Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work and no excel if possible Sadly this is all we were given for this question... 1) Your company has been doing

Please show all work and no excel if possible

Sadly this is all we were given for this question...

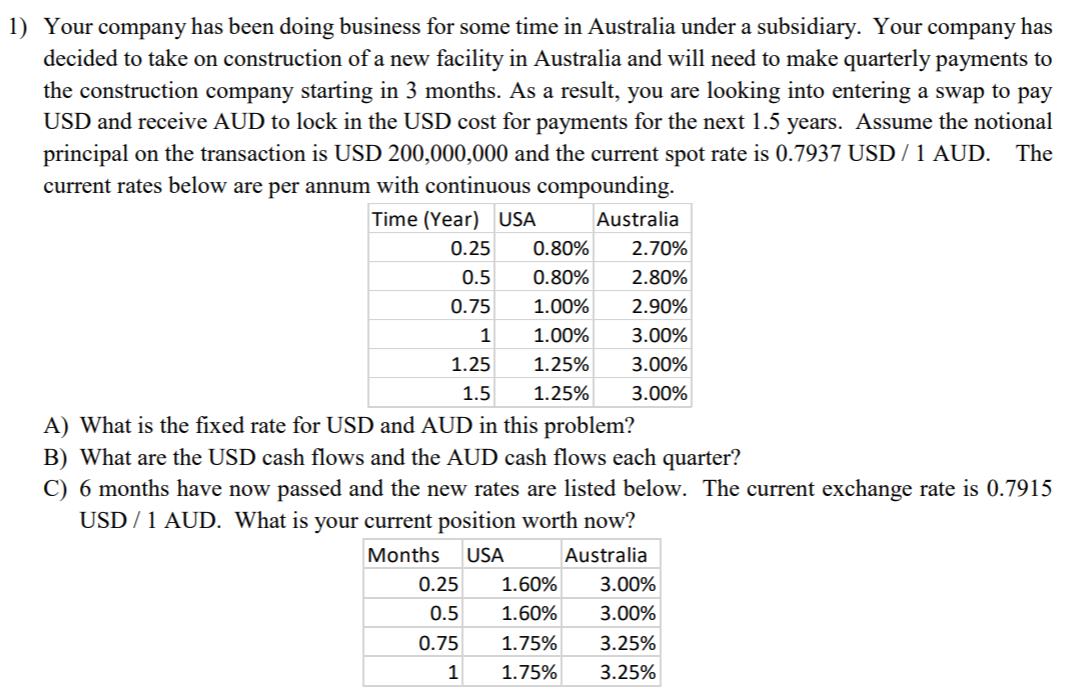

1) Your company has been doing business for some time in Australia under a subsidiary. Your company has decided to take on construction of a new facility in Australia and will need to make quarterly payments to the construction company starting in 3 months. As a result, you are looking into entering a swap to pay USD and receive AUD to lock in the USD cost for payments for the next 1.5 years. Assume the notional principal on the transaction is USD 200,000,000 and the current spot rate is 0.7937 USD/1 AUD. The current rates below are per annum with continuous compounding. Time (Year) USA Australia 0.25 0.80% 2.70% 0.5 0.80% 2.80% 0.75 1.00% 2.90% 1 1.00% 3.00% 1.25 1.25% 3.00% 1.5 1.25% 3.00% A) What is the fixed rate for USD and AUD in this problem? B What are the USD cash flows and the AUD cash flows each quarter? C) 6 months have now passed and the new rates are listed below. The current exchange rate is 0.7915 USD/1 AUD. What is your current position worth now? Months USA Australia 0.25 1.60% 3.00% 0.5 1.60% 3.00% 0.75 1.75% 3.25% 1 1.75% 3.25% 1) Your company has been doing business for some time in Australia under a subsidiary. Your company has decided to take on construction of a new facility in Australia and will need to make quarterly payments to the construction company starting in 3 months. As a result, you are looking into entering a swap to pay USD and receive AUD to lock in the USD cost for payments for the next 1.5 years. Assume the notional principal on the transaction is USD 200,000,000 and the current spot rate is 0.7937 USD/1 AUD. The current rates below are per annum with continuous compounding. Time (Year) USA Australia 0.25 0.80% 2.70% 0.5 0.80% 2.80% 0.75 1.00% 2.90% 1 1.00% 3.00% 1.25 1.25% 3.00% 1.5 1.25% 3.00% A) What is the fixed rate for USD and AUD in this problem? B What are the USD cash flows and the AUD cash flows each quarter? C) 6 months have now passed and the new rates are listed below. The current exchange rate is 0.7915 USD/1 AUD. What is your current position worth now? Months USA Australia 0.25 1.60% 3.00% 0.5 1.60% 3.00% 0.75 1.75% 3.25% 1 1.75% 3.25%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started