Please show all the work for both problem. Thank you!

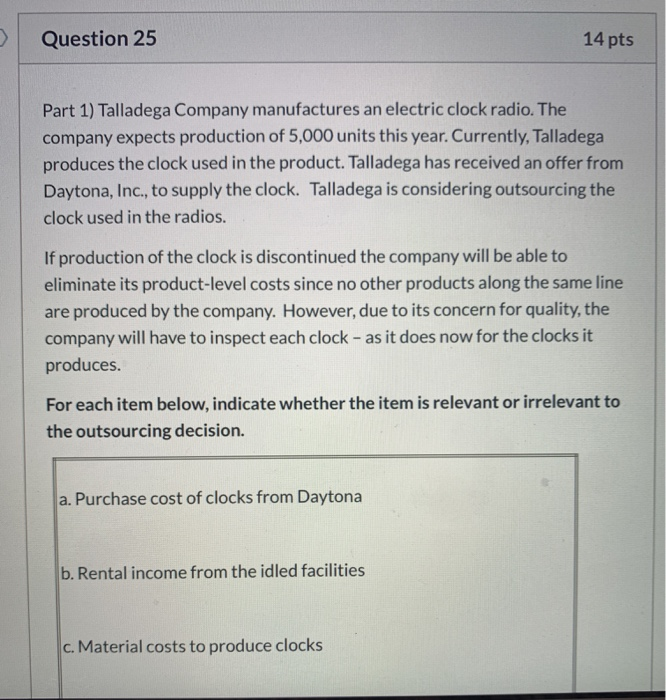

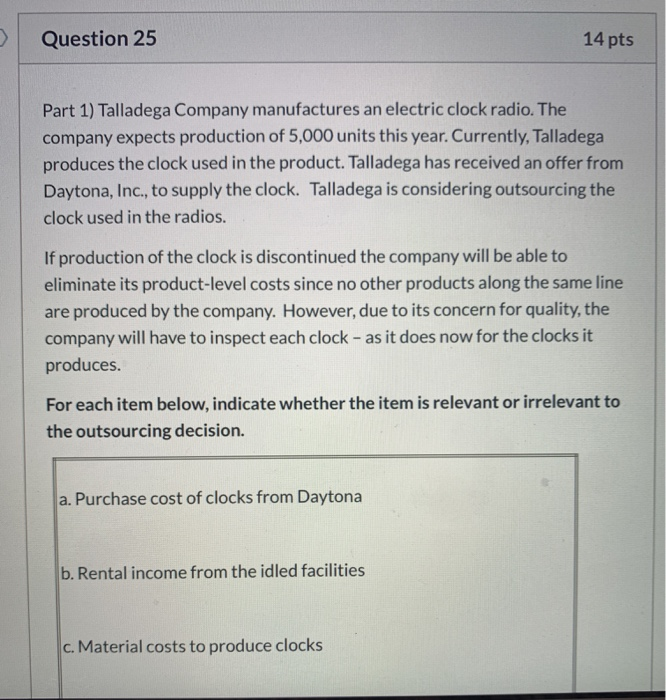

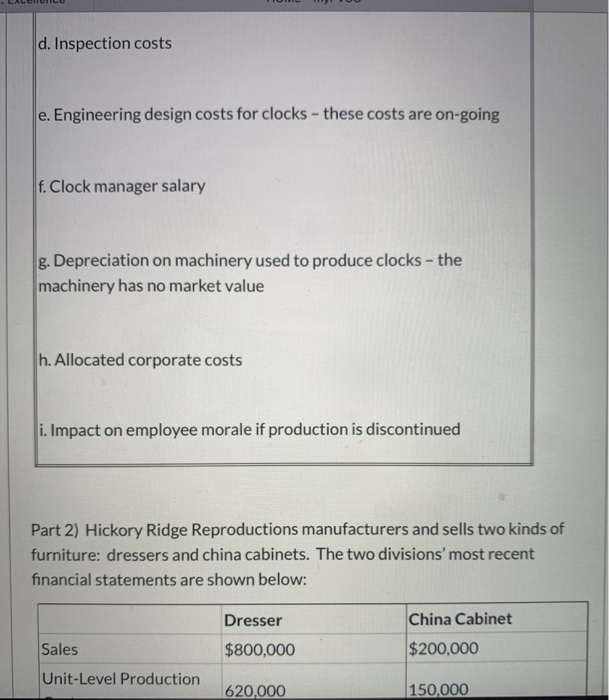

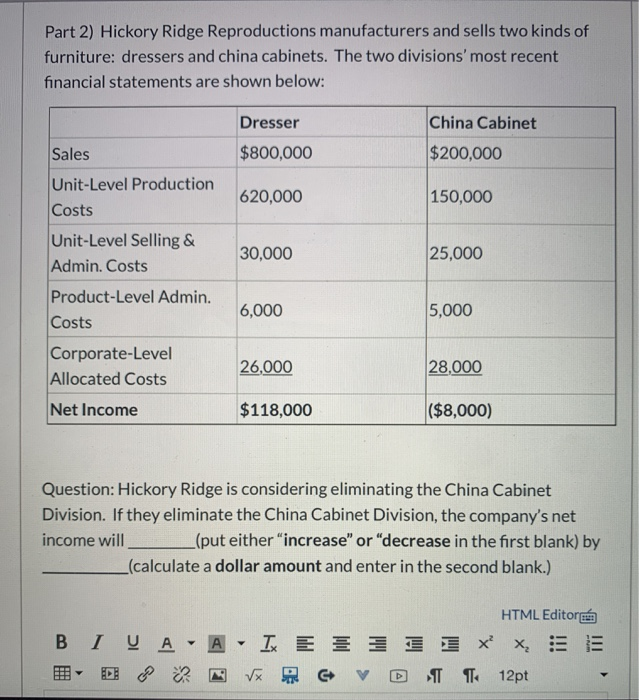

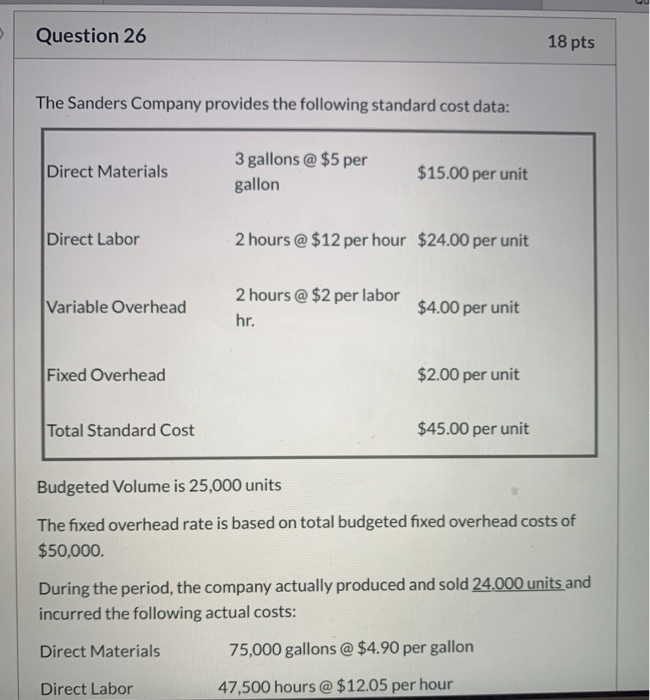

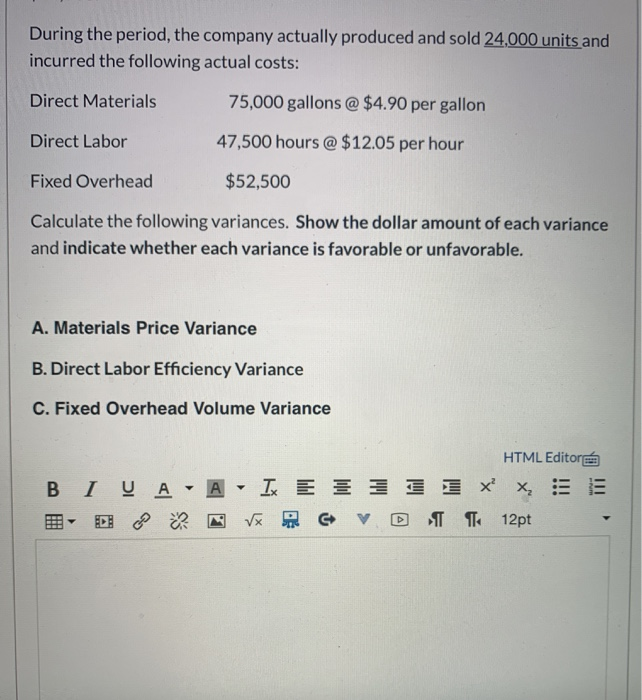

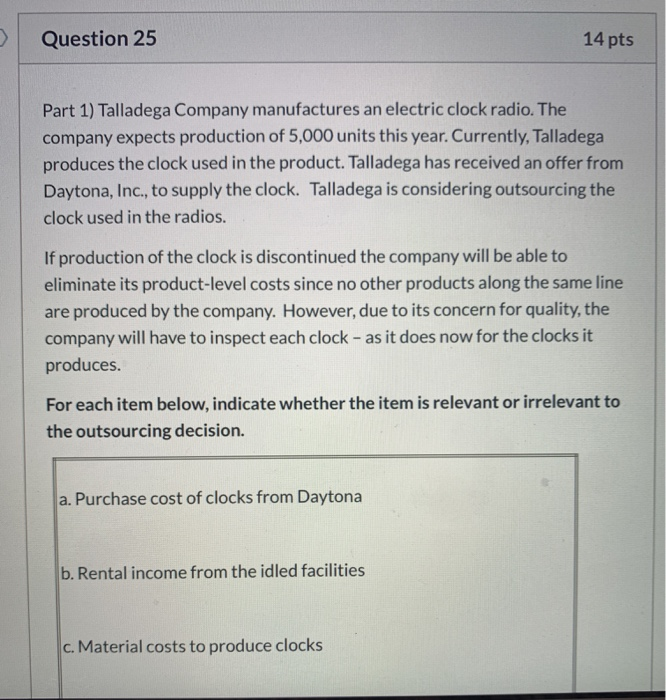

Question 25 14 pts Part 1) Talladega Company manufactures an electric clock radio. The company expects production of 5,000 units this year. Currently, Talladega produces the clock used in the product. Talladega has received an offer from Daytona, Inc., to supply the clock. Talladega is considering outsourcing the clock used in the radios. If production of the clock is discontinued the company will be able to eliminate its product-level costs since no other products along the same line are produced by the company. However, due to its concern for quality, the company will have to inspect each clock - as it does now for the clocks it produces. For each item below, indicate whether the item is relevant or irrelevant to the outsourcing decision. a. Purchase cost of clocks from Daytona b. Rental income from the idled facilities c. Material costs to produce clocks d. Inspection