Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show all work 5. Facebook had only one angel investor, Peter A. Thiel (the founder of PayPal). Mr. Thiel invested more than once in

please show all work

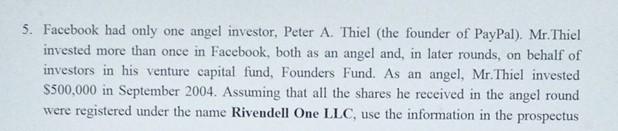

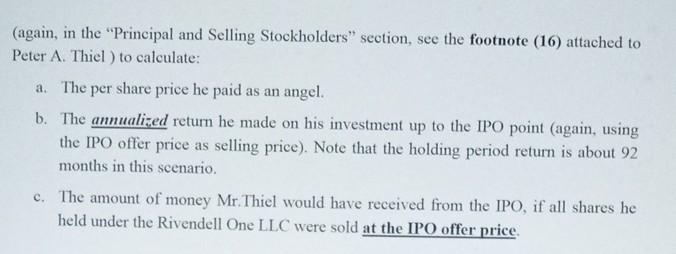

5. Facebook had only one angel investor, Peter A. Thiel (the founder of PayPal). Mr. Thiel invested more than once in Facebook, both as an angel and, in later rounds, on behalf of investors in his venture capital fund, Founders Fund. As an angel, Mr. Thiel invested $500,000 in September 2004. Assuming that all the shares he received in the angel round were registered under the name Rivendell One LLC, use the information in the prospectus (again, in the "Principal and Selling Stockholders" section, see the footnote (16) attached to Peter A. Thiel ) to calculate: a. The per share price he paid as an angel. b. The annualized return he made on his investment up to the IPO point (again, using the IPO offer price as selling price). Note that the holding period return is about 92 months in this scenario. c. The amount of money Mr. Thiel would have received from the IPO, if all shares he held under the Rivendell One LLC were sold at the IPO offer price. 5. Facebook had only one angel investor, Peter A. Thiel (the founder of PayPal). Mr. Thiel invested more than once in Facebook, both as an angel and, in later rounds, on behalf of investors in his venture capital fund, Founders Fund. As an angel, Mr. Thiel invested $500,000 in September 2004. Assuming that all the shares he received in the angel round were registered under the name Rivendell One LLC, use the information in the prospectus (again, in the "Principal and Selling Stockholders" section, see the footnote (16) attached to Peter A. Thiel ) to calculate: a. The per share price he paid as an angel. b. The annualized return he made on his investment up to the IPO point (again, using the IPO offer price as selling price). Note that the holding period return is about 92 months in this scenario. c. The amount of money Mr. Thiel would have received from the IPO, if all shares he held under the Rivendell One LLC were sold at the IPO offer priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started