Answered step by step

Verified Expert Solution

Question

1 Approved Answer

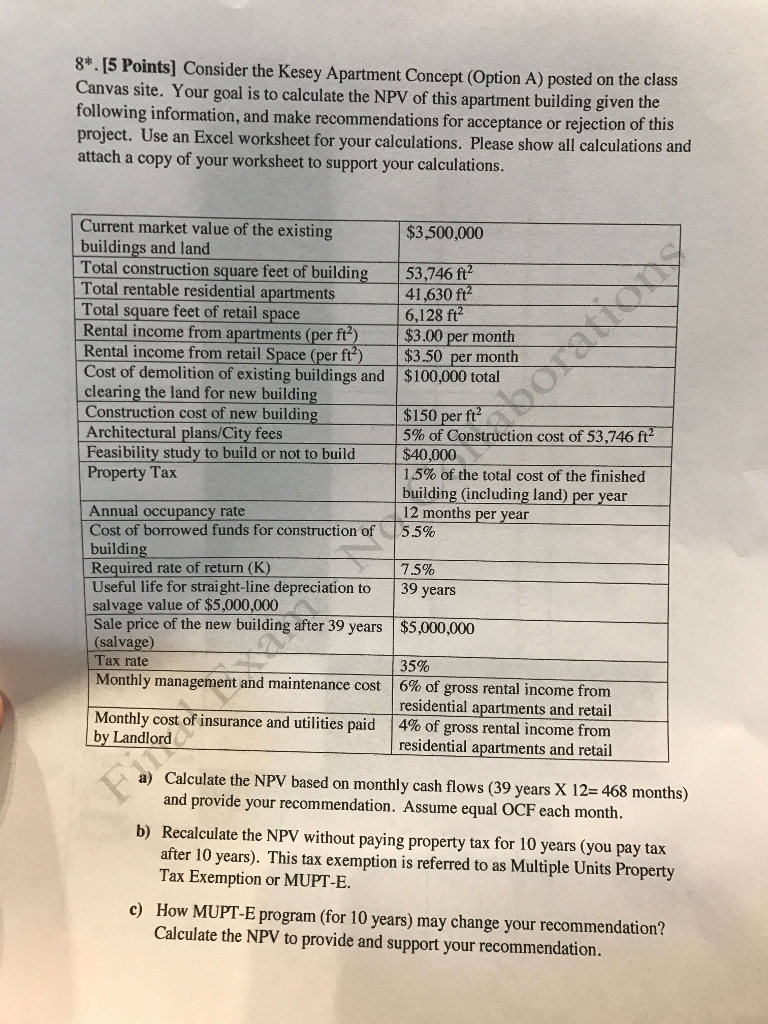

Please show all work 8*.15 Points] Consider the Kesey Apartment Concept (option on the class A) posted Canvas site. Your goal is to calculate the

Please show all work

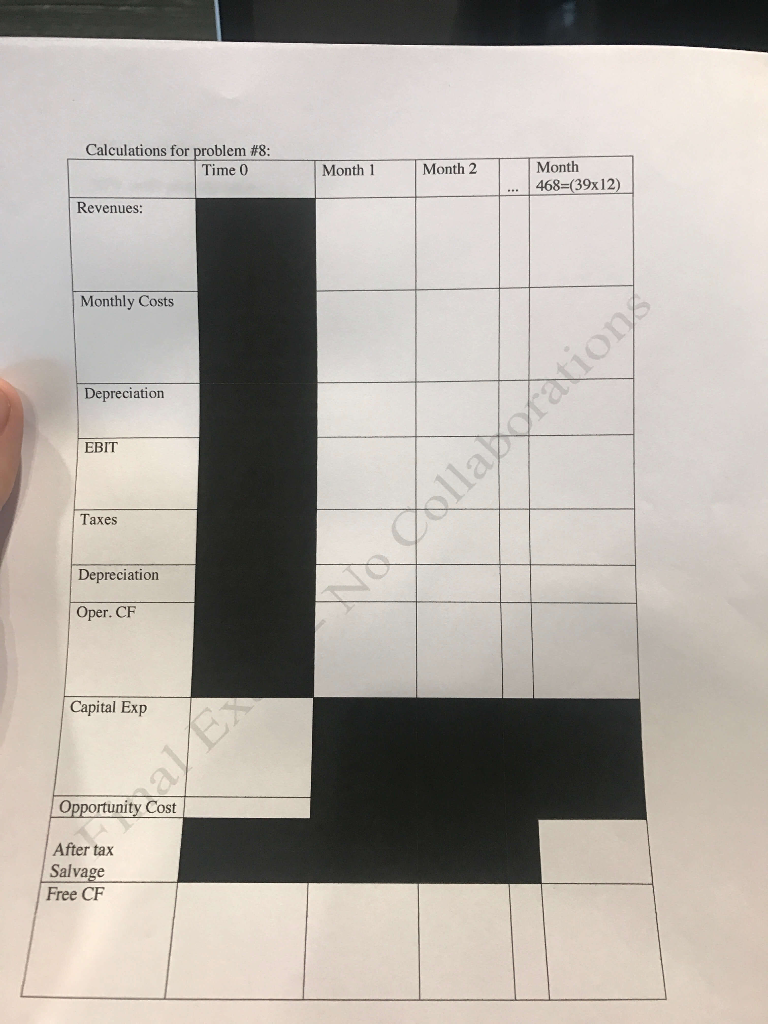

8*.15 Points] Consider the Kesey Apartment Concept (option on the class A) posted Canvas site. Your goal is to calculate the NPV of this apartment building given the following information, and make recommendations for acceptance or rejection this project. Use an Excel worksheet for your calculations. of and Please show all attach a copy of your works to support your calculations Current market value of the existing $3,500,000 buildings and land Total construction square feet of building 53,746 ft2 Total rentable residential apartments 411630 ft Total square feet of retail space 6,128 ft Rental income from apartments (per ft $3.00 per month Rental income from retail Space (per fte) 50 per month Cost of demolition of existing buildings and $100,000 total clearing the land for new building of new building S150 per Construction co Architectural plans/City fees 5% of Construction cost of 53,746 ft2 Feasibility study to build or not to build $40,000 Property Tax 15% of the total cost of the finished building (including land per year Annual occupancy rat 12 months per year Cost of borrowed funds for construction of 5.5% buildin Required rate of return (K 7.5% Useful life for straight-line depreciation to 39 years salvage value of $5,000,000 sale price of the new building after 39 years $5,000,000 (salva Tax rate 35% Monthly management and maintenance cost 6% of gross rental income from Monthly cost residential apartments and retail by Landlord of insurance and utilities paid 4% of gross rental income from residential apartments and retail a) Calculate the NPV based on monthly cash flows (39 years x 12 468 monthso and provide your recommendation. Assume equal ocF each month. b) Recalculate the NPV without paying property tax for 10 years (you pay tax after 10 years). This tax exemption is referred to as Multiple Units Property Tax Exemption or MUPT-E c) How MUPT-E program (for 10 years) may change your recommendation? Calculate the NPV to provide and support your recommendationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started