costs e. Engineering design costs for clocks - these costs are on-going! f. Clock manager salary g. Depreciation on machinery used to produce clocks - the machinery has no market value h. Allocated corporate costs i. Impact on employee morale if production is discontinued Part 2) Hickory Ridge Reproductions manufacturers and sells two kinds of furniture: dressers and china cabinets. The two divisions' most recent financial statements are shown below: Dresser $800,000 China Cabinet $200,000 Sales Unit-Level Production 620,000 150,000 Part 2) Hickory Ridge Reproductions manufacturers and sells two kinds of furniture: dressers and china cabinets. The two divisions' most recent financial statements are shown below: Dresser $800,000 China Cabinet $200,000 620,000 150,000 30,000 25,000 Sales Unit-Level Production Costs Unit-Level Selling & Admin. Costs Product-Level Admin. Costs Corporate-Level Allocated Costs 6,000 5,000 26,000 28.000 Net Income $118,000 ($8,000) Question: Hickory Ridge is considering eliminating the China Cabinet Division. If they eliminate the China Cabinet Division, the company's net income will __ _(put either "increase" or "decrease in the first blank) by (calculate a dollar amount and enter in the second blank.) B I V A - A - Ix E N VX A 1 I V D 1 x 1 HTML Editora E 12pt - Question 26 18 pts The Sanders Company provides the following standard cost data: Direct Materials 3 gallons @ $5 per gallon $15.00 per unit Direct Labor 2 hours @ $12 per hour $24.00 per unit Variable Overhead 2 hours @ $2 per labor hr. $4.00 per unit Fixed Overhead $2.00 per unit Total Standard Cost $45.00 per unit Budgeted Volume is 25,000 units The fixed overhead rate is based on total budgeted fixed overhead costs of $50,000. During the period, the company actually produced and sold 24.000 units and incurred the following actual costs: Direct Materials 75,000 gallons @ $4.90 per gallon Direct Labor 47,500 hours @ $12.05 per hour During the period, the company actually produced and sold 24,000 units and incurred the following actual costs: Direct Materials 75,000 gallons @ $4.90 per gallon 47,500 hours @ $12.05 per hour Direct Labor Fixed Overhead $52,500 Calculate the following variances. Show the dollar amount of each variance and indicate whether each variance is favorable or unfavorable. A. Materials Price Variance B. Direct Labor Efficiency Variance C. Fixed Overhead Volume Variance HTML Editor B I VA - A - IX ET13 1 x , E - ? ? Vx 12pt