Please show all steps and formulas.

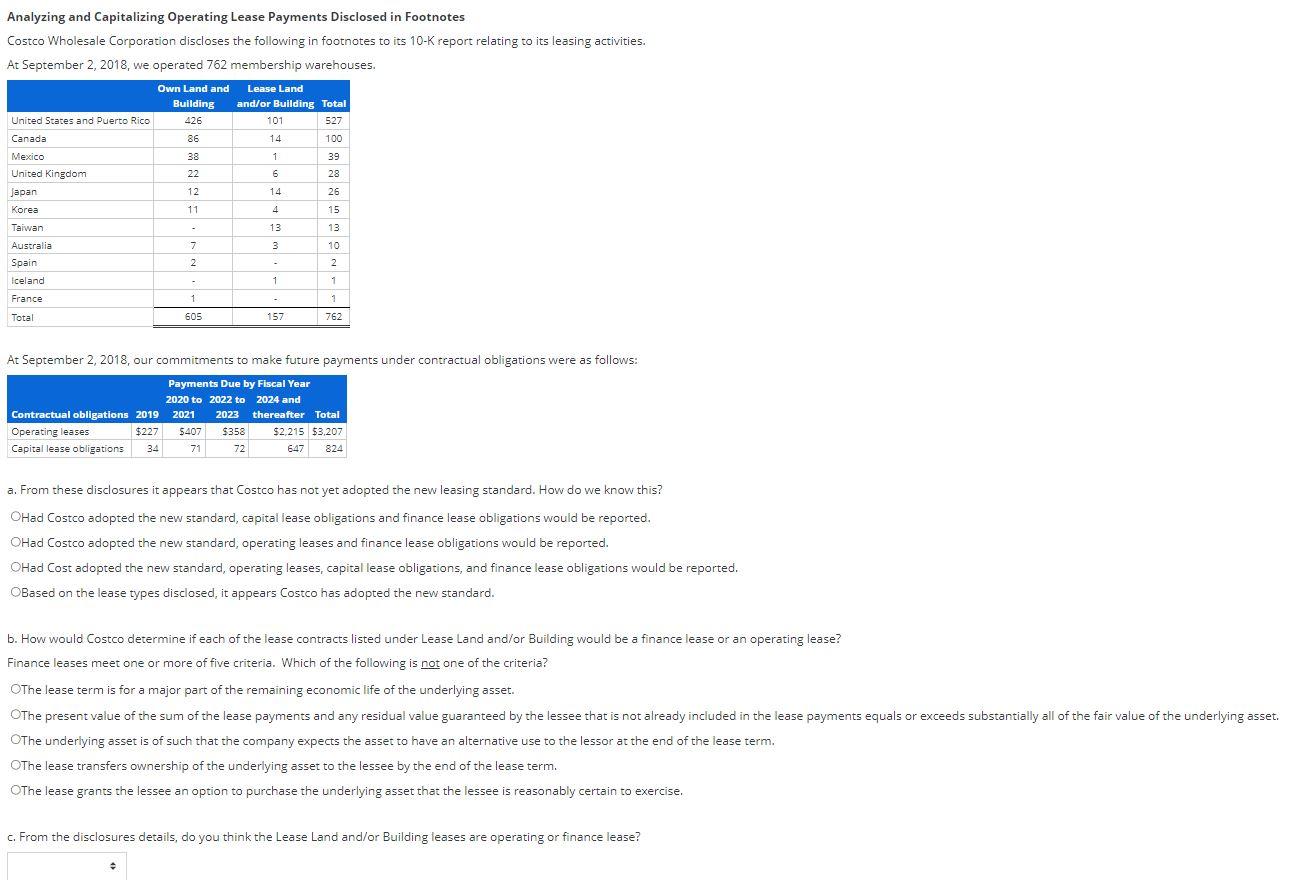

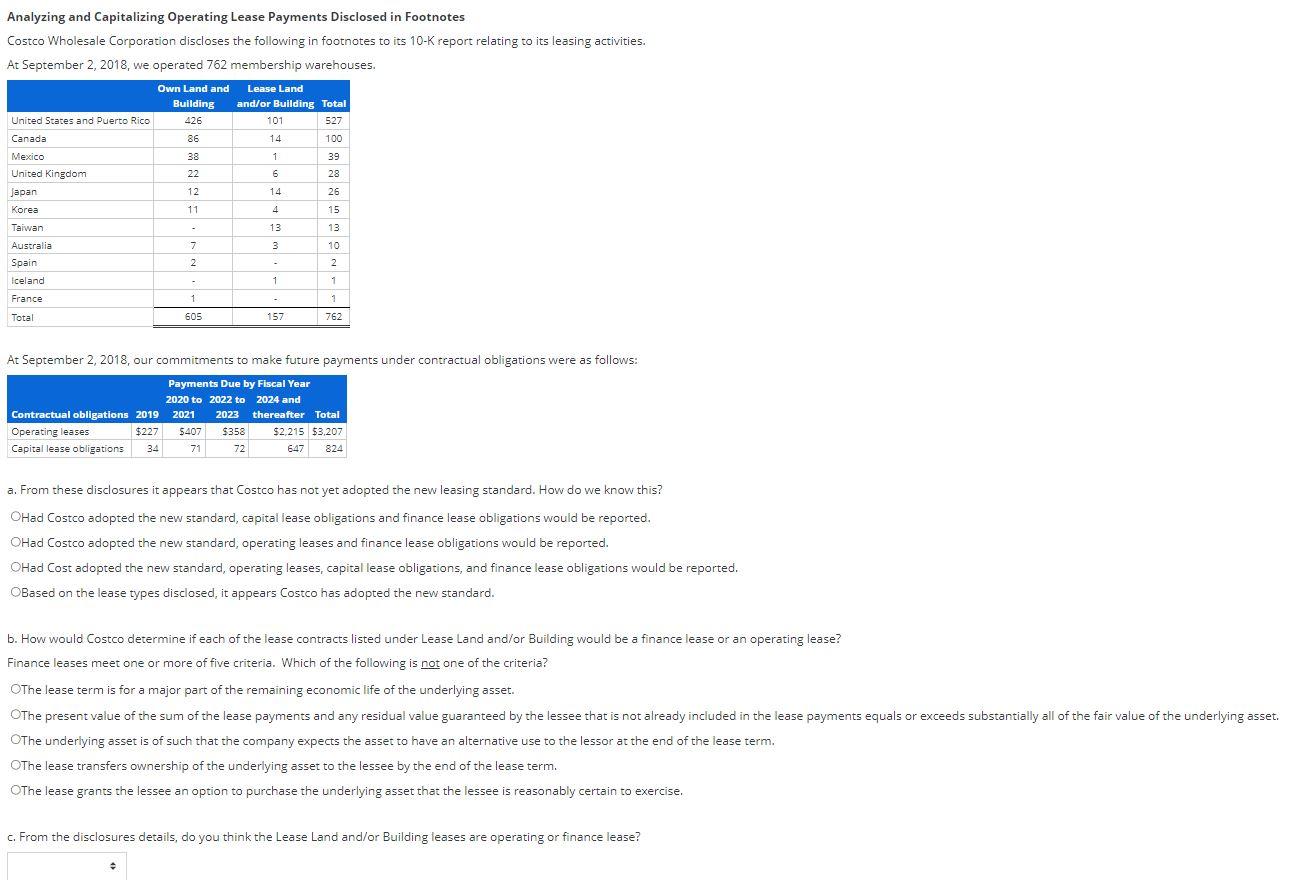

Analyzing and Capitalizing Operating Lease Payments Disclosed in Footnotes Costco Wholesale Corporation discloses the following in footnotes to its 10 -K report relating to its leasing activities. At September 2, 2018, we operated 762 membership warehouses. At September 2,2018, our commitments to make future payments under contractual obligations were as follows: a. From these disclosures it appears that Costco has not yet adopted the new leasing standard. How do we know this? OHad Costco adopted the new standard, capital lease obligations and finance lease obligations would be reported. OHad Costco adopted the new standard, operating leases and finance lease obligations would be reported. OHad Cost adopted the new standard, operating leases, capital lease obligations, and finance lease obligations would be reported. OBased on the lease types disclosed, it appears Costco has adopted the new standard. b. How would Costco determine if each of the lease contracts listed under Lease Land and/or Building would be a finance lease or an operating lease? Finance leases meet one or more of five criteria. Which of the following is not one of the criteria? OThe lease term is for a major part of the remaining economic life of the underlying asset. -he underlying asset is of such that the company expects the asset to have an alternative use to the lessor at the end of the lease term. The lease transfers ownership of the underlying asset to the lessee by the end of the lease term. he lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise, c. From the disclosures details, do you think the Lease