Answered step by step

Verified Expert Solution

Question

1 Approved Answer

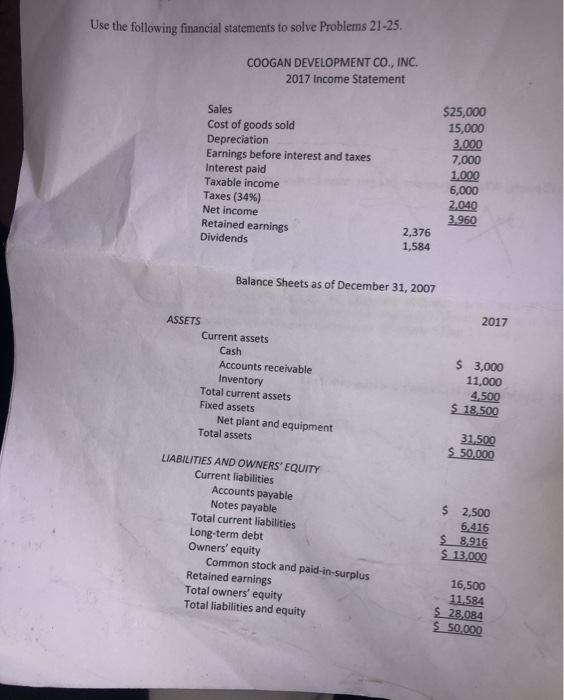

(Please show all work) 1. What is Coogan's debt-equity ratio? 2. What is the common size percentage for accounts payables? 3. what is Coogan's operating

(Please show all work)

1. What is Coogan's debt-equity ratio?

2. What is the common size percentage for accounts payables?

3. what is Coogan's operating flow?

4. What is tge maximum rate the firms assest can grow assets using retained earnings as the inle source of financing?

5. You are required to compare the financials of Coogan Development with South development. Briefly analyze the possible reasons why South Development may not be a. alpropriate benchmark firm for coogan development. (mention at least 2 reasons)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started