Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work, especially the standard deviation calculation of the portfolio in (a). Suppose that a fund that tracks the S&P has expected return

Please show all work, especially the standard deviation calculation of the portfolio in (a).

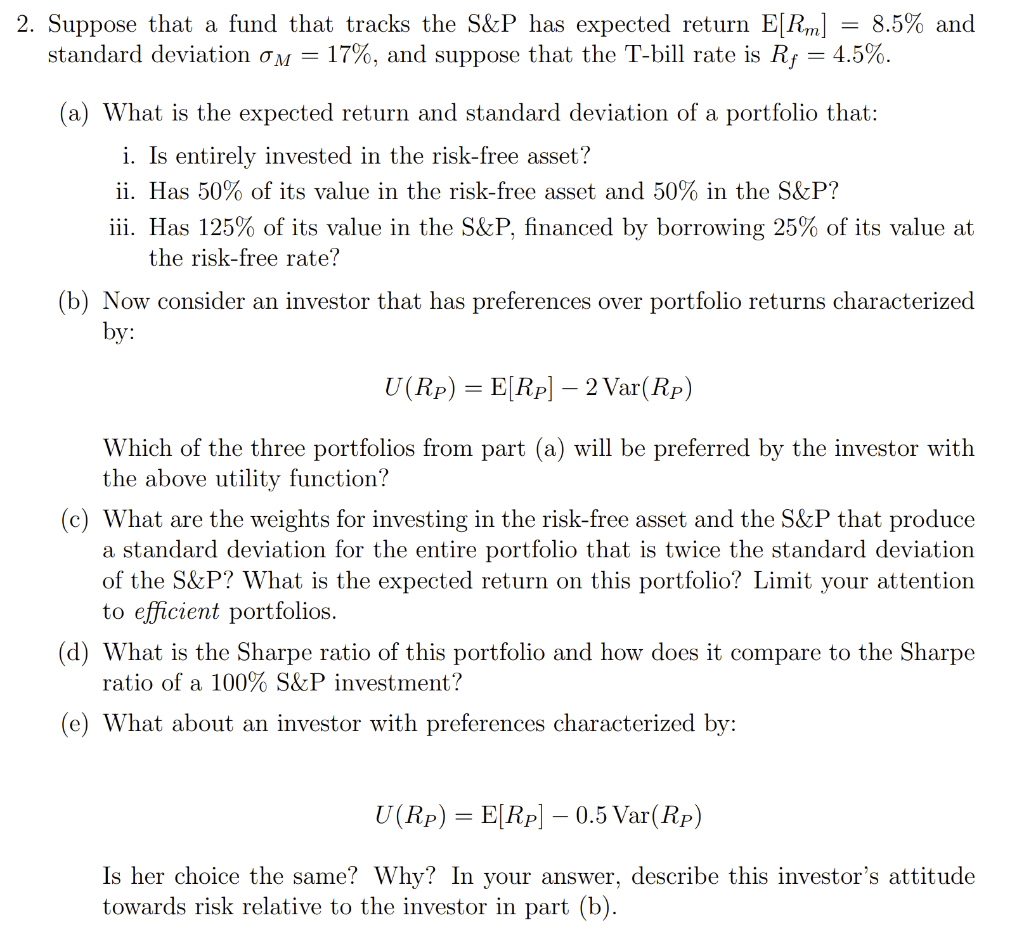

Suppose that a fund that tracks the S&P has expected return E[Rm]=8.5% and standard deviation M=17%, and suppose that the T-bill rate is Rf=4.5%. (a) What is the expected return and standard deviation of a portfolio that: i. Is entirely invested in the risk-free asset? ii. Has 50% of its value in the risk-free asset and 50% in the S&P ? iii. Has 125% of its value in the S\&P, financed by borrowing 25% of its value at the risk-free rate? (b) Now consider an investor that has preferences over portfolio returns characterized by: U(RP)=E[RP]2Var(RP) Which of the three portfolios from part (a) will be preferred by the investor with the above utility function? (c) What are the weights for investing in the risk-free asset and the S\&P that produce a standard deviation for the entire portfolio that is twice the standard deviation of the S\&P? What is the expected return on this portfolio? Limit your attention to efficient portfolios. (d) What is the Sharpe ratio of this portfolio and how does it compare to the Sharpe ratio of a 100%S&P investment? (e) What about an investor with preferences characterized by: U(RP)=E[RP]0.5Var(RP) Is her choice the same? Why? In your answer, describe this investor's attitude towards risk relative to the investor in part (b)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started