Answered step by step

Verified Expert Solution

Question

1 Approved Answer

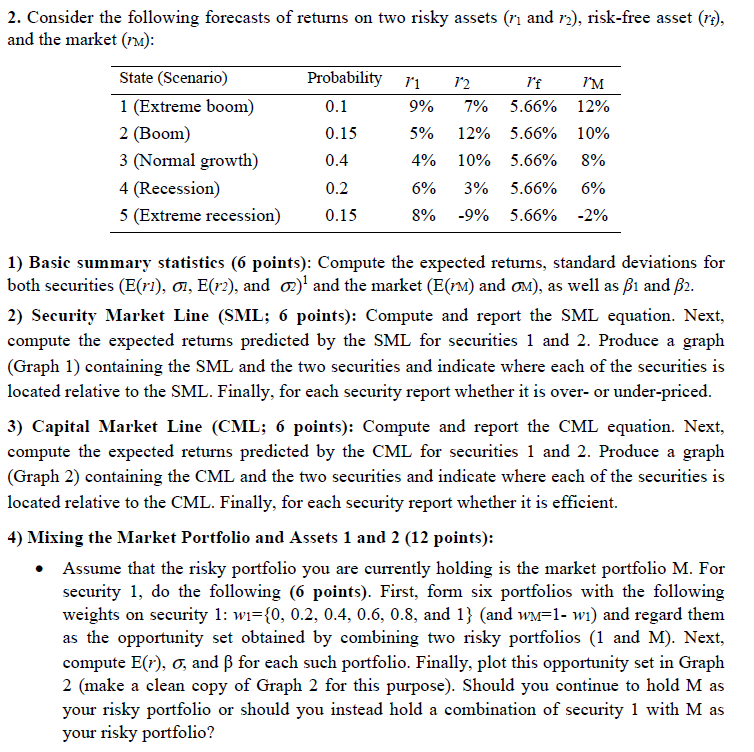

Please show all formula with explanation. Thank you. 2. Consider the following forecasts of returns on two risky assets (i and r2), risk-free asset (r),

Please show all formula with explanation.

Thank you.

2. Consider the following forecasts of returns on two risky assets (i and r2), risk-free asset (r), and the market (M) Probability 12 State (Scenario) 1 (Extreme boom) 2 (Boom) 3 (Normal growth) 4 (Recession) 5 (Extreme recession) 9% 5% 4% 6% 8% 7% 12% 10% 3% -9% 5.66% 5.66% 5.66% 5.66% 5.66% /M 12% 10% 8% 6% -2% 0.15 0.4 0.2 1) Basic summary statistics (6 points): Compute the expected returns, standard deviations for both securities (E(n), . E(r), and)' and the market (E(M) and M1), as well as 1 and 2 2) Security Market Line (SML; 6 points): Compute and report the SML equation. Next, compute the expected returns predicted by the SML for securities 1 and 2. Produce a graph (Graph 1) containing the SML and the two securities and indicate where each of the securities is located relative to the SML. Finally, for each security report whether it is over- or under-priced 3) Capital Market Line (CML; 6 points): Compute and report the CML equation. Next, compute the expected returns predicted by the CML for securities 1 and 2. Produce a graph (Graph 2) containing the CML and the two securities and indicate where each of the securities is located relative to the CML. Finally, for each security report whether it is efficient. 4) Mixing the Market Portfolio and Assets 1 and 2 (12 points): Assume that the risky portfolio you are currently holding is the market portfolio M. For security 1, do the following (6 points). First, form six portfolios with the following weights on security 1: wi-s0, 0.2, 0.4, 0.6, 0.8, and 1} (and wM-1- w) and regard them as the opportunity set obtained by combining two risky portfolios (1 and M). Next, compute E(r), and for each such portfolio. Finally, plot this opportunity set in Graph 2 (make a clean copy of Graph 2 for this purpose). Should you continue to hold M as your risky portfolio or should you instead hold a combination of security 1 with M as your risky portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started