Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show all work. I am including my first attempt as an example but it was not correct. thank you! MGMT 4630 CoQ Assignment Read

Please show all work. I am including my first attempt as an example but it was not correct. thank you!

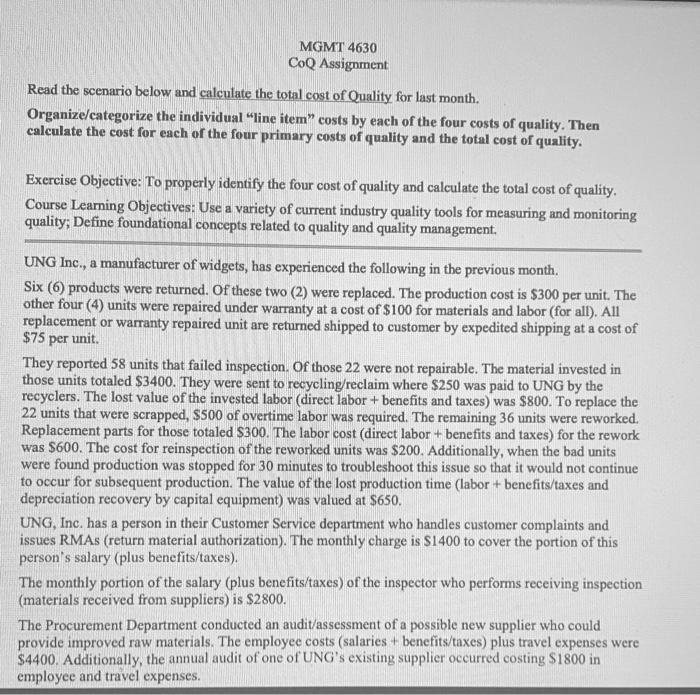

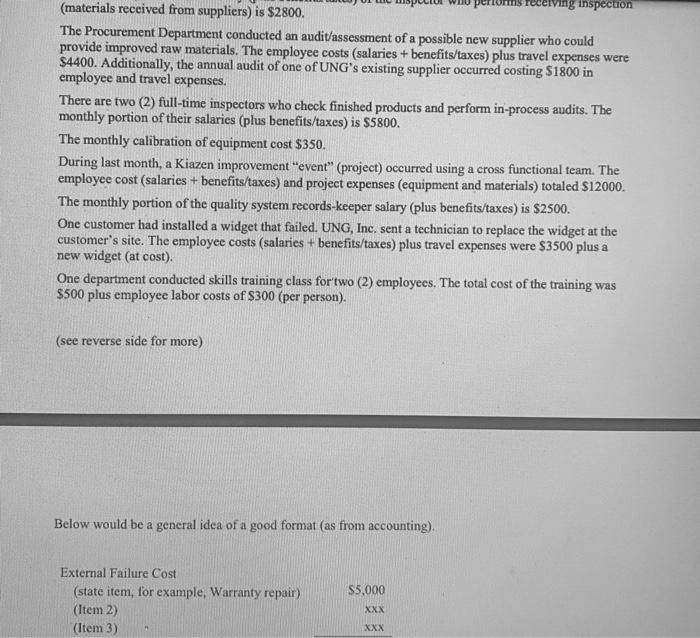

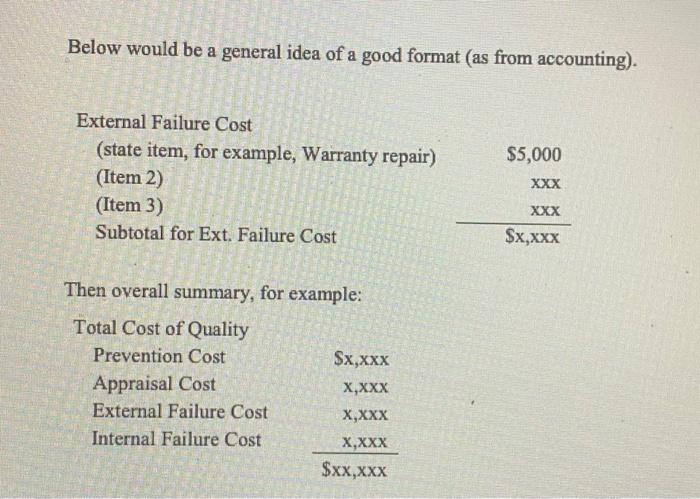

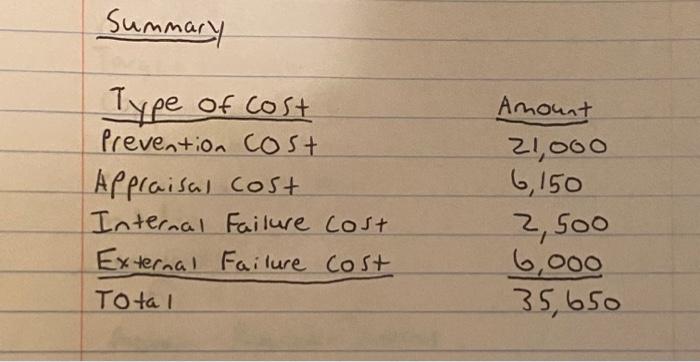

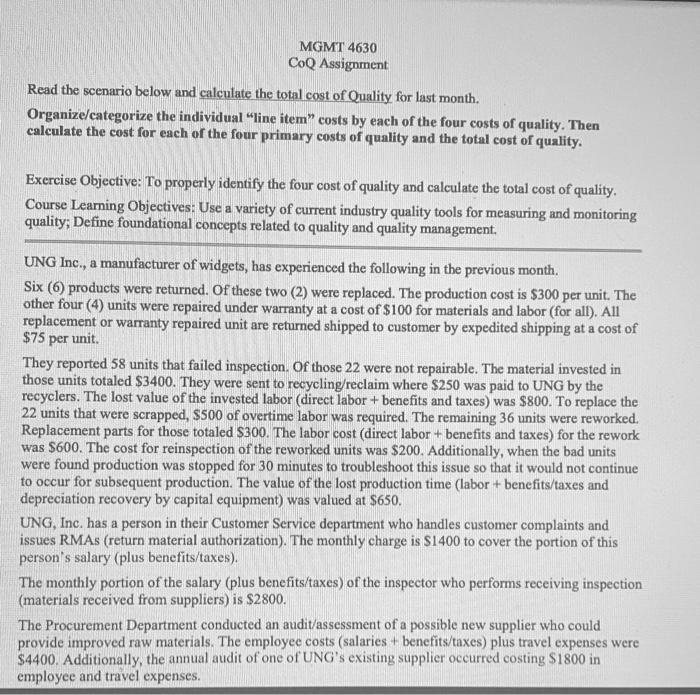

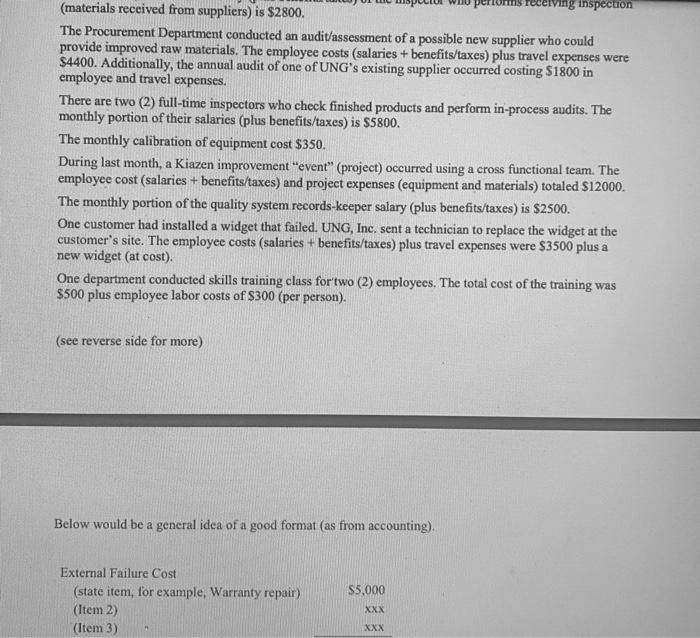

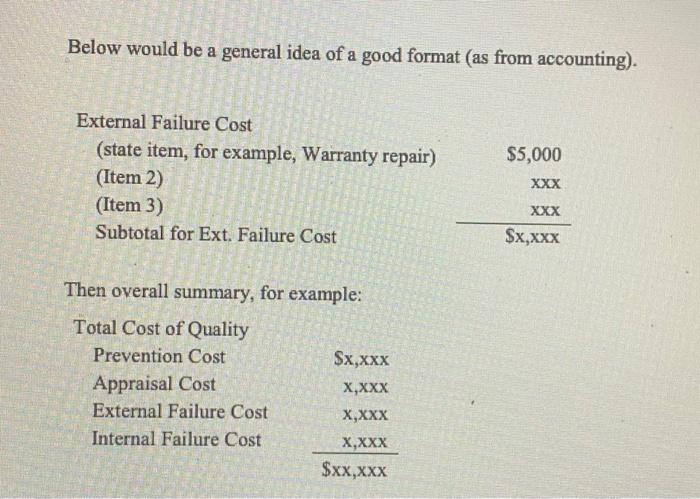

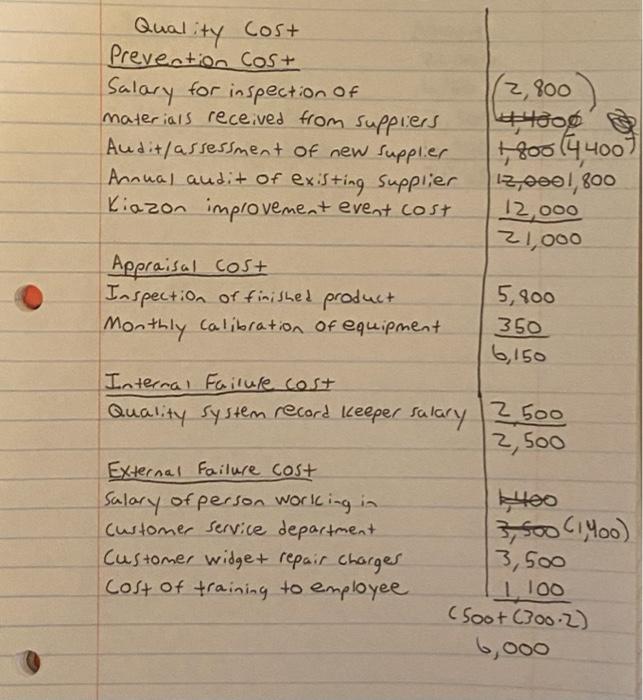

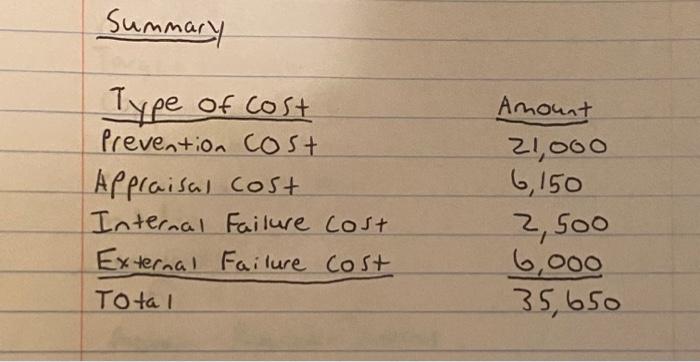

MGMT 4630 CoQ Assignment Read the scenario below and calculate the total cost of Quality for last month. Organize/categorize the individual "line item" costs by each of the four costs of quality. Then calculate the cost for each of the four primary costs of quality and the total cost of quality. Exercise Objective: To properly identify the four cost of quality and calculate the total cost of quality. Course Learning Objectives: Use a variety of current industry quality tools for measuring and monitoring quality; Define foundational concepts related to quality and quality management. UNG Inc., a manufacturer of widgets, has experienced the following in the previous month. Six (6) products were returned. Of these two (2) were replaced. The production cost is $300 per unit. The other four (4) units were repaired under