Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show ALL work for each problem. 15. Four years ago, you borrowed $50,000 to buy a motor boat. You have decided to repay the

Please show ALL work for each problem.

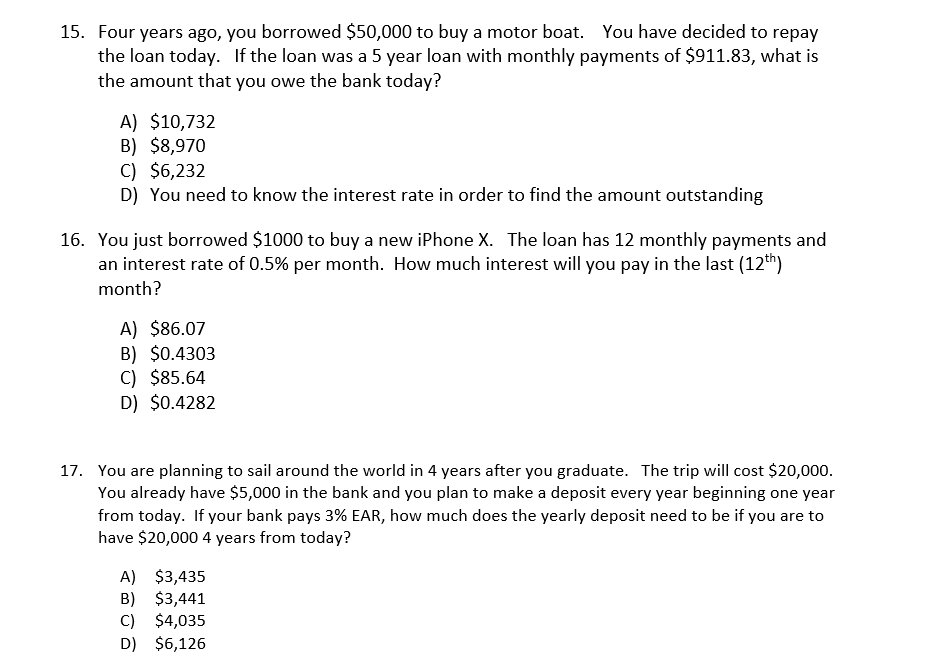

15. Four years ago, you borrowed $50,000 to buy a motor boat. You have decided to repay the loan today. If the loan was a 5 year loan with monthly payments of $911.83, what is the amount that you owe the bank today? A) $10,732 B) $8,970 C) $6,232 D) You need to know the interest rate in order to find the amount outstanding 16. You just borrowed $1000 to buy a new iPhone X. The loan has 12 monthly payments and an interest rate of 0.5% per month. How much interest will you pay in the last (12th) month? A) $86.07 B) $0.4303 C) $85.64 D) $0.4282 You are planning to sail around the world in 4 years after you graduate. The trip will cost $20,000 You already have $5,000 in the bank and you plan to make a deposit every year beginning one year from today. If your bank pays 3% EAR, how much does the yearly deposit need to be if you are to have $20,000 4 years from today? 17. A) $3,435 B) $3,441 C) $4,035 D) $6,126

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started