Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all steps/equations Problem 2 (35 points) Suppose a bank offers a loan of $100,000 with the following conditions: Monthly payments of $1,000, starting

Please show all steps/equations

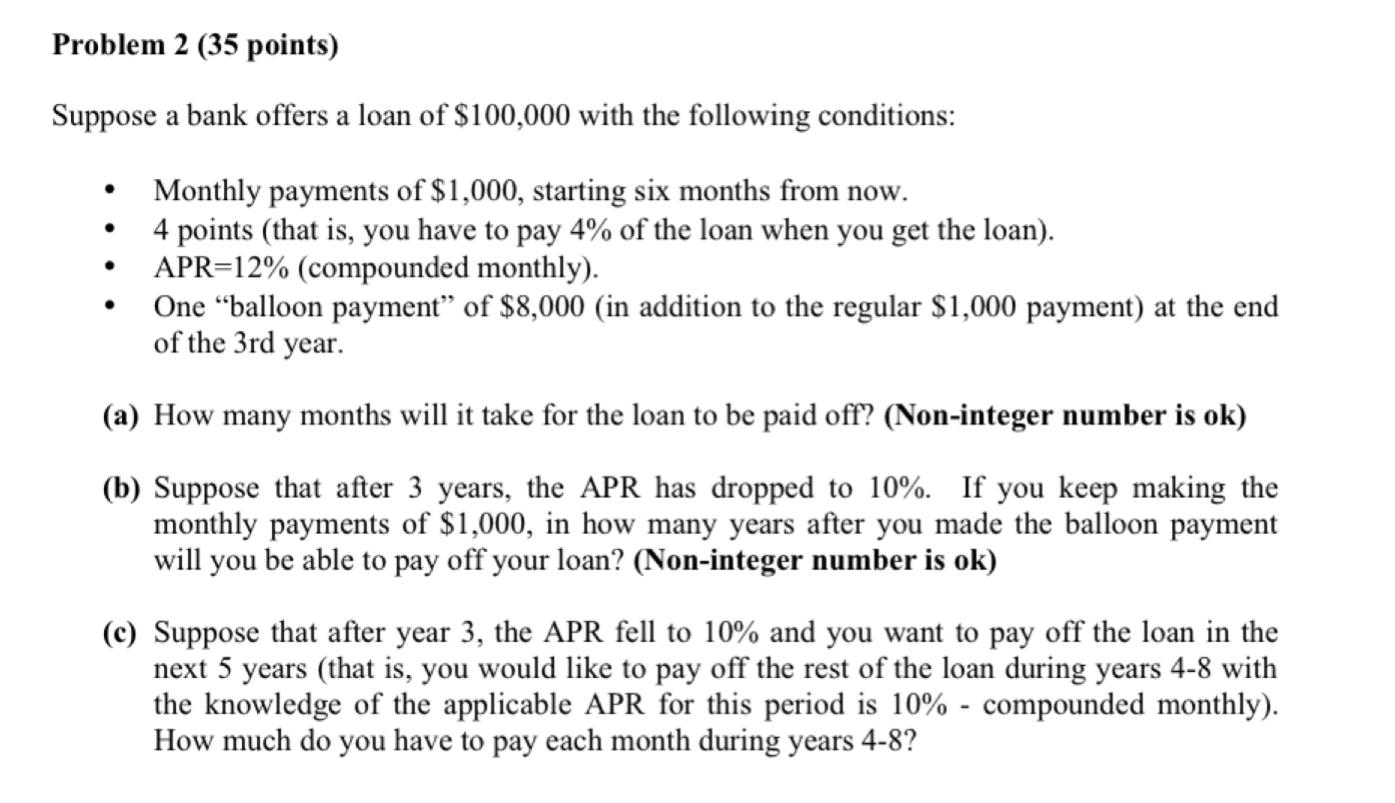

Problem 2 (35 points) Suppose a bank offers a loan of $100,000 with the following conditions: Monthly payments of $1,000, starting six months from now. 4 points (that is, you have to pay 4% of the loan when you get the loan). APR=12% (compounded monthly). One balloon payment" of $8,000 (in addition to the regular $1,000 payment) at the end of the 3rd year. (a) How many months will it take for the loan to be paid off? (Non-integer number is ok) (b) Suppose that after 3 years, the APR has dropped to 10%. If you keep making the monthly payments of $1,000, in how many years after you made the balloon payment will you be able to pay off your loan? (Non-integer number is ok) (C) Suppose that after year 3, the APR fell to 10% and you want to pay off the loan in the next 5 years (that is, you would like to pay off the rest of the loan during years 4-8 with the knowledge of the applicable APR for this period is 10% - compounded monthly). How much do you have to pay each month during years 4-8? Problem 2 (35 points) Suppose a bank offers a loan of $100,000 with the following conditions: Monthly payments of $1,000, starting six months from now. 4 points (that is, you have to pay 4% of the loan when you get the loan). APR=12% (compounded monthly). One balloon payment" of $8,000 (in addition to the regular $1,000 payment) at the end of the 3rd year. (a) How many months will it take for the loan to be paid off? (Non-integer number is ok) (b) Suppose that after 3 years, the APR has dropped to 10%. If you keep making the monthly payments of $1,000, in how many years after you made the balloon payment will you be able to pay off your loan? (Non-integer number is ok) (C) Suppose that after year 3, the APR fell to 10% and you want to pay off the loan in the next 5 years (that is, you would like to pay off the rest of the loan during years 4-8 with the knowledge of the applicable APR for this period is 10% - compounded monthly). How much do you have to pay each month during years 4-8Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started