Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work and only answer: what is the WACC before breaks? What is the breakpoint? What is the MCC, (after breakpoint)? Question 1

Please show all work and only answer:

what is the WACC before breaks?

What is the breakpoint?

What is the MCC, (after breakpoint)?

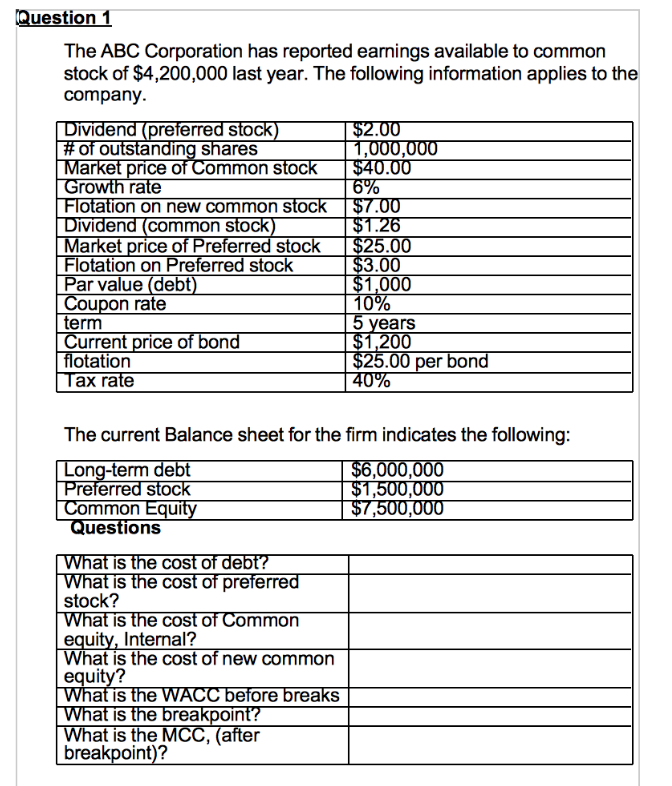

Question 1 The ABC Corporation has reported earnings available to common stock of $4,200,000 last year. The following information applies to the company. Dividend (preferred stock) $2.00 #of outstanding shares 1,000,000 Market price of Common stock $40.00 Growth rate 6% Flotation on new common stock $7.00 Dividend (common stock) $1.26 Market price of Preferred stock $25.00 Flotation on Preferred stock $3.00 Par value debt) $1,000 Coupon rate 10% term 5 years Current price of bond $1,200 flotation $25.00 per bond Tax rate 40% The current Balance sheet for the firm indicates the following: Long-term debt $6,000,000 Preferred stock $1,500,000 Common Equity $7,500,000 Questions What is the cost of debt? What is the cost of preferred stock? What is the cost of Common equity, Internal? What is the cost of new common equity? What is the WACC before breaks What is the breakpoint? What is the MCC, (after breakpoint)? Question 1 The ABC Corporation has reported earnings available to common stock of $4,200,000 last year. The following information applies to the company. Dividend (preferred stock) $2.00 #of outstanding shares 1,000,000 Market price of Common stock $40.00 Growth rate 6% Flotation on new common stock $7.00 Dividend (common stock) $1.26 Market price of Preferred stock $25.00 Flotation on Preferred stock $3.00 Par value debt) $1,000 Coupon rate 10% term 5 years Current price of bond $1,200 flotation $25.00 per bond Tax rate 40% The current Balance sheet for the firm indicates the following: Long-term debt $6,000,000 Preferred stock $1,500,000 Common Equity $7,500,000 Questions What is the cost of debt? What is the cost of preferred stock? What is the cost of Common equity, Internal? What is the cost of new common equity? What is the WACC before breaks What is the breakpoint? What is the MCC, (after breakpoint)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started