Land and/or Building leases are operating or finance lease? Analyzing and Capitalizing Operating Lease Payments Disclosed in Footnotes Costco Wholesale Corporation discloses the following in footnotes to its 10 -K report relating to its leasing activities. At September 2, 2018, we operated 762 membership warehouses. At September 2,2018, our commitments to make future payments under contractual obligations were as follows: a. From these disclosures it appears that Costco has not yet adopted the new leasing standard. How do we know this? OHad Costco adopted the new standard, capital lease obligations and finance lease obligations would be reported. OHad Costco adopted the new standard, operating leases and finance lease obligations would be reported. OHad Cost adopted the new standard, operating leases, capital lease obligations, and finance lease obligations would be reported. OBased on the lease types disclosed, it appears Costco has adopted the new standard. b. How would Costco determine if each of the lease contracts listed under Lease Land and/or Building would be a finance lease or an operating lease? Finance leases meet one or more of five criteria. Which of the following is not one of the criteria? OThe lease term is for a major part of the remaining economic life of the underlying asset. -he underlying asset is of such that the company expects the asset to have an alternative use to the lessor at the end of the lease term. The lease transfers ownership of the underlying asset to the lessee by the end of the lease term. he lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise, c. From the disclosures details, do you think the Lease Land and/or Building leases are operating or finance lease