Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work and answer ALL questions. Thank you Investment tax credits and the user cost of capital: Consider the user coss of capital

Please show all work and answer ALL questions.

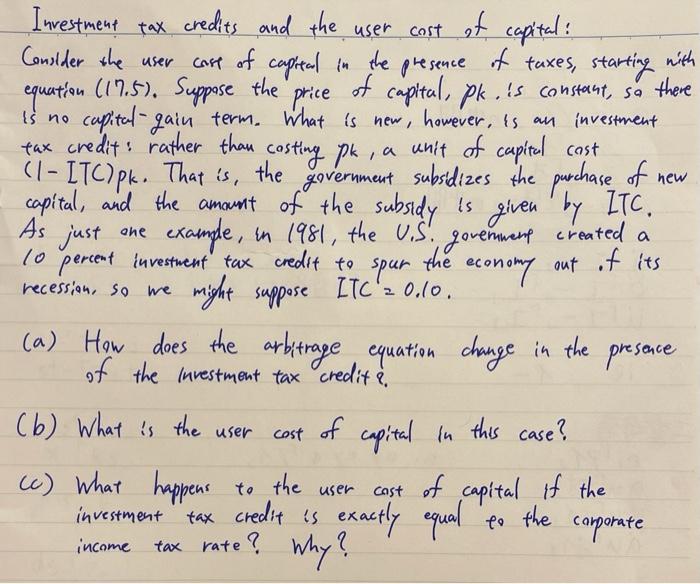

Investment tax credits and the user cost of capital: Consider the user coss of capital in the presence if taxes, starting with equation (17.5). Suppose the price of capital, pk. is constant, sa there is no cuppital-gain term. What is new, however, is an investment tax credit: rather than costing pk, a unit of capital cast (1-ITC) pk. That is, the gavernment subsidizes the purchase of new capital, and the amaunt of the subsidy is given by ITC. As just one example, in 1981, the U.S. govemuenp created a 10 percent investrent tax credit to spur the economy out if its recession, so we might suppose ITC=0.10. (a) How does the arbitrage equation change in the presence of the investment tax credit?. (b) What is the user cost of cupital in this case? (c) What happens to the user cost of capital if the investment tax credit is exactly equal to the comporate income tax rate? Why

Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started