warranty at a cost of $100 for materials and labor (for all). All replacement or warranty repaired unit are returned shipped to customer by expedited shipping at a cost of $75 per unit. They reported 58 units that failed inspection. Of those 22 were not repairable. The material invested in those units totaled $3400. They were sent to recycling/reclaim where $250 was paid to UNG by the recyclers. The lost value of the invested labor (direct labor + benefits and taxes) was $800. To replace the 22 units that were scrapped, S500 of overtime labor was required. The remaining 36 units were reworked. Replacement parts for those totaled 300. The labor cost (direct labor + benefits and taxes) for the rework was $600. The cost for reinspection of the reworked units was $200. Additionally, when the bad units were found production was stopped for 30 minutes to troubleshoot this issue so that it would not continue to occur for subsequent production. The value of the lost production time (labor + benefits/taxes and depreciation recovery by capital equipment) was valued at $650. UNG, Inc. has a person in their Customer Service department who handles customer complaints and issues RMAs (return material authorization). The monthly charge is $1400 to cover the portion of this person's salary (plus benefits/taxes). The monthly portion of the salary (plus benefits/taxes) of the inspector who performs receiving inspection (materials received from suppliers) is $2800. The Procurement Department conducted an audit/assessment of a possible new supplier who could provide improved raw materials. The employee costs (salaries + benefits/taxes) plus travel expenses were $4400. Additionally, the annual audit of one of UNG's existing supplier occurred costing $1800 in employee and travel expenses. receiving inspection (materials received from suppliers) is $2800. The Procurement Department conducted an audit/assessment of a possible new supplier who could provide improved raw materials. The employee costs (salaries + benefits/taxes) plus travel expenses were $4400. Additionally, the annual audit of one of UNG's existing supplier occurred costing $1800 in employee and travel expenses. There are two (2) full-time inspectors who check finished products and perform in-process audits. The monthly portion of their salaries (plus benefits/taxes) is $5800. The monthly calibration of equipment cost $350. During last month, a Kiazen improvement "event" (project) occurred using a cross functional team. The employee cost (salaries + benefits/taxes) and project expenses (equipment and materials) totaled $12000. The monthly portion of the quality system records-keeper salary (plus benefits/taxes) is $2500. One customer had installed a widget that failed. UNG, Inc, sent a technician to replace the widget at the customer's site. The employee costs (salaries + benefits/taxes) plus travel expenses were $3500 plus a new widget (at cost). One department conducted skills training class for two (2) employees. The total cost of the training was $500 plus employee labor costs of $300 (per person). (see reverse side for more) Below would be a general idea of a good format (as from accounting), External Failure Cost (state item, for example, Warranty repair) (Item 2) (Item 3) $5,000 XXX XXX Below would be a general idea of a good format (as from accounting). $5,000 External Failure Cost (state item, for example, Warranty repair) (Item 2) (Item 3) Subtotal for Ext. Failure Cost XXX XXX $x,xxx Then overall summary, for example: Total Cost of Quality Prevention Cost Sx,xxx Appraisal Cost X,XXX External Failure Cost X,XXX Internal Failure Cost X,XXX $xx,xxx Qual lity cost Prevention Cos + Salary for inspection of (2,800 materials received from suppliers 4 to Audit/ assessment of new supplier 1,800 14 4007 Annual audit of existing supplier 13,0001 800 Kiazon improvement event cost 12,000 21,000 Appraisal Cost Inspection of finished product 5,800 Monthly Calibration of equipment 350 6,150 Internal Failule cost Quality system record keeper salary | 500 12,500 400 External Failure cost Salary of person working in customer service department Customer widget repair charges Cost of training to employee 3, Soo (1Moo) 3,500 1 100 (Soot (30o.2) 6,000 Summary Type of cost Prevention cost | Appraisal cost Internal Failure cost External Failure cost Total Amount 21,000 6, 150 2, Soo 6,000 35,650

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started