Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all the workings Question: Assume that you want to purchase 4 round lot shares of GP. The current share price of GP is

Please show all the workings

Question:

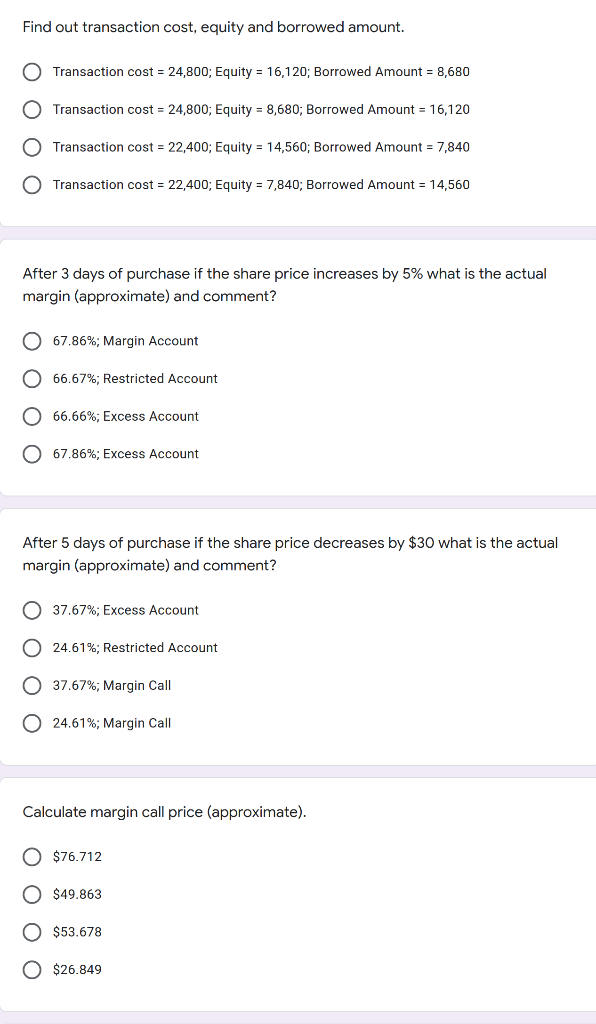

Assume that you want to purchase 4 round lot shares of GP. The current share price of GP is $56. Your initial margin is 65%. Maintenance margin is 27%. GP pays half yearly dividend of $1 per share. For the borrowed amount you have to pay interest of 7% per annum. After 3 month you want to sell the shares for $62.

Find out transaction cost, equity and borrowed amount. Transaction cost = 24,800; Equity = 16,120; Borrowed Amount = 8,680 Transaction cost = 24,800; Equity = 8,680; Borrowed Amount = 16,120 Transaction cost = 22,400; Equity = 14,560; Borrowed Amount = 7,840 Transaction cost = 22,400; Equity = 7,840; Borrowed Amount = 14,560 After 3 days of purchase if the share price increases by 5% what is the actual margin (approximate) and comment? 67.86%; Margin Account 66.67%; Restricted Account 66.66%; Excess Account 67.86%; Excess Account After 5 days of purchase if the share price decreases by $30 what is the actual margin (approximate) and comment? 37.67%; Excess Account O 24.61%; Restricted Account 37.67%; Margin Call 24.61%; Margin Call Calculate margin call price (approximate). O $76.712 $49.863 O $53.678 O $26.849

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started