Answered step by step

Verified Expert Solution

Question

1 Approved Answer

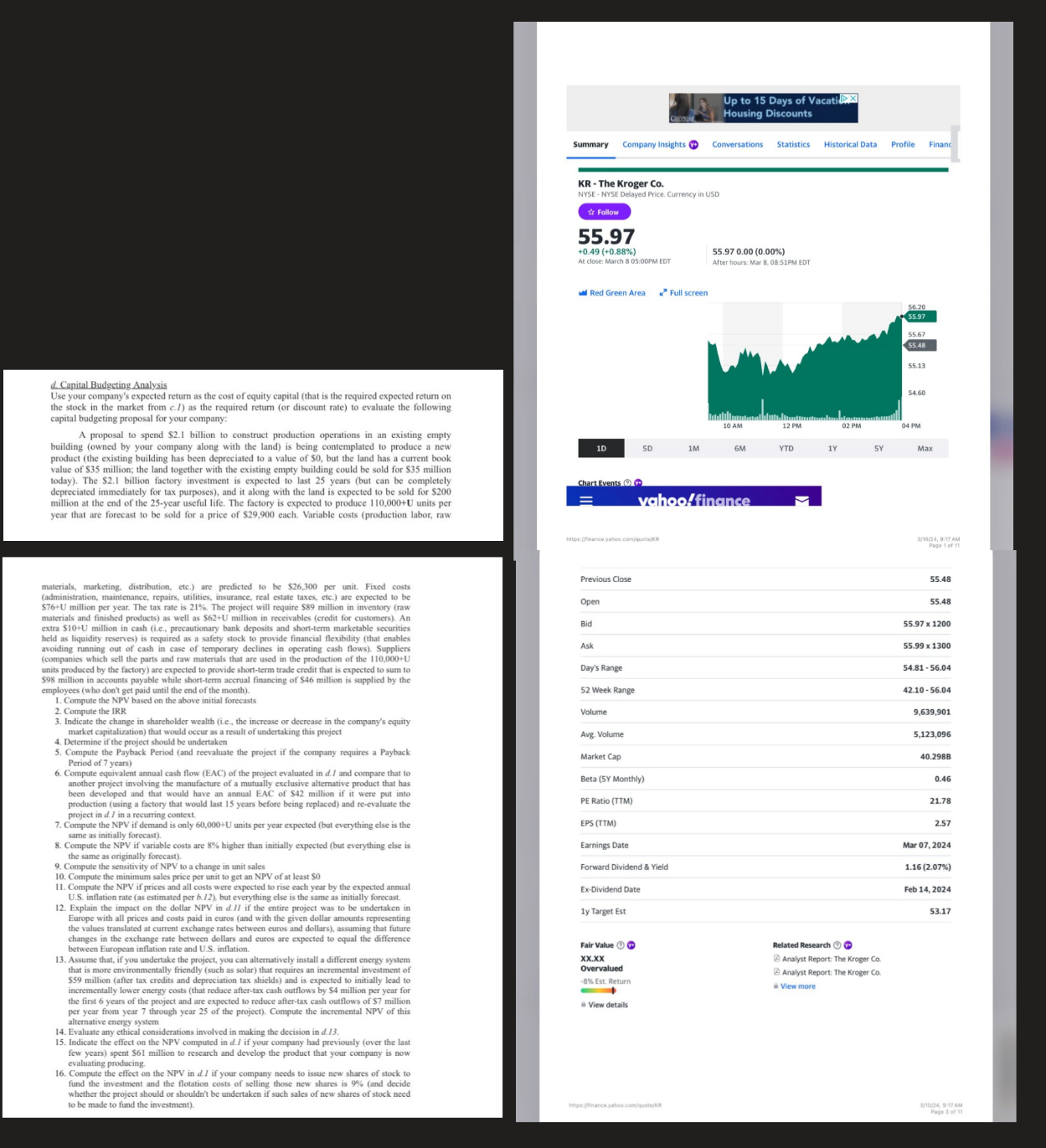

PLEASE SHOW ALL WORK d . Capital Budgeting AnalysisUse your company's expected return as the cost of equity capital ( that is the required expected

PLEASE SHOW ALL WORK

d Capital Budgeting AnalysisUse your company's expected return as the cost of equity capital that is the required expected return on the stock in the market from c as the required return or discount rate to evaluate the following capital budgeting proposal for your company:A proposal to spend $ billion to construct production operations in an existing empty building owned by your company along with the land is being contemplated to produce a new product the existing building has been depreciated to a value of SO but the land has a current book value of S million; the land together with the existing empty building could be sold for $ milliontoday The $ billion factory investment is expected to last years but can be completely depreciated immediately for tax purposes and it along with the land is expected to be sold for $ million at the end of the year useful life. The factory is expected to produce U units per year that are forecast to be sold for a price of $ each. Variable costs production labor, raw

U

PLEASE SHOW EVERY STEP BY STEP FOR EVERY QUESTION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started