Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all explanations 14. For a 25% interest in partnership capital, profits, and losses, contributes a machine having a basis of $40,000 and an

please show all explanations

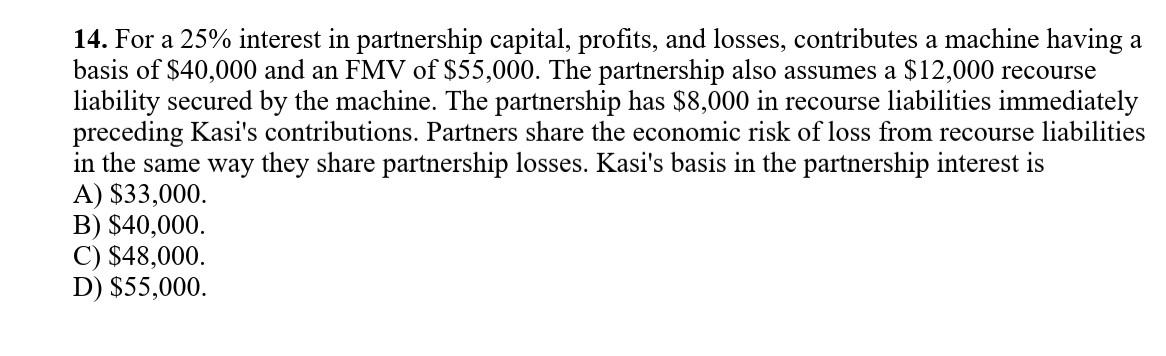

14. For a 25% interest in partnership capital, profits, and losses, contributes a machine having a basis of $40,000 and an FMV of $55,000. The partnership also assumes a $12,000 recourse liability secured by the machine. The partnership has $8,000 in recourse liabilities immediately preceding Kasi's contributions. Partners share the economic risk of loss from recourse liabilities in the same way they share partnership losses. Kasi's basis in the partnership interest is A) $33,000. B) $40,000. C) $48,000. D) $55,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started