Answered step by step

Verified Expert Solution

Question

1 Approved Answer

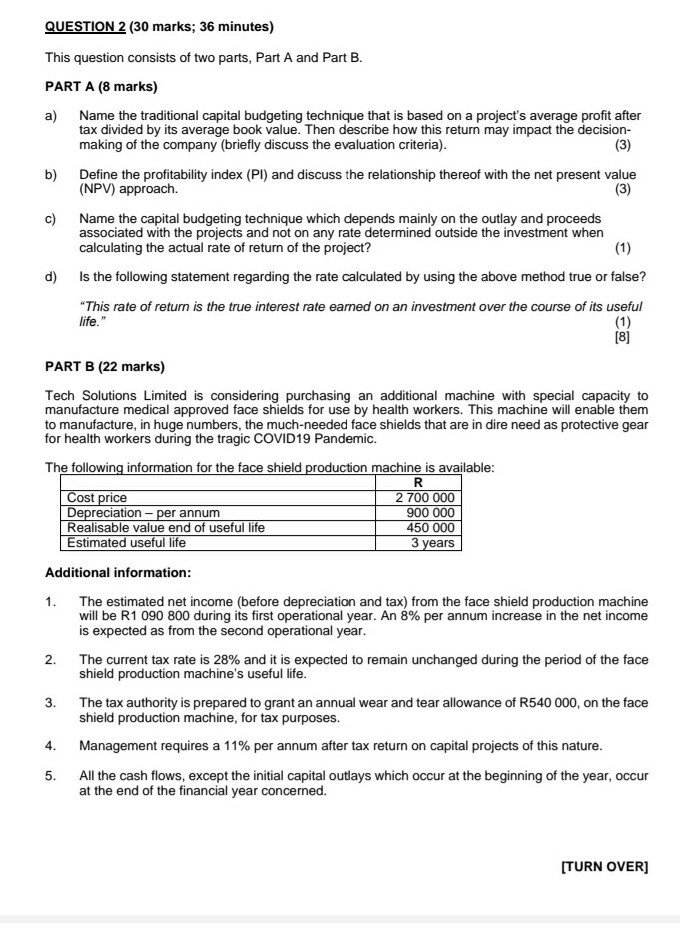

please show all steps QUESTION 2 (30 marks; 36 minutes) This question consists of two parts, Part A and Part B. PART A (8 marks)

please show all steps

QUESTION 2 (30 marks; 36 minutes) This question consists of two parts, Part A and Part B. PART A (8 marks) a) Name the traditional capital budgeting technique that is based on a project's average profit after tax divided by its average book value. Then describe how this return may impact the decision- making of the company (briefly discuss the evaluation criteria). (3) b) Define the profitability index (Pl) and discuss the relationship thereof with the net present value (NPV) approach. (3) c) Name the capital budgeting technique which depends mainly on the outlay and proceeds associated with the projects and not on any rate determined outside the investment when calculating the actual rate of return of the project? (1) d) is the following statement regarding the rate calculated by using the above method true or false? "This rate of return is the true interest rate earned on an investment over the course of its useful life." (1) [8] PART B (22 marks) Tech Solutions Limited is considering purchasing an additional machine with special capacity to manufacture medical approved face shields for use by health workers. This machine will enable them to manufacture, in huge numbers, the much-needed face shields that are in dire need as protective gear for health workers during the tragic COVID19 Pandemic. The following information for the face shield production machine is available: R Cost price 2 700 000 Depreciation - per annum 900 000 Realisable value end of useful life 450 000 Estimated useful life 3 years Additional information: 1. The estimated net income (before depreciation and tax) from the face shield production machine will be R1 090 800 during its first operational year. An 8% per annum increase in the net income is expected as from the second operational year. The current tax rate is 28% and it is expected to remain unchanged during the period of the face shield production machine's useful life. 3. The tax authority is prepared to grant an annual wear and tear allowance of R540 000, on the face shield production machine, for tax purposes. 4. Management requires a 11% per annum after tax return on capital projects of this nature. 5. All the cash flows, except the initial capital outlays which occur at the beginning of the year, occur at the end of the financial year concerned. 2. [TURN OVER]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started