Answered step by step

Verified Expert Solution

Question

1 Approved Answer

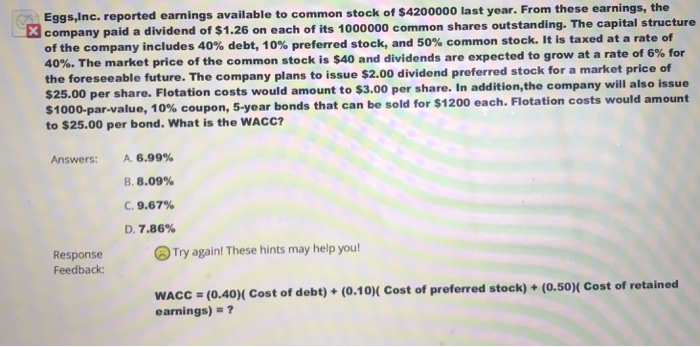

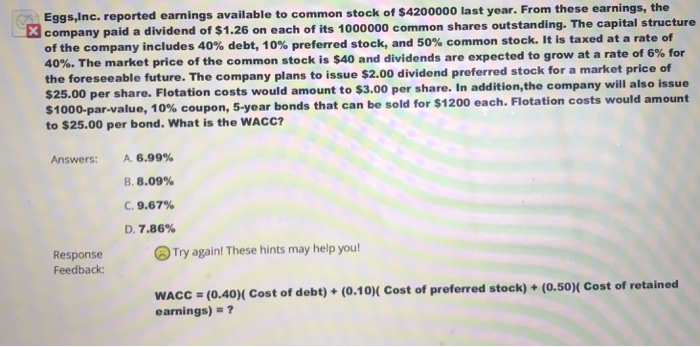

Please show all work, especially for Rs and Rp portion of WACC Eggs,Inc. repo rted earnings available to common stock of $4200000 last year. From

Please show all work, especially for Rs and Rp portion of WACC

Eggs,Inc. repo rted earnings available to common stock of $4200000 last year. From these earnings, the company paid a dividend of $1.26 on each of its 1000000 common shares outstanding. The capital structure of the company includes 40% debt, 10% preferred stock, and 50% common stock. It is taxed at a rate of 40%. The market price of the common stock is $40 and dividends are expected to grow at a rate of 6% for the foreseeable future. The company plans to issue $2.00 dividend preferred stock for a market price of $25.00 per share. Flotation costs would amount to $ $1000-par-value, 10% coupo to $25.00 per bond. What is the WACC? 3.00 per share. In addition,the company will also issue n, 5-year bonds that can be sold for $1200 each. Flotation costs would amount A 6.99% B. 8.09% C. 9.67% D. 7.86% Answers: Response Try again! These hints may help you Feedback: WACC (0.40)( Cost of debt) (0.10)( Cost of preferred stock)+ (0.50)( Cost of retained earnings)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started