Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all the detailed calculations with explanations to answer the question Sylvia Mackenzie, a single Canadian resident, owns all of the issued and outstanding

please show all the detailed calculations with explanations to answer the question

please show all the detailed calculations with explanations to answer the question

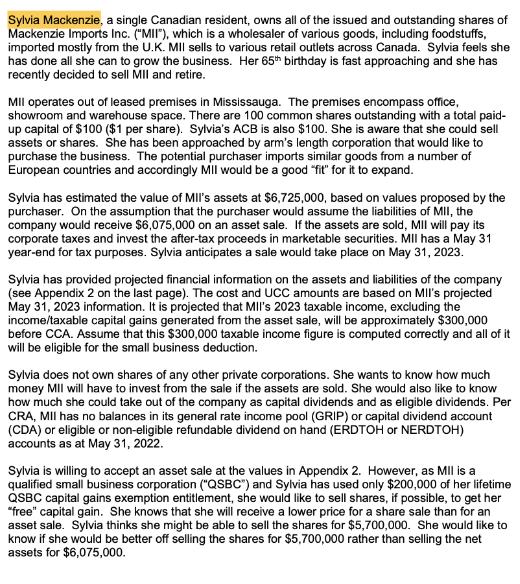

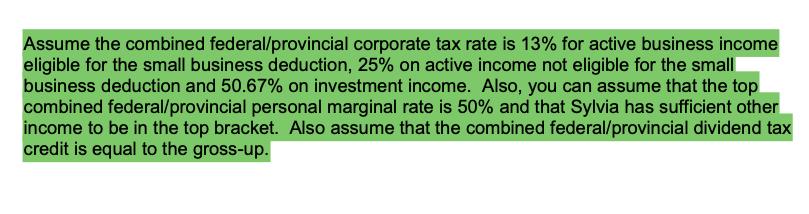

Sylvia Mackenzie, a single Canadian resident, owns all of the issued and outstanding shares of Mackenzie Imports Inc. ("MII"), which is a wholesaler of various goods, including foodstuffs, imported mostly from the U.K. MIl sells to various retail outlets across Canada. Sylvia feels she has done all she can to grow the business. Her 65th birthday is fast approaching and she has recently decided to sell MII and retire. MII operates out of leased premises in Mississauga. The premises encompass office, showroom and warehouse space. There are 100 common shares outstanding with a total paid- up capital of $100 ($1 per share). Sylvia's ACB is also $100. She is aware that she could sell assets or shares. She has been approached by arm's length corporation that would like to purchase the business. The potential purchaser imports similar goods from a number of European countries and accordingly MII would be a good "fit" for it to expand. Sylvia has estimated the value of MII's assets at $6,725,000, based on values proposed by the purchaser. On the assumption that the purchaser would assume the liabilities of MII, the company would receive $6,075,000 on an asset sale. If the assets are sold, MII will pay its corporate taxes and invest the after-tax proceeds in marketable securities. MII has a May 31 year-end for tax purposes. Sylvia anticipates a sale would take place on May 31, 2023. Sylvia has provided projected financial information on the assets and liabilities of the company (see Appendix 2 on the last page). The cost and UCC amounts are based on MII's projected May 31, 2023 information. It is projected that MII's 2023 taxable income, excluding the income/taxable capital gains generated from the asset sale, will be approximately $300,000 before CCA. Assume that this $300,000 taxable income figure is computed correctly and all of it will be eligible for the small business deduction. Sylvia does not own shares of any other private corporations. She wants to know how much money MII will have to invest from the sale if the assets are sold. She would also like to know how much she could take out of the company as capital dividends and as eligible dividends. Per CRA, MII has no balances in its general rate income pool (GRIP) or capital dividend account (CDA) or eligible or non-eligible refundable dividend on hand (ERDTOH or NERDTOH) accounts as at May 31, 2022. Sylvia is willing to accept an asset sale at the values in Appendix 2. However, as Mil is a qualified small business corporation ("QSBC") and Sylvia has used only $200,000 of her lifetime QSBC capital gains exemption entitlement, she would like to sell shares, if possible, to get her "free" capital gain. She knows that she will receive a lower price for a share sale than for an asset sale. Sylvia thinks she might be able to sell the shares for $5,700,000. She would like to know if she would be better off selling the shares for $5,700,000 rather than selling the net assets for $6,075,000.

Step by Step Solution

★★★★★

3.28 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether Sylvia Mackenzie should sell the shares of Mackenzie Imports Inc MII for 5700000 or the net assets for 6075000 well need to calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started