Answered step by step

Verified Expert Solution

Question

1 Approved Answer

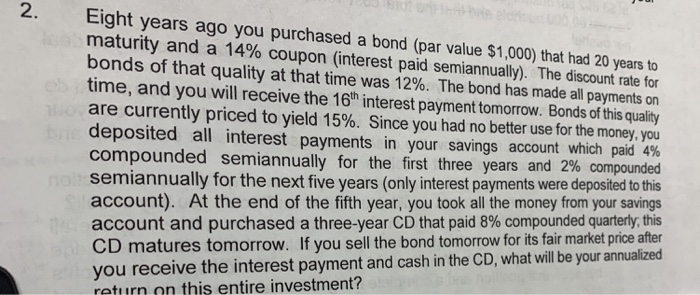

please show all work :) 2. Eight years ago you purchased a bond (par value $1,000) that had 20 years to maturity and a 14%

please show all work :)

2. Eight years ago you purchased a bond (par value $1,000) that had 20 years to maturity and a 14% coupon (interest paid semiannually). The discount rate for bonds of that quality at that time was 12%. The bond has made all payments on time, and you will receive the 16th interest payment tomorrow. Bonds of this quality Ho are currently priced to yield 15%. Since you had no better use for the money, you deposited all interest payments in your savings account which paid 4% compounded semiannually for the first three years and 2% compounded oi semiannually for the next five years (only interest payments were deposited to this account). At the end of the fifth year, you took all the money from your savings account and purchased a three-year CD that paid 8% compounded quarterly, this CD matures tomorrow. If you sell the bond tomorrow for its fair market price after you receive the interest payment and cash in the CD, what will be your annualized return on this entire investment? 2. Eight years ago you purchased a bond (par value $1,000) that had 20 years to maturity and a 14% coupon (interest paid semiannually). The discount rate for bonds of that quality at that time was 12%. The bond has made all payments on time, and you will receive the 16th interest payment tomorrow. Bonds of this quality Ho are currently priced to yield 15%. Since you had no better use for the money, you deposited all interest payments in your savings account which paid 4% compounded semiannually for the first three years and 2% compounded oi semiannually for the next five years (only interest payments were deposited to this account). At the end of the fifth year, you took all the money from your savings account and purchased a three-year CD that paid 8% compounded quarterly, this CD matures tomorrow. If you sell the bond tomorrow for its fair market price after you receive the interest payment and cash in the CD, what will be your annualized return on this entire investment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started