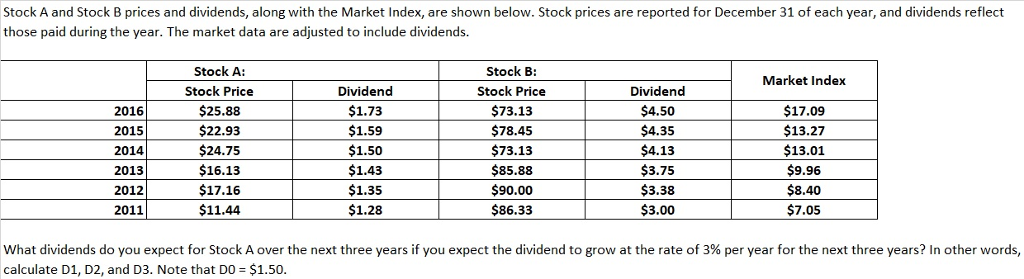

Stock A and Stock B prices and dividends, along with the Market Index, are shown below. Stock prices are reported for December 31 of each year, and dividends reflect those paid during the year. The market data are adjusted to include dividends. Stock A: Stock Price $25.88 $22.93 $24.75 $16.13 $17.16 $11.44 Stock B: Stock Price $73.13 $78.45 $73.13 $85.88 90.00 $86.33 Market Index 2016 2015 2014 2013 2012 2011 Dividend $1.73 $1.59 $1.50 $1.43 $1.35 $1.28 Dividend $4.50 $4.35 $4.13 $3.75 $3.38 $3.00 $17.09 $13.27 $13.01 $9.96 $8.40 $7.05 what dividends do you expect for Stock A over the next three years if you expect the dividend to grow at the rate of 3% per year for the next three years? In other words, calculate D1, D2, and D3. Note that DO $1.50 Stock A and Stock B prices and dividends, along with the Market Index, are shown below. Stock prices are reported for December 31 of each year, and dividends reflect those paid during the year. The market data are adjusted to include dividends. Stock A: Stock Price $25.88 $22.93 $24.75 $16.13 $17.16 $11.44 Stock B: Stock Price $73.13 $78.45 $73.13 $85.88 90.00 $86.33 Market Index 2016 2015 2014 2013 2012 2011 Dividend $1.73 $1.59 $1.50 $1.43 $1.35 $1.28 Dividend $4.50 $4.35 $4.13 $3.75 $3.38 $3.00 $17.09 $13.27 $13.01 $9.96 $8.40 $7.05 what dividends do you expect for Stock A over the next three years if you expect the dividend to grow at the rate of 3% per year for the next three years? In other words, calculate D1, D2, and D3. Note that DO $1.50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started