Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all steps calculations. Allocating Transaction Price to Performance Obligations and Recording Sales Value Dealership inc. markets and sells vehicles to retal customers. Along

Please show all steps calculations.

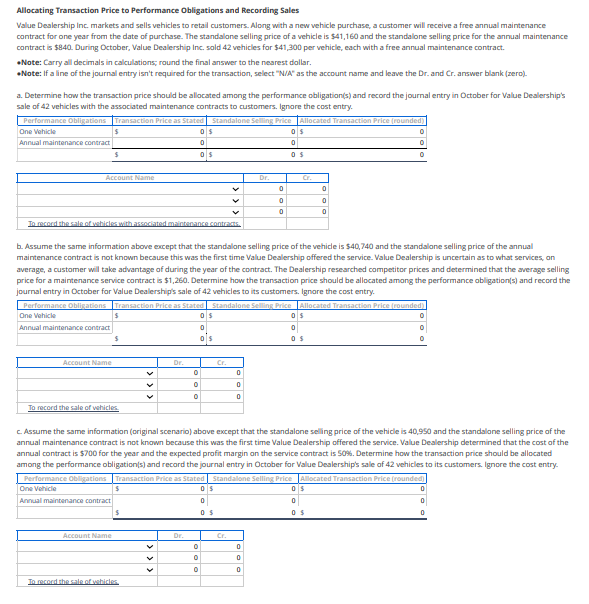

Allocating Transaction Price to Performance Obligations and Recording Sales Value Dealership inc. markets and sells vehicles to retal customers. Along with a new vehicle purchase, a customer will receive a free annual maintenance contract for one year from the date of purchase. The standalone selling price of a vehicle is $41,160 and the standalone selling price for the annual maintenance contract is $840. During October, Value Dealership Inc. sold 42 vehicles for $41,300 per vehicle, each with a free annual maintenance contract. *Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Note: If a line of the journal entry isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answer blank (zero). a. Determine how the transaction price should be allocated among the performance obligation(s) and record the journal entry in October for Value Dealership's sale of 42 vehicles with the associated maintenance contracts to customers. Ignore the cost entry. b. Assume the same informatian above except that the standalone selling price of the vehicle is $40,740 and the standalone selling price of the annual maintenance contract is not known because this was the first time Value Dealership offered the service. Value Dealership is uncertain as to what services, an average, a customer wil take advantage of during the year of the contract. The Dealership researched competitor prices and determined that the awerage selling price for a maintenance service contract is $1,260. Determine how the transaction price should be allocated among the performance obligation( $ ) and record the journal entry in October for Value Dealership's sale of 42 vehicles to its customers. Ignore the cost entry. c. Assume the same information (original scenario) abave except that the standalone seling price of the vehicle is 40,950 and the standalone selling price of the annual maintenance contract is not known because this was the first time Value Dealership offered the service. Value Dealership determined that the cost of the annual contract is $700 for the year and the expected profit margin on the service contract is 50%. Determine how the transaction price should be allocated among the performance obligation(s) and record the journal entry in October for Value Dealership's sale of 42 vehicles to its customers. Ignore the cost entry

Allocating Transaction Price to Performance Obligations and Recording Sales Value Dealership inc. markets and sells vehicles to retal customers. Along with a new vehicle purchase, a customer will receive a free annual maintenance contract for one year from the date of purchase. The standalone selling price of a vehicle is $41,160 and the standalone selling price for the annual maintenance contract is $840. During October, Value Dealership Inc. sold 42 vehicles for $41,300 per vehicle, each with a free annual maintenance contract. *Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Note: If a line of the journal entry isn't required for the transaction, select "N/A" as the account name and leave the Dr. and Cr. answer blank (zero). a. Determine how the transaction price should be allocated among the performance obligation(s) and record the journal entry in October for Value Dealership's sale of 42 vehicles with the associated maintenance contracts to customers. Ignore the cost entry. b. Assume the same informatian above except that the standalone selling price of the vehicle is $40,740 and the standalone selling price of the annual maintenance contract is not known because this was the first time Value Dealership offered the service. Value Dealership is uncertain as to what services, an average, a customer wil take advantage of during the year of the contract. The Dealership researched competitor prices and determined that the awerage selling price for a maintenance service contract is $1,260. Determine how the transaction price should be allocated among the performance obligation( $ ) and record the journal entry in October for Value Dealership's sale of 42 vehicles to its customers. Ignore the cost entry. c. Assume the same information (original scenario) abave except that the standalone seling price of the vehicle is 40,950 and the standalone selling price of the annual maintenance contract is not known because this was the first time Value Dealership offered the service. Value Dealership determined that the cost of the annual contract is $700 for the year and the expected profit margin on the service contract is 50%. Determine how the transaction price should be allocated among the performance obligation(s) and record the journal entry in October for Value Dealership's sale of 42 vehicles to its customers. Ignore the cost entry